Summary: The Dollar Index did a U-turn after hitting fresh 29-month highs to 99.667 following the release of the worst US ISM Manufacturing report in over a decade. USD/DXY closed at 99.155, down 0.22% from 99.36 yesterday. Against the Yen, the Dollar slid from 2-week highs at 108.47 to 107.70 as the dire US factory report fuelled concern that the US economy may be headed toward a recession. The Euro was up 0.28% to 1.0937 after touching May 2017 lows (1.08792) weighed by soft Eurozone inflation and weak manufacturing data of its own. The Australian Dollar underperformed, plunging to 0.66717, its lowest point since 2008 after the RBA cut its cash rate to a record low 0.75% and expressed concerns about job growth.

Wall Street stocks slid while Treasuries rose. The DOW dropped the most in 5 weeks to 26,992. (26,820.) The S&P 500 lost 1.4% to 2,940 from 2,985 yesterday. US bond yields dropped. The 10-year rate fell 3 basis points to 1.64%. Two-year US yields plunged 8 basis points to 1.55%.

Data released yesterday: Japan’s Tankan Manufacturing Index rose to 5, beating forecasts of 1.

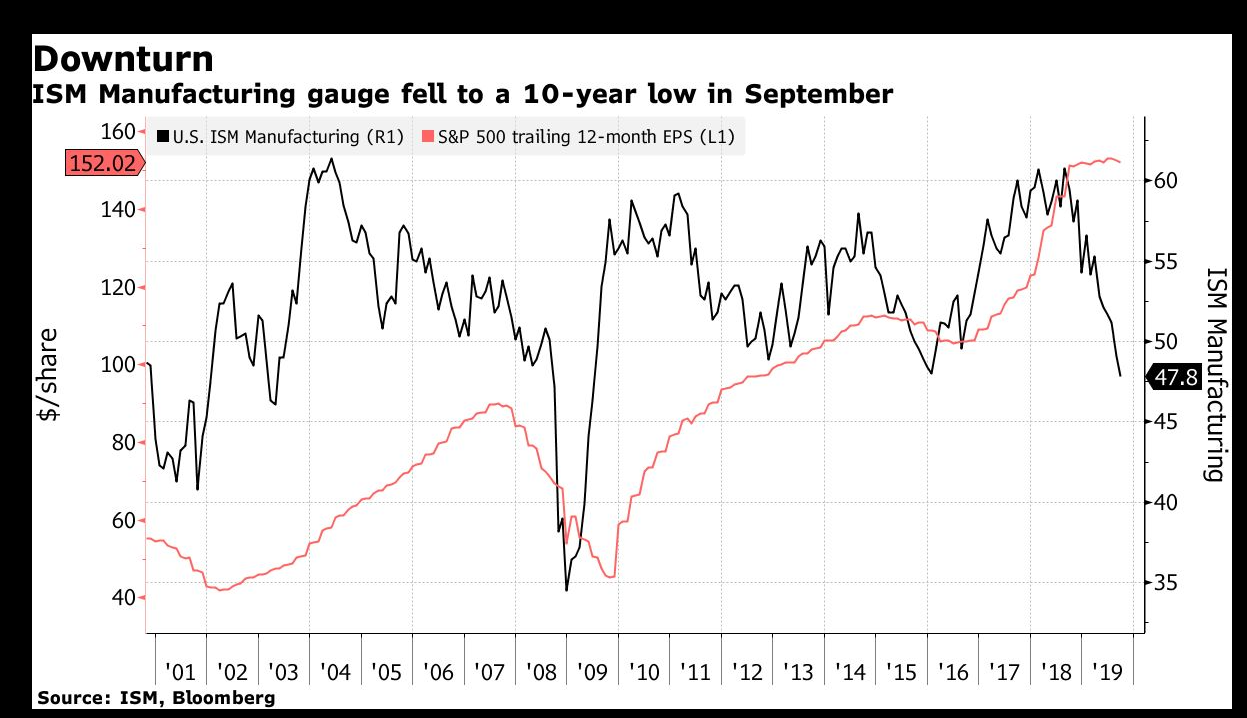

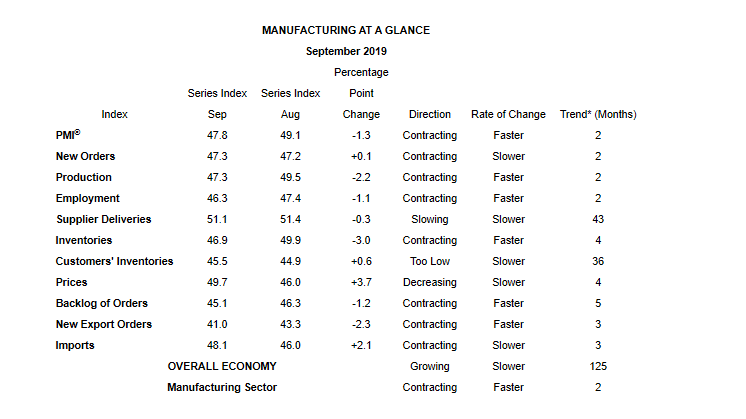

The Eurozone Flash Headline CPI Estimate underwhelmed, printing 0.9% against expectations of 1.0%. Euro area Manufacturing PMIs were mostly weaker than forecasts. US ISM Manufacturing PMI for September fell to 47.8 from 49.1 in August, missing median forecasts of 50.4. The ISM’s Employment component also hit multi-year lows.

- EUR/USD – The Euro traded heavy all day, hitting a fresh 29 month low at 1.08792 following a soft Eurozone CPI report. The shared currency then rallied on the back of the overall weaker US Dollar to finish at 1.0937. Gains were constrained by mostly weak Euro area factory reports.

- USD/JPY – Against the Yen, the Dollar reversed its trend, initially hitting an overnight and two-week high at 108.471 before sliding to close at 107.70 on the back of the US ISM plunge.

- AUD/USD – the Australian Dollar initially rallied after the RBA cut its cash rate by 0.25% to a record low 0.75%. The move had been widely expected. The Australian central bank expressed concern about employment growth in its statement, with some forecasting more rate cuts in 2020. AUD/USD plunged to 0.66717, lows not seen since 2008, recovering to close at 0.6705.

On the Lookout: The economic data calendar is light for today ahead of Friday’s US Payrolls report. While the US ISM Manufacturing report was the lowest in a decade, the Dollar’s background remained solid. The US economy Is still growing faster than the rest of the world, so the Dollar seems to be the safest bet, according to some traders. We shall see.

We note that the Employment Component of the ISM report also fell to multi-year lows (46.3 from 47.4). I wonder how this will impact Friday’s US Payrolls report.

Today’s data calendar is light. China is still celebrating its National Day, and markets are still closed. Japanese Consumer Confidence (September) kick off the data today. European data kick off with Switzerland’s CPI, and UK Construction PMI. The US reports on its ADP (Private Sector) Non-Farms Employment Change.

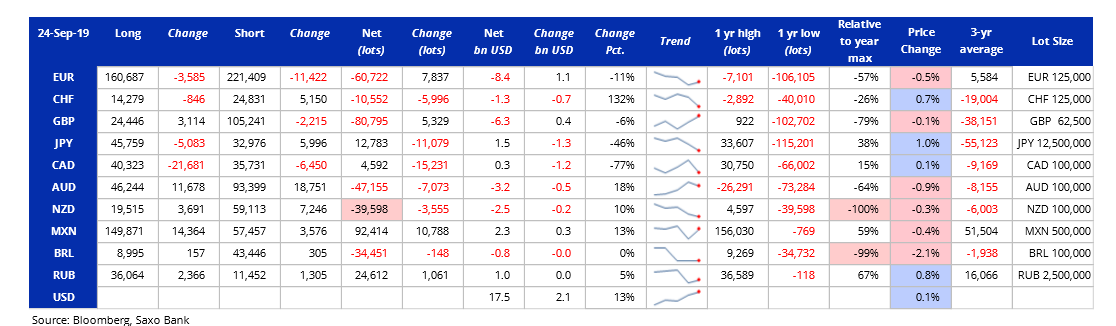

Trading Perspective: The latest Commitment of Traders/CFTC report (week ended 24 September) from Saxo Bank highlighted that net long US Dollar bets hit June highs. The highlight was the net short Kiwi bets hit a new record of 40,000 lots (-NZD 39,598 contracts).

While the Dollar may be the safest bet given the US economy is the least ugly compared to the rest of the world, market positioning is still long USD. This may be about to change.

US bond yields also fell with the 10-year rate falling 3 basis points to 1.64%. US rates have farther to fall. A bad Payrolls number on Friday will see yields plunge further. Without yield support, the Dollar will turn down.

- EUR/USD – The shared currency recovered to close at 1.0937 following a slump to 1.08792. Soft Eurozone inflation and weak manufacturing reports from Spain and Italy weighed on the Euro. German and French factory production matched forecasts. The latest Commitment of Traders report saw net Euro shorts trimmed further to total -EUR 60,722 contracts. EUR/USD has immediate resistance at 1.0950 followed by 1.0980. Immediate support can be found at 1.0900 and 1.0880. The Euro net short position is still at multi-year highs. There is no reason for selling it at current levels. Look to trade a likely range today of 1.0900-1.0970. Buy dips.

- AUD/USD – the Aussie Battler got poleaxed after an initial jump following the RBA rate cut to 0.75%, an all-time low, which was widely expected. AUD/USD rose to 0.6776 before plunging to 0.66717 after the RBA statement revealed that the central bank is concerned with job growth. The tone of the report, according to some bank analysts, suggest that Governor Philip Lowe and fellow policymakers have left the door open to further rate reductions in 2020. That remains to be seen. Other factors for the poor Aussie Dollar performance are the weak global economic backdrop and its effect on the market’s risk sentiment. Meantime net Aussie short bets for the week ended 24 September rose to -AUD 47,155 contracts (-AUD 40,082 prior week). A weak overall US Dollar will see these Aussie shorts run for cover. Immediate resistance lies at 0.6760 followed by 0.6770. Immediate support can be found at 0.6680 followed by 0.6650. Look to buy dips with a likely 0.6690-0.6750 range today.

- USD/JPY – The Dollar slipped back against the Japanese currency after hitting fresh two-week highs at 108.47. The plunge in the US ISM to the lowest in a decade turned the Greenback around, as well as risk sentiment. Both favoured the Yen. Japan’s 10-year JGB yield was up 2 basis points to -0.16%. US 10-year rates dropped 3 basis points. USD/JPY closed at 107.70 after hitting a low at 107.628. Immediate support lies at 107.60. The next support level comes in at 107.30. Immediate resistance can be found at 108.00 followed by 108.30. The latest COT report (weekended 24 Sept) saw net speculative JPY long bets trimmed further to +JPY 12,783 contracts. Look to sell rallies with a likely range today of 107.40-107.90.

Happy trading all.