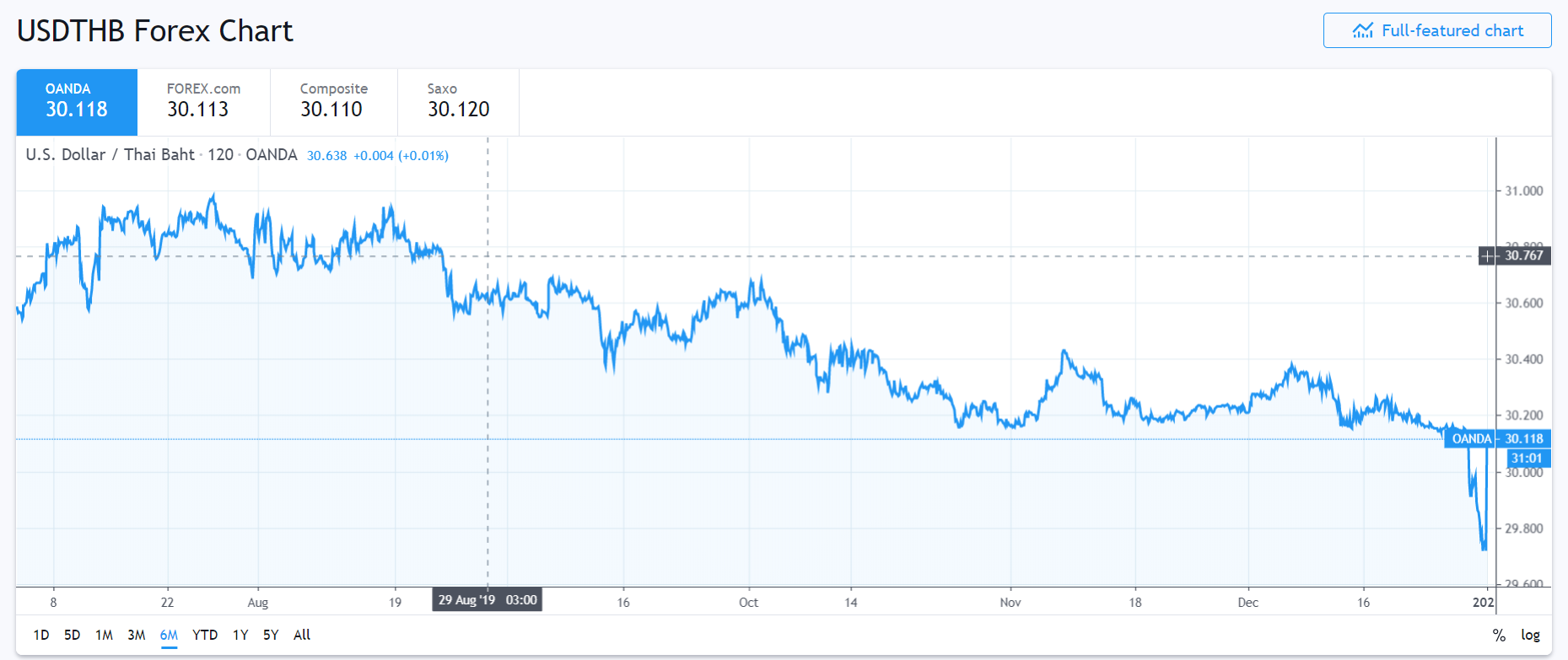

Summary: The Dollar slid anew against the majors after the US Conference Board reported that Consumer Confidence weakened marginally in December to 126.5 from November’s upward revised up to 126.8 (125.5). It was a clear case of further stale long Dollar positions being unwound against its main rivals in low volume trade. The Euro climbed to 1.12392, easing to settle at 1.1215 in early Sydney. Sterling outperformed, hitting two-week highs at 1.32845, finishing at 1.3250. The Dollar Index (USD/DXY) slid 0.33% to 96.42 (96.74). The Australian Dollar reached fresh 5-month highs at 0.70319, dipping to 0.7015 at this time of writing. Elsewhere, USD/CAD slid to 1.2950 lows not seen since October 2018, before climbing to 1.2975. Canada’s Loonie ended the year as the strongest major currency. The People’s Bank of China announced that it would trim its RRR (Reserve Requirement Ratio) by 50 basis points effective January 6. Prior to that President Trump announced that the Phase-One US-China trade deal would be signed on January 15 at the White House. The US Dollar stabilised against the Emerging Market currencies after plunging against some EMFX. Against the Thai Baht, the Dollar jumped 1.31% to 30.17 after plunging to 29.86 on 31 December 2019. To this writer, it smacks of a classic intervention by the Bank of Thailand to prevent any further Baht strength. Wall Street stocks slipped on profit-taking. The DOW was 0.12% lower at 28.417.

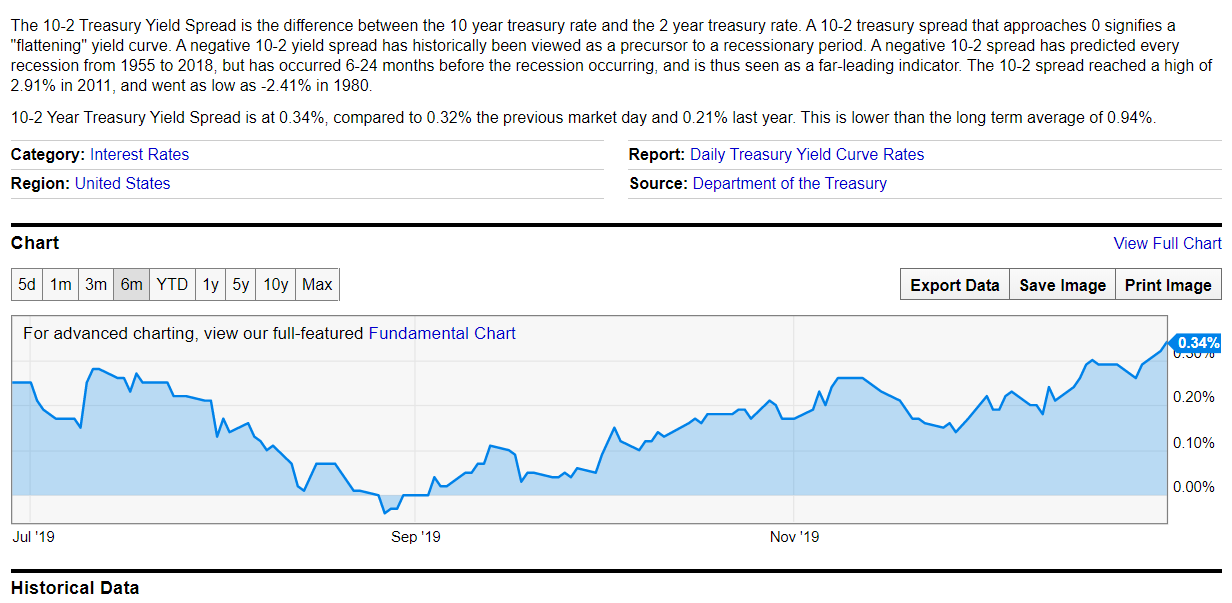

The US 10-year to 2-Year Treasury Spread widened to 0.34 %, its biggest in over 6-months, indicating that the US economy may have dodged a recession.

China’s Manufacturing PMI (December) matched the previous months output with a 50.2 print, beating forecasts at 50.1.

Chinese Non-Manufacturing PMI fell to 53.5, missing median forecasts at 54.2.

The US Fed Dallas Services Index improved in December to 17.9 from 1.2 in November.

- EUR/USD – The Euro advanced to 1.12392 overnight and 5-month high before easing to settle at 1.1215 in New York. The shared currency has benefitted from sustained buying back of speculative short Euro bets into year-end low volume trade.

- AUD/USD – The Australian Dollar gained a foothold above 0.70 cents, lifting to 0.70319 overnight and 5-month highs, closing marginally lower at 0.7015. The Aussie Battler has continued to benefit in the current risk positive environment. Aussie net short bets have also been squeezed higher.

- USD/CAD – Canada’s Loonie closed at 1.2975, ending 2019 as the world’s strongest major currency. The Canadian Dollar gained 5% against its US counterpart in a year that saw FX volatility slump to record lows. Unlike the other IMM currencies, speculative bets are long of the Loonie, which would limit gains in early 2020.

- GBP/USD – Sterling benefitted from the overall weaker US Dollar, climbing to 1.32845, two- week highs, from 1.3125. The move back above 1.30 is attempting to retrace its highs just ahead of Boris Johnson’s election victory in December at 1.3515.

- USD/THB – The Dollar soared back against the Thai Baht to 30.17 from its 29.978 close in Asia on the 31st of December 2019. The Thai Baht was Asia’s strongest currency in 2019, up 8% against the US Dollar, way ahead of any of the Majors. The Bank of Thailand has found it tough to halt the depreciation of the currency. The move up in the US Dollar from 29.97 to 30.17 smacks of a Bank of Thailand “smoothing” operation.

On the Lookout: FX will be cautious on the first trading day of 2020 after the news that China (PBOC, China’s central bank) reduced the RRR (effective January 6). The lifting of the RRR at this time of the year is to reduce the risk of a credit crunch into the Lunar New Year holidays later this month. The Lunar New Year celebration (Year of the Rat) begins on January 25.

Today sees the release of global Manufacturing PMI reports which should set the short-term tone of FX. China stars off with its Caixin Manufacturing PMI. The other Asian data released is Australia’s Commodity Prices (Annual). Euro area Manufacturing PMI’s follow with Spain, Italy, France, Germany and the Eurozone reports. The UK follows with its Final Manufacturing activity report. Canadian Final Manufacturing PMI follows. The US reports its Challenger Job Cuts, Weekly Unemployment Claims and Final Manufacturing PMI. So, a bit of data to spice up our day.

Trading Perspective: While most markets will return today, volumes will remain low and conditions thin until next week. The Dollar, however, should stabilise.

First US data has mostly improved this week. Analysts point out that the trade positive news has taken away negative risk tone, and in fact turned it positive. The US Dollar was looked at as the safe- haven currency, which is no longer the case. At the end of the day, the move down in the Greenback has been mainly the result of speculative long USD bets trimming their positions against the Euro, Sterling, Aussie and Yen. Lastly, the Dollar which fell hardest against the EM currencies before the New Year, has bounced back. Expect the Greenback to see support and hold its current levels.

- EUR/USD – The Eur traded to 1.12392, overnight and 5-month highs. Immediate resistance lies at 1.1240/50 followed by 1.1280. Immediate support can be found at 1.1195 followed by 1.1165. Euro area and Eurozone Manufacturing activity is released later today. Look for the Euro to consolidate with a likely 1.1175-1.1235 range today. Prefer to sell rallies.

- AUD/USD – The Aussie Battler rallied to 0.70319, overnight and 5-month highs before easing to settle at 0.7015. Immediate support lies at 0.7000, followed by 0.6970. The Aussie’s move north is the result of covering of speculative short bets, which have been at their biggest for most of last month. On the day, the Aussie has immediate resistance at 0.7030 followed by 0.7060. Look to trade a likely range of 0.6990-0.7030 today. Prefer to sell rallies.

- GBP/USD – Sterling has bounced back to over half its gains following Boris Johnson’s election victory in December. Sterling plunged to 1.2900 from 1.3500 and yesterday finished at 1.3250 after trading to 1.32845 highs. GBP/USD has immediate resistance at 1.3285 followed by 1.3345. Immediate support can be found at 1.3202 followed by 1.3152. Look for consolidation on the Pound with a likely range today of 1.3200-1.3300. Prefer to sell rallies.

- USD/CAD – The Dollar plunged against the Loonie to an overnight and 14-month low at 1.29516 before a modest rally to 1.2975 at the NY close. The Canadian Dollar was the best performing Major in 2019, appreciating 5% against the Greenback. USD/CAD fell below the 1.30 level for the first time this year. The Canadian Dollar’s appreciation came during a time of extremely low FX volatility. In our latest Commitment of Traders/CFTC report, speculative Canadian Dollar longs were at +CAD 20,741 bets. Apart from the Mexican Peso, it was the only IMM currency where speculators were long of the currency. Meantime the Canadian economy has underperformed. GDP has shrunk for the fist time in 8 months while Job Losses increased to 71,200 (16 December), the biggest loss since 2009. Immediate resistance for the USD/CAD lies at 1.3000 followed by 1.3040. Immediate support can be found at 1.2950 followed by 1.2920. Look to buy USD dips with a likely range today of 1.2970-1.3020.

Happy trading all.