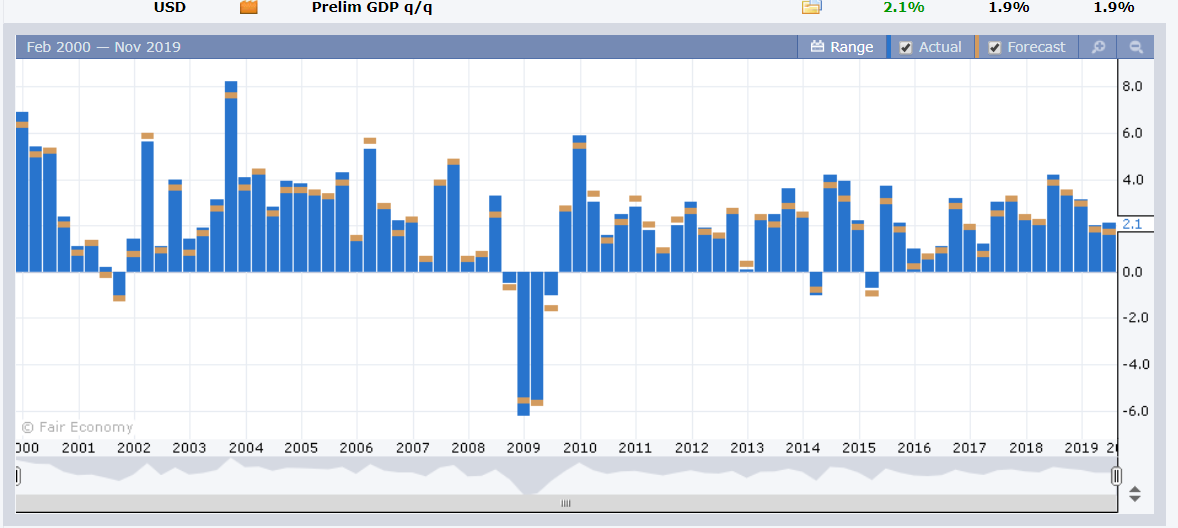

Summary: The Dollar grinded higher in dull, low volume, holiday-thinned trading supported by mostly upbeat US data. US Q3 GDP saw an upward revision to 2.1% from 1.9% while Durable Goods Orders rose 0.6% on increased defence spending. The Core PCE Price Index though dipped to 0.1% against 0.2% expected. Treasuries fell, Bond yields climbed with the benchmark US 10-year rate up 3 basis points to 1.77%. The Euro ended 0.15% lower at 1.1003 after dipping to 1.0992 overnight. USD/JPY broke through its November high to 109.61 before settling at 109.52. Trade hopes kept the market’s risk-on stance intact. Sterling traded in familiar ranges and climbed back to 1.2910 in late New York (1.2862). A UK election poll (YouGov MRP) continued to show a significant Tory majority for the upcoming election. The Australian Dollar edged lower to 0.6778 (0.6788) after Westpac Bank called for two rate cuts in 2020. The Dollar Index (USD/DXY) managed to climb 0.13% to 98.381 (98.274). Stocks climbed for the fourth straight day running to hit record highs. The US S&P 500 gained 0.26% to 3,153.00.

In other data released, Australian Construction Work Done beat expectations, rising to -0.4% (f/c -1.0%) while New Zealand’s Trade Balance underwhelmed to -1,013 million (f/c -1,000 million). Germany’s Import Prices fell to-0.1% bettering expectations of -0.2%.

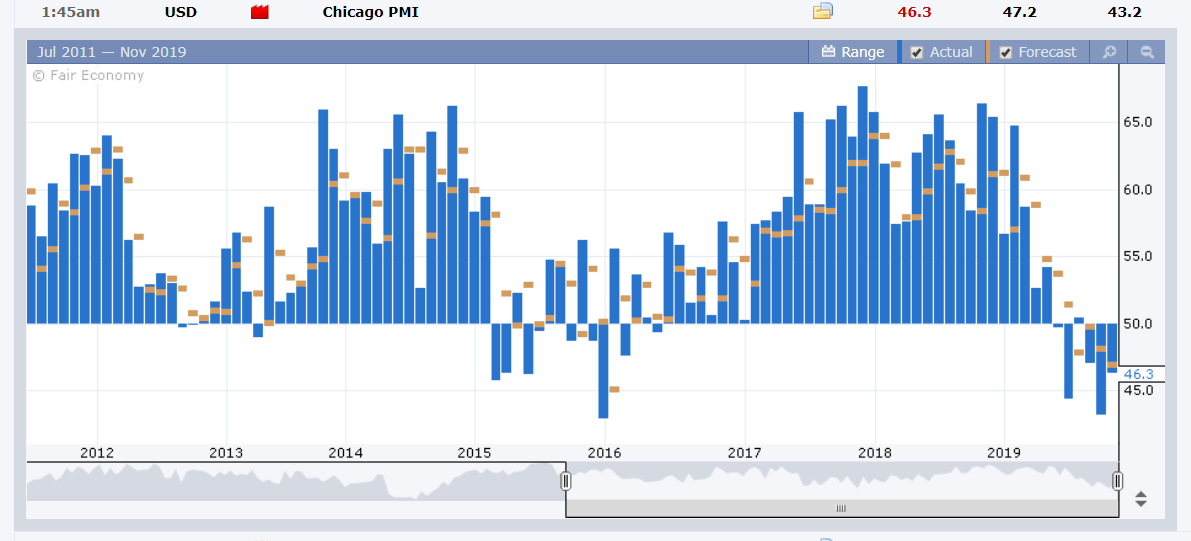

US Chicago PMI missed forecasts at 46.3 against expectations of 47.2. US Pending Home Sales fell to -1.7% in November from October’s 1.5%.

- EUR/USD – the shared currency fell to an overnight and two-week low at 1.09924 before rallying to settle at 1.1003 in New York. Sentiment on the Euro remains bearish into today’s US Thanksgiving holiday with the specs positioned short.

- USD/JPY – The combination of upbeat risk appetite and higher US bond yields boosted the Dollar to fresh November highs at 109.61 overnight before easing to 109.52 in New York. The haven darling Yen was the worst performing currency in thin trading.

- AUD/USD – The Aussie dipped back to 0.6778 at the close after trading in a familiar dull 0.67719-0.6791 overnight range.

- GBP/USD – Trading in the Pound was lacklustre with the British currency rallying back above 1.29 to close at 1.2909 (1.2862). Sterling continued to trade on the latest election poll, which favoured the Conservative Party although at latest glance at headlines, the lead over Labour has diminished.

On the Lookout: Markets continued with their risk-on stance with hopes for a trade deal at highs for this month. The move up in Wall Street stocks for the 4th day in a row plus slightly more upbeat US data enabled the Dollar to grind further up.

Not all the US data was upbeat with disappointments in the Chicago PMI and Pending Home Sales. The Core PCE Price Index in Q3 was lower which kept inflation subdued and may bother the Fed.

Markets may have gotten too euphoric leaving stocks and the Dollar vulnerable to a pullback in thin trading even if a trade agreement is reached in the near term.

Today’s data releases are relatively light with the US celebrating its Thanksgiving holiday. Japan starts off with its Retail Sales (y/y) for November, New Zealand releases its ANZ Business Confidence Index which is followed by Australia’s Q3 Private Capital Expenditure. Europe sees Swiss Q3 GDP, German Preliminary CPI, Spanish Flash CPI (November). Finally, Canada reports on its Current Account.

Trading Perspective: FX sentiment continues to favour the Greenback while market positioning remains short. We reported yesterday that net total long US Dollar bets increased to the biggest in 4 weeks. Which is a red light to an ex-trader like this writer, particularly in thin trading during the Thanksgiving weekend. As the familiar robot in the old TV series, “Lost in Space” used to say “Danger Will Robinson, danger”. Extra caution is warranted.

- EUR/USD – The shared currency continued to trade heavy against the Greenback, sliding to 1.09924 before climbing to settle at 1.1003. The Euro has immediate support at 1.0985 followed by 1.0965. A clean break through 1.0965 will see 1.0940. Immediate resistance can be found at 1.1030 (overnight high traded was 1.10244). The next resistance level lies at 1.1060. Look for a likely trading range of 1.0985-1.1025. Prefer to buy dips at current levels.

- USD/JPY – The Dollar continued to grind higher against the haven Yen with the market’s risk-on stance. The 2-basis point climb in the US 10-year yield also boosted the USD/JPY. Japan’s 10-year JGB yield closed at -0.13% (-0.11%). Overnight high traded was 109.609. Immediate resistance can be found at 109.60 and 109.80. The next resistance can be found at 110.10. Immediate support lies at 109.30 followed by 109.00. We highlighted that market positioning saw an increase in net speculative JPY shorts to -JPY 35,031 contracts. Much of the Dollar’s ascent against the Japanese currency is due to the market’s expectations of a trade deal. We could be in a classic case of “buy the rumour, sell the fact” here. Look to sell rallies with a likely range of 109.10-109.60.

- USD/DXY – The Dollar Index (USD/DXY) grinded higher to gain a further 0.13% to 98.381 closing in New York. The overnight high traded was 98.44 with immediate resistance found at 98.50. The next resistance level lies at 98.80. Immediate support can be found at 98.20 followed by 98.00 and 97.80. Look to sell rallies with a likely range of 98.10-98.40.

- AUD/USD – The Australian Dollar traded in a familiar range between 0.6772 and 0.6791 overnight, closing at 0.6777 for a loss of 0.13%. The Aussie spec market is short as we highlighted on Tuesday. Total net Aussie short bets rose to -AUD 47,240 contracts, the biggest total since mid-October. Immediate support lies at 0.6770 and 0.6740. Immediate resistance can be found at 0.6800 followed by 0.6830. Look to buy dips with a likely range today of 0.6770-0.6820.

Happy Thanksgiving Day and trading all.