Summary: It was a market where the Dollar Index (USD/DXY) closed little changed (98.207) ahead of today’s Jackson Hole, Wyoming central bank symposium. However, there was lots of movement in FX. The British Pound soared 1% against the Dollar to 1.2255 (1.2125), hitting one-month highs after German Chancellor Angela Merkel said a solution to the Irish border could be found ahead of the October 31 Brexit deadline. Against the beleaguered Euro, Sterling was up 1.08%. EUR/GBP plummeted to 0.9043 (0.9145). EUR/USD was modestly lower at 1.1080 (1.1087) despite better-than-expected rises in Euro area PMI’s. The Dollar dipped against the Yen to 106.42 (106.62). The Aussie fell 0.42% to 0.6760 (0.6780) while the Kiwi dropped 0.62% to 0.6370 (0.6403) after China’s offshore Yuan slumped 0.3% against the Greenback to 11-year lows (USD/CNH 7.0885 vs 7.0700). Asian currencies were all lower against the Dollar. Welcome to the good old world of FX!

US Bond yields rose while stocks ended with moderate gains. The US 10-year bond yield climbed to 1.61% (1.59%). The spread between the US 2-year and 10-year yield moved to flat after briefly hitting negative territory. The Dow climbed 0.17% to 26,225.

Fedspeak revealed a deep divide amongst US policymakers on interest rates. Amidst a worsening global economic outlook two Fed officials said they saw no need for easing at this time.

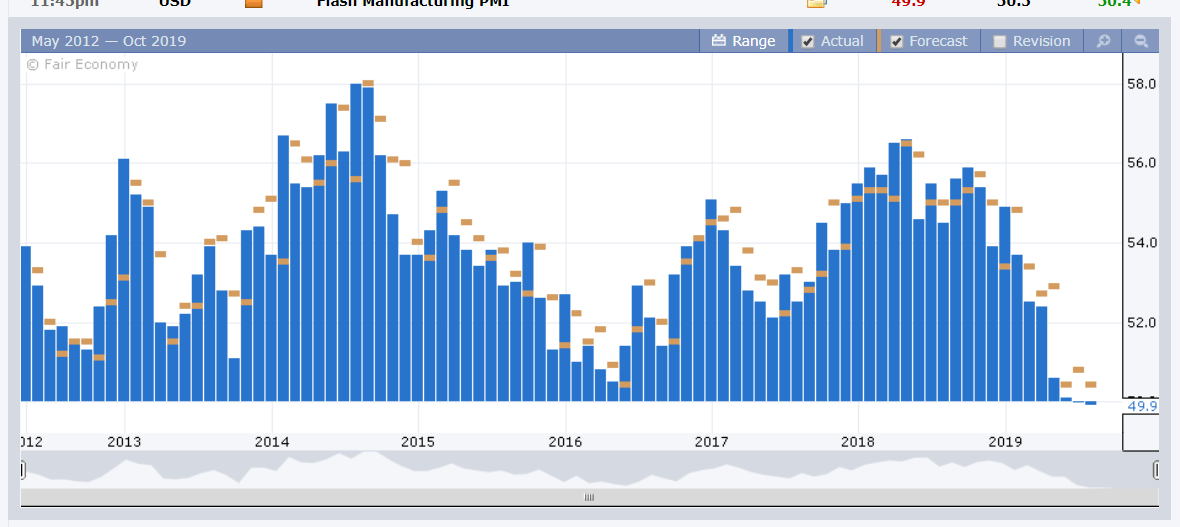

Australia’s Flash Composite PMI’s missed forecasts at 49.5 from 51.5. French, German and Eurozone Flash Manufacturing and Services PMI’s were all better than expected. US Flash Manufacturing PMI’s fell to 49.9 in August from 50.4 and a forecast of 50.9. US Flash Services PMI also underperformed. US Weekly Jobless Claims improved to 209,000 from 220,000.

- GBP/USD – The British currency jumped after Angela Merkel lifted invertor’s hopes that a solution to the crucial Irish border could be found before the October 31 Brexit deadline. Sterling soared to 1.2273, one-month highs before settling at 1.2255 as spec shorts scrambled for cover.

- EUR/USD – The Euro remained on the backfoot closing near at 1.1080 (1.1087) despite better-than-expected Euro area PMI data. Sentiment toward the shared currency remains bearish with the ECB expected to announce fresh stimulus measures in September.

- AUD/USD – The Aussie dropped after the Chinese Yuan hit its weakest since March 2008. USD/CNH jumped 0.3% to 7.0885 (7.0700) while Asian currencies fell. AUD/USD retreated to 0.6760 at the close.

On the Lookout: All eyes on Jerome Powell due to deliver a keynote speech at the Jackson Hole symposium in Wyoming (12 midnight Sydney 23 August). Powell’s speech will be on the “Challenges of Monetary Policy”. He faces a divided Fed after two key policymakers said they saw no need for easing at this time. Kansas City Federal Reserve president Esther George (a noted hawk) said that the July rate cut was not needed, and that further stimulus measures are not needed. Patrick Harker, Philadelphia Federal Reserve Head said that there was no need for another rate reduction. Dallas Fed President Kaplan backed the July rate cut. Powell will want to be seen not bowing to repeated attacks from President Donald Trump for not easing policy further. Markets are expecting the US central bank head to clarify the July meeting minutes “mid-cycle adjustment” message and re-affirm an easing stance. The risk is that Powell downplays any rate cut chances.

The US 2-year against 10-year bond yield spread closed flat (1.61%). A move to negative territory, the market’s most feared recession signal, will put pressure on the US Dollar.

Trading Perspective: It all boils down to Jackson Hole, the annual Wyoming symposium hosted by the Kansas City Fed which is attended by global central bankers, finance ministers and academics and financial market participants. In the past, Jackson Hole has moved FX and this year is no different. Be ready for a volatile ride in FX tonight.

- GBP/USD – Yesterday’s move in Sterling saw the impact of market positioning in FX. While Angela Merkel’s comments offered hope for a Brexit backstop solution, the reality is that the UK and EU remain far apart on the issue. French President Macron was sceptical after a meeting with Boris Johnson. For weeks, Sterling has been under pressure on fears that Johnson would take the UK out of the EU without a deal. Net speculative short GBP bets increased to multi-year highs according to the latest COT/CFTC report. GBP/USD jumped to an overnight high at 1.2273 from 1.2125 yesterday before settling at 1.2255. Immediate resistance lies at 1.2270-1.2300. Immediate support can be found at 1.2220 and 1.2180. From here it will depend much on where the US Dollar heads. Look for a volatile 1.2200-1.2300 range today.

- EUR/USD – The Euro slid to 3-week lows at 1.10636 before settling at 1.1080 in New York. The shared currency traded to an overnight high at 1.11132. The immediate resistance at 1.1120/30 is strong and would have to see a clean break to push the Euro higher. Immediate support at 1.1060 should hold, otherwise we will see EUR/USD test this year’s low at 1.1025. The next support level lies at 1.0980. Market sentiment is decidedly bearish, but the specs are short. Look to trade a likely range of 1.1060-1.1110 until Powell speaks at Jackson Hole.

- AUD/USD – Like the Euro, market sentiment is bearish on the Australian Battler. Net speculative Aussie shorts increased to -AUD 62,912 contracts, an increase of 13% from the previous week. Spec shorts are now at 83% of 2019’s biggest total. The Australian Dollar TWI is at lows now seen since 2008. All supportive factors. On the other hand, continuing weakness in the Chinese Yuan and Asian currencies will weigh on the Australian currency. The locals are decidedly bearish which makes this writer want to buy Aussie dips. An overly bearish domestic market has almost always been a reverse indicator. AUD/USD closed at 0.6760 from 0.6780 yesterday. Immediate support lies at 0.6750 (overnight low 0.67509). The next support level lies at 0.6730 and 0.6700. Immediate resistance can be found at 0.6790 (overnight high 0.67872) followed by 0.6810. Look to buy dips with today’s range likely 0.6750-0.6800.

Put those tin helmets on and get ready to rumble. Happy Friday and trading all.