Summary: The Dollar Index (USD/DXY), a popular gauge of the Greenback’s value against a basket of 6 major currencies fell 0.56% to 99.558 (100.183) after the Federal Reserve announced it provide USD 2.3 trillion in loans to businesses to support the economy. US Initial Jobless Claims climbed to 6.606 million in the week ended March 3, more than economist’s expectations of 5 million. Best performing currency went to the Australian Dollar, for the second day running, this time surging 1.65% to 0.6340 (0.6232). The Euro advanced 0.65% to 1.0927 (1.0855) against the broadly-based weaker US Dollar. Sterling rose 0.53% to 1.2460 (1.2380), aided by the news that UK PM Boris Johnson has left ICU. The US Dollar dropped 0.8% against the Canadian Loonie to 1.3980 (1.4020) despite a fall in Brent Crude Oil prices and a dismal Employment Report. USD/JPY dipped to 108.50 from 108.90 on lower US bond yields. Emerging Market currencies extended their rallies against the Greenback. Against the South African Rand, the Dollar slid to 18.0300 from 18.20 yesterday.

Wall Street stocks rose. The DOW added 1.7% to 23,790 (23,080) while the S&P 500 rose 1.8% to 2,790 (2,750). The benchmark US 10-Year bond yield eased to 0.72% from 0.77% yesterday. Germany’s 10-year Bund yield was 5 basis points lower to -0.36%.

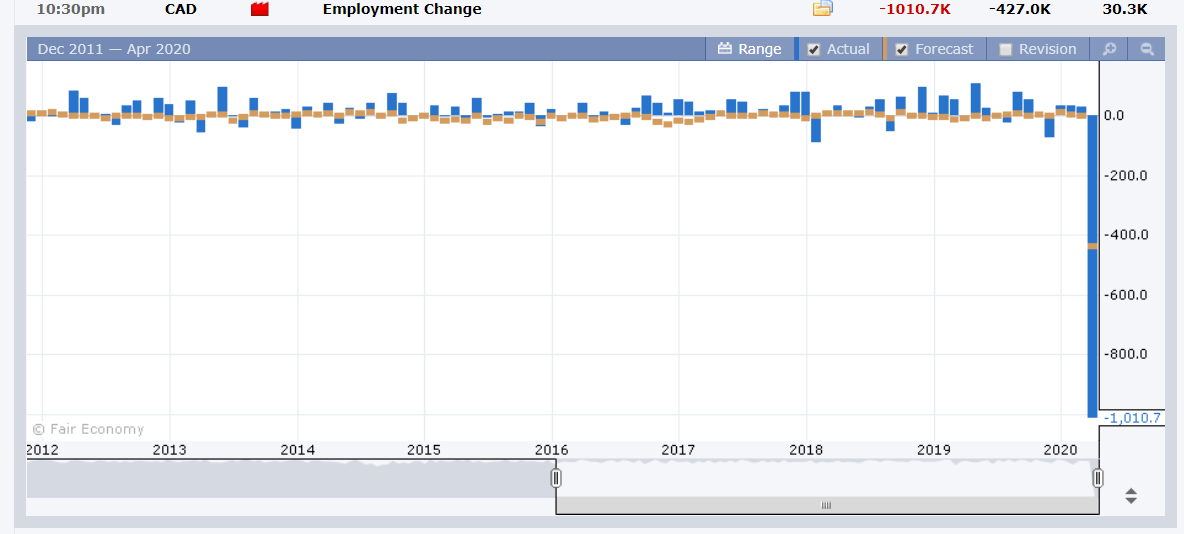

UK Construction Output underwhelmed to -1.7% against forecasts of +0.3%. Britain’s Trade Deficit widened to -GBP 11.58 billion from -GBP 3.7 billion. Italian Industrial Production beat forecasts, rising to -1.2% against -1.6%. Canada’s Employment plunged by 1.01 million workers, more than twice the total job losses during the 2008/2009 global financial crisis and much worse than forecasts of a 427,000 loss. The Unemployment rate in March jumped to 7.8%, from 5.6%. US Core PPI rose to 0.2%, beating forecasts of 0.0%. Headline Producer Prices were at -0.2% against forecasts at -0.3%.

On the Lookout: Today FX trading will be thin with Australia, New Zealand, Switzerland, the UK and Canada closed in observance of Good Friday. On Monday, apart from those closed today, most of Europe will also be closed to observe Easter Monday.

The focus will be on the G20 meetings and the US CPI release (both today).

Other data releases today are Japan’s PPI and Bank Lending reports. China releases its Annual CPI and PPI data. Europe sees French Industrial Production before the US Headline and CPI numbers are released. Federal Reserve FOMC members Loretta Mester and Randal Quarles have speaking engagements.

Trading Perspective: The Dollar retreated on the back of the dismal US Jobless Claims and lower bond yields following the Fed’s announcement of direct loans to small and medium size companies. Jerome Powell, in a speech afterwards, said that the US central bank would continue to use all the tools at its disposal until the US economy begins to rebound fully from the harm caused by the Covid-19 breakout. This reduced the Dollar’s safe haven support, boosting risk currencies like the Aussie, Kiwi, Canadian Loonie as well as EMS.

While this is the case, speculative market positioning remains mostly short of US Dollars mainly against the Euro. Dollar shorts have also been established against the Yen, Sterling and Canadian Dollar to a lesser extent. Today begins the long Easter weekend where liquidity is at a premium and market positioning is a factor. Not a time for any strong opinions. Look to trade within established ranges.

EUR/USD – Boosted by a Weaker US Dollar, 1.1000 to Cap

The Euro advanced 0.65 % to close at 1.0927 from yesterday’s opening at 1.0855. Overnight high traded was 1.09518. Broad-based US Dollar weakness boosted the Euro higher. European Union members reached a deal overnight to provide further support to member nations. In Germany, Chancellor Angela Merkel pointed out that tighter measures to slow the spread of Covid-19 may not be necessary. All mildly positive for the shared currency. The main negative is the current market’s speculative positioning. We highlighted that net speculative long Euro bets were at their largest since June 2018 in the latest Commitment of Traders report. Something to watch out for, particularly in less liquid markets.

EUR/USD has immediate resistance at 1.0950/1.0980 and 1.1000. Immediate support can be found at 1.0900/1.0870 and 1.08940. Look for a likely range today of 1.0850-1.0950. Prefer to sell EUR/USD rallies.

AUD/USD – Up on Soft USD, Illiquidity into Chinese Data – 0.6150-0.6400

The Aussie surged higher after the US Dollar broke lower in response to the climb in the latest weekly Unemployment Claim. The number of Americans claiming for Unemployment benefits rose to 6.606 million from the previous week’s upwardly revised 6.867 million (6.648 million). The jump also beat median forecasts of 5 million. The Federal Reserve also surprised markets with its announcement to provide loans to small and medium sized businesses worth USD 2. 3 trillion.

US 10-year bond yields dropped 5 basis points to 0.72%. Australia’s 10-year bond yield, by contrast was unchanged at 0.90%. The yield gap narrowed. Which should see the AUD/USD capped.

AUD/USD closed 0.6335 after trading to 0.6363 overnight high. Immediate resistance lies at the 0.6360 level followed by 0.6400. Immediate support can be found at 0.6300 followed by 0.6240. Markets will be thin as Australia and New Zealand markets will be closed today and Monday. Expect a volatile long weekend with a likely range of 0.6200-0.6400.

USD/CAD – Weaker, But Base Forming, 1.3950-1.4150 Likely

The USD/CAD pair dipped to 1.3980 from 1.4020 yesterday also weighed by the overall weaker US Dollar. Canada’s Employment was just as, if not more dismal than that of its southern neighbour. According to Royal Bank of Canada, the plunge in Employment to 1.01 million in March was the largest dating back to 1976 and were more than twice the total job losses in the 2008/2009 Global Financial Crisis. The Jobless rate soared to 7.8% from 5.6% in February and worse than forecasts of 7.4%. Brent crude oil prices ended lower at USD 33.10 (USD 34.50) despite Russian assurances that talks with Saudi Arabia were going well on cutting production.

The main driver lower for USD/CAD was the soft US Dollar. We highlighted yesterday that speculators turned long CAD bets to +CAD 7,316 contracts from the previous week’s -CAD 29,245. Which is a huge turnaround. Market positioning will be a factor this long weekend as Canada also will be away in observance of Good Friday and Easter Monday.

Immediate support for USD/CAD lies at 1.3970 followed by 1.3940. Immediate resistance can be found at 1.4030 followed by 1.4080 and 1.4130. Look for a likely range ahead of 1.3970-1.4170, prefer to buy any dips.