Summary: The Dollar erased gains following better-than expected US Retail Sales data in dull holiday trade. After climbing to 97.45, 3-week highs on Thursday, the Dollar Index (USD/DXY) slipped to 97.295, down 0.10%. With most of the markets closed for Easter holidays on Friday and Monday, volumes were light with little movement. The Euro rallied off lows at 1.1230 to 1.1260 this morning. Euro-area PMI’s were mixed. Sterling stayed soggy, failing to gain on the Dollar’s retreat, closing little-changed at 1.2980. US bond yields were unchanged after Thursday’s rally. Benchmark 10-year yield remained at 2.59%. Yesterday, US Existing Home Sales missed forecasts.

Oil prices were the biggest movers for the currency markets yesterday. The US government said it would no longer issue a pass that allowed eight countries to buy Iranian oil without facing sanctions. Among these countries are China and India. Brent Crude Oil prices jumped 3%, the highest in 6 months. Which lifted currencies such as the Canadian Loonie (+0.3%) and Russian Rouble (+0.5%) against the Greenback.

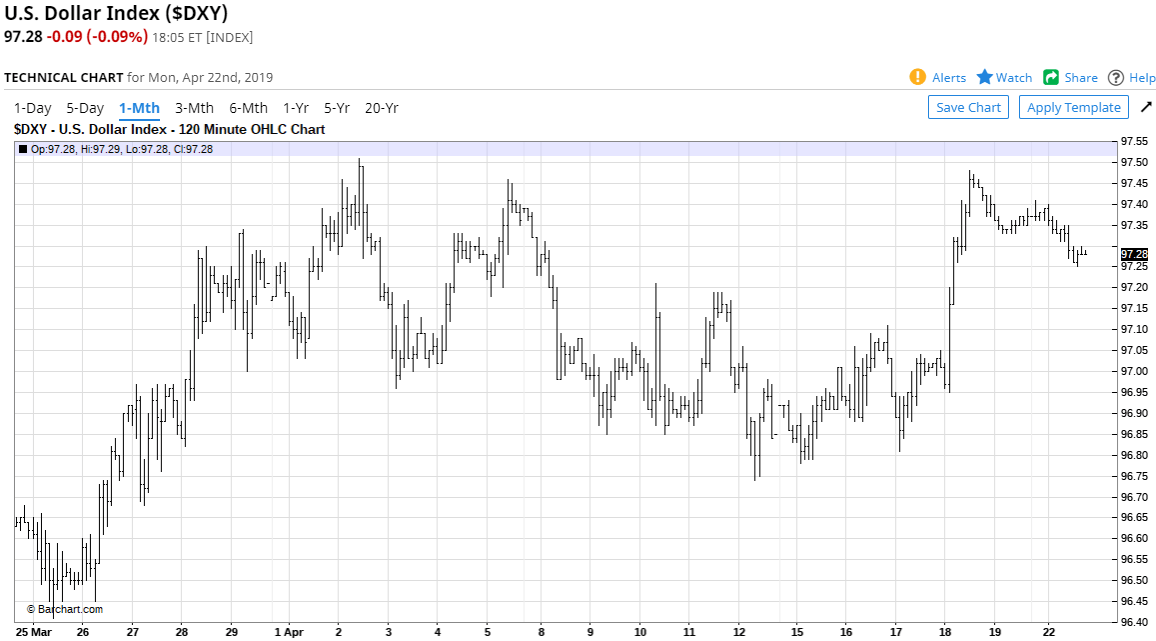

- USD/DXY – The Dollar Index rallied on the back of better-than-forecast US March Headline and Core Retail Sales following a weak start to the year. USD/DXY traded to 97.488 from 97.011 Thursday, fresh 3-week highs, before drifting lower to 97.295 this morning.

- EUR/USD – The Euro slumped 0.6% to 1.1230 following the robust US retail sales report. Euro area PMI’s were mixed. EUR/USD then climbed off its lows in dull holiday trade to finish at 1.1260 this morning.

- USD/JPY – Dollar Yen trading was muted with the overall range between Thursday and today a mere 22 pips (111.84-112.06). USD/JPY closed at 111.95 with little to drive it either way.

- GBP/USD – Sterling remained glued near the bottom end of its range at 1.2985. Stronger-than-expected UK Retail Sales failed to lift the British Pound on Thursday. It literally hasn’t moved since then, closing at 1.2982 yesterday. Brexit’s drama, due to its extended uncertainty, pushes aside British data. The Bank of England is unlikely to act on interest rates while Brexit remains unresolved.

On the Lookout: Expect a muted start today with little data due. Today sees the release of Japan’s BOJ Core CPI (annual), Eurozone March Consumer Confidence and US New Home Sales for March. Tomorrow sees Australia’s RBA Headline and Trimmed Means CPI report. Japan reports its All Industries Activity as well as Leading Economic Index for February. Germany follows with its IFO Business Climate, Current Assessment and Expectations Index for April. The ECB’s Economic Bulletin rounds off European data. The UK reports on its Public Sector Net Borrowing (Spending) for March. The Bank of Canada and Bank of Japan Interest Rate Decisions, policy meetings and rate statements are on Thursday followed by US Headline and Core Durable Goods Orders (March). The week ends with Friday’s Tokyo and Japanese CPI, Industrial Production, Retail Sales and Unemployment Rate. The US reports its Preliminary Q1 2019 Advance GDP, GDP Price Index as well as Personal Consumption Expenditure data.

Trading Perspective: The better-than-expected US Retail Sales report lifted the US 10-year bond yield to 2.61% before slipping to close at 2.59%. Where it remained due to the thin holiday-affected markets over Easter. The fall in US Existing Home Sales date in muted markets had little effect on treasury yields. We shall see today. The data releases ahead will determine the next move for US yields. A sustained rally above 2.60% should provide the Dollar Index (USD/DXY) the lift through strong resistance at 97.50. Markets will look ahead to this week’s data and events releases.

Data releases start in earnest on Wednesday. The Bank of Canada and Bank of Japan Interest rate and policy meetings Thursday will be closely watched. The US releases its Preliminary 2019 Q1 Advance GDP report on Friday. This often has the most impact on the markets. Market positioning will not have changed much despite no report over the Easter weekend. The CFTC report will be released on April 27.

- EUR/USD – The Euro broke through immediate support at 1.1250 following the robust US Retail Sales report. EUR/USD traded to a low of 1.1226 on Thursday before recovering to 1.1258 this morning. Overnight high traded was at 1.1262. Immediate resistance for today can be found at 1.1270 followed by 1.1310. Immediate support lies at 1.1240 and 1.1210.

Market positioning is still short EUR bets. Look for a likely range today of 1.1235-75. Prefer to buy dips - USD/JPY – On Friday, in muted and thin markets, the BOJ trimmed the amount of debt it offered to buy at a regular market operation in the 10 to 40-year maturities. This pushed the USD/JPY below 112.00 to 111.895. Ahead of this week’s BOJ meeting, traders were wary to push the currency too much either way. US 10-year JGB yields were little-changed at -0.03%. The Dollar finished little-changed at 111.95 Yen. USD/JPY has immediate resistance at 112.00 followed by 112.20. Immediate support can be found at 111.80 and 111.50. Look to sell rallies with a likely 111.75-112.15 range today.

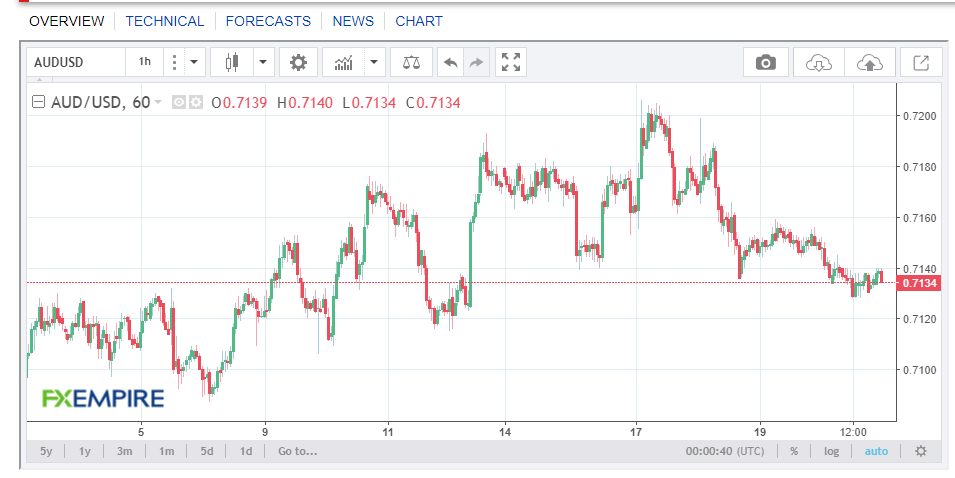

- AUD/USD – The Australian Dollar dropped to a low of 0.7128 yesterday before settling at 0.7135 early this morning. Initially, better-than-forecast US retail sales did not impact the Aussie much, it closed on Thursday at 0.7170. AUD/USD has drifted lower since. The RBA’s Headline and Trimmed Mean CPI for Q1 2019 are due for release tomorrow. This will determine the next big move for the Battler. Immediate support lies at 0.7130 followed by 0.7110. Immediate resistance can be found at 0.7175 and .7200. Market positioning remains long Aussie. Look for a likely range today of 0.7130-0.7180. Prefer to buy dips.

Have a good week ahead and happy trading all.