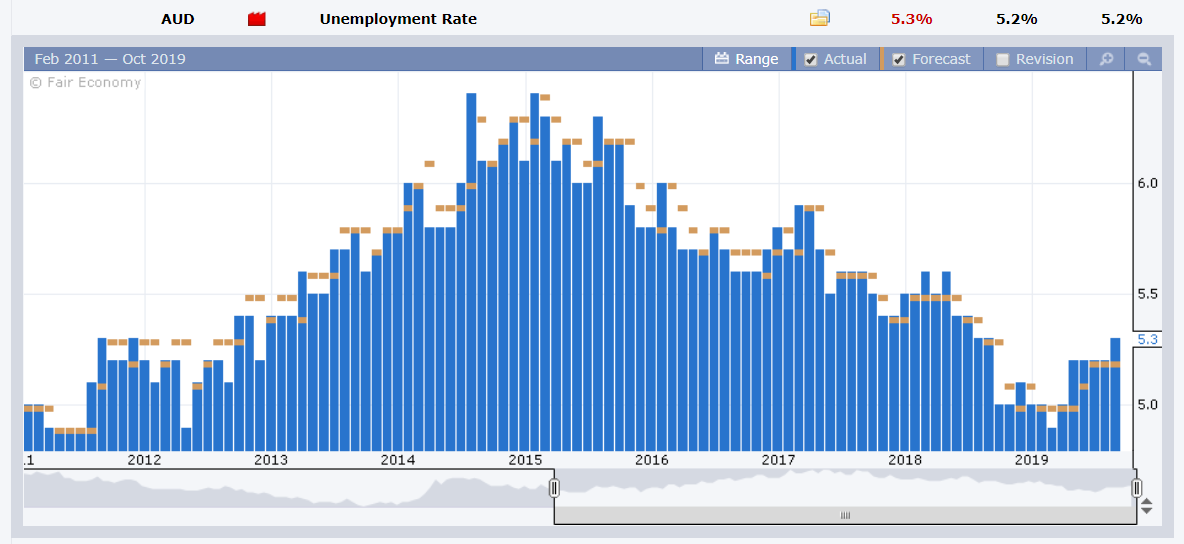

Summary: The Dollar finished mixed the day after a hawkish Fed rate cut and no policy changes from the Bank of Japan, the Swiss National Bank and the Bank of England. While the Dollar Index (USD/DXY) often a mirror of the Euro was lower, the Greenback rose against the antipodean currencies. The Euro was up 0.10% to 1.1042 from 1.1028. Sterling soared to fresh 7-week highs (1.2560) after European Commissioner Juncker said a Brexit deal is possible before Oct 31 if alternative arrangements address the backstop objectives. GBP/USD closed at 1.2527, up 0.4%. The US Dollar fell against the Yen to 108.04 from 108.45 after the BOJ kept policy unchanged and US bond yields slipped. Benchmark US 10-year treasury rates were at 1.78% from 1.80%. The Dollar Index (USD/DXY) was 0.19% lower to 98.369 (98.593 yesterday). The Australian Dollar dropped to 0.6792 (0.6829) after Australia’s Unemployment rate shot up to a twelve-month high at 5.3% despite strong Employment growth. Antipodean cousin, the New Zealand Dollar was down 0.28% to 0.6299.

Wall Street stocks drifted at the New York close to end mildly lower. The OECD downgraded global economic growth to its worst level since the recession brought about by the financial crisis.

Japan’s All Industry Activity Index missed forecasts at 0.2% against 0.4%. US Weekly Unemployment Claims were lower at 208,000, against 210,000 expected. The US Philadelphia Manufacturing Index beat expectations climbing to 12 from 10.9. US Existing Home Sales rose to 5.49 million in August from July’s 5.42 million.

- EUR/USD – The Euro maintained its foothold above 1.10, finishing at 1.1040 from 1.1027 yesterday. The shared currency traded in a familiar range between 1.1023 and 1.1073.

- USD/JPY – Lower US bond yields and a less positive risk stance by the markets saw the Japanese currency climb against the US Dollar. USD/JPY dipped to 108.04 in New York from 108.45 yesterday. The Bank of Japan left its policy rate unchanged at -0.10%.

- AUD/USD – Australia’s Unemployment Rate rose to 5.3% against a forecast of 5.2%, its highest for this year. The Aussie Battle fell to 0.6780 before closing at 0.6792 (0.6830 yesterday). The Australian Business Insider reported that the local market is signalling a 70% chance of an October rate cut.

- GBP/USD – Sterling rallied to finish 0.42% at 1.2530 after European Commissioner Jean Claude Junker said that if objectives for the backstop are met through alternative arrangements, the backstop wouldn’t be needed and there could be a Brexit deal before the October deadline. The British Pound got a strong boost from the comments.

On the Lookout: After the other central banks left their interest policies unchanged, FX action was limited to familiar range trading. The Dollar Index, a measure of the Greenback’s value against 6 currencies, mainly the Euro was a touch lower. Against other currencies, the US Dollar was mixed.

Wall Street stocks trimmed early gains following the OECD’s downgrade of the global economy. On the trade front, both China and the US signalled impatience with talks currently at a standstill. The Yen and Swiss Franc rallied.

Fedspeak begins today with FOMC members Williams and Rosengren scheduled to talk at different functions. Williams is speaking at a Swiss National Bank conference in Zurich. Rosengren is due to speak at a credit conference in New York.

Other data released today include Japanese National Core CPI (y/y) and Credit Card Spending. The Euro area sees Germany’s August PPI and Eurozone Consumer Confidence data. In the UK, the Bank of England releases is Quarterly Economic Bulletin. Canada’s Headline and Core Retail Sales follow. There are no US data reports due today.

Trading Perspective: Overnight US bond yields were a touch lower. US two-year treasury rates were down 2 basis points to 1.74%. Other global bond yields were flat apart from Australia’s which dropped 7 basis points following the rise in the Jobless rate.

Stocks erased early gains while the Yen and Swiss France rallied. Both the Aussie and Kiwi were lower. With risk aversion creeping in, this general pattern should dictate Asian trading within ranges established yesterday.

- EUR/USD – The Euro traded between 1.1023 and 1.1073 range yesterday. EUR/USD held above the pivotal support at 1.1000. Given the lower US yields, expect the shared currency to hold its gains. EUR/USD has immediate resistance at 1.1070 followed by 1.1100. Immediate support lies at 1.1020 and 1.1000. Look for a likely range today of 1.1030-1.1080.

- USD/JPY – The Dollar slumped to an overnight low at 107.788 against the Yen from 108.45, before settling at 108.04. Immediate support lies at the 107.80 level followed by 107.50. Immediate resistance can be found at 108.20 and 108.50. While the momentum is lower for USD/JPY given lower US bond yields and more risk averse markets, keep in mind that market positioning is long of JPY bets (ie short USD). Look for a likely trading range today between 107.70-108.30. Prefer to buy dips.

- AUD/USD – The Aussie Battler was under pressure all day following the release of Australia’s Employment report. While Employment saw a strong gain of +34,700 jobs (against a forecast of +15,200), the Jobless rate rose to 12-month highs at 5.3%. The Participation rate (proportion of people looking for work) was also higher at 66.1%, a new record. AUD/USD traded to an overnight low at 0.67803. This is immediate support on the day. The next support level can be found at 0.6850. Immediate resistance can be found at 0.6810 and 0.6840. Look to trade a likely range today of 0.6770-0.6820. Prefer to buy dips.

- GBP/USD – Sterling jumped to a fresh 7-week high at 1.2560 on the Junker comments regarding the backstop and a possible Brexit deal before the October deadline. GBP shorts continue to reduce their positions which should keep the Pound buoyant. GBP/USD closed a touch lower at 1.2530 (1.2470 yesterday). Today is the highest close for Sterling since July 19. This makes me a bit cautious up at current levels. Immediate resistance lies at 1.2560 and 1.2600. Immediate support can be found at 1.2500 and 1.2470. Look to sell rallies with a likely range between 1.2475-1.2555 today.

Happy Friday and trading all.