Summary: The Dollar eased against most of its Rivals ahead of this week’s ECB policy meeting and FOMC minutes release. Traders pared their long USD bets after the Greenback failed to gain fresh ground following Friday’s mixed US Payrolls report. The Euro, most shorted currency against the Greenback, rallied to near 2-week highs before settling at 1.1260, up 0.44%. This week’s focus is on Wednesday’s ECB meeting where no policy changes are expected. The press conference which follows will be of keen interest. ECB policymakers may touch on the possibility of tiered rates amid weak growth in the Euro region and fears of a global recession. Hours later, the US Fed releases the minutes of its latest FOMC meeting following a key inflation report (CPI). All happening tomorrow!

USD/JPY slipped 0.21% to 111.50 from 111.72 yesterday. Speculative JPY short bets were the second biggest, next to the Euro. The Australian Dollar rallied to 0.7125 from 0.7107, up 0.35%. Sterling rose to 1.3067 from 1.3037 on the back of the generally weaker US Dollar. PM May tries to convince the opposition Labour party to approve her Brexit deal. May has until Friday to bring a deal to the EU for a response.

Wall Street stocks were little-changed. Treasury yields steadied. Benchmark US 10-year yield closed at 2.52% from 2.50% yesterday. No fresh concrete news on China-US trade talks emerged.

Data releases were light yesterday. Japan’s Consumer Confidence slipped to 40.5 from 41.5. Eurozone Sentix Investor Confidence Index beat forecasts. Canadian Housing Starts underwhelmed.

- EUR/USD – The Single currency rallied off it’s 1.1200 base to an overnight and near 2-week high at 1.12744 before settling at 1.1260. Total net speculative short bets in the Euro increased to -EUR 99,200 contracts (week ended April 2) from the previous week’s -EUR 80,300. It’s a big increase in shorts, currently at multi-year highs.

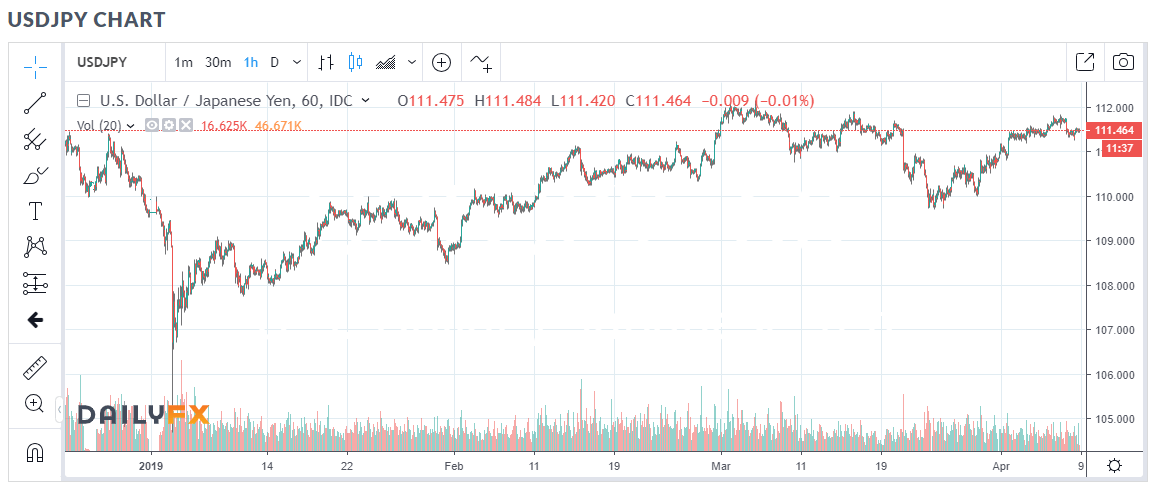

- USD/JPY – the Dollar eased after twice attempting to trade at 112.00 since Friday. USD/JPY traded to 111.74 before easing to 111.50 at the close. The Yen is the second most shorted currency against the Dollar. The 112.00 level will be difficult to break.

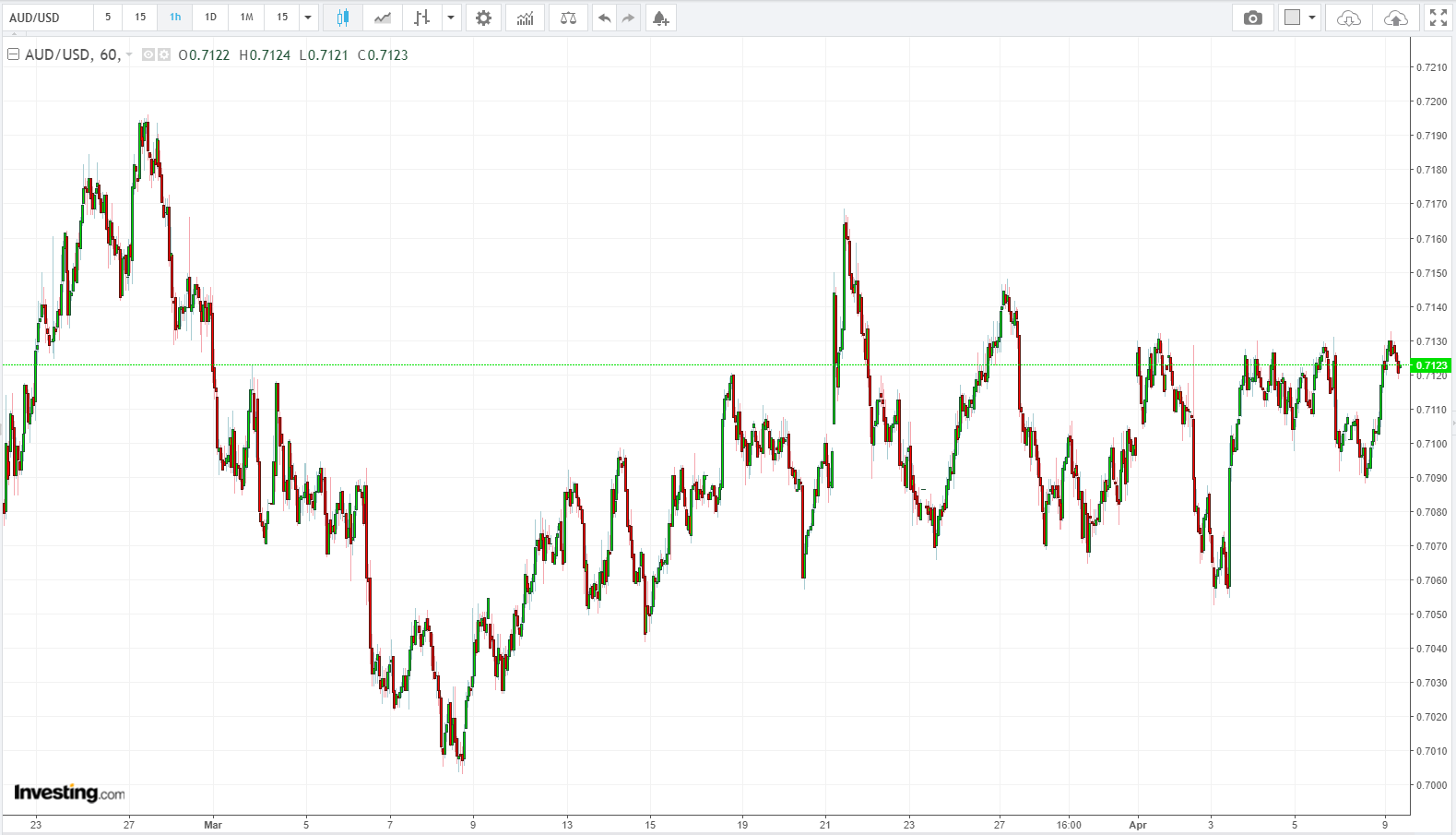

- AUD/USD – The Australian Dollar benefitted from the overall weaker Greenback, trading to 0.71307 and settling at 0.7125. Many traders remain bearish on the Aussie Battler and the market is short.

On the Lookout: Data releases today are light and mostly 2nd-tier. Australia reports on its Home Loans for March which are expected to slip 3.0% from the February’s 2.6% fall. Europe starts off with Switzerland’s Jobless rate followed by Italian Retail Sales. The US releases its NFIB Small Business Index as well as JOLTS Job Openings. Job Openings, which exclude the farming industry, are forecast to fall to 7.54 million from 7.58 million. Tomorrow’s the big day with the ECB policy meeting, US Headline and Core inflation reports and the FOMC minutes.

Trading Perspective: Expect the currencies to consolidate their gains against the US Dollar today. US bond yield rises were not matched by their Rivals. This should provide support for the Greenback. The Dollar Index (USD/DXY) closed at 97.062, down 0.32% (97.363 yesterday). The support at 97.00 should hold. Benchmark US 10-year bond yields climbed to 2.52% (2.50%). Germany’s 10-year Bund yield closed flat at 0.00%. Japan’s 10-year JGB yield fell two basis points to -0.06%. Australian 10-year yields slipped 3 basis points to 1.87%.

- EUR/USD – While the Euro has rallied off it’s base at 1.1200, the bounce was limited to 1.12744, near two-week highs. Market sentiment is still decidedly bearish on the Euro with many looking for 1.1000 next. While the ECB is not expected to change policy, there is talk about a tiering of rates due to the weak Euro area growth and fears of a global recession. Mario Draghi’s press conference following the ECB’s last meeting saw the Euro plummet from 1.1320 to 1.1175. While the Euro bounced to 1.1420 following the Fed’s dovish bent in its March meeting, it has since grinded lower. Short market positioning remains at an extreme. Look for consolidation with a likely range today of 1.1230-80. Look to buy dips.

- USD/JPY – The Dollar failed to break 112.00 against last night with the high at 111.74. Immediate resistance lies at 111.70 followed by 112.00 which is strong. The widening of the gap in the 10-year yields will support USD/JPY today. Immediate support can be found at 111.30 (overnight low 111.280). The next support level is at 111.00. Net JPY shorts had a small increase in the latest CFTC report. The Yen is still the second most shorted currency against the Dollar. Look to sell USD/JPY rallies with a likely range today of 111.25-75.

- AUD/USD – The Australian Dollar bounced from overnight lows at 0.70876 to finish at 0.7125 in New York, up 0.35%. An overall weaker Greenback supported the Battler. Emerging Market currencies were mixed. Markets are looking for a breakthrough in the China-US trade talks to lift the Aussie. Yet gains have been fleeting and limited. The main driver for the Aussie will still be the US Dollar. Speculative Aussie shorts are also at extremes. Immediate support can be found at 0.7110 and 0.7080. Immediate resistance can be found at 0.7140 and 0.7170. Look to buy dips with a likely range today of 0.7110-40.

Happy trading all.