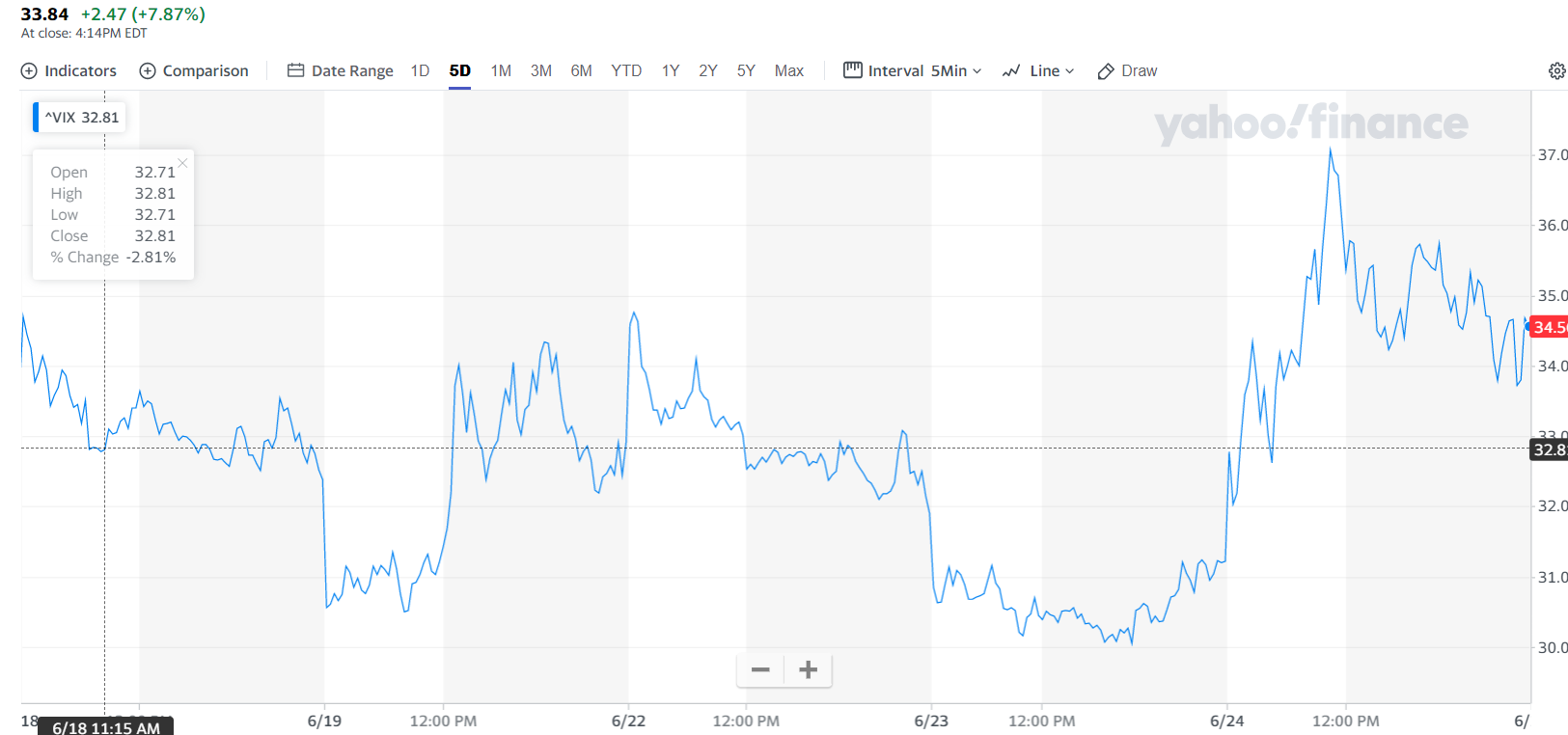

Summary: A resurgence in coronavirus infections in multiple US states hit risk appetite hard. California and Florida, the two largest economies in America reported a record number of new Covid-19 cases. Outside of the US, Brazil’s daily cases climbed by over 37,000. The US Dollar advanced against all of its rivals, including the haven associated Yen and Swiss Franc. The Dollar Index (USD/DXY) rebounded to 97.232 from 96.692, up 0.61%. Wall Street stocks took a beating, the S&P 500 slumped 2.6%. The CBOE VIX (Fear) Index jumped 8% to close at a one-week high. The IMF said it now expected global output to shrink by 4.9% instead of its April prediction of a 3.0% contraction. Elsewhere, the RBNZ kept its policy unchanged but kept the prospect of negative interest rates alive while signalling its displeasure on the recent rise of the New Zealand Dollar. The NZD/USD pair or Kiwi, as it is known among FX traders, plunged, losing 1.41% to 0.6407 (0.6500) and finish as worst performing currency. The Australian Dollar, the risk barometer of FX, slumped 1.11% to 0.6870 (0.6928). Against the traditional haven Japanese Yen, the US Dollar advanced 0.59% to 107.07 from 106.55. Broad-based US Dollar strength pushed the Euro down 0.55% to 1.1250 from 1.1310. Sterling fell 0.86% to 1.2420 (1.2518) after several UK health officials warned the British government about the risk of a second wave of Covid-19 infections as Prime Minister Boris Johnson continued to lift restrictions. The DOW finished at 25,522 from 26,110 yesterday for a loss of 2.16%. The S&P 500 slumped 2.6% to 3,057 (3,125). Global bond yields declined. The benchmark US 10-year yield was at 0.68% in late New York from 0.7% yesterday. Germany’s 10-year Bund yielded -0.45% from -0.41%. There were no major data releases yesterday.

Germany’s IFO Business Climate Index climbed to 86.2, beating forecasts of 85.0. The US House Price Index (HPI) rose to 0.2% from a previous 0.1%, but less than expectations of 0.3%.

On the Lookout: Risk aversion will remain elevated in Asia today. The resurgence of Covid-19 infections are outweighing the global stimulus efforts so far.

Today’s economic calendar picks up with New Zealand Trade Balance where the surplus is forecast to climb slightly from the previous month. Japan’s All Industry Activity Index follows. European reports kick off with Germany’s GFK Consumer Climate Index. The ECB releases its latest Monetary Policy Meeting Accounts. The UK follows with it Conference Board’s Realised Sales data. The US kicks off a busy calendar with Headline and Core Durable Goods Orders, with both seen improving. US Q1 Final GDP, Goods Trade Balance, Preliminary Wholesale Inventories and finally Weekly Claims for Unemployment Benefits round up the day’s reports.

Trading Perspective: FX can expect further choppy markets today. The resurgence in coronavirus cases in the US and around the globe will continue to be monitored which will see the risk-off theme extended in Asia. The US-China trade war is still an issue although it remains in the background for now. Tensions between the US and Europe are on the rise following reports that Europe might not allow visitors from the US when it opens. The US moved to put pressure on the European Union by flagging possible changes in tariffs on EU goods. In this risk-off environment the US Dollar will continue to win against all its rivals. We look at some individual currencies.

EUR/USD – Back Down Again, USD Strength, Tariff Threat Weigh

The Euro did a U-turn after the US Dollar rebounded against all its rivals on the market’s risk-off stance due to a resurgence in coronavirus cases. EUR/USD finished near its overnight lows at 1.1250 from yesterday’s opening at 1.1310. Broad-based US Dollar strength and the fresh threat of new US tariffs on up to USD 1.3 billion of European products weighed on the shared currency. The ongoing aircraft dispute between the US and the European Union was cited by the Office of the US Trade representative. Some saw this as a retaliation by the Trump administration to Europe’s suggestion that it will close its borders to Americans when they open.

EUR/USD has immediate support at 1.1240 (overnight low traded was 1.12498). The next support level lies at 1.1200. The strong support level at 1.1170 is under threat once again. Immediate resistance can be found at 1.1280 followed by 1.1310. Look to sell Euro rallies in a likely range today of 1.1210-1.1310. The speculative long Euro bets have yet to succumb. The time may be coming soon.

NZD/USD – RBNZ Clips the Kiwi’s Wings, What’s Next for the Bird?

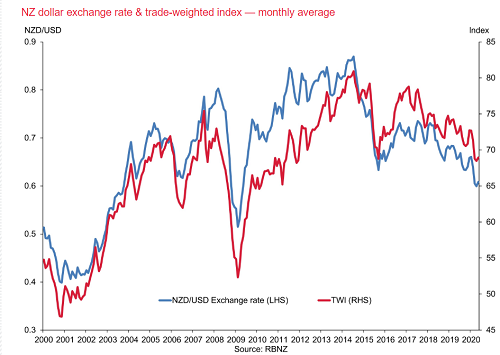

The New Zealand Dollar or Kiwi as it is fondly known among FX traders had its wings clipped by the RBNZ yesterday following the conclusion of its monetary policy meeting. The New Zealand central bank kept its interest rate and policy unchanged as was widely expected. However, the RBNZ surprised many when it left the possibility of negative interest rates alive and indicated its preference for a weak currency. Comments from the RBNZ that “members noted that the exchange rate has appreciated since the May Statement, dampening the outlook for inflation and reducing returns for New Zealand exports.”

The RBNZ is referring to the New Zealand Trade Weighted Index (NZDTWI) which measures the value of the New Zealand Dollar against New Zealand’s major trading partners (China, Australia, USA, South Korea, UK, Europe, Singapore and others). The RBNZ has been known to talk the currency down in the past when it has risen, this time suggesting the option of a negative policy rate. Which should be taken seriously by FX.

NZD/USD has immediate support at 0.6400 followed by 0.6370 and 0.6330. Immediate resistance can be found at 0.6440 and 0.6470. Look for the Kiwi to consolidate today with a likely range of 0.6370-0.6470. Look to sell rallies.

AUD/USD – Risk-Off, Weak Kiwi See Bears Take Control

The Australian Dollar fell following a souring of risk appetite from reports of rising Covid-19 infections in several US states and other global hotspots. AUD/USD slumped 1.1% to 0.6870 in late New York from 0.6930 yesterday. Victoria, the country’s second most populous state, reported a rise of 20 new infections and one death yesterday. It was the 8th consecutive day that the state reported double-digit cases. Last night supermarket giants Coles and Woolies reintroduced purchase restrictions in the state after experiencing high demand for certain items (toilet paper, hand sanitiser, flour, pasta etc).

The Aussie Battler will remain pressurised on the broad-based US Dollar strength and weak New Zealand Dollar. AUD/USD has immediate support at 0.6860 (overnight low 0.68625). The next support level comes in at 0.6830 and 0.6800. Immediate resistance can be found at 0.6890 and 0.6910. Look for the Aussie to consolidate within a 0.6800-70 range today. Prefer to sell rallies.