A recent CME disciplinary citation is noteworthy for what was missing and raises the specter that the exchange is playing favorites.

On December 21, 2017, the CME Group issued a disciplinary action against a trader, Daniel Ostroff, for spoofing.

“Pursuant to an offer of settlement in which Dan Ostroff neither admitted nor denied the rule violation upon which the penalty is based, on December 19, 2017, a Panel of the Chicago Mercantile Exchange (‘CME’) Business Conduct Committee found that between September 15, 2014, and January 22, 2015, Ostroff entered orders in the December 2014 and March 2015 E-Mini S&P 500 futures (‘E-Mini’) contracts without the intent to trade those orders. ” The action stated. “ The Panel specifically found that Ostroff placed large orders on one side of the market opposite smaller orders resting on the other side of the market. The Panel found that the effect of this strategy was to induce market participants to trade opposite Ostroff’s smaller resting orders or better his bid/offer, which he would then trade against.”

What is Spoofing?

Spoofing is “a practice in which traders attempt to give an artificial impression of market conditions by entering and quickly canceling large buy or sell orders onto an exchange, in an attempt to manipulate prices. Though the tactic has long been used by some traders, regulators have begun clamping down on the practice. The 2010 Dodd-Frank Act specifically forbids spoofing.” The Website Market Wiki noted.

Ostroff and 3 Red Trading

While the order seems unremarkable at first blush, it’s what is missing which is revealing.

While the order seems unremarkable at first blush, it’s what is missing which is revealing.

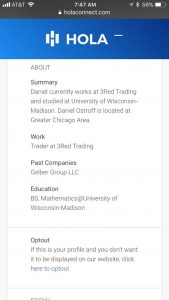

During the period when this alleged misconduct occurred, Ostroff worked for 3 Red Trading.

Who is 3 Red Trading

3 Red Trading is “a prop trading firm” with offices in Chicago and New York.

“We leverage technology and math to implement competitive trading strategies while managing risk and responding to market dynamics.” Its website stated.

3 Red is a powerful trading firm based out of Chicago but with multiple offices, which an industry source stated did between 20-50% of all CME trades on any given day. About this time last year, 3 Red Trading was implicated by the Commodities Futures Trading Commission (CFTC), in another significant spoofing scheme, which the CFTC said was masterminded by the company’s Chief Executive Officer (CEO).

A story in the Financial Times last year, stated: “3Red and its head trader, Igor Oystacher, emerged as one of the most active participants on US and European futures exchanges.”

But its what the story said next which is key: “But for years it undertook a manipulative and deceptive spoofing scheme, according to a consent order signed Tuesday by US district judge Amy St Eve in Chicago.

The 3 Red Spoofing Scandal

On December 20, 2016, the CFTC announced that a federal court had reached a decision in a spoofing case against 3 Red Trading and its CEO and principal trader Igor Oystacher.

“The U.S. Commodity Futures Trading Commission (CFTC) today announced that Judge Amy J. St. Eve of the U.S. District Court for the Northern District of Illinois entered a Consent Order of Permanent Injunction (Order) against Defendants Igor B. Oystacher and his proprietary trading company, 3Red Trading LLC (3Red), both of Chicago, Illinois, finding that the Defendants engaged in a manipulative and deceptive spoofing scheme while trading at least five different futures contracts on four exchanges for more than two years, which violated certain provisions of the Commodity Exchange Act (CEA) and CFTC Regulations adopted pursuant to the CFTC’s anti-spoofing and expanded anti-fraud and anti-manipulation authority under the Dodd-Frank Act.”

The CFTC further noted, “The Order further finds that Oystacher and 3Red engaged in this scheme by manually placing passive displayed orders at or near the best price on one side of the market behind existing orders in such size or number that it created a false or misleading impression of market depth and then subsequently cancelling those orders simultaneously or nearly simultaneously with the entry of an order at the same or better price on the opposite side of the market. According to the Order, this strategy allowed Oystacher and 3Red to buy or sell futures contracts in quantities and/or at price levels that would not have otherwise been available to them in the market, absent the spoofing conduct.”

Playing Favorites?

When looking at other spoofing cases, it appears that 3 Red Trading receives relative slaps on the wrist.

In July 2017, the CFTC announced sanctions against spoofer Simon Posen, who was not only fined $635,000 but also banned from trading.

“The U.S. Commodity Futures Trading Commission (CFTC) today issued an Order filing and settling charges against Simon Posen of New York, New York for engaging in thousands of incidents of “spoofing” — bidding or offering with the intent to cancel the bid or offer before execution — in gold, silver, and copper futures contracts traded on the Commodity Exchange, Inc., and crude oil futures contracts traded on the New York Mercantile Exchange over a period spanning more than three years. Posen traded from home for his own account and was not employed by any corporate entity, according to the Order.”

Meanwhile, Michael Coscia was not only fined $1.4 million but was prosecuted criminally and sentenced to three years in prison in 2016; he remains incarcerated. Coscia, like Oystacher, was the CEO and main trader of a firm, Panther Energy Trading LLC.

According to news accounts, his trades primarily occurred on CME exchanges.

“Evidence presented during his trial included testimony from his own computer programmer at Panther Energy Trading, who said that Cosca had designed two algorithm programs to be used for high-frequency trading and gave the programmer specific instructions on how he wanted the programs to operate. These programs worked as Coscia intended, moving the markets in a direction that was favorable to him. As a result, he was able to generate $1.4 million in illegal profits between August and October 2011.

“Coscia dealt in futures contracts, which are standardized, legally binding agreements to buy or sell a specific product or financial instrument in the future. The buyer and seller of a futures contract agree on a price today for a product or financial instrument to be delivered or settled in cash on a future date. The type of trading that Coscia did—high-frequency trading—is a form of automated trading that uses computer algorithms to make decisions and place orders and is designed to enable traders to communicate with markets in milliseconds.

“The contract markets Coscia worked in—like the Chicago Mercantile Exchange, the Chicago Board of Trade, and the New York Mercantile Exchange—are part of what’s known as CME Group. And CME markets offer futures contracts in commodities like gold, soybean meal, soybean oil, and high-grade copper, as well as contracts that reflected changes in the value of the Euro and British pound against the U.S. dollar.”

It’s noteworthy that only the Federal Bureau of Investigation and the Department of Justice can investigate and prosecute spoofing cases criminally, but in general, a compelling referral of any crime from another federal agency- be it the Securities and Exchange Commission, the CFTC, or the Environmental Protection Agency- will put that case at the top of the pile.

Neither Ostroff nor Oystacher were banned from the business and while Oystacher’s fine seems significant- $2.5 million- it’s in the context of him running a major trading firm which continues to be a big player on CME.

Ostroff was fined $35,000 and is currently serving a 25-day suspension forbidden “from accessing any CME Group Inc. trading floor and all direct and indirect access to all electronic trading and clearing platforms owned or controlled by CME Group Inc., including CME Globex. The suspension shall run from December 21, 2017 through January 14, 2018.” According to the CME citation.

Furthermore, since this is the second occurrence there appears to be a lack of institutional control. It’s made that much worse that the original scandal involved the CEO and chief trader.

Chris Grams, a public affairs officer for the CME Group, said: “We’re not able to comment beyond what’s in the disciplinary notice in question.”

A voice mail at 3 Red Trading was left unreturned, and an email to Ostroff’s Linkedin account was also left unreturned.