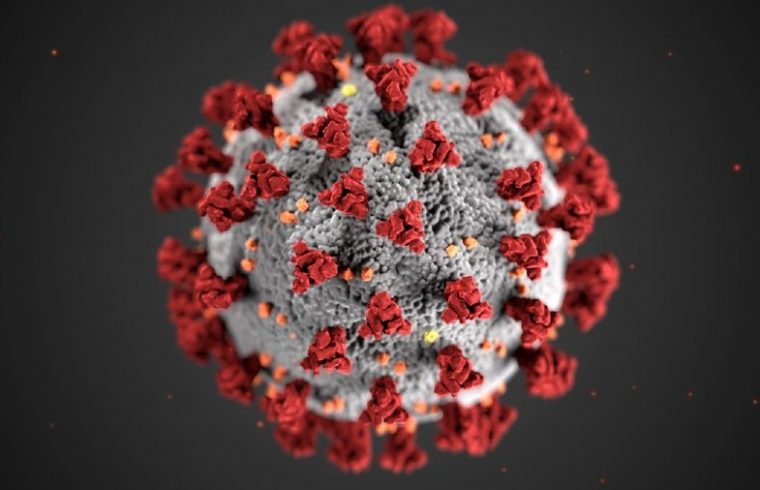

The Commodities Futures Trading Commission (CFTC) is taking aggressive action in light of coronavirus.

Heath Tarbert, the Chair of the CFTC, put out a six minute video detailing what the CFTC is doing.

“Major economies, including ours, are feeling the impact of the coronavirus. The spread of this pandemic has triggered a period of enormous volatility,” he said.

He said that the CFTC will focus on five objectives.

- Increased monitoring of derivatives markets and their participants.

- Using CFTC’s regulatory framework to promote orderly and liquid markets

- Responding swiftly to changing conditions, with practical and targeted relief

- Communicating consistently and transparently with all stakeholder.

- Maintaining commitment to advancing strategic policy goals

“We’re engaging with clearinghouses, exchanges, and analyzing market activity,” Tarbert said, explaining further, “We’re monitoring infrastructure that are essential to orderly trading.”

“We’re also regularly checking on financial resources and operational status of key market participants and intermediaries,” he continued, “This includes, for example, registered swap dealers and futures commission merchants.”

Referring to the third objective, Tarbert stated, “Social distancing can create novel hurdles to complying with regulatory requirements, written with centralized offices in mind. So, we’ve encouraged registrants to talk to us about what relief and other assistance they might need.”

Tarbert as a result of these discussions the CFTC has led “to nearly a dozen actions that will take by week’s end to provide more flexibility.”

“We remain in close contact with our fellow domestic and international regulators, in Congress, and with industry,” he stated.

“On the home front, we’re implementing best practices to safeguard the health of our employees,” Tarbert also noted.

Tarbert said that meetings on rulemaking and other CFTC matters will not be cancelled but rather most will be moved to telephones and videoconferencing.

“Yes, that means in the months ahead, we’ll continue to pursue important rulemaking,” Tarbert stated, “In the near term, we’ll propose and update to our bankruptcy provisions for the first time in thirty-seven years, as well as enhancements to the quarterly reports filed by commodity focused investment funds.”

Tarbert said the CFTC also plans on finalizing cross border proposals for clearinghouses and swap and for the capital rule.

“And yes, by year end, we’ll also finalize our recently proposed position limits rule, that is so important for protecting the agriculture and energy sectors from excessive speculation,” Tarbert stated of another issue that the CFTC plans on finishing, despite the challenges posed by coronavirus.

The CFTC lists ten letters which it has sent out in the recent weeks, which have provided temporary relief due to coronavirus.

On March 20, the CFTC sent out a letter to provide temporary relief for commodity pool operators.

That letter delayed annual reports for small and mid-size commodity pool operators which were due on May 15 and are now due on July 15.

The letter also delayed for forty-five days due dates for annual reports for other sized commodity pool operators.

Another no action letter, this one to forex brokers on March 17, delayed the requirements for recording of oral communications until June 15.