Summary: Holiday-thinned markets turned cautious on a partial trade deal between China and the US while scepticism over a Brexit deal rose. FX reverted to familiar ranges in subdued trade with Japan, Canada and the US on holiday. The Dollar Index (USD/DXY) gained ground following two days of losses to finish at 98.516 (98.332 yesterday). Sterling fell 0.68% to 1.2562 (1.2615) after a deal to ease Britain’s departure from the European Union faced uncertainty. Euro area nations reportedly wanted more concessions from Boris Johnson. A total agreement was unlikely this week. The Euro dipped 0.07% to 1.1025 from 1.1036. Germany’s Wholesale Prices fell more than forecast.

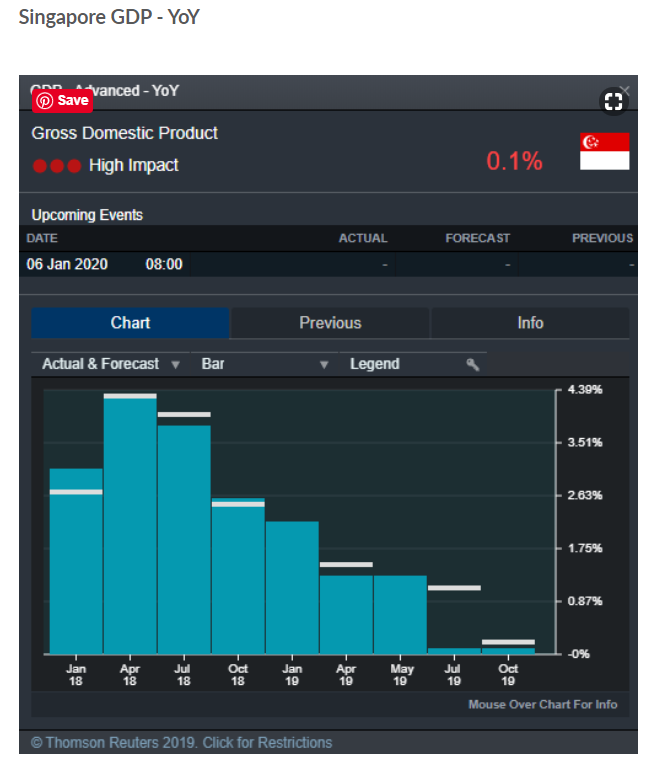

The Dollar ended flat against the safe-haven Yen at 108.35. Ahead of today’s release of the RBA meeting minutes, the Australian Dollar retreated in cautious trade to 0.6775 from 0.6793. The RBA trimmed rates at that last meeting. Elsewhere in Asia, the Monetary Authority of Singapore (MAS), effectively eased rates for the first time since 2016. The Singapore central bank did this by reducing the slope of the Singapore Dollar’s NEER (Nominal Effective Exchange Rate). Which is effectively the Singapore Dollar’s weighted average rate against a basket of foreign currencies. The effective easing was less than traders expected. The Dollar eased against the Singapore Dollar (USD/SGD) to 1.3695 from 1.3729. Singapore’s economy avoided a technical recession as Q3 growth rose 0.1%, missing forecasts at 0.2%. Wall Street stocks slipped in limited trade. Bond yields were unchanged.

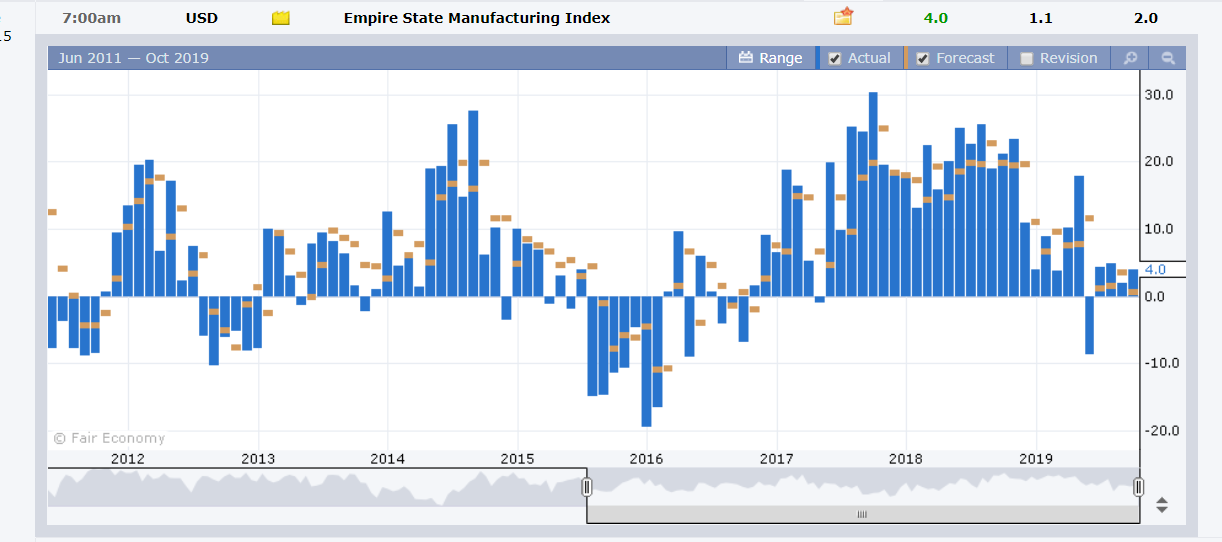

China’s Trade Surplus increased in CNY terms to CNY 275 billion in September from CNY 240 billion in August. US Empire State Manufacturing Index rose to 4.0, beating forecasts of 1.1.

- EUR/USD –The Euro fell back into range trading, dipping to 1.1025 after touching 1.10428 highs in Asia. The shared currency hit a low of 1.10126 before steadying in quiet trade.

- GBP/USD – “What goes up must come down.” The British Pound fell back to 1.2562 from 1.2610 as optimism on a smooth Brexit waned with EU and UK leaders stressing that there was still a long way to go, before they could agree a Brexit deal. Much of Sterling’s spike over the weekend to 1.27068 was the result of fierce short covering in less liquid conditions.

- USD/JPY – The Dollar eased to 108.35 after trading to a near 6-week high at 108.628 on Friday on the market’s risk on stance. USD/JPY peaked at 108.521 yesterday before dropping to a low at 108.033.

- USD/SGD – The Greenback eased against the Singapore Dollar to 1.3695 from 1.3728 yesterday and 1.3757 Friday. Asian FX were disappointed that the MAS easing was less than they expected, “only just.” Still it was the first easing from the Singapore central bank since 2016. The Singapore Dollar has been exceptionally strong and recorded gains against the Greenback and other currencies. Expect a reversal of this with a vigilant MAS on the lookout.

On the Lookout: Global markets return to normal conditions today. The Asian day starts off with a data deluge from China and Japan. The RBA releases its latest monetary policy meeting minutes in Sydney (11.30 am). China reports on its September CPI and PPI. Japanese markets return today with the release of Japanese Revised Industrial Production and Tertiary Industry Activity. BOJ Governor Haruhiko Kuroda is due to speak at a Bank of Japan Branch Managers meeting in Tokyo (11.30 am Sydney). European reports today: Switzerland’s PPI, French Final CPI and Germany’s ZEW Economic Sentiment. The UK releases its Employment report for September with Average Weekly Earnings (Wages), Claimant Count Change (Unemployment Benefits), and Unemployment Rate. Bank of England Governor Mark Carney is due to testify at Financial Treasurer’s Select Committee in London.

Trading Perspective: Expect FX to trade in familiar ranges as the Dollar consolidates after two days of losses. The Commitment of Traders report will be released tomorrow due to the US holiday yesterday.

On the trade front, China reportedly wants to hold more talks with the US to hammer out details of President Trump’s touted “Phase One” deal. Which includes a delay of the Oct 15 tariffs, China’s agreement to buy more US agricultural products, more FX transparency. FX will continue to monitor developments on this front. Watch USD/JPY, this should be the main barometer.

Markets will look to Wall Street as US Q3 earnings season begins. Trades will look to the manufacturing and export industries to see the impact of the strong US Dollar.

While the Dollar’s corrective downtrend has hit a pause, it is by no means over with.

- USD/JPY – The Dollar trade to a 6-week and overnight high at 108.628 on Friday afternoon in New York following optimism which was built on a China-US limited trade deal. Overnight the USD/JPY traded to 108.521. USD/JPY closed at 108.35 in New York. Immediate resistance lies at 108.60/70 which should contain any Dollar rallies. The next resistance level lies at 109.00. Immediate support can be found at 108.30 followed by 108.00. Look for a likely trade today of 108.00-108.60. Prefer to sell rallies.

- EUR/USD – The Euro dipped to 1.1025from 1.1036 yesterday. Overall trading range for the shared currency was 1.10126-1.10428, familiar trading ranges in subdued markets. We could be back into a 1.0980-1.1080 range (September). Immediate resistance in the Euro lies at 1.1050 (overnight high 1.1043) followed by 1.1080. Immediate support can be found at 1.1000 followed by 1.0980. Look to trade a likely range of 1.1000-1.1070. With market positioning still short of Euro bets, the ideal trade is to buy dips.

- AUD/USD – The Australian Dollar eased against the overall stronger Greenback to 0.6775 from 0.6792 yesterday. AUD/USD traded to a high at 0.68104 on Friday boosted by the prospects of a breakthrough in the US China trade talks. With FX turning cautious last night, the Aussie Battler retreated. Traders will monitor the RBA’s minutes of its most recent policy meeting. The Australian central bank cut its Official Cash Rate by 0.25% at that meeting. While the RBA said that interest rates would remain low for an extended period, they did not give any clues as to future policy. At the end of the day, the RBA are done for now and the Aussie market remains short. AUD/USD has immediate support at 0.6750 (overnight low 0.67512) and 0.6720. Immediate resistance can be found at 0.6800 followed by 0.6830. Look to trade a likely range today of 0.6760-0.6810. Prefer to buy dips.

- USD/SGD – The MAS effective easing disappointed Singapore Dollar bears who had anticipated more. USD/SGD eased to 1.36757 before settling at 1.3695, and 1.3728 yesterday. This was the first easing by the MAS since 2016 and the Singapore Central Bank is aware of the currency’s strength on a trade weighted basis. Immediate support can be found at 1.3680 followed by 1.3650. Immediate resistance lies at 1.3720 followed by 1.3760. Look to buy any USD/SGD dips or sell SGD against the Yen or Aussie.

Happy trading all.