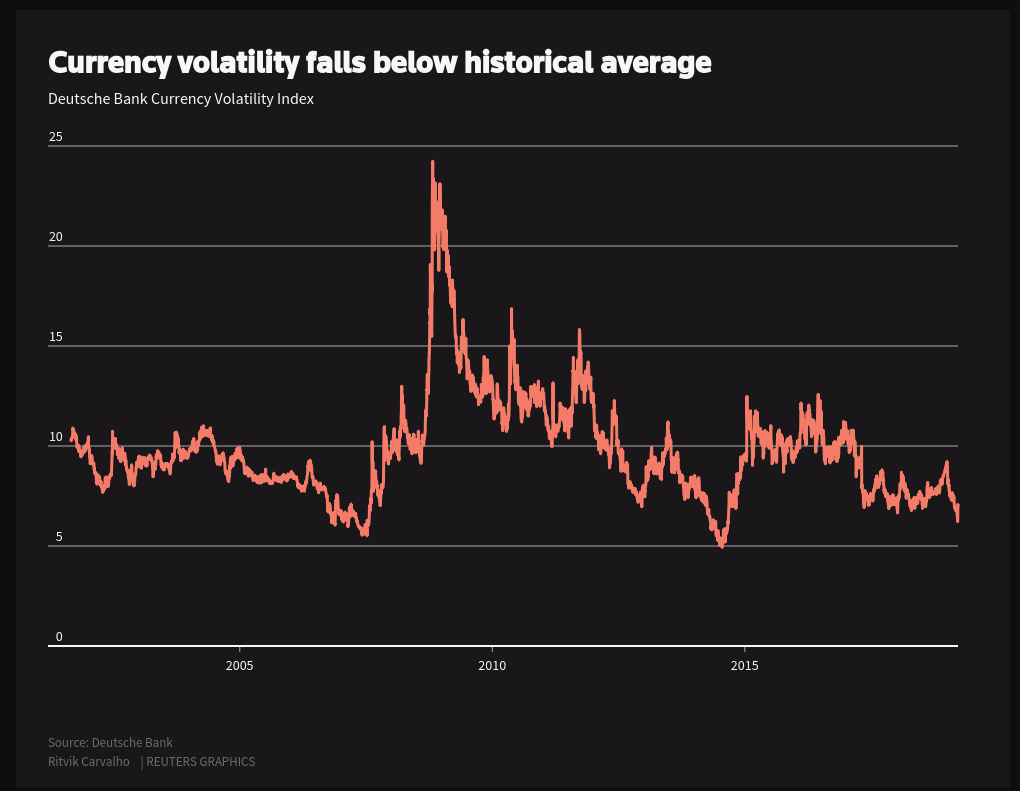

Summary: Ten-year US Bond Yields soared 9 basis points (2.50%), its biggest daily gain in almost 4 months. Rival global bond yields rose in synch. Stronger-than-expected Chinese PMI’s lifted equities on the market’s risk-on stance. Currency traders, however, did not share the same enthusiasm. FX volatility, already low, was suppressed further. Reuters reported that extremely low volatility has impacted the daily US$ 5.1 trillion-a-day FX market. With global central banks turning dovish, there is little divergence to move currencies against the Dollar and one another. Deutsche Bank’s Implied Currency Volatility Index Chart showed that FX vols fell to their lowest since March 2014. Trading volumes have also fallen. Notable exceptions though were the British Pound and Turkish Lira.

The Dollar Index closed flat at 97.244. EUR/USD traded in a relatively narrow 49-pip range, closing little-changed at 1.1214 (1.1217 yesterday). The risk-on stance and higher US bond yields saw USD/JPY rally to 111.35 from 110.85. Sterling rallied to 1.3115 (1.3032) lifted by stronger UK economic data.

Wall Street stocks lifted to the highest levels of the year. The DOW finished at 26,237, up 1.18%.

China’s Caixin Manufacturing Index climbed to 50.8 against analysts forecast of 50.1. Australia’s NAB Business Confidence Index dropped to 0 from 2, its lowest level in over 3 years. Euro area Manufacturing PMIs mostly matched forecasts. UK Manufacturing PMI in March beat forecasts, up to 55.1 from 52.0. US Headline and Core Retail Sales underwhelmed. Core sales fell to -0.4 from an upwardly revised 0.4%.

- EUR/USD – The Single currency traded in a relatively tight range between 1.1204 and 1.1250. The trading range in the world’s most traded currency pair has fallen to its narrowest quarterly range on record, according to a Reuters report. EUR/USD closed at 1.1214.

- AUD/USD – The Australian Dollar benefited from the market’s risk-on stance climbing 0.41% to 0.7115 (0.7099). National Australia Bank’s Business Survey underwhelmed. The RBA is expected to keep its Cash Rate at 1.50% today while changing its rhetoric to the dovish side, as the RBNZ did last month.

- USD/JPY – While the Dollar rallied against the Japanese Yen, volatility in this currency pair has also suffered a drop in recent months. USD/JPY finished up 0.45% at 111.35 from 110.85. The trading range last night was 63 pips.

- GBP/USD – rallied to 1.1315 from 1.3035 yesterday. Upbeat UK Manufacturing PMI and chances that a soft Brexit option will be chosen by lawmakers lifted Sterling.

On the Lookout: Today’s big event is the RBA rate decision and policy meeting (2.30 pm Sydney time). The RBA is not expected to move its cash rate (1.5%). However, some believe that Australian policymakers may follow the RBNZ’s lead by acknowledging it may cut interest rates again. The RBA still watches key Australian job market indicators for any policy changes. Last month Australian Unemployment fell to 4.9%, its lowest level in eight years. Job vacancies point to firm hiring ahead. However last month’s move by the RBNZ has many expecting the RBA to do the same. The economies and boards are different.

Australian Building Approvals for March will be released earlier (11.30 am Sydney time), while the Australian Federal Budget will be handed down 5 hours after the RBA’s rate decision.

Today also sees Spanish Employment Change (expected to all to -33,300 from 3,300). Eurozone PPI for March and UK Construction PMI are also due out. US Headline and Core Durable Goods Orders follow. Progress on China-US trade talks will continue to be monitored. UK Parliament vote on a series of Brexit options with some hoping for a softer Brexit than May’s defeated version.

Trading Perspective: The climb in the US 10-year bond yield was a whopping 9 basis points. While those of its Rivals climbed in synch, the rise was not as pronounced. Germany’s 10-Year Bund rose to -0.03% from -0.07% while Japanese 10-Year JGB’s slipped to -0.09% (-0.10%). This should be US Dollar supportive in Asian trading. Expect the recent ranges to hold with traders searching for the next market-moving factor to shake up sleeping volatility.

- AUD/USD – Will the RBA shake things up (ala Taylor Shift) today? The Australian Dollar has benefited from the market’s risk-on stance. China-US talks will go on for a few months more while we can expect further Chinese stimulus measures. Emerging Market currencies may have seen the worst of it and are recovering. Commodity prices are up. All Aussie supportive. AUD/USD has immediate support at 0.7100 followed by 0.7070. Immediate resistance can be found at 0.7130/40 followed by 0.7170 and 0.7200. Look to buy dips. Ahead of the RBA decision, look for a likely 0.7100/40.

- EUR/USD – The Euro held above 1.1200 although it closed not much higher above it. Euro area PMI data releases yesterday mostly matched forecasts. Immediate resistance lies at 1.1250. Immediate support can be found at 1.1200. Market positioning remains short in this currency pair. While the Euro area data fell in Q1, they should stabilise in Q2. So should the Single Currency. Look to buy dips to 1.1200 today.

- GBP/USD – Sterling survived another attempt below 1.3000, rallying to 1.3150 overnight high on the back of an upbeat UK Manufacturing report. Brexit’s focus is now on Brexit options. The longer the delay, the more chances of a softer Brexit, means more chance of a strong British Pound. Immediate resistance lies at 1.3150 followed by 1.3200. Immediate support can be found at 1.3080 and 1.3030. Likely range today 1.3080-1.3180.

Happy trading all.