The dovish outlook from FED failed to impress Asian equities which finished mixed today as media reports suggested that progress in relation to China-US trade negotiations have been stymied with the Chinese unwilling to yield to US demands, the Hang Seng benchmark in Hong Kong finished 0.85 percent lower at 29,071. The Shanghai Composite finished 0.35 percent higher at 3,101 and in Singapore, the FTSE Straits Times index added 0.27 percent at 3,215. Australian stock market has rallied late in the session to break out of its recent run of losses as the ASX 200 closed marginally higher in another day of choppy trade. The index swung between gains and losses earlier in the session before settling to a 2 point gain at 6167.2. In Japan, stocks markets were closed for a public holiday.

In commodities markets, Light Crude Oil finally today broke above the $60 mark to four-month high, currently trading at 60.23, Brent oil also rallies adding a dollar to $68.66/barrel as Venezuela and Iran impacting oil supply and cuts set to continue at the June meeting for OPEC, oil has been steadily bid in recent days. OPEC has already helped oil prices rise by 30% this year as it moves to cut global supplies. Gold jumped 18 dollars yesterday from 1302 to 1320 at 3-week high, after FOMC forecast. XAUUSD immediate resistance stands at yesterday high at $1321, and more offers will be found at 1330 zone. The precious metal may find support at $1302 where the 50-day moving average crosses, ahead of testing 100-day simple moving average down to $1271.

A mixed start for equities in early European session mirroring the sentiment seen in US equity futures, with investors digesting the FED forecasts and watching the developments surrounding Brexit, DAX30 is underperforming giving up 0.36 percent to 11,562. CAC40 is 0.02 percent higher at 5,384 while FTSE100 in London is 0.36 higher at 7,316. Any delay to the Brexit process will now need to be agreed by the other 27 EU members, with talks about possible conditions for an extension to be held before this week’s EU summit

On the Lookout: While markets try to digest the dovish stance from the FED, EU leaders meet today to discuss, among other things, whether to grant the UK an extension of Article 50. A final verdict is not expected today, and a press conference will be held afterward. The New Zealand economy grew 0.6% q/q in Q4, in line with analysts expectations, resulting in slow down of annual growth rate from 2.6% in Q3 to 2.3% in Q4 (annual average growth eased from a revised 3.1% in Q3 to 2.8% in Q4). Fitch credit agency says that if economic growth in Canada is near potential, and the country avoids a recession, budget deficits are still in line with falling debt ratio.

In Central Bank announcements today we expect Norges Bank to raise the policy rate by 25bp to 1.00%, as the economy is in very good shape. The Swiss National Bank is widely expected to keep its policy rate unchanged at -0.75% at today’s quarterly policy meeting.

The Bank Of England is set to leave its policies unchanged, with the interest rate at 0.75% and the Quantitative Easing program at £435 billion. The decision and the release of the minutes scheduled for 12:00GMT. In the US macro calendar, we have the Philly Fed Manufacturing Index and initial weekly jobless claims.

Trading Perspective: In forex markets, AUDUSD saw an initial spike above 71.65 US cents, during Wall Street session following Greenback weakness on the dovish US Fed and an unexpected dip in the Aussie unemployment rate, which fell to 4.9% in February – the lowest level since June 2011. The Australian dollar has now eased to 71.41 US at the stat of European trading session. The Kiwi, also spiked to 0.6937 amid USD weakness even the economic growth numbers are not supportive. US dollar index lost momentum trading at 95.47 as the Fed maintained interest rates at 2.25%-2.5% while adjusting their “dot plot” with a further rate hike in 2019 unlikely, down from two rate hikes previously, and only one hike in 2020.

GBPUSD is trading lower today after reports that EU leaders said to be looking at 22 May as the Brexit extension date rather than 30 June as requested by Theresa May. In today’s Bank of England policy meeting, it’s widely expected that the Central Bank will keep the monetary policy settings unchanged.

The short term technical picture has turned bearish for GBPUSD as the pair failed to materialize USD weakness and drop below the hourly moving averages. On the downside, major support will be found at 1.3050 where cross the 50-day moving average while more protection can be found at 200-day moving average around 1.2985. On the flip side, major resistance can be found at 1.3232 where the 50 hourly moving average stands, and then at 1.3382, the yearly high will be met with strong supply.

In GBP futures markets the open interest shrunk markedly on Wednesday by nearly 51K contracts, as per advanced figures from CME Group. On the other hand, volume reversed five consecutive daily drops and rose by almost 51.7K contracts.

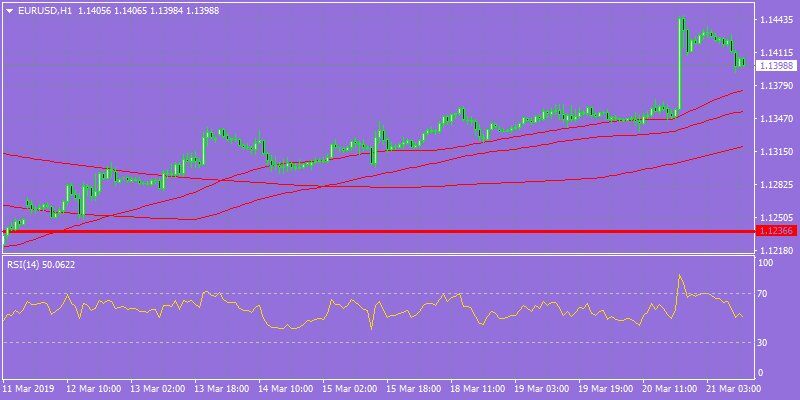

EURUSD rallied yesterday breaching the 50 and 100-day moving average after more dovish FED. The pair will find immediate resistance at the 200-day moving average at 1.1483 and is looking to break above in order to establish a new bullish trend targeting the yearly high at 1.1570. The low from yesterday session at 1.1337 provides solid support if the pair manages to break the 1.14 round figure.

It is worth mentioning that traders keep pricing in the first ECB rate hike at some point in H2 2020.

On the Euro political front, headwinds are expected to emerge in light of the upcoming EU parliamentary elections, where the focus of attention will be on the potential increase of the populist and right-wing option among voters.

In Euro future markets, traders significantly trimmed their open interest positions by around 46.6K contracts on Wednesday from the previous session. Volume instead, rose by around 72.6K contracts after four consecutive daily drops.

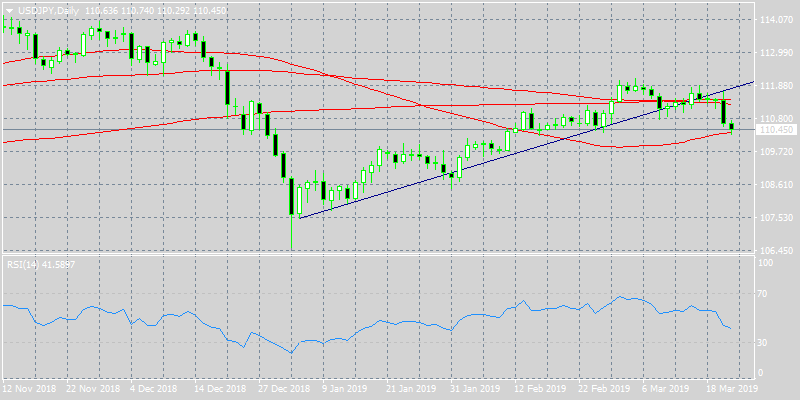

USDJPY slummed in US session, just to find support at the critical 50-day moving average at 110.31. The bearish momentum seems more likely to extend towards the key 110.00 psychological figure before the pair eventually drops to test the 109.60 horizontal support. Immediate resistance for the pair stands at 111 round mark.

In Yen futures markets, open interest dropped by more than 51K contracts on Wednesday, reversing two consecutive daily builds. On the opposite direction, volume increased for the second day in a row, this time by around 42.7K contracts.