Summary: The Federal Reserve sprouted fresh dovish shoots following up its “patient” approach to monetary policy. The central bank held interest rates steady while policymakers shifted their projections for a rate hike to zero from 3 last December. The Fed also downgraded its economic outlook, trimming GDP to 2.1% from 2.3% in 2019 and to 1.9% from 2.0% in 2020. It also decided to slow its monthly reduction of treasury holdings beginning in May.

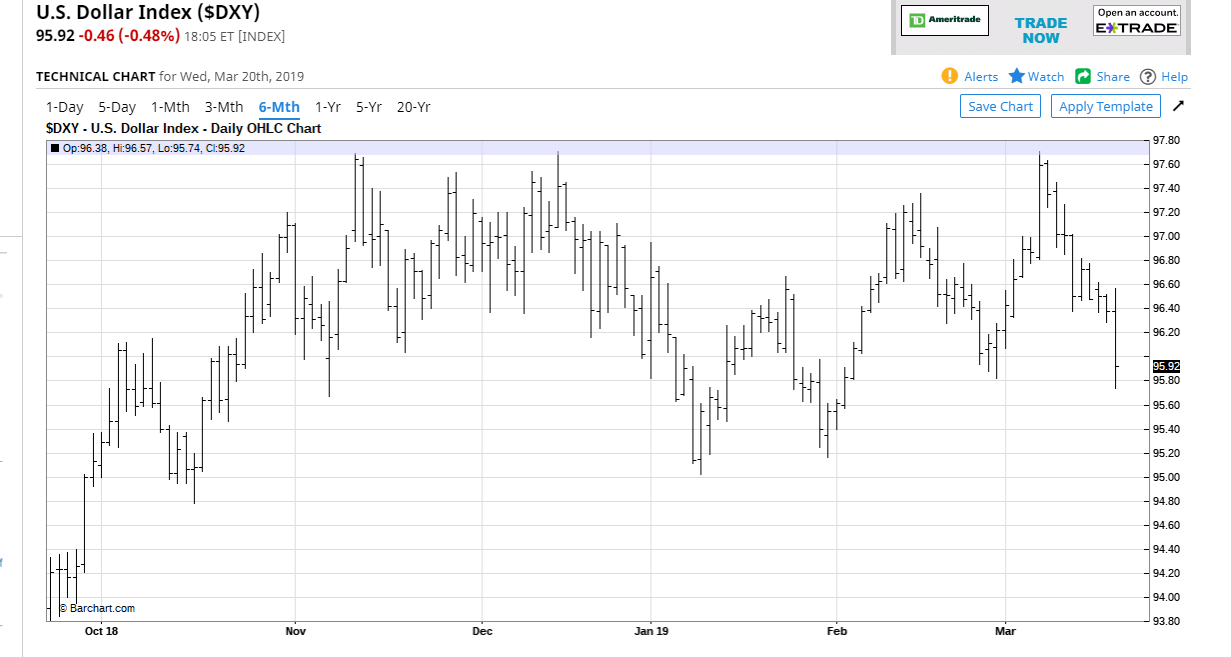

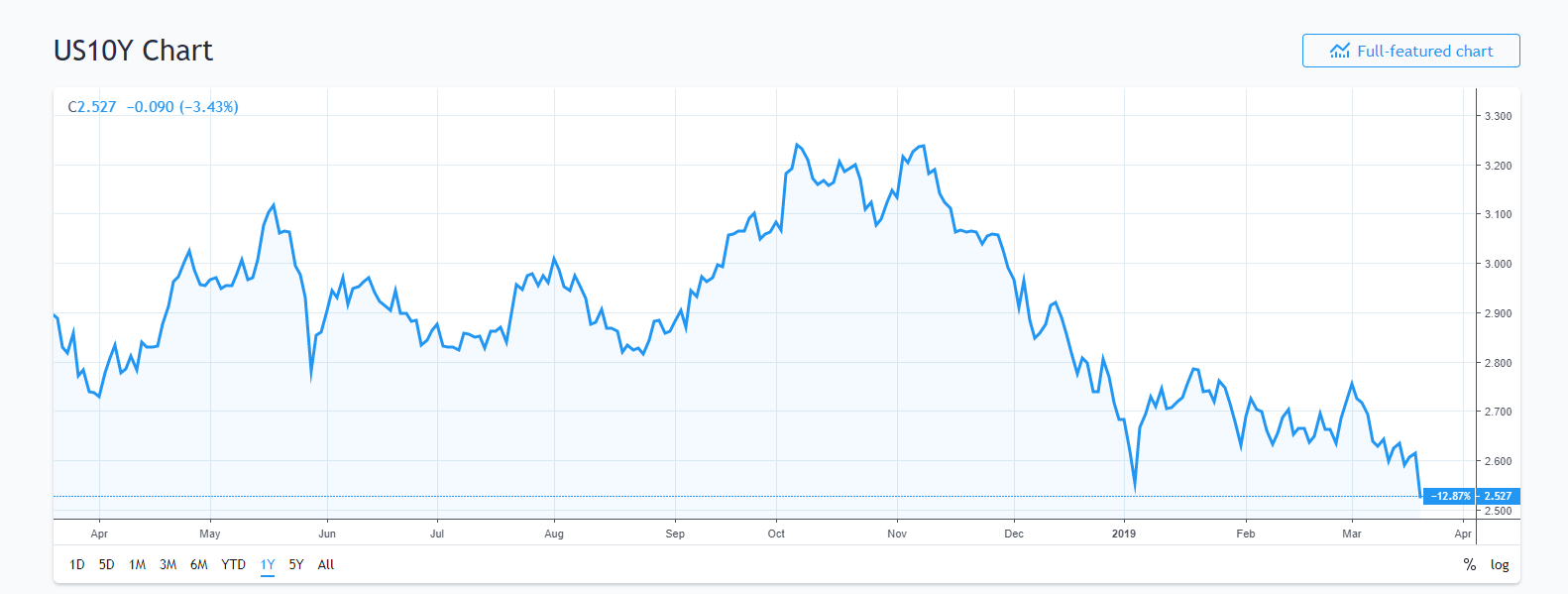

Benchmark 10-year US government bond yields slumped to 2.53% from 2.61%, 15-month lows. The Dollar Index (USD/DXY), a gauge of the Greenback against 6 major currencies fell 0.6% to 95.74, a 6-week low before settling at 96.00. USD/JPY nosedived to 110.68 from 111.35 yesterday, down 0.72%. The Euro extended its rally that began this week, finishing up 0.5% at 1.1413. Sterling stayed weak, closing 0.6% lower at 1.3198 due to uncertainty about how and when Britain will exit the EU.

The Australian Dollar traded to 0.7150, 3-week highs, before ending at 0.7128. Emerging Market currencies soared against the Greenback. The South African Rand was up 1.88%, while the Indian Rupee gained 0.75%. USD/THB was little-changed ahead of this weekend’s general election.

Wall Street stocks fell following the slump in US bond yields. The DOW fell 0.6%, while the S&P 500 was down 0.4%.

- EUR/USD – The Euro which dropped the furthest against the Greenback after the ECB met earlier this month, extended its climb to 1.14481, early February highs. The Single Currency settled at 1.1413 in early Sydney and looks poised to trade in a higher band.

- USD/JPY – The Dollar nosedived against the Japanese Yen to 110.536 following the slump in US 10-year bond yields to 2.53%. Japan’s 10-year JGB yield was unchanged at -0.05%. The Greenback looks headed for 110 Yen next.

- GBP/USD – Sterling stayed soft as more drama and uncertainty over Brexit start to burden the British currency. While a No-Brexit deal has been virtually ruled out, PM May’s request to delay Brexit until June 30 faced resistance from parts of the European Union. GBP/USD closed at 1.3213 in New York and has been slipping since, down currently to 1.3188.

- USD/DXY – The Dollar Index fell to an overnight and 6-week low of 95.740 before settling to close at 96.00. A sustained break of 95.80 could see 95.00.

On the Lookout: The markets will continue to monitor Brexit which seems even more muddled than before. The Pound would be lower had it not been for a weaker overall US Dollar. UK economic data has surprisingly been upbeat of late, Tuesday’s UK Employment data above forecasts.

Traders will also keep a close eye on today’s economic data from New Zealand (Q4 GDP), Australia (Employment Change, Unemployment Rate). The Swiss National Bank and Bank of England meet today on monetary policy. Both are expected to maintain current policy. The Bank of England’s monetary policy statement and economic assessment will be scrutinised given the latest Brexit drama. The US releases its Philly Fed Manufacturing Index as well as Weekly Jobless Claims.

Trading Perspective: “What goes up must come down, spinning wheel got to go round…” The Blood, Sweat and Tears 1968 hit tune was written to symbolise that everything comes full circle. The same seems to be the case for the US Dollar. The US Federal Reserve’s perspective has seen a major change with a more dovish view than many expected. The 10-year US bond yield is headed for 2.5%, January 2018 lows. The latest COT report saw speculative long Dollar bets to 9-week highs. The pressure is for a lower Greenback.

- EUR/USD – The Euro’s slump to 1.1177 following the ECB meeting was short-lived and we find ourselves challenging 1.1450. The overall range has now shifted up to the previous 1.13-1.16 band. Immediate resistance lies at 1.1450 followed by 1.1500. Immediate support can be found at 1.1400, 1.1380 and 1.1350. Look for a likely range today of 1.1385-1.1455. Euro area Flash Manufacturing and Services PMI’s are due out tomorrow. If they beat forecasts, we could see the Euro finish above 1.1500 this week.

- USD/JPY – Japan has a bank holiday today which should keep volumes thin. The slump in US 10-year yields will keep this currency pair under pressure. USD/JPY has immediate support at 110.50 followed by 110.30 and 110.00. Immediate resistance can be found at 110.80 and 111.00. Look to sell rallies above 110.80 today with a likely range of 110.30-80.

- GBP/USD – Expect the Pound to remain soft in choppy trading until the Bank of England meeting. Brexit’s uncertainty will keep Sterling’s topside to immediate resistance at 1.3240 and 1.3270. Immediate support can be found at 1.3180 followed by 1.3150. Look for a likely range today of 1.3170-1.3270. Just trade the range shag on this one.

- AUD/USD – the Aussie Battler rallied to 0.7150, late February highs. Immediate resistance at 0.7150 should hold into this mornings Australian Employment report. Median forecasts are for a gain of 14,800 full-time jobs in February following January’s 39,100 gain. The Jobless rate is expected to remain at 5%. Anything above 15,000. Employment gain will see the Aussie test higher with 0.7180 and 0.7200 the next resistance levels. An Employment gain of less than 10,000 could see 0.7090 support tested. The next level of support can be found at 0.7060. Look to buy dips today in a likely 0.7070-0.7170 range.

Happy trading all.