Summary: The Euro extended its grind higher, pushing the Dollar down against most of its Rivals. Traders positioned for a potentially more dovish Fed amid concerns of a slowdown in the US economy. The Fed kicks off its meeting today and concludes early tomorrow (Sydney time). Markets will have a close look at whether the FOMC lowered their interest rate forecasts in the next 3 years. US policymakers are expected to provide more clues to Fed’s intention to trim their massive balance sheet holdings. Sterling ended a touch higher at 1.3275 (1.3258) after a better-than-expected UK Employment report. The Jobless rate fell to 3.9% from 4.0% while Earnings bettered forecasts. The Australian Dollar drifted lower to 0.7090, down 0.11% after the RBA confirmed its neutral policy stance but expressed concern about the weak housing market.

Australian House Prices in Q4 2018 fell 2.4% from the previous fall of 1.5%. US Factory Orders underwhelmed in February, up 0.1% against a forecast rise of 0.3%.

Emerging Market currencies slipped after several days of gains versus the Greenback. The USD/THB drifted higher ahead of the country’s general election this coming Sunday (March 24). This is the first election in Thailand since the military coup 5 years ago.

Wall Street surrendered early gains to close modestly lower. The US 10-year bond yield steadied at 2.61% (2.60% yesterday).

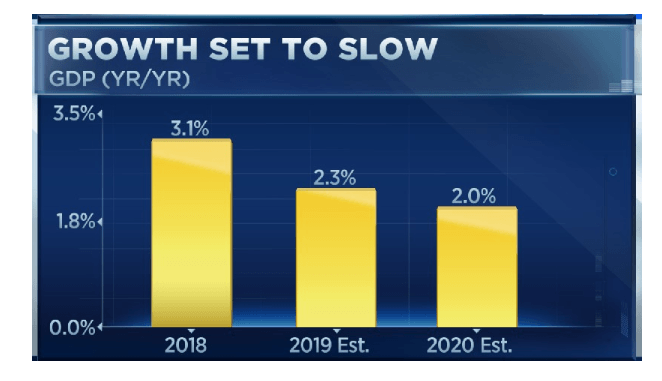

CNBC released the results of its March Fed Survey, “US economic growth is likely so slow sharply this year and next.” Weaker global growth and tariffs were the major culprits. Donald Trump needs to make a China trade deal, the report concluded.

- EUR/USD – the Euro continued to grind higher against the Dollar, finishing up 0.19% at 1.1355 after testing 1.1362 overnight. The Single Currency in almost 3 weeks.

- GBP/USD – Sterling survived the shock block of a 3rd vote unless PM Theresa May makes fundamental changes to her Brexit plan, something she needs EU support for. Upbeat UK Employment data buoyed the Pound. GBP/USD lifted to 1.3275, up from 1.3258 yesterday.

- AUD/USD –the Aussie drifted lower after hitting a high of 0.7111 following the release of the RBA meeting minutes. A generally softer US Dollar and a short speculative Aussie market supports the Battler.

- USD/JPY – slipped to an overnight low of 111.16 on concerns of another delay in the trade talks between China and the US. The underwhelming US economic data has also weighed on the USD/JPY. The Dollar climbed to 111.83 last Friday after the BOJ kept its ultra-loose monetary policy intact.

On the Lookout: It’s all about the Fed meeting today. We can expect the Dollar to consolidate in what is likely a slow Asian trading day. Data releases are light today. New Zealand reports on its Q4 Current Account to begin with. The Bank of Japan releases its monetary policy meeting minutes from the previous month. The UK has its latest inflation data with CPI, Core CPI and Retail Price Index.

The Fed then releases its Fed Funds rate decision (no changed from current 2.5%), FOMC Statement, and economic projections (5 am Sydney, Thursday 21 Mar). Federal Reserve Head Jerome Powell’s press conference starts half an hour later.

Trading Perspective: Will we witness a more “patient,” more dovish Fed? The trading market may be looking too much into tonight’s meeting and anything less than a more dovish Fed might disappoint. We could see the Dollar have short-term spike higher first.

I’m always keeping an eye on the EM currencies for a guide. A few days before the US Dollar topped out against the Majors, the Greenback started sliding versus the EM’s. Today it’s the reverse. The bigger picture is still market positioning (long USD bets) which needs further correction. In the short term though a lot of expectation is being built for a dovish US central bank. Hmm…

- EUR/USD – The Single currency will be the first to benefit from a weaker US Dollar. That’s because it’s the most oversold. If we see a confirmation of a dovish Fed, expect the Euro to test and break through immediate resistance at 1.1360 to the next level of 1.1400. The next resistance is at 1.1420 which should hold first up. If we see a disappointment for the Fed doves, the Euro will slump to 1.1320 followed by 1.1300. A test of 1.1280 will probably follow. Expect that to hold until the next set of data. Friday sees the release of Euro area manufacturing and services PMI, crucial for the Eurozone. Likely range today 1.1285-1.1385.

- GBP/USD – The Pound is still potentially the most volatile of the majors. This is not likely to change anytime soon. British PM May meets with EU leaders to try and hammer yet another deal to bring to the UK Parliament. Meantime tonight’s UK inflation data will also be crucial for the Pound. GBP/USD has immediate resistance at 1.3300 followed by 1.3340 and then 1.3380. Immediate support can be found at 1.3240 followed by 1.3200. We could be in for a 1.3200-1.3400 range today. Tin helmets on girls and boys.

- USD/JPY – A dovish Fed will see US yields tumble and this will have a marked effect on the Dollar Yen. USD/JPY has immediate support at 111.15 followed by 110.85. Immediate resistance can be found at 111.60 and 111.90. This would be my preferred currency pair to sell if we see a more dovish Fed. The market is short JPY bets and it has the farthest way to move.

- AUD/USD – A neutral RBA concerned with weaker house prices weighed on the Australian Dollar which has rallied courtesy of a weaker Greenback. Asian EM currencies all fell against the US Dollar and this weighed on the Aussie. However, a more accommodating Fed will boost the Aussie through immediate resistance at 0.7120. The next resistance level lies at 0.7150. Immediate support can be found at 0.7050 and 0.7020. Remember that speculators are short of Aussie which saw an increase in the latest COT report. Likely range today 0.7040-0.7140.

Happy trading all.