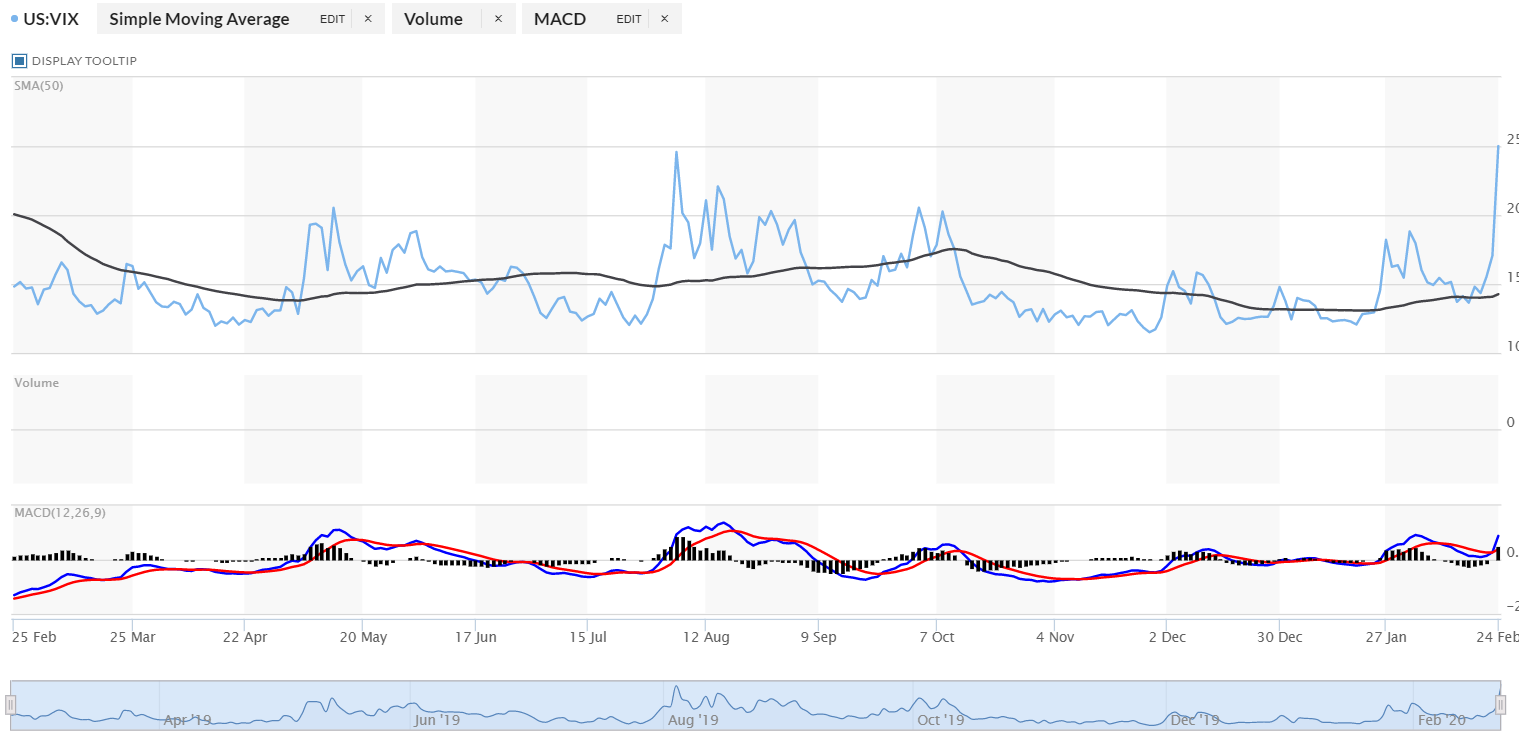

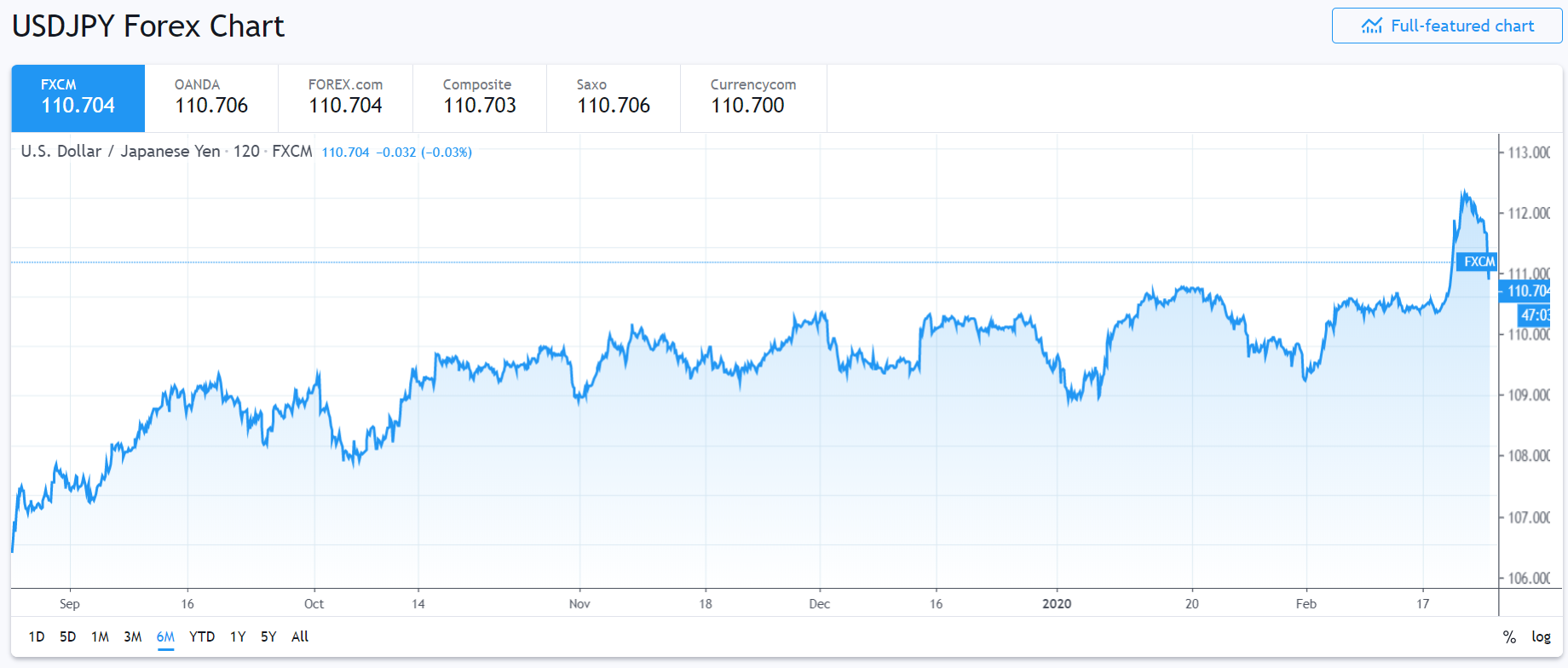

Summary: The Yen reversed its spectacular 2-day slide, lifting to 110.34 at one stage, before closing 0.70% up against the US Dollar (USD/JPY 110.70 from 111.57) as the coronavirus illness spread outside China. Iran, Italy and South Korea reported the largest number of cases causing market panic on growing concerns of the possible effects on global growth. Stocks and Bond Yields fell sharply. The CBOE VIX Volatility Index skyrocketed 46.1% to 24.99, highs not seen since December 2018. Risk and Emerging Market Currencies slumped against the Greenback. The Australian Dollar hovered above decade lows, dipping 0.2% to 0.6602 (0.6627). The Euro maintained its overnight advance after an upbeat German IFO Business survey, closing little changed at 1.0847 (1.0849). Sterling retreated 0.29% against the Greenback to 1.2920, as tensions mounted ahead of Britain’s trade deal with the European Union. Against the EM FX Russian Rouble, the US Dollar jumped 2% to 65.33 from 64.02 yesterday. Wall Street stocks tumbled. The DOW ended 2.83% lower at 28,130.

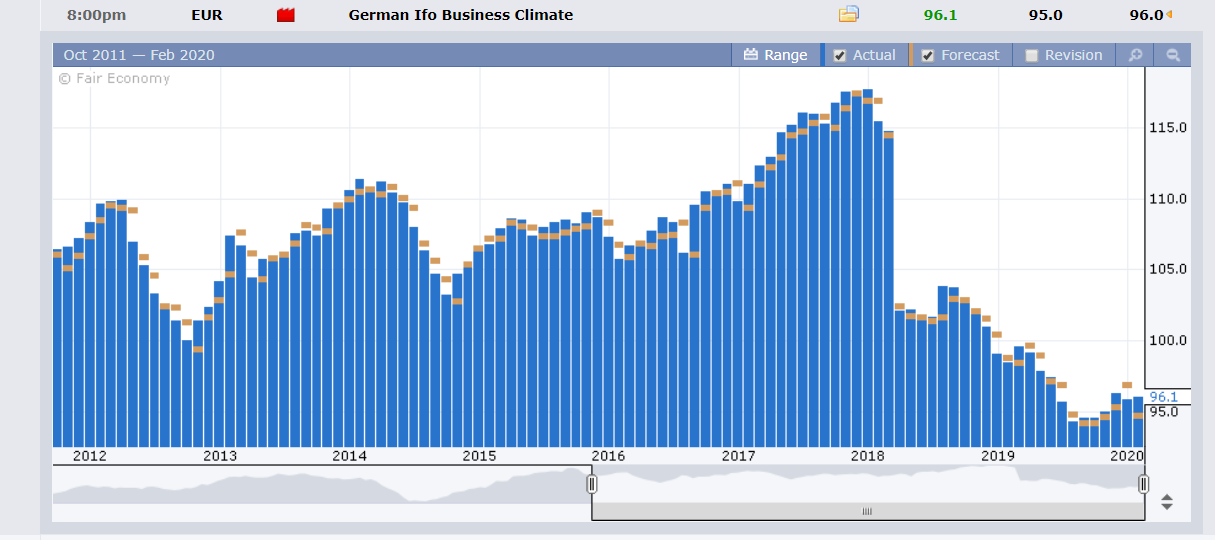

The S&P 500 lost 2.8% to 3,250 from 3,340 yesterday. US bond yields tumbled. The benchmark 10-year treasury yield fell to 1.37% from 1.47% yesterday, putting the key rate near its all-time low close at 1.3600. Yesterday saw limited data releases. New Zealand’s Q4 2019 Headline Retail Sales dipped to 0.7%, missing forecasts at 0.8%. Q4 Core Sales underwhelmed at 0.5%, against 0.9% forecast. Germany’s IFO Business Climate Survey surprised to the upside at 96.1, beating median expectations of 95.0 and a previous 96.0.

Trading Perspective: In all the FX mix, the Dollar Index (USD/DXY), a popular gauge of the Greenback’s value against a basket of 6 major currencies was modestly lower 99.287 (99.337 yesterday). The market has extended its risk-off stance due growing fears that the coronavirus spread outside China is heading toward a global pandemic. Stocks and bond yields tumbled. The key US 10-year treasury rate dropped a whopping 10 basis points to 1.37%, one basis point above its all-time low. Rival bond yields were also lower but not to the extent of the fall in US rates. Germany’s 10-year Bund yield was 5 basis points lower to -0.48%. Japanese 10-year JGB rates were unchanged at -0.06%. Ongoing coronavirus fears have led to a repricing of 2020 Fed rate cuts. Without the yield advantage, the Dollar will find it difficult to rally much further. Speculative market positioning is still long US Dollar bets overall. Further US Dollar correction lower is likely even in the current environment. There are no first-tier economic data scheduled for release today. Markets will continue to fix their sights on the coronavirus developments.

USD/JPY – The combination of its universal haven appeal and lower US 10-year yields saw the Japanese Yen outperform FX. The Dollar fell to an overnight low at 110.333 Yen before rallying to settle at 110.70, a loss of 0.7%. USD/JPY has immediate and key support at 110.30. A break of this level will see 109.70 followed by 109.20. Immediate resistance lies at 111.10 and 111.60. Look for consolidation in likely range of 110.30-110.90 range today. Prefer to sell rallies.

AUD/USD – The Australian Dollar remains soggy given Australia’s trade relationship with China. Economists are now calling for an RBA rate cut as soon as April. While the economy created 13,500 Jobs in last week’s Employment report, Wages stayed low and the Jobless rate jumped to 5.3% from 5.1%. Economic data released this week see the ANZ Business Confidence and Private Capital Expenditure reports released (Thursday, 27 Feb). Don’t forget that the other side of the Australian Dollar FX price is the US Dollar. A weaker US Dollar will still see a stronger Aussie. Ten-year Australian bond yields were 2 basis points lower to 0.91%. The Australian Dollar TWI remains near 2007-2008 lows. Which is closely monitored by the RBA. This should be supportive for the Battler. Immediate support lies at 0.6580 followed by 0.6540. Immediate resistance can be found at 0.6620 and .6650. Look to trade a likely range today of 0.6585-0.6635. Prefer to buy dips.

EUR/USD – The Euro ended virtually flat at 1.0847 after climbing to 1.08723 overnight high on the upbeat German IFO Business survey. Immediate support lies at 1.0840 followed by 1.0810. Immediate resistance can be found at 1.0870 and 1.0900. Look for the Euro to consolidate in a likely 1.0835-1.0885 range. Look to buy dips.

GBP/USD – Sterling slipped back to 1.2920 from 1.2958 yesterday, down 0.29%. The British currency risks disappointment from rising fiscal stimulus expectations and the formal trade negotiations between the UK and EU. Also, speculative market positioning is long GBP bets. Expect Sterling to hold its own against the US Dollar but fall against its other Rivals like the Euro and Yen. GBP/USD has immediate resistance at 1.2950 followed by 1.2980. Immediate support can be found at 1.2885 and 1.2845. Look to trade a likely range today of 1.2885-1.2955.

EUR/GBP – The Euro rallied against the British Pound to 0.84070 overnight high before settling to a NY close at 0.8400, (0.8372) a gain of 0.47%. EUR/GBP has immediate resistance at 0.8410 followed by 0.8460. Immediate support can be found at 0.8370 and 0.8340 (overnight low 0.83439). Look to trade a likely range of 0.8380-0.8430. Prefer to buy dips, this cross-currency pair is headed higher.

GBP/JPY – With the haven Yen now in the ascendancy and Sterling wavering, this cross-currency pair is under pressure. GBP/JPY closed at 143.00, for a loss of 0.89% (144.57 yesterday). Overnight low traded was 142.632. GBP/JPY has immediate support at 142.60 followed by 142.10. Immediate resistance can be found at 143.30 and 143.70. Look to sell rallies with a likely range today of 142.50-143.50.

Happy trading all.