Asian indices finished mixed today as the China-U.S. trade dispute entering the 15th month, with few signs a deal will be reached in the near-term. The Nikkei225 finished 0.16 percent lower to 21,117 the Hang Seng benchmark in Hong Kong finished 0.42 percent higher at 27,384. The Shanghai Composite finished 0.02 percent higher to 2,852 below the 100-day MA, while in Singapore the FTSE Straits Times index finished 0.28 percent lower to 3,169. Australian equities finished 35 points lower or 0.6% to 6,456. However, the ASX managed to gain 1.4% over the past five trading sessions, thanks to the post-election rally early in the week.

European session started higher today following heavy losses in the previous session amid geopolitical concerns and as the European election voting began, the DAX30 is 0.85 percent higher to 12,054 and CAC40 is 0.83 percent higher at 5,325 while the FTSE MIB in Milan is trading 0.72 percent higher at 20,383. The London Stock Exchange is adding 0.67 percent to 7,279 amid reports that Prime Minister Theresa May will confirm her exit date later in the day.

In commodities markets crude oil plunged to 58.45 having the worst daily decline since December 2018 after American Petroleum Institute data showed that U.S. crude stockpiles rose unexpectedly the previous week. Bears during US session broke below 58.00 a barrel along with the 200 and 100 simple moving averages but managed to rebound slowly and regain the 58 zone. Brent oil also trades lower at $68,33 per barrel as major oil producers have yet to agree on adjustments on output. Gold is the winner as finally got some bids after the consolidation around 1273 zone the two-week lows. The precious metal breached the 100 and 200-hour moving average and that gave the short term control back to bulls. XAUUSD technical picture is bullish now after yesterdays strong rebound. Gold will find support at 1272 the low from yesterday while more bids will emerge at 200-day moving average at 1255, on the upside resistance stands at 1296 the 100-day moving average.

In cryptocurrencies market, bitcoin (BTCUSD) consolidates around 7,850 after the popular crypto pressured above the 8,000 zone. The daily low for BTC was at 7,783 and the daily high at 7,973. Immediate support for BTC stands now at $7,000 round figure, on the upside strong resistance stands at 8,300 the recent high. Ethereum (ETHUSD) rebounds after yesterday sell off to 246, on the upside the immediate resistance stands at 263 the high during yesterday session while the support stands at 235 and the 100 hour SMA, Litecoin (LTCUSD) also trades higher at 93.80. The crypto market cap holds above $173.0B.

On the Lookout: In the US macro news the US May preliminary Manufacturing PMI fell to 50.6, its lowest in almost ten years, while the Services Index fell to 50.9 its lowest in 36 months. The United States Kansas Fed Manufacturing Activity declined to 2 in May from previous 12.

In Eurozone Germany released the IFO Business Climate for May, which declined to 97.9 from 99.2, amid a sharp slide in the assessment of the current situation.

In the America economic calendar, we await the US durable goods orders data is issued. Next week, updates on business investment, building approvals and credit growth feature.

Trading Perspective: It was a high volatility trading session in forex markets, the US dollar made an attempt to yearly highs but sellers stepped in and drove the price back to 97.65 a fresh weekly low, as US Treasury yields collapsed, with the 10-year note yield currently at 2.29% and traders disappointed by worst Markit May preliminary estimates, showing that growth in business activity slowed sharply both in the US. The Aussie dollar rebounds to 0.6895 from yesterday multi-month lows at 0.6868 as RBA Governor Philip Lowe said the board “will consider the case” for an interest rate cut on June 4. Kiwi managed to regain the 0.65 level, and as of writing the pair is trading at 0.6529.

GBPUSD managed to avoid another daily loss supported by a slide of the greenback below the 98 level. Bearish momentum for Cable is still intact as growing concerns over the PM May’s resignation are back in play. The pair yesterday made fresh 5-month lows at 1.2604 and today hit the daily low at 1.2648 and the daily high at 1.2685. On the upside immediate resistance now stands at 1.2686 the high from Asian session and the 50-hour moving average while more sellers will emerge at the 100-hour moving average at 1.2712. Sterling shows persistent weakness amid UK political uncertainty and also on the back of risk aversion.

In Sterling futures the open interest increased by around 7.3K contracts, reaching the ninth consecutive build, volume kept the choppy activity and dropped by around 29.1K contracts.

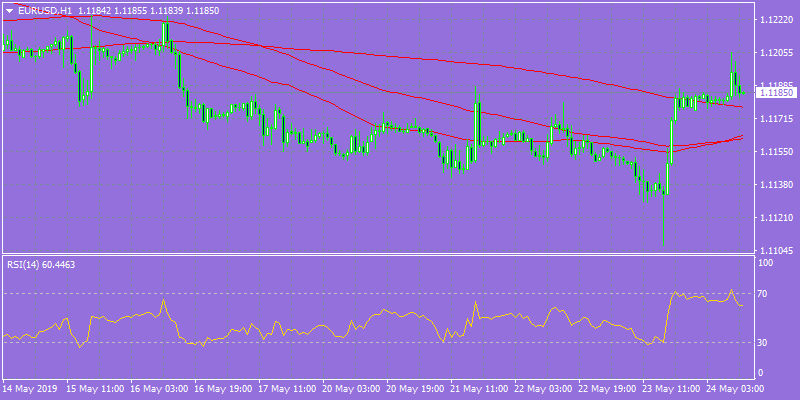

EURUSD yesterday crashed to lowest since 2017 at 1.1105 on trade tensions, patient Fed, German macro weakness, and EU elections. The pair managed to rebound fast from the lows and breached all major hourly moving averages giving bulls the upper hand for the short term. On the upside, the immediate resistance stands at 1.12 the high from Asian session, while more offers will emerge at 1.1245 the 50-day moving average.

In euro futures, the open interest rose by around 21.1K contracts on Wednesday, the largest single-day increase reaching the sixth consecutive build. Volume reversed the previous drop and rose by around 124.6K contracts, the largest move since April 23.

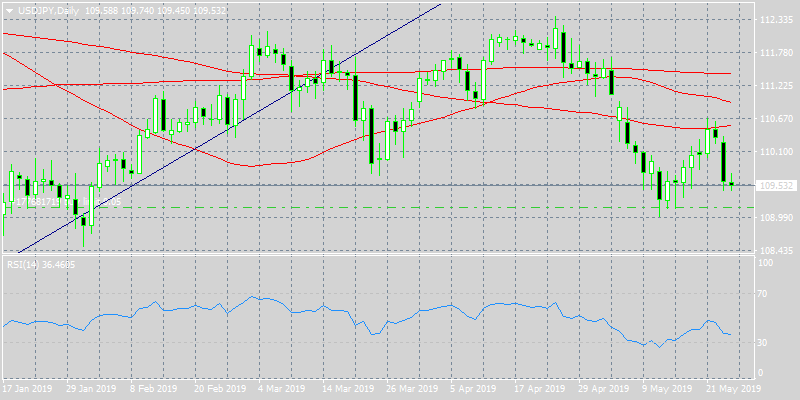

USDJPY was the loser of the day as the pair broke the 110 level and ended down to 109.50 amid USD weakness across the board. Today the pair hit the low at 109.45 and the high at 109.74. The pair will find support at 109.45 Friday low, on the upside immediate resistance for the pair now stands at 110 and then at 110.54 the 100-day moving.

In Yen futures, the open interest increased by almost 2.4K contracts on Thursday and volume also rose by nearly 49K contracts.

USDCAD trades at 1.3450 in the middle of the recent trading range. The pair will find immediate support at the 50-day moving average around 1.3392 while extra support stands at 1.3300 round figure. On the upside, immediate resistance stands at the 1.35 zone.