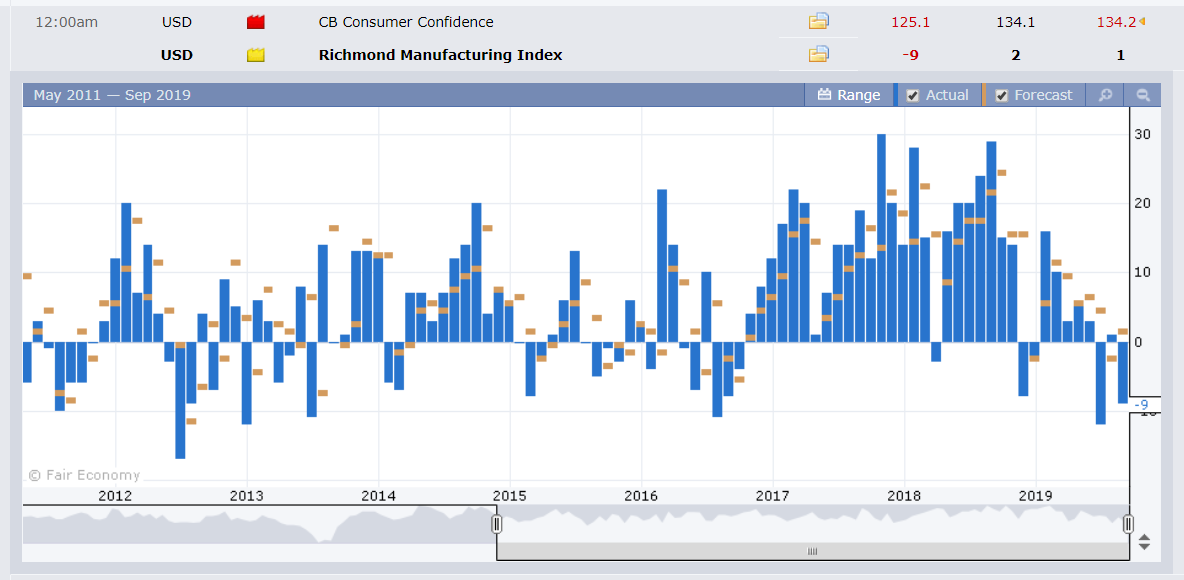

Summary: The US Dollar, stocks, and bond yields fell as political turmoil embroiled Washington, DC. US Democrats called for an impeachment inquiry against President Trump. The inquiry would review whether Trump sought the Ukraine’s help in smearing former US Vice President Joe Biden, the Democrat front-runner in the 2020 Presidential election. Which would amount to a violation of the US Constitution. Poor data reads from the US Conference Board’s Consumer Confidence (125.11 against f/c of 134.1) and Richmond Manufacturing Index (-9.0 versus f/c +2.0) added to the Greenback’s woes. The Dollar slumped 0.53% against the Yen to 107.07 (107.50) and 0.48% against the Swiss Franc (0.9857 from 0.9903) as risk appetite soured. New Zealand’s Kiwi Dollar extended its advance against the US Dollar to 0.6327 from 0.6293 ahead of today’s RBNZ policy meeting. The Euro lifted to 1.1020 (1.0995) on the overall weaker Dollar. The Dollar Index (USD/DXY) eased to 98.345 (98.632). Sterling rose to 1.2494 (1.2435) despite the UK Court ruling that Boris Johnson suspended Parliament unlawfully.

US Treasuries rallied, bond yields slumped. The ten-year yield slumped 8 basis points to 1.65%. Wall Street stocks fell. The Dow was 0.5% lower to 26,865 (27,007). The S&P 500 dropped 0.9% to 2,971.

Other data released yesterday: Japan’s Flash Manufacturing PMI dipped to 48.9 from 49.3. Germany’s IFO Business Climate Index was up to 94.6 in September from 94.3 previously.

- USD/JPY – The safe-haven Yen outperformed the majors, rising 0.53% against the Dollar. Lower US bond yields and a risk-off stance from the market saw USD/JPY slump to 106.961 overnight lows before settling at 107.07 at the New York close.

- EUR/USD – rallied off it’s lows at 1.09839 to finish up 0.24% to 1.1022. German IFO Business Climate beat forecasts in contrast to disappointing US data.

- NZD/USD – the Kiwi extended its rally from 4-year lows at 0.6255 on Monday to 0.6332 before settling at 0.6325 in New York. The RBNZ is not expected to reduce its Official Cash Rate, currently at 1.00%. Markets will watch the brief statement following on the possibility of further easing toward the year-end.

- GBP/USD – Sterling rallied to 1.2495 from 1.2435 despite the UK Court ruling that Boris Johnson’s suspension of the UK Parliament for 5 weeks was unlawful. Broad-based US Dollar weakness boosted the British currency.

On the Lookout: All eyes on Washington, DC today to see where the impeachment inquiry from US Democrat lawmakers, led by House of Representatives Speaker Nancy Pelosi, leads to. President Trump has weathered repeated scandals since he took oath in 2017.

The weaker US data saw bond yields slump with the 10-year rate down to 1.65%. The US Consumer Confidence level fell to its lowest in 9 months. Global rival yields dipped, but not to the extent of the US fall. This will continue to weigh on the Greenback. Markets will focus on upcoming economic reports.

Data released today: New Zealand’s Trade Deficit rose to -NZD 1.565 billion against forecasts of -NZD 1.19 billion. From Japan, the BOJ releases its monetary policy meeting minutes from the last meeting. The BOJ also reports its Japanese Core CPI data. The RBNZ is not expected to trim its Official Cash Rate at 1.00% today (12 noon Sydney). The RBNZ Statement follows shortly after.

Euro area data kick off with Germany’s GFK Consumer Climate and Switzerland’s Credit Suisse Economic Expectations. The UK reports on its CBI Realised Sales and High Street Lending. US New Home Sales round up today’s reports. US FOMC Members Evans (Chicago) and George (Kansas City) have speaking engagements.

Trading Perspective: We highlighted yesterday that total net speculative US Dollar longs had increased to their highest since June in the latest Commitment of Traders/CFTC report. The Trump political turmoil, weaker US data, prolonged trade war with China and current market positioning will see further broad-based Dollar declines.

- EUR/USD – The Euro traded to an overnight low at 1.09839 yesterday before finishing at 1.1020. Immediate resistance can be found at 1.1030 (overnight high 1.10241). The next resistance level lies at 1.1060. Immediate support is found at 1.1000 followed by 1.0980. Look to buy dips with a likely range today of 1.1010-1.1060.

- USD/JPY – The market’s overall risk-off stance and lower US bond yields will weigh on the Dollar. USD/JPY has immediate support at 106.90 (overnight low at 106.961). The next support level lies at 106.70 and 106.30. Immediate resistance lies at 107.40 and 107.80 (overnight high 107.799). The BOJ releases its latest policy meeting minutes today. The latest COT/CFTC report saw a trimming of net JPY long bets. The US political turmoil will keep USD/JPY under pressure. Look for a likely trading range today of 106.70-107.40. Just trade the range shag on this one.

- NZD/USD – The RBNZ is not expected to cut its Overnight Cash Rate at the conclusion of its meeting today. Markets expect the RBNZ statement which follows to point to a rate reduction most probably in November. NZD/USD extended its gains from yesterday’s short covering rally to an overnight high at 0.63332 before easing to 0.6325. New Zealand’s trade deficit released earlier this morning, slightly underwhelmed. NZD/USD currently sits at 0.6318. Immediate resistance lies at 0.6335 followed by 0.6365. Immediate support can be found at 0.6315 followed by 0.6285. Look to buy dips with a likely 0.6285-0.6335 range today.

- GBP/USD – Sterling rallied as the US Dollar fell against it’s rivals. GBP/USD hit an overnight high at 1.25032 before settling at 1.2495. Immediate resistance lies at 1.2505 followed by 1.2535. Immediate support can be found at 1.2445 and 1.2415. The UK ruling that Boris Johnson’s suspension of Parliament for 5 weeks was unlawful makes it less likely that the UK will leave the EU without a transition agreement. The uncertainty though will dog the British currency. Look to trade a likely range today of 1.2430-1.2510.

Happy trading all.