Summary: The Dollar rebounded against its rivals boosted by rising US treasury yields in an otherwise featureless (data-wise) Monday. Ahead of key US treasury auctions this week, the benchmark 10-year yield climbed to one-month highs at 0.71% (0.68% yesterday). Against the Japanese Yen, the US Dollar soared the highest, up 1.02% to 107.65 (106.68). Risk currencies which have rallied since Thursday, stumbled led by the Australian Dollar, down 0.51% against the Greenback to 0.6490 (0.6532). The USD/CAD pair soared 0.74% to 1.4015 (1.3935) after Brent Crude Oil prices slid 3.2%. Sterling retreated against the Dollar to 1.2335 (1.2405) as British Prime Minister Boris Johnson spoke to his country Sunday on how to get the economy back to work. Johnson encouraged workers to return to work but also urged people to stay at home if possible, which was confusing to many. Johnson will give more details today. The Euro dipped 0.21% to 1.0815 from 1.0840 on the overall bid US Dollar. Against the Asian and EM currencies, the Greenback advanced. USD/SGD rallied to 1.4175 from 1.4125. Wall Street stocks finished with modest losses. The DOW slipped 0.72% to 24,215 (24,430). The S&P 500 was down 0.3% to 2,927 from 2,940 yesterday. Global treasury yields climbed, taking the lead from their US counterpart. Germany’s 10-year Bund yield finished at -0.52% from -0.53% yesterday. Japanese ten-year JGB yields were unchanged at 0.01%.

Yesterday’s data calendar was light. New Zealand’s ANZ Business Confidence Index was at -45.6 in April from March’s-66.6. Italy’s Industrial Production slumped to -28.4%, underwhelming expectations at -20.0%.

On the Lookout: Economic data releases pick up today. Fed speak picks up today with FOMC Members Patrick Harker (Fed President – Philadelphia) and Federal Reserve Governor and Vice-Chair Randal Quarles speaking at separate occasions. Cleveland President and FOMC member Loretta Mester speaks early tomorrow morning (Wednesday, 7 am Sydney). Input from the Federal Reserve speakers will impact the Dollar this week.

The current state of US-China relations is also a key potential issue, and any rise in tensions will impact risk appetite and the US Dollar.

Australia kicks off with its National Australia Bank Business Confidence Index. Japan reports on its Leading Indicators. Chinese CPI and PPI data follow. Also due today (no specific time given) is China’s Foreign Direct Investment (April). No Euro area reports are scheduled for release today. Australia’s Budget Release is due tonight (no specific time). US reports follow with its Headline and Core CPI data.

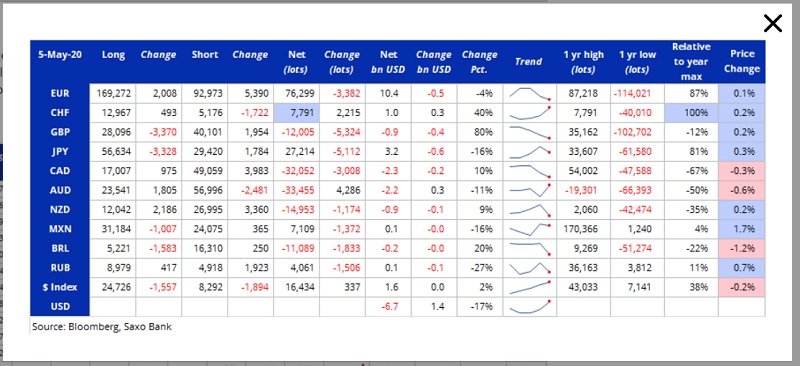

Trading Perspective: Amidst the rebound in US bond yields which has been a pillar of support for the Dollar, the latest Commitment of Traders report (week ended May 5) saw speculative USD shorts reduced for the second week in a row. Saxo Bank reported that speculative Dollar shorts were reduced by 17% to a total of -USD 6.7 billion. The Greenback was bought against the Euro, Yen, to reduce shorts. Against the Pound, and Canadian Dollar the Dollar was also bought, but for the purpose of adding shorts. The Greenback was sold against the Aussie to reduce shorts.

Given the economic reports being released this week, input from the various Fed speakers, Covid-19 flare-ups amidst a return to work in many countries, current state of US-China relations and market positioning, FX could be in for high volatility. Happy days.

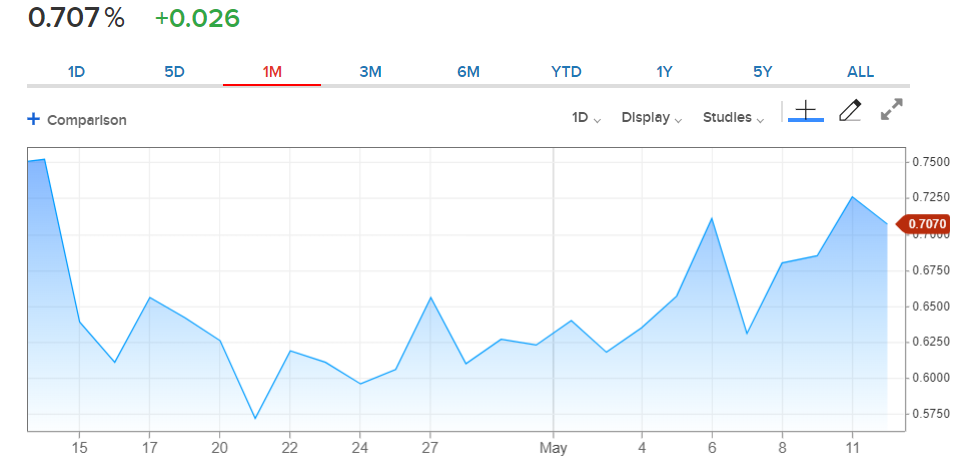

AUD/USD – Looking for Direction: Bid US Yields, Short Positioning, Focus on China CPI

The Australian Dollar retreated against the broadly firmer US Dollar following two solid trading days of gains. AUD/USD had a go at 0.65614 last night, just short of 0.6570 resistance, tumbling back to 0.64564 overnight before climbing to settle at 0.6490 at the New York close, a loss of 0.51%. Strong risk sentiment which has boosted the Aussie Battler has begun to wilt under the pressure of higher yields ahead of the US treasury auction.

The latest Commitment of Traders report (week ended 5 May) saw net speculative Aussie short bets trimmed to -AUD33,455 contracts from -AUD 37,741 the previous week. While the short AUD market positioning is a support for the Battler, the currency is vulnerable to bouts of risk aversion.

AUD/USD has immediate resistance at 0.6520 followed by 0.6560. Strong resistance lies at the 0.6600/20 area. Support for the Aussie Battler can be found at 0.6450 (overnight low, 0.64564) followed by 0.6420. Expect the AUD/USD pair to consolidate today with a likely range of 0.6430-0.6530. Prefer to sell rallies on the day.

EUR/USD – Holds 1.08 But Still Shaky on Spec Longs, EU Concerns

The Euro finished 0.27% lower in subdued trade, settling at 1.0815 in late New York from its 1.0840 opening yesterday. EUR/USD traded to an overnight low of 1.08027, managing to hold above the 1.0800 support level. The shared currency remains dogged by EU concerns following last week’s German Constitutional Court ruling which is weighing on the Euro. The latest Commitment of Traders report (week ended May 5) saw speculative long Euro bets trimmed to +EUR 76,299 from the previous week’s +EUR 79,681. Net total shorts though are still 87% from yearly highs.

EUR/USD has immediate resistance at 1.0850 (overnight high 1.08505) followed by 1.0880 and then1.0900. Immediate support can be found at 1.0800 and 1.0770. In the current environment, expect the shared currency to consolidate in a likely trading range of 1.0780-1.0830. The risk for the Euro is still lower and it should grind through all of the bids clustered around the lower support levels.

USD/CAD – Bid USD and Lower Oil vs Short CAD Bets, Risks Higher

The Dollar had another roller coaster day against the Canadian Loonie. USD/CAD initially slumped to 1.39005 overnight low before a strong bounce to 1.40425, easing to settle at 1.4015 at the New York close. Broad-based US Dollar strength and a fall in Crude Oil prices boosted the USD/CAD pair. Canada’s 10-year bond yield was unchanged at 0.58% in contrast with the 3-basis point climb in US 10-year rates to 0.71%.

The latest Commitment of Traders report (week ended May 5) saw net speculative CAD short bets increase to -CAD 32,052 contracts from the previous week’s -CAD 29,044. The percentage of CAD shorts against its yearly high is 67%. This has and will continue to be a barrier to USD/CAD gains. We could see a battle forming between the 1.3850-1.4250 range in the coming weeks.

USD/CAD has immediate resistance at 1.4050 followed by 1.4100. Immediate support lies at 1.3980 and 1.3940. Look for a likely consolidative range today between 1.3985-1.4085. Prefer to buy dips today.