Should we radically rethink the role of cash to deal with the lower bound on interest rates?

The lower bound on interest rates has been a major challenge for central bankers in the multiple crises over the last ten years. It threatens the effectiveness of monetary policy by preventing it from steering financial conditions. Moreover, the continuous decline in both the real rate and confidence in the central bank, as well as resistance at the retail level, raises the question of whether negative rates should be part of the standard toolkit of central banks.

In the context of the Eurosystem’s asset purchase programmes, the combined package of negative nominal interest rates and lending schemes that incentivise banks to increase lending (e.g. the targeted longer-term refinancing operations, or TLTROs) have been an effective and appropriate way to combat these challenges. While cash represented the largest part of central bank balance sheets before the crisis, other elements of the balance sheet have since gained more prominence in the operational framework of monetary policy.

Some people want to abolish cash by taking advantage of recent technological advances, such as distributed ledger technology (DLT), or replace public money with private money, in total denial of people’s trust in liabilities issued by central banks and the fact that their continued demand for cash exceeds GDP growth. Others argue for the introduction of a dual currency scheme where the central bank would divide the monetary base into two separate local currencies – cash and electronic money (e-money). E-money would be issued only electronically and would pay the policy rate of interest, and cash would have an exchange rate – the conversion rate – against e-money, which could be manipulated to match negative rates on e-money by setting the conversion rate for cash lower than one to one.1

I have experienced the nightmare of dual exchange regimes before the euro and I have doubts about these arguments. Our unconventional measures have proven sufficient to meet the challenges of low inflation. The Governing Council has confidence in the sustained adjustment in the path of inflation. Recent evidence supports the hypothesis that there is some substitutability between conventional and unconventional monetary policies.2

Additionally, while being able to set significantly negative rates may work smoothly in an economic model, I am less certain how the general public would react, particularly after millennia of positive nominal rates. Not only would such rates be deeply unpopular, there may also be unintended changes in behaviour that could dampen the effectiveness of the measure.

The fact that banks do not pass negative rates on to most depositors,3 and notably not to households, is a warning sign for central banks of how people may react if attempts were made to extend the lower bound of rates downwards by replacing cash with some form of remunerated digital currency. What assets the central bank ought to hold against these widely held liabilities driving bank disintermediation and deleveraging?

A potential decision to issue a central bank digital currency (CBDC) needs to be assessed in relation to the impact on the financial system. In an extreme case, during a systemic banking crisis, holding risk-free central bank-issued CBDC could become vastly more attractive than bank deposits. There could be a sector-wide run on bank deposits, magnifying the effects of the crisis.

Even in the absence of a crisis, readily convertible CBDC could crowd out bank deposits – putting the two-tier banking system at risk. Then, the efficient flow of credit to the economy would likely be impaired. The central bank – now holders of deposit funding – would have to decide which projects to finance, either directly, by replacing commercial banks, or indirectly, by deciding which banks would receive funding. This would lead to a situation in which the central bank pretends to know better than the established system of the decentralised allocation of credit.

Overall, there is currently no convincing motivation for the Eurosystem to issue CBDC to the general public. It is unnecessary and appears to be disproportionate to the aims put forward by its proponents. There is no need to fix something that is not broken. If anything, one could imagine a digital representation of cash that replicates the features of cash in the reasonably distant future, if people demanded it. And I have not even mentioned the insufficient robustness or reliability of some technologies like DLT, or their energy insufficiencies and dependencies.

How does technological change affect the monetary transmission mechanism and monetary policy?

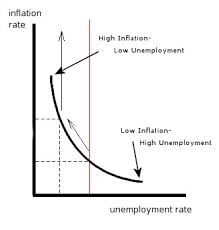

Technological change has multifaceted effects on the transmission mechanism. It is important not to jump to conclusions, for example that, because the Phillips curve has become flatter, monetary policy needs to be more aggressive. Let me add that, beyond technological changes, additional liquidity demand factors also stem from regulatory change, fragmentation and the fact that the banking union is incomplete.

I will consider how technological change affects the following three broad channels of monetary transmission, without focusing on the consequences structural changes will have for the operational framework:

- How policy rates affect market interest rates and financial conditions.

- Labour markets and the non-accelerating inflation rate of unemployment (NAIRU).

- Price-setting and the Phillips curve.

Financial innovations have the potential to impact the way the economy is financed

A change from bank-based to market-based financing has been taking place for some time in the euro area, partly related to financial innovation. This has led to firms having a more diversified financing structure and has improved their resilience to shocks emanating from the banking system. At the same time, corporate exposure to volatility in market rates has increased.

Fintechs can lead to further bank disintermediation, but also financial deepening, by allowing otherwise constrained households and firms to borrow.4 In addition, fintech can strengthen unregulated lending activities, posing challenges to financial stability. This might affect the transmission mechanism, although how it will do so is not yet clear.

Labour markets and the NAIRU

The possible disruption from technological change is likely to be felt in labour markets. Email, videoconferencing, secure VPN5 connections and outsourcing across countries all enable services to be provided from a distance, and permit a greater degree of flexibility in working practices – a massive socioeconomic shift.

In the labour market the internet enables more services to be offered with less intermediation at lower prices. Fragmentation of labour time is shown in the diverging results of compensation per employee and compensation per hour worked.

For some workers this is a positive development, allowing them to participate in the workforce where previously they were excluded.6 For others, the greater individualisation can lead to insecurity, affecting households’ income. More individualised roles can also weaken the power of collective bargaining to maintain the labour share of income.7

While the productivity-enhancing aspects of digitalisation might tend to raise potential output growth, the effects operating through labour and capital are more uncertain, and might even work in different directions.

There may be some substitution of labour for capital, with possible repercussions for the bargaining power of workers, and a shift in investment to the IT sector as a result of digitalisation and servicification. If there is a skill bias in the transition to digital technology, this could lead to a greater mismatch in labour markets, and therefore a higher NAIRU and lower potential output growth.

On the other hand, digital production and supply chains, and digital communication and connectivity, would tend to lower the NAIRU and raise potential output, because of the productivity increases resulting from faster collection and evaluation of data, and the greater efficiency of digitally underpinned production.

The overall effect of digitalisation and new technologies on demand and supply therefore depends on many factors. These include the initial conditions: economies with high-quality institutions and governance are likely to see faster adoption and implementation of digital technologies and a faster impact on potential output.

From a monetary policy perspective, it is important to monitor the digital transformation of the economy. Some economists argue that output, productivity, intangible investment and prices have become more difficult to measure as a result of digitalisation. Literature suggests that, even though some mismeasurement exists, its impacts may not necessarily be greater than in previous episodes of technological change.8

But the analysis is ongoing, with various opinions and sometimes conflicting results. Of course, the fast pace of change across all areas of the economy also requires us to update our tools for monitoring it, and leverage the opportunities modern technology gives us, including new and better data.

Price-setting and the Phillips curve

Technological progress poses a particularly acute challenge because of its direct impact on businesses’ price-setting behaviour; behaviour that directly underlies the inflationary process.

The growing importance of e-commerce, rapid product introduction and substitution, and the quality adjustment of new products also pose their own challenges for measuring inflation. Technological progress has resulted in the creation of products such as smartphones and internet service providers that had no equivalent in the past; failing to properly measure the quality improvements in new products can result in an upward bias in measured inflation. On the other hand, the reduction in shelf-life of many products and the heavy discounting of less-fashionable older versions could instead create downward bias in traditional price indices.9

Technological changes to price and wage-setting behaviour have much deeper relevance for central banks than just the measurement of inflation. The speed and extent of how inflation reacts to shocks affects the optimal monetary policy response:

- E-commerce may result in suppliers changing prices more frequently.10 Not only are Amazon’s prices more flexible than prices of brick-and-mortar stores, Amazon’s competitors are forced to adjust prices more often for products that are also offered by Amazon.11More frequent price changes result in a steeper Phillips curve – prices react more quickly and strongly to changes in costs and output. This could also mean that inflation reacts much faster to monetary policy.12

- Since online stores effectively offer the same price across locations, e-commerce may restrict the ability of businesses to set prices that deviate substantially from those of large online retailers while reflecting local conditions. So prices may change more often, but they may be more uniform, which in turn may restrict the ability of prices to reflect idiosyncratic and regional shocks.13

- E-commerce changes not only how firms set prices but also how consumers shop. It has revolutionised the transparency of pricing both within and across countries, allowing consumers to easily compare prices and swap one product for another. This can result in higher demand elasticities, eroding the monopolistic and monopsonistic power of suppliers and reducing mark-ups. Profit margins at Amazon (less than 4%) are much lower than at Walmart (more than 20%).14 Such a change in demand elasticities and mark-ups can be viewed as a flattening of the Phillips curve.

- Finally, the emerging prevalence of e-commerce can create new opportunities for consumers to switch their shopping outlets over the business cycle. For example, there is evidence that households actively exploit price differentials across stores and “trade down” in recessions (e.g. switch from a regular grocery store to a discounter). It could be predicted that this switching will be amplified in the future because switching to an online store is particularly easy. As a result, aggregate “true” inflation may be more cyclically sensitive than is suggested by headline inflation.15

The impact of e-commerce on the slope of the Phillips curve is uncertain, and studies have generally struggled to find large effects on annual inflation. Given the overall difficulty in estimating the slope of the Phillips curve, this is not entirely a surprise.

Conclusions

As with measuring consumer price indices, the greater availability of more granular data has enabled a much greater understanding of how businesses set prices. But while policymakers should adapt policy to take into account changes in the underlying price-setting process, we should also exercise due prudence, given the uncertainty surrounding model estimates.

Price stability-oriented monetary policy needs to monitor innovations and their impact on financial conditions, economic growth and inflation. And we have to be mindful of changes in the information content of the indicators that central banks use as a basis for policy decisions (e.g. monetary aggregates and inflation rates).

As the impact of innovations cannot be estimated in advance with sufficient certainty regarding the direction, size and duration of the effects, and uncertainty therefore prevails, monetary policy should act prudently and be forward-looking.