The Phillips curve is the connective tissue between the Federal Reserve’s dual mandate goals of maximum employment and price stability. Despite regular declarations of its demise, the Phillips curve has endured. It is useful, both as an empirical basis for forecasting and for monetary policy analysis.

The paper by Peter Hooper, Rick Mishkin, and Amir Sufi-HMS for short-provides an in-depth analysis of key aspects of inflation dynamics in the United States and how they may have changed. This study is particularly timely against the backdrop of an emerging consensus that the Phillips curve has become nearly flat. If this is true it would fundamentally alter the employment-inflation trade-offs the Fed confronts.

There is a lot to like about this paper: It synthesises existing research, new analysis, and bridges the study of wages and prices. Too often these are studied in isolation. But most significant, as someone who has discussed papers at the USMPF that reached the century mark in page count, this year’s paper came in at a relatively svelte 65 pages. I hope this represents a durable structural shift, and isn’t merely a reflection of the fact that this year’s paper has three authors rather than the usual four.

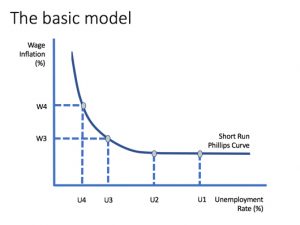

The paper covers a lot of ground, so I will only summarize a few key takeaways. First, HMS find evidence of asymmetric effects of unemployment on both price and wage inflation, with very low rates of unemployment leading to disproportionately large movements in inflation. That is, the Phillips curve is very much alive in very tight labor markets. Second, they find that the dynamics of price inflation have changed in important ways; specifically, it has become less sensitive to the business cycle and less persistent. Finally, they draw the policy conclusion that Fed policymakers should not be complacent about the possibility of a resurgence of inflation in the context of a tight labor market.

In my remarks, I will discuss two issues. First, that price inflation dynamics have changed significantly in recent decades. I will argue that a number of structural factors have contributed to the appearance of a flattening of the Phillips curve and that a modified formulation that accounts for these changes displays little sign of the Phillips curve flattening. Second, I will turn to the issue of anchoring of inflation expectations and the need for the Fed to be vigilant in maintaining the anchor in the right place. Before I continue, I’ll give the standard Fed disclaimer that the views I express are mine alone and do not necessarily reflect those of the Federal Open Market Committee or anyone else in the Federal Reserve System.

Has the Phillips Curve Changed, or Is it a Trick of the Data?

Throughout the paper, HMS use a reduced-form Phillips curve regression as a basis for their analysis. For my remarks, I simplify the specification and assume the inflation rate depends on the unemployment gap (and variants thereof), four lags of inflation, and a constant (relative to HMS, I have dropped the import price and inflation expectations terms).

Overall, the results for the core personal consumption expenditures (PCE) price index inflation using this simplified specification are quite similar to those reported in HMS. The full-sample (1961-2017) estimated coefficients using the core PCE price inflation rate are reported in the first column of the upper part of Table 1. The second column reports results corresponding to the “spline” specification of HMS, where positive values of the unemployment gap are added to the equation to capture asymmetry in the response of inflation to labor market tightness versus slack. The third and fourth columns of Table 1 report the corresponding estimation results for the subsample of 1961-1987, and the final two columns report the results for the subsample 1988-2017. Like HMS, the latter sample shows far less intrinsic persistence in inflation and a severe flattening of the Phillips curve relative to the full-sample results.

Interestingly, I find evidence in the early (pre-1988) sample that suggests that inflation was, if anything, more sensitive to the unemployment gap when unemployment was high, rather than low. Although these estimates are imprecise, this pattern is the opposite of the claim by HMS, which relies on full-sample estimates to draw conclusions. This also runs counter to HMS’s historical narrative about the 1960s and the dangers of a red-hot labor market. I will not dwell on this further, but it is a reminder that findings of nonlinearities in Phillips curves are often not robust.

The apparent breakdown in this simple price Phillips curve in the past 30 years reflects a number of structural changes in the U.S. economy. The Federal Reserve’s success in re-anchoring inflation expectations at a low level can explain the decline in inflation persistence seen in the data. However, he role of well-anchored expectations in flattening the Phillips curve is not obvious, and as HMS note, this flattening is not as clear in the wage inflation equations. This suggests other forces are at work.

Several usual suspects come to mind, including the effects of supply shocks, increased globalization of goods markets and supply chains, and changes in the market structure for consumer goods. For example, Alberto Cavallo has shown how Amazon and other online retailers have fundamentally changed price dynamics for consumer goods, with prices changing more rapidly and more affected by exchange rate changes. In today’s globalized and rapidly changing economy, standard reduced-form Phillips curve models that focus primarily on the demand-driven movements in inflation are less relevant. Other factors besides the state of the business cycle dominate price movements for a wide variety of goods.

CSI to the Rescue

In theory, one could try to modify the model to account of these factors, but for the present purpose, a more straightforward approach is to focus on prices for categories of consumer spending that are less susceptible to supply shocks, international trade, and changing market structure. This approach follows in the tradition of “core” measures of inflation that remove the categories that are particularly prone to supply shocks. A number of related measures have been developed along these lines, including work at both the New York and San Francisco Feds.

In my remarks I will use the “Cyclically Sensitive Inflation” measure, or CSI, developed by Jim Stock and Mark Watson.5By design, CSI includes the categories that are cyclically sensitive and less prone to measurement error or other non-cyclical drivers. In practice, this measure more heavily weights services with well-measured market-based prices and significantly down-weights goods. Figure 1 compares the four-quarter moving averages of CSI to that of core PCE price inflation, with the shaded regions indicating NBER-dated recessions.

Regression results using CSI display neither a flattening of the short-run Phillips curve nor signs of nonlinearities. The lower part of Table 1 reports the estimation results using CSI inflation. Starting with the linear specification, the full-sample and early-sample results are very similar to those using core PCE price inflation. This is not altogether surprising since the two series track each other closely during the first half of the sample. The big difference is in the later sub-sample, where the coefficient on the unemployment gap is not that much smaller than in the early sample, and larger than in the full-sample estimation. Moreover, there is little evidence of nonlinearity in the Phillips curve relationship in either the full or later samples. Evidently, both the flattening of the Phillips curve and evidence of nonlinearities depend on including goods and other categories that are primarily influenced by non-cyclical factors.

These results suggests that the Phillips curve is alive and kicking when inflation is measured using categories that are cyclically sensitive, rather than buffeted by supply and other shocks. Based on this analysis, the trade-offs between employment and inflation the Fed faces haven’t fundamentally changed.

That does not imply there have not been meaningful changes in inflation dynamics-inflation persistence has fallen significantly for the CSI as well. This means that transitory shocks no longer get embedded in inflation expectations, but instead have relatively short-lived effects on inflation. This is a very favorable development for the economy and monetary policy, which can safely “look through” transitory shocks.

Anchoring Inflation Expectations at the Target

This brings me to my second point of the importance of anchoring inflation expectations at the target level. As HMS correctly stress, policymakers cannot take for granted that inflation expectations will remain well anchored. They highlight the risk that very tight labor markets could eventually lead to a resurgence of inflation and unmoor expectations, as in the 1960s. I concur that we must remain vigilant regarding a sustained takeoff in inflation.

We must be equally vigilant that inflation expectations do not get anchored at too low a level. So far during this expansion, core and overall PCE inflation has averaged about 1.5 percent, well below the Fed’s 2 percent target. Taking a longer perspective, over the past 25 years, core and overall inflation have both averaged 1.8 percent.

This persistent undershoot of the Fed’s target risks undermining the 2 percent inflation anchor. In this regard, research by Ulrike Malmendier and Stefan Nagel is sobering. They find that inflation expectations are heavily influenced by the inflation experience in one’s own lifetime, which implies that decades of too low inflation can become embedded in expectations. Indeed, we have seen some worrying signs of a deterioration of measures of longer-run inflation expectations in recent years, as seen in Table 2.

Importantly, this sustained undershoot of the inflation target is likely to be a recurring dilemma for the Fed and central banks in Japan and Europe that have had similar experiences over the past decade. This problem of inflation running chronically below the target stems in part from the limited ability of central banks to offset economic downturns due to the lower bound on interest rates in a low-neutral-rate environment.

Implications for the Monetary Policy Framework

The risk of the inflation expectations anchor slipping toward shore calls for a reassessment of the dominant inflation targeting framework. A number of alternative frameworks and strategies have been proposed that hold the promise of better achieving the inflation goal and holding fast the inflation anchor. In this regard, I am very pleased that the Federal Reserve is undertaking a review of our policy framework this year, a topic that Federal Reserve Vice Chairman Clarida will discuss in his lunch remarks today.

In summary, the Phillips curve is alive and well. I wholeheartedly agree with the authors that we must not be complacent about inflation expectations becoming unmoored, whether at too high or too low level.