Summary: The Dollar Index, a gauge of the Greenback’s value against a basket of 5 major currencies, was up 0.17% to 99.132 (98.988). Trade tension rose just days before high-level talks between the world’s two largest economies. The Trump administration put visa restrictions on Chinese officials linked to the mass detention of Muslims in Xianjiang Province and announced it would blacklist 28 Chinese companies. Sterling, which has an 11.9% weight in the Dollar Index, slumped 0.57% to 1.2225 from 1.2295, finishing as worst-performing currency. Talks between Boris Johnson and Angela Merkel failed to find common ground on a possible solution to Brexit. The Dollar dipped against the haven-sought Yen to 107.10 (107.30). The Euro fell for the 3rd day in a row to 1.0955 from 1.0975, failing to clear 1.1000 yet again. AUD/USD was little changed at 0.6732. Fed Chair Jerome Powell reiterated that the US economy is facing some risks and acknowledged that Job growth is slowing. Powell said the Fed was contemplating the possibility of purchasing Treasury bills yet saying that this was not QE(?).

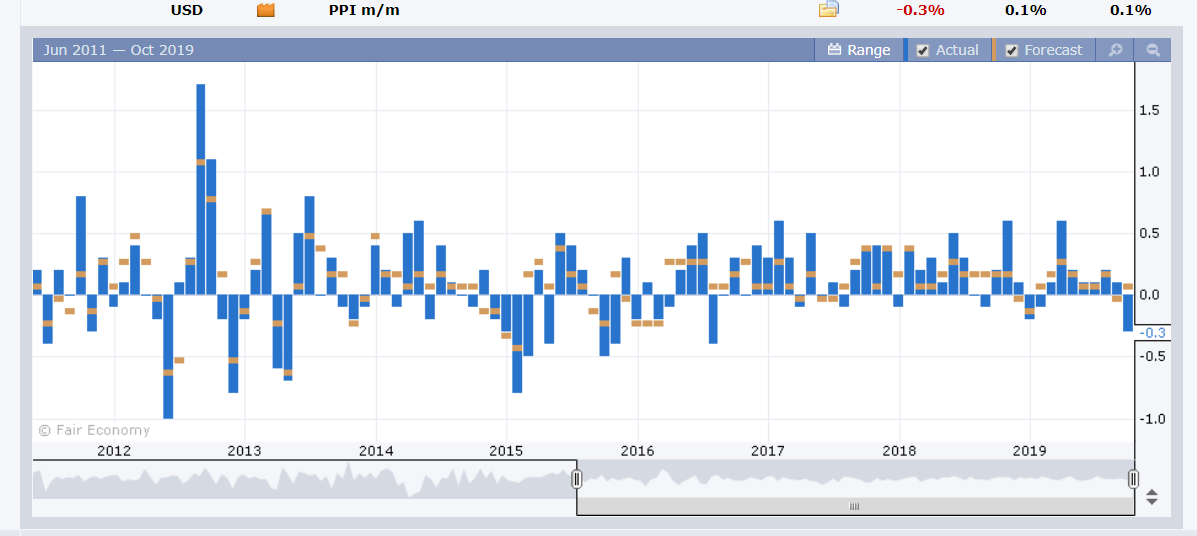

US bond yields ended lower after a report showed that Headline US Producer Prices unexpectedly fell in September to -0.3%, missing expectations of 0.2%, its lowest in almost 3 years. The weakness in producer inflation reflects the downturn in the US factory sector. Two-year US bond yields slumped 4 basis points to 1.42%. The benchmark 10-year US rate ended at 1.53% from 1.56%.

Wall Street stocks closed at their lows following the rise in trade tensions and weak PPI report. The DOW finished at 26,173 from 26,490. The S&P 500 was 1.5% lower to 2,893 from 2,943 yesterday.

China’s Caixin Services PMI dipped to 51.3, missing forecasts of 52.1. German Industrial Production outperformed, rising to 0.3% in September from August’s -0.6%. US September Core PPI (excluding food and energy) dropped to -0.3% from August’s 0.1%.

- EUR/USD – The Euro retreated 0.15% to 1.0955 at the New York close after trading to an overnight high at 1.0996. Despite better-than-forecast German Industrial Production data, rising global trade tensions boosted the US Dollar’s haven status and weighed on the shared currency.

- USD/JPY – The Dollar eased against the Yen to 107.10 from 107.30 weighed by lower US bond yields. The Yen’s haven status also buoyed the Japanese currency. Overnight low for the Dollar was at 109.806.

- GBP/USD – Sterling slumped to 1.2225 from 1.2295, down 0.58% after yet another attempt at a Brexit solution failed. This time it was a phone conversation between Boris Johnson and Angela Merkel. The two leaders were unable to find common ground about a possible solution to Brexit.

- AUD/USD – the Australian Dollar was little changed against the Greenback at 0.6732 despite the weaker than expected Chinese Services PMI report.

On the Lookout: The Dollar continues to garner safe-haven support on the tense outlook of the trade talks between China and the US. Markets will continue to be driven by these trade tensions.

Meantime US economic data continues to underperform. US bond yields have retreated to levels where we started off the week. Jerome Powell said that the Fed will soon start growing its balance sheet again. Although he said that this was not QE, its hard to think otherwise. This is negative, not positive for the US Dollar.

Today’s data calendar is light. Australia begins our day with its Westpac Consumer Sentiment Index. Japanese Preliminary Machine Tool Orders follow. The Eurogroup meetings in Brussels which are attended by the ECB President and Finance Ministers from the Euro area countries discuss a range of financial issues and could be market moving. US JOLT Job Openings finish off the day’s data releases. Fed Chair Jerome Powell is due to participate in a panel discussion at a Fed function in Kansas City. The release of the FOMC’s latest meeting minutes is the day’s big event (4 am Sydney time tomorrow).

Trading Perspective: The Dollar Index (USD/DXY) managed a modest gain of 0.17% to 99.132. The result is due to a fall in Sterling and the Euro (which together carry a 69.5% weight in the USD/DXY). Otherwise the Dollar was mixed against other rivals. USD/JPY was a touch lower, while the Aussie and Kiwi were little changed. Against Emerging Market currencies, the Dollar saw mild gains.

US data releases have disappointed. The unexpected fall in US Producer Prices puts further pressure on the Fed to trim rates a 3rd time this year when they meet later this month. Jerome Powell said that the Fed will start expanding its balance sheet soon. While he said that this is not QE, its hard to think otherwise. US bond yields are headed down. Market positioning remains long of Dollar bets. None of these factors are Dollar supportive. The Greenback’s safe-haven status is treading on thin ice.

- USD/DXY – The Dollar Index gained 0.17% to close in New York at 99.132 (98.988 yesterday). Overnight high traded was at 99.249. USD/DXY has continued to grind higher after trading to 99.67 on October 2. Overnight low for the Dollar Index was 98.848. Immediate resistance for today lies at 99.25 followed by 99.50. Immediate support can be found at 98.90 and 98.60. The FOMC’s latest meeting minutes will be followed by the US September CPI report. Last night’s drop in US producer prices may be a preview of a soft CPI. Look for a likely trading range of 98.775-99.25. Prefer to sell rallies.

- EUR/USD – The Euro lost ground against the US Dollar despite better-than-forecast German Industrial Production data. Brexit woes have begun to weigh on the Euro as well as the Pound. Meantime, net short Euro bets increased to -EUR 65,978 contracts from the previous week’s -EUR 60,722. EUR/USD has immediate support at 1.0940 (overnight low 1.09411) followed by 1.0910. Immediate resistance can be found at 1.0980 followed by 1.1000. Look to trade a likely range today of 1.0940-1.0990. Prefer to buy dips.

- GBP/USD – Sterling slumped 0.57% to 1.2225, finishing as worst performing currency as Brexit talks collapsed. A blame game between the EU and UK has ensued. This will keep the Pound pressurized. Most analysts are expecting an extension followed by another UK election. Which is hard to predict. GBP/USD has immediate support at 1.2190 (overnight low 1.2195). The next support level lies at 1.2165. Immediate resistance can be found at 1.2250 and 1.2280. Prepare for a volatile ride on the Pound and trade a range between 1.2180 and 1.2280. In the long run, an overall weaker US Dollar will support Sterling.

Happy trading all.