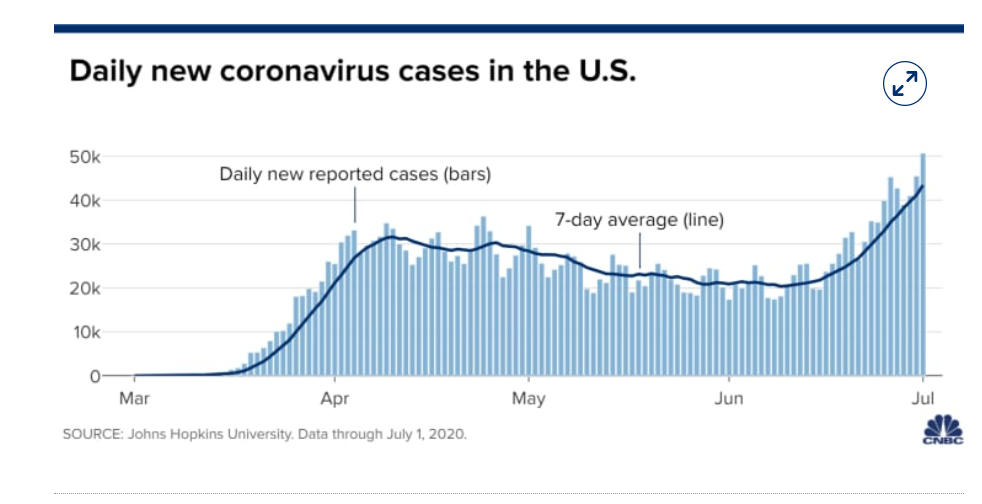

Summary: A strong Payrolls report with upward revisions to last month’s data was clouded by a report that the US had its largest single-day increase in new Covid-19 cases yesterday. A total of approximately 50,600 additional Covid-19 cases were reported in the U.S. yesterday. The Labour Department reported that the US economy created 4.8 million Jobs in June, much stronger than median forecasts of 3.037 million. May’s Employment gain was revised up to 2.699 million from 2.509 million. The Unemployment Rate in June dropped to 11.1%, bettering forecasts of 12.4% and improving from the previous month’s 13.3%. The Dollar fell immediately following the release of the Payrolls report, before grinding its way back. Wall Street stocks pared gains as speculation grew that rising coronavirus cases could derail an economic rebound. The Dollar Index (USD/DXY), a favourite gauge of the Greenback’s value against a basket of 6 major currencies, finished with a modest gain of 0.02% to 97.220 from 97.143 yesterday. The Euro traded 0.11% lower to 1.1240 (1.1253 yesterday) after peaking at 1.1303. Sterling eased to 1.2465 in late New York trade from 1.2478 yesterday and an overnight high at 1.2530. The Australian Dollar was modestly higher at 0.6925 (0.6916). Against the Japanese Yen the Dollar was up 0.11% to 107.50 from 107.45. The USD/CAD pair slipped to 1.3570 (1.3585). New Zealand’s Kiwi was best the best performer among the majors, climbing to 0.6510 from 0.6478, a gain of 0.4%. The Greenback was mixed against the Asian and EM currencies. USD/THB (Dollar vs Thai Baht) last traded at 31.10 from 31.00 while USD/ZAR (Dollar vs South African Rand) slipped 0.62% to 16.98 from 17.05 yesterday. Wall Street stocks pared gains at the close into the long holiday weekend that starts today. The Dow finished at 25,855 (25,695) up 0.66%. The S&P 500 rose to 3,135 (3,115 yesterday), a gain of 0.7%. Bond yields were little changed.

The key US 10-year Treasury yielded 0.67% (0.66% yesterday). Germany’s 10-year Bund yield closed at -0.43% from -0.40%. Japan’s 10-year JGB rate was at 0.02% from 0.03% yesterday.

Australia’s Trade Surplus in June shrank to 8.03 billion from 8.8 billion, missing forecasts of 9.0 billion. The Eurozone’s PPI dipped to -0.6%, lower than expectations of -0.4%. The Eurozone Unemployment rate dipped to 7.4% beating forecasts at 7.6%. Canada’s Trade Deficit improved to

-CAD 0.7 billion from -CAD 3.3 billion, beating forecasts at -CAD 3.0 billion. US Wages (Average Hourly Earnings) in June fell to -1.2%, missing expectations at -0.8% and a previous -1.0%. Unemployment Claims in the US for the latest week rose to 1.427 million from 1.480 million, missing forecasts of 1.350 million. US Factory Orders rose to 8.0% in June from May’s -13.0%, but lower than forecasts of 8.6%.

On the Lookout: With the US markets out today in observance of the 4th of July Independence Day holiday, trading should be quiet. But we cannot discount some volatility prior to the US time here in Asia and Europe if we see a rapid rise in global coronavirus infections. Risk appetite is vulnerable.

Economic data released today kick off with Australia’s AIG and Commonwealth Bank Services PMI’s (June). Australia also releases its May Retail Sales report. Japan’s Jibun Bank Services PMI data comes next before China’s Caixin Services PMI (June). European data kick off with Euro area (Spain, Italy, France) and the Eurozone report on their respective Services PMI’s. Germany releases its June Final Manufacturing PMI. Britain rounds up the day’s report with its Final Services PMI.

Today’s main event is a speech from ECB Governor Christine Lagarde at an ECB online conference on growth models (8.40 pm Sydney time).

Trading Perspective: The US Dollar ended little changed against its rivals, higher versus the Euro, Sterling, and a few Asian and Emerging Market currencies such as the Thai Baht and South African Rand. The Greenback fell modestly against the New Zealand, Australian and Canadian Dollars. The strong US Jobs report was clouded by the rising coronavirus cases in the country. Equity markets pared their gains. Risk will be driven ultimately by the Covid-19 outbreak with the spotlight on the number of deaths from the rapid rise in infections, as well as the response from the US government and Federal Reserve. Meantime we can expect the currencies to consolidate with the US Dollar maintaining its overall bid.

EUR/USD – Struggling to Keep Gains, Shake-Out of Stale Longs Next

The Euro failed to take advantage of the US Dollar’s initial weakness, trading to an overnight high at 1.13028 before falling to a low at 1.1223, closing in New York at 1.1240. Euro area economic data released yesterday were mixed. Spain saw its number of unemployed people climb to 5,100, widely missing forecasts for drop of 113,000. The overall Eurozone Unemployment rate fell to 7.4 %, beating forecasts at 7.6%.

Speculators have yet to correct their net Euro longs which are at their biggest total since early 2018. Until at least 30% of these longs are cleared, the Euro will struggle to see any meaningful rallies from current levels. The longer we stay in this range, the more chances there are for a break lower.

The consolidation in the shared currency should continue with immediate resistance found at 1.1290 followed by 1.1320. Immediate support can be found at 1.1220 followed by 1.1170. Look for consolidation within a likely range today of 1.1180-1.1280. Prefer to sell into any rallies.

GBP/USD – Drop from One-Week Peak and Brexit Fears Weigh

Sterling rallied to a fresh-week high at 1.2530 before slipping back to finish at 1.2465 in New York, modestly lower from 1.2478 yesterday. Like the Euro, the British Pound was unable to take advantage of the overall weaker US Dollar. The British Prime Minister Boris Johnson has set-out his post-coronavirus recovery plan.

Meantime uncertainty over Brexit continues to weigh on the Pound. Just about halfway through the transition period there has not been much progress from the EU and UK in their negotiations. A top meeting between officials from the European Union and the United Kingdom scheduled for tomorrow has been cancelled. A Financial Times article reported that almost three quarters of UK manufacturers are preparing to cut jobs in the next 6 months. Which will add pressure on the government for more economic stimulus to protect employment.

GBP/USD has immediate support at 1.2460 followed by 1.2430 and 1.2370. Immediate resistance can be found at 1.2500 followed by 1.2530. Look for consolidation today in a likely range of 1.2400-1.2500. Prefer to sell into any rallies to 1.2500.

AUD/USD – Recent Rally in Jeopardy from Renewed Spike in Australian Infections

The Australian Dollar closed little changed at 0.6925 from 0.6916 as risk appetite remained in the balance. The strong US payrolls report saw equities hang on to their gains as a rapid rise in coronavirus cases in America and other new hotspots clouded the near-term outlook. The Australian Business Insider reported that Victoria’s Covid-19 outbreak has spread to other states and territories with new cases reported in Sydney and Darwin. Which were traced to travellers returning from quarantine in Melbourne. The report also quoted epidemiologists saying that it was “highly likely” that more Melbourne suburbs will be forced back into lockdown.

The trade conflict between Australia and China, and the US and China is also key to the Aussie Battler’s fortunes. FX Street reported this morning that “China announced its readiness to levy 12% tariffs on Australian beef.” Today sees Australia’s CBA Services PMI’s, China’s Caixin PMI’s and Australian Retail Sales (May).

AUD/USD traded to an overnight high at 0.69522. Immediate resistance today can be found at 0.6950 followed by 0.6980 and then 0.7010. Immediate support lies at 0.6900 followed by 0.6860. The next support level is found at 0.6830. The recent rally in the Aussie is in jeopardy. Look to sell rallies in a likely range today of 0.6840-0.6940.