1 Introduction

1 Introduction

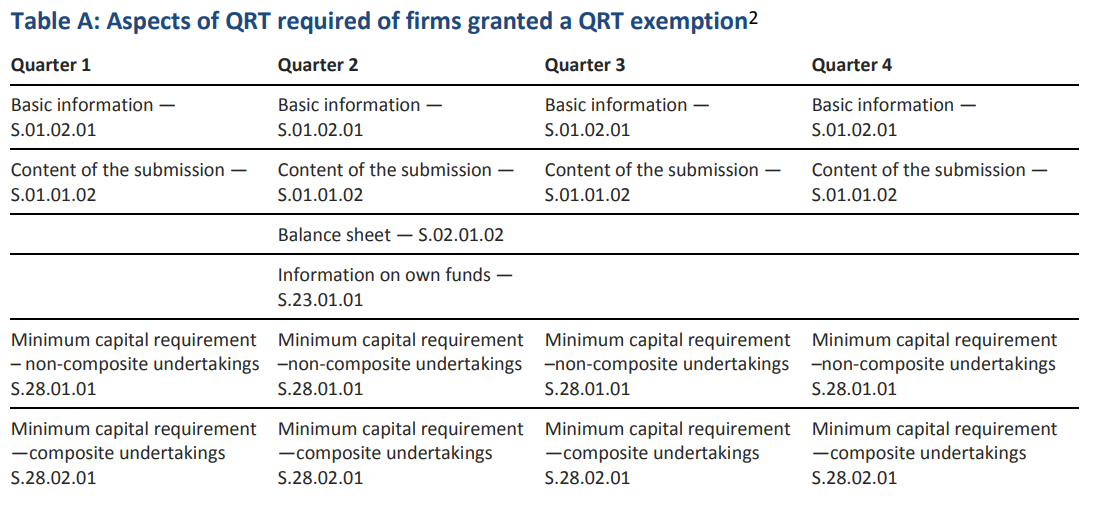

Update: On 6 July 2016, template reference numbers in Table A were updated to reflect those published in the Commission Implementing Regulation (EU) 2015/2450 of 2 December 2015. There are no changes to the content of Table A.

1.1 This supervisory statement is addressed to all UK Solvency II firms and to Lloyd’s. It should be read alongside all relevant EU legislation, and the Reporting Part of the Prudential Regulation Authority (PRA) Rulebook. It clarifies the PRA’s implementation of the Solvency II regime’s requirements in relation to supervisory reporting.

1.2 In particular, this statement:

- Lists the reporting requirements that are subject to this exemption; and

- Explains the steps a firm must take to apply for the exemption, and how the decision will

be communicated to the firm.

1.3 This statement expands on the PRA’s general approach as set out in its insurance approach document. By clearly and consistently explaining its expectations of firms in relation to the particular areas addressed, the PRA seeks to advance its statutory objectives of ensuring the safety and soundness of the firms it regulates, and contributing to securing an appropriate degree of protection for policyholders. The PRA has considered matters to which it is required to have regard, and it considers that this statement is compatible with the Regulatory Principles and relevant provisions of the Legislative and Regulatory Reform Act 2006. This statement is not expected to have any direct or indirect discriminatory impact under existing UK law.

1.4 This statement has been subject to public consultation and reflects the feedback that was received by the PRA.

2 Solvency II reporting

2.1 The submission of national specific templates is in addition to those set out in the Solvency II Regulations, and as referred to in Chapter 2 in the Reporting Part of the PRA Rulebook.

2.2 A firm may disclose on a voluntary basis any information or explanation related to its solvency and financial condition which is not already required to be disclosed in accordance with Reporting 3.3–3.8, 4, 5.1, 5.3, 5.4 and 5.5.

3 Scope of quarterly reporting exemption

3.1 The PRA considers that some firms may be eligible for the exemption set out in Article 35(6) of the Solvency II Directive. Specifically, the PRA considers that firms designated as category four and five by the PRA, whether solo or part of a group, may meet the requirements of exemption from quarterly reporting. While the PRA expects that all other firms should report on a quarterly basis, on an exceptional basis it may also consider exemptions for firms not in category four or five on a case-by-case basis. These cases could include small firms that are part of groups where the group is designated as category one, two or three by the PRA.

3.2 The reporting requirements are set out in the Solvency II Regulations and in Reporting 2.1–2.14 in the Reporting Part of the PRA Rulebook. Article 35(6) of the Solvency II Directive states that supervisory authorities may limit reporting with a frequency shorter than one year where ‘submission of that information would be overly burdensome in relation to the nature, scale and complexity of the risks inherent in the business of the undertaking’. This exemption is only available to firms that cumulatively represent less than 20% of a Member State’s life and nonlife insurance and reinsurance market shares respectively.1 On this basis, the PRA has determined that firms designated by the PRA as category four and five, both solo and part of a group, may be eligible for the exemption from quarterly reporting. Other firms may also, exceptionally, be eligible.

3.3 Firms that are granted the solo-level exemption will only have to submit the quarterly reporting templates (QRT) identified in Table A.

3.4 As shown in the table, the exemption from quarterly reporting at the solo level does not apply to:

- Minimum capital requirement (MCR) quarterly reporting, as this is a separate requirement

set out in Article 129(4) of the Solvency II Directive; - Second quarter reporting of own funds and balance sheet templates; and

- The basic information and content of submission templates.

The latter templates will help the PRA understand basic information about each submission and facilitate validation checks.

3.5 Article 254 of the Solvency II Directive states that the group supervisor may limit reporting with a frequency shorter than a year at the level of the group when all (re)insurance firms within the group benefit from the exemption from quarterly reporting at the solo level. The PRA has determined that groups subject to group supervision by the PRA which meet this criteria set out in Article 254 may be eligible for this exemption from quarterly reporting at the level of the group. Groups that are granted this exemption may not be required to submit any group level quarterly reporting templates.

3.6 The PRA may, where necessary to meet its objectives, make ad hoc requests for quarterly reporting from firms holding an exemption. Firms granted an exemption from quarterly reporting should therefore maintain their ability to respond to such ad hoc requests in a timely manner.

Application for Solvency II quarterly reporting exemptions

3.7 Firms that believe they are eligible for exemptions to quarterly reporting should discuss this exemption with their supervisor prior to submitting a formal application. Similarly, groups subject to group supervision by the PRA that believe they are eligible for exemptions to quarterly reporting at the level of the group should discuss this exemption with their group supervisor prior to submitting a formal application. An application should then be submitted by completing the relevant questionnaire published on the Bank of England website in 2015 Q1. Any applications for quarterly reporting exemptions, either at solo or group level, intended to apply for the 2016 reporting year should be submitted by Tuesday 1 September 2015. Given that the group level reporting exemption may only be granted once all solo firms within a group have been granted the solo level exemption, the timing of decisions on the two types of applications may differ.

3.8 Once the PRA has assessed an application it will inform the firm of its decision. Where an application is approved, the firm will be sent a Direction letter that sets out the duration of the exemption. The PRA expects firms to have a contingency plan in place in case their application is rejected and maintain contingency plans in case the exemption should expire without being extended. The PRA expects firms to notify their supervisory contact as soon as they believe there are any circumstances which may impact their suitability to hold an exemption.

4 Cost benefit analysis

4.1 The PRA regards the costs are proportionate to the benefits as the impact on policyholder protection is likely to be minimal. The PRA would still receive sufficient information to enable a proportionate level of supervision but with lower administrative compliance costs for exempted firms.

1 Introduction

1 Introduction