Positive Brexit headlines showed that Theresa May managed to get legal assurances from EU on the on Irish backstop boosting sentiment in Asian trading. In Japan, the Nikkei225 main index added 1.79 percent to 21,503 and the Hang Seng benchmark in Hong Kong gained 1.46 percent at 28,920. The Shanghai Composite rose 1.10 percent at 3,060, while stocks in Australia traded in positive territory until the final minutes of the session. The ASX 200 finished 5 points lower or 0.1% to 6,174.

In commodities markets, the Crude oil is trading 0.5 percent higher at $57.08/barrel while Brent oil is 0.4 percent higher at $66.84/barrel. Gold trading started softly at $1295 after hitting the daily high at $1297 below the major resistance at $1300. The precious metal price may find support at $1280 ahead of testing the 100-day simple moving average down to $1265.

On the Lookout: Australia’s ANZ-Roy Morgan Consumer Confidence nosedived to 109.5, a fall of 4.6% from the previous week’s reading.

During the Wall Street session, economic calendar includes the US Feb CPI report at 12:30GMT and the Meaningful Parliamentary vote on the UK PM May’s Brexit deal due later at 19:00GMT. Also, the US API crude stockpiles data that will be released at 21:30GMT.

In Central Banks events we have the speech by the FOMC member Brainard. Speech by Reserve Bank Deputy Governor Guy Debelle. On Thursday, the BOJ is expected to keep rates unchanged. Kuroda speaks as well and focus will be on whether the signals the potential for more easing due to lower growth and inflation expectations.

Trading Perspective: The Aussie dollar is trading higher the last hours reaching the 0.7075 zone against the downbeat NAB Australian business survey. The Kiwi, also advanced to daily tops at 0.6845, having benefitted from upbeat stocks and oil prices. The US dollar index breached the lower band of the recent trading range between 97 and 97.70 as investors sentiment improves.

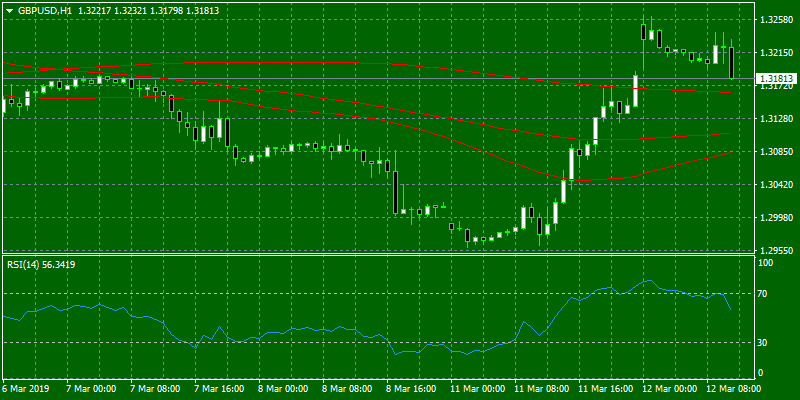

GBPUSD: The good news from Brexit frontier helped sterling to break above all the major short term resistances reaching up to 1.3265 in the Asian session. Traders are closely watching the developments around Brexit votes and rumors, and we can see huge moves in the pair.

It will be a busy Brexit Calendar this week, here are the main events

- 12th March – Next “meaningful vote” on Brexit in UK Parliament

- 13th March – Parliamentary vote on opposing “no deal” exit option

- 14th March – Parliamentary vote on extending negotiations/Article 50

- 21st – 22nd March – EU Leaders’ Summit

- 29th March – Article 50 end date

- 9th May – European Council (heads of state) meeting

- 18th – 23rd May – EU Parliamentary elections

- 20th – 21st June EU Leaders’ Summit

The technical picture is bullish for GBPUSD, and an attempt to 1.33 area looks possible. On the downside, major support will be found at 1.2990 where the 50 and 200-day moving averages are crossing.

Open interest in GBP futures markets rose by nearly 2.6K contracts on Monday from the previous session, reverting seven consecutive daily drops according to preliminary figures from CME Group. Volume rose for the third session in a row, this time by nearly 86K contracts, the largest daily build so far this year.

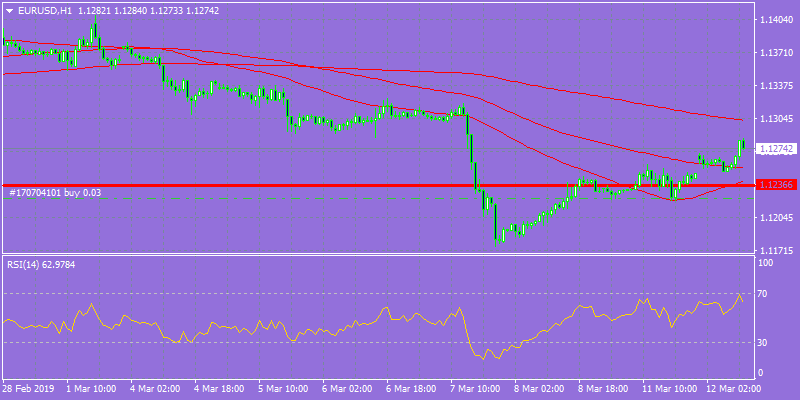

EURUSD started the day higher at 1.1280 area in an attempt to regain some of the previous week losses. The pair is trading in the middle of the range between the 100 and 200-day moving averages and the RSI has reached overbought level.

In Euro future markets, traders added around 21.2K contracts to their open interest positions at the beginning of the week from Friday’s final 538,702 contracts, reverting the previous drop. In the same direction, volume increased by around 46.4K contracts.

USDJPY is consolidating in mid 111 area searching for the next move that might start after tomorrow’s speech from BoJ’s Kuroda.

In JPY futures markets, open interest increased by almost 5.8K contracts at the beginning of the week from Friday’s 195,906 contracts. On the other hand, volume shrunk for the first time after three consecutive builds, this time by around 15.6K contracts.