Summary: The first quarter of 2020 ended with the Covid-19 outbreak giving no break to markets as the number of cases in the US, Italy and Spain grew. The Dollar Index (USD/DXY), a measure of the Greenback’s value against 6 major currencies ended modestly higher at 99.08, from 99.03 yesterday. For the quarter, the US Dollar was up 2.8%. In another highly volatile session, the Euro eased to 1.1025 from 1.1043, after dropping to an overnight low at 1.0927. The Aussie rose to 0.62138, a 2-week high before easing to 0.6143, belying its wild 143 pip range. Against the Yen, the Dollar fell to 107.56 from 107.86 after hitting an overnight high at 108.73. Japan’s fiscal year-end yesterday saw demand for the Japanese currency as corporates and asset managers adjusted their portfolio’s. Sterling ended little changed at 1.2416 from 1.2406 yesterday. The US Dollar slumped 0.77% against the Canadian Loonie to 1.4095 from 1.4147 as Oil prices posted small gains. Emerging Market currencies were mostly higher against the US Dollar following recent steep losses. Reuters reported that the “Federal Reserve moved to expand the ability of dozens of foreign central banks to access Dollars during the coronavirus crisis.” This will help pare Dollar gains with more supply from the US central bank for short term foreign company demand. USD/SGD eased to 1.4215 from 1.4235. Against the Thai Baht, the Dollar rose to 32.75, up 0.45% from 32.55 yesterday.

Wall Street stocks closed the quarter officially in the red. The Dow finished at 2% lower to 21,925. The S&P 500 lost 1.9% to 2,590. US bond yields were mixed. Two-year treasury yields climbed to 0.25% from 0.23% while the key 10-year rate dipped to 0.66% from 0.70%. Other global bond yields were mixed.

China’s Manufacturing PMI in March rose to 52 from 35.7, beating forecasts at 44.9. While the data showed improvement, markets were sceptical this could continue. China’s official Caixin Manufacturing PMI data is released today. The US Conference Board Consumer Confidence Index fell in March to 120.00 from an upwardly adjusted 132.6 in February although it beat forecasts at 115.1.

On the Lookout: FX carried a slight risk-off tone heading into the first day of Q2 2020 with the coronavirus crisis ever-present. Meantime the Fed and global central banks have continued to throw everything at the Covid-19 as economists expect global growth to be punished in the second quarter. Today’s spotlight is on the global Manufacturing PMI’s and US ADP Private Sector Jobs change. Australia starts off with the AIG and CBA Manufacturing PMI reports. Japan’s Tankan Manufacturing and Non-manufacturing indexes follow. China rounds up Asia’s reports with its official Caixin Manufacturing PMI. European data start off with Germany’s Retail Sales followed by Swiss, Euro-area, Eurozone and UK Manufacturing PMI’s. The Eurozone also releases its Unemployment rate. North American reports start off with Canada’s Manufacturing PMI. The US ISM Manufacturing PMI, ADP Private Non-Farms Employment Change, Construction Spending and Wards Total Vehicle Sales round up the day’s report. Huge in terms of first-tier data.

Trading Perspective: The ever-present coronavirus crisis will continue to dominate FX and all financial markets. While the US Dollar should see further short-term support, trading will continue to highly volatile. Sean Lee, founder and CEO of FXWW, a firm that sources FX talent from the retail market, observed that the discretionary traders, those with institutional experience have returned the best results in the past 8 weeks. Volatility can be your best friend if discretion is used.

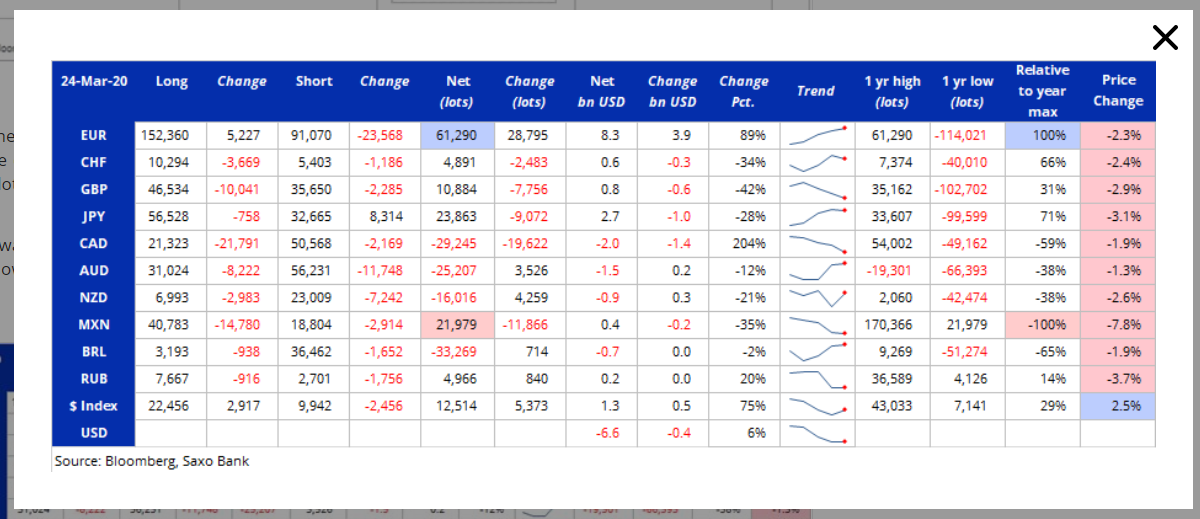

The latest Commitment of Traders CFTC report saw net speculative USD shorts climb to a total of USD 6.6 billion in the week ended 24 March. Most of the build was due to strong buying in the Euro. In the JPY and CAD the USD was bought. We look at the individual currencies in their respective reports.

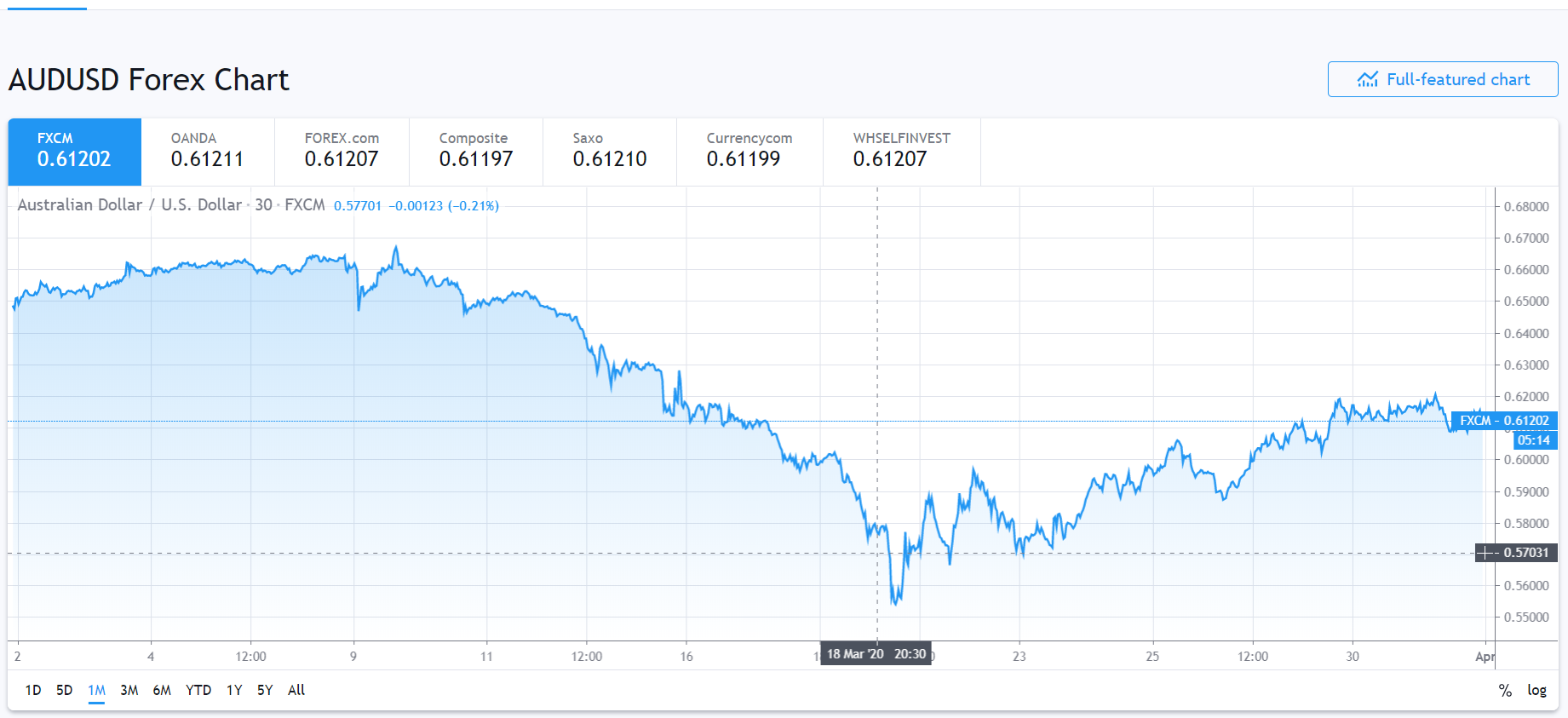

AUD/USD – Stuck Near Upper End of Recent Trading Range, USD to Dictate

The Aussie eased off two-week and overnight highs at 0.62138, falling to 0.60706 in choppy trade to finish 0.25% lower in late New York to 0.6145. It was a case of risk-off against a slightly weaker US Dollar with the Aussie trying to find its way.

Traders viewed the upbeat March Chinese Manufacturing and Non-manufacturing PMI released yesterday with scepticism. Today, traders will focus on China’s official Caixin Manufacturing PMI, also forecast to improve. Australia’s AIG and Commonwealth Bank PMI’s are also due out as well as that of the US later today. At the end of the day, US Dollar will dictate where the Aussie goes.

The best way to approach the Aussie is to trade the recent range with discretion. The immediate resistance at 0.6200/20 is strong and a clean break of that could see 0.6250, 0.6280 and 0.6330. Immediate support lies at 0.6100 followed by 0.6070. A break of 0.6070 could see 0.6000/20 tested. Much depends on the upcoming data and the latest coronavirus reports. Be flexible and look to trade a similar 0.6070-0.6220 range. Prefer to be short near 0.6200 on the day.

EUR/USD – Weighed by Spec Longs, Struggling Through 1.1150-1.1200

The Euro had a highly choppy trading session slipping to an overnight low at 1.0927 from its opening at 1.1045 after failing to break above 1.10527 highs. While the Euro bounced back and held above 1.1000, the shared currency is on shaky ground. Another downside attempt cannot be ruled out. Look for further consolidation in the Euro.

The latest Covid-19 update saw total cases in Italy and Spain continue to climb although they have started to level off. Spanish authorities see the outbreak as peaking. The total deaths in each country outnumber those in the US so far. Today sees the release of Euro area (Germany, France, Italy and Spain) as well as Eurozone Manufacturing PMI’s. This will show just how far the outbreak has weighed on the Euro area and Eurozone economies.

EUR/USD has immediate support at 1.1000 followed by 1.0970 and 1.0930. A break below 1.0930 could see us back to 1.0870. Immediate resistance can be found at 1.1055 followed by 1.1085. Look to trade a likely range today of 1.0930-1.1070. Prefer to sell rallies near 1.1050, we could trade lower in the short term before up again. Keep in mind that net speculative Euro long bets increased to +EUR 61,290 contracts from the previous week’s +32,495. That’s hefty.

USD/CAD – Expect Another Wild Ride, 1.4000 To Hold

The Canadian Dollar went looney, plunging to 1.40694 lows overnight from an overnight high at 1.43492 before settling to 1.4080. In early Sydney, USD/CAD dropped sharply to 1.4011 before bouncing back to its current level of 1.4080. What a wild ride, what a Loonie!

The Oil sensitive Canadian Dollar gained versus the US Dollar as Oil prices stabilised and the Dollar Index dipped. However, the USD/CAD will find it tough to break through the 1.4000 psychological level. Global growth and oil prices will remain weak. Technically, expect the 1.4000 level to hold unless we see extreme weakness in the US Dollar.

For now, the USD/CAD looks likely to trade in a band between 1.40 and 1.4300. Immediate support lies at 1.4030 and 1.4000. Immediate resistance can be found at 1.4130 followed by 1.4200. The latest Commitment of Traders/CFTC report for the week ended 24 March saw net speculative Canadian Dollar shorts increased to -CAD 29,245 from -CAD 9,623. This should keep USD/CAD topside to 1.43-1.45. Look to trade a likely 1.4030-1.4230 range today. Prefer to buy dips down at current levels.