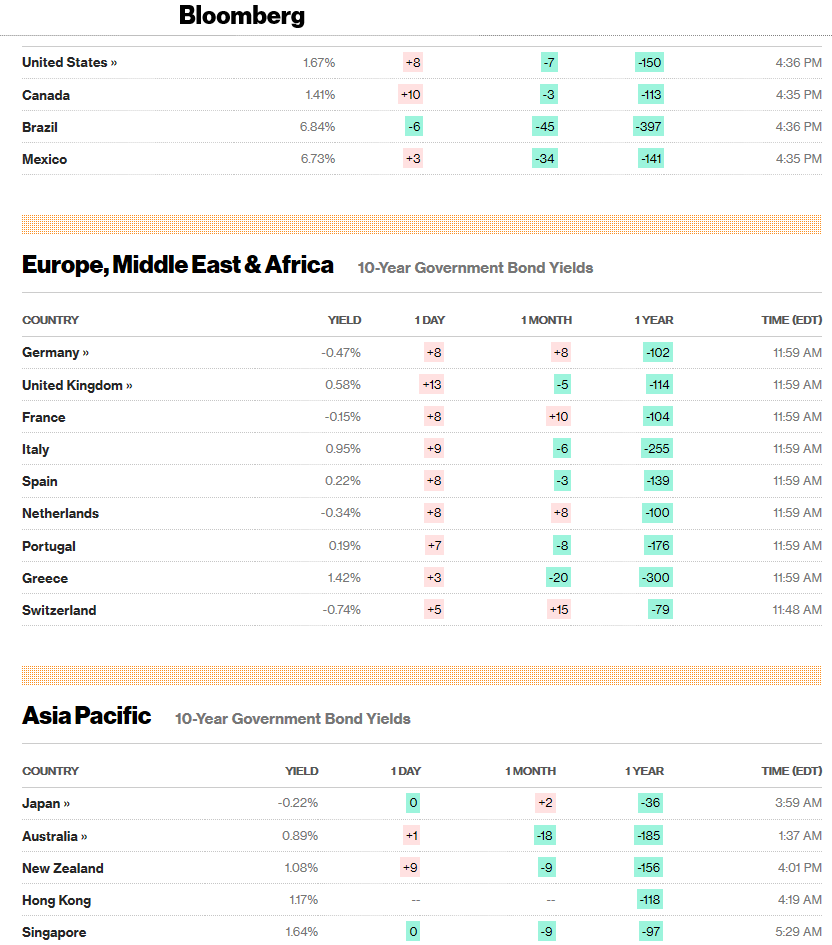

Summary: The British Pound soared 2% (1.2450) on positive comments from the leaders of the UK and Republic of Ireland on Brexit. Meantime, the Dollar Index fell 0.4% to 98.715, its biggest one-day drop since September 4 as high-level trade negotiations between Beijing and Washington were underway. President Trump said trade talks were going well as the first day’s discussions were wrapping up. Prospects for a partial deal between the US and China fuelled risk appetite. The Australian Dollar bounced back to 0.6762, up 0.65% leading trade-oriented currencies higher. Short covering lifted the Euro to a high at 1.10335 before easing to settle at 1.100, again of 0.22%. The risk-on stance boosted USD/JPY to close at 107.95 from 107.50 yesterday. Against the offshore Chinese Yuan and EM currencies, the Dollar was broadly lower. USD/CNH eased 0.3% to 7.1150 (7.1420). Global bond yields jumped as geopolitical fears eased on developments of both sides of the Atlantic. The 10-year US bond yield was up 7 basis points to 1.66%. Germany’s 10-year Bund rate rose to -0.47% from -0.55%. UK ten-year gilt yields lifted 12 basis points to 0.58% (0.46%).

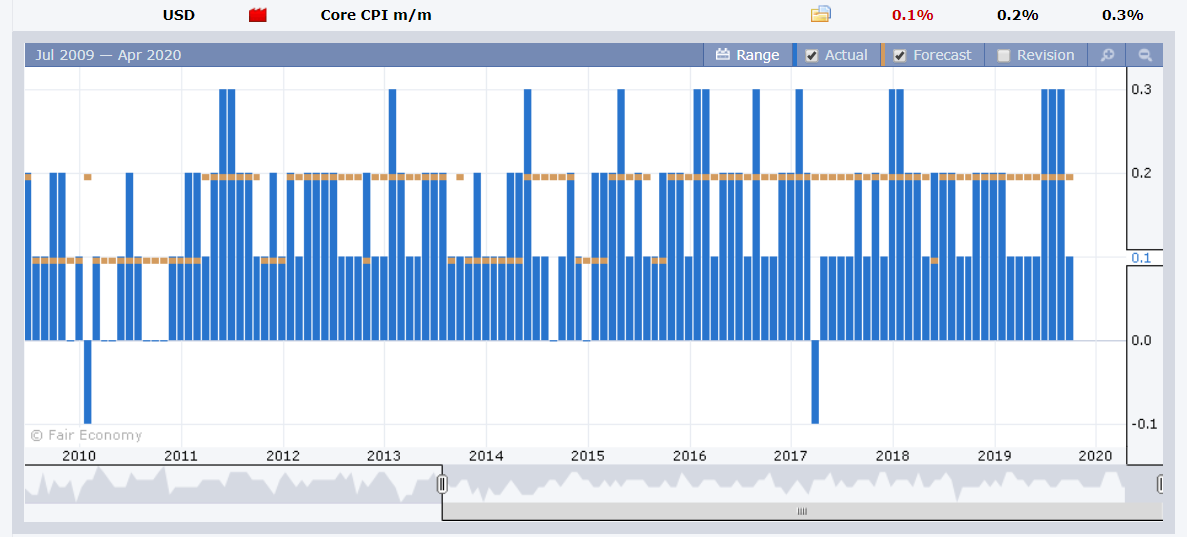

Data releases yesterday saw US inflation ease. US September Headline CPI retreated to 0.0% from 0.1% in August. Core CPI dipped to 0.1% from 0.3%. US Weekly Jobless Claims unexpectedly fell to 210,000 against median forecasts of 215,000. UK and Euro area data were mixed.

Equities rallied as investors focussed on trade talks. The DOW lifted to 26,505, up 0.56% (26,340) while the S&P 500 gained 0.69% to 2,940 (2,920).

- GBP/USD – Sterling traded to an overnight and 16 day high at 1.24695 before easing to 1.2450 in New York. Irish leaders said that there is a pathway to a possible Brexit deal following a meeting between UK PM Boris Johnson and his Republic of Ireland counterpart Leo Varadkar. The meeting lasted for over three hours and discussions were described as “detailed and constructive.” Short covering in the Pound did the rest.

- EUR/USD – The shared currency rallied on improved geopolitical sentiment and broad-based US Dollar weakness. Germany’s 10-year bond yields spiked 8 basis points which boosted the Euro to an overnight and near 3-week high at 1.10335, easing to settle at 1.1007 at the close.

- USD/JPY – Risk-on, Dollar-Yen up. USD/JPY traded to 107.973 before settling currently at 107.87. Optimism on the US-China trade talks and higher US bond yields lifted the Dollar higher against the Yen. Japan’s 10-year JGB yield was unchanged at -0.22%.

- AUD/USD – the trade oriented Australian Dollar resumed it’s climb on the optimistic trade outlook and easing geopolitical tensions. AUD/USD rallied to 0.67744 before settling at 0.6762 in New York.

On the Lookout: Asian markets will determine whether the optimism surrounding trade talks and Brexit can be sustained. Traders will keep their eyes on the latest media releases as clues to the next FX moves. US data released last night saw a soft inflation report which supported expectations that the Fed will trim rates this month for the third time this year. While the weekly Unemployment Claims unexpectedly fell, Job growth remains slow.

Today’s data calendar is light. New Zealand’s Business NZ Manufacturing Index, just released, matched forecasts at 48.4 Japan reports on its M2 Annual Money Stock. Germany releases its Final CPI report. The Eurozone ECOFIN Meetings in Brussels are underway today (a meeting on Euro area economic policies attended by Eurozone Finance ministers). Canadian Employment Change and Unemployment Rate (September) follow. US University of Michigan Consumer Sentiment and Inflation Expectations round up the day’s reports.

Trading Perspective: US Dollar is on the defensive. The jump in US bond yields were matched, if not bested by its Rivals. Eurozone bond yields jumped to 3-week highs on the improved risk sentiment due to optimism on Brexit and US-China trade talks. Markets also sense that the ECB may have run its course on monetary policy easing for now. Ten-year Italian bond yields climbed 10 basis points to 1.07%. The Greenback’s yield differential is narrowing and will continue to do so.

Market positioning remains long of US Dollar bets and short of currencies. The latest Commitment of Traders/CFTC report saw speculators short of Euro, Sterling, Aussie, and Kiwi bets. Against the Yen, speculators trimmed their JPY long bets. Much of yesterday’s move higher in the currencies was the result of short covering. We can expect more of the same ahead if trade talks go well.

- EUR/USD – The Euro closed above 1.1000 for the first time since September 25, but only just (1.1007). The rise in Eurozone bond yields and narrowing differentials with US rates will keep the Euro supported. Much depends on how Brexit and China-US trade talks progress from here. EUR/USD traded to an overnight high at 1.10335. Immediate resistance can be found at 1.1040 followed by 1.1080. Immediate support lies at 1.0990 and 1.0960. Speculators (latest COT report for the week ended 01 Oct) increased their short Euro bets to -EUR 65,978 contracts from -EUR 60,722. Look for a likely trading range today of 1.0985-1.1065. Look to buy those dips.

- GBP/USD – The British Pound soared to finish at 1.2450, up 2% and was best performing currency. Speculative GBP short bets ran for the exit on the positive comments following the meeting between the leaders of the UK and Republic of Ireland. The Irish backstop (border) is at the centre of Brexit talks. The positive meeting between both leaders improved the chances of a Brexit deal between the UK and EU. GBP/USD has immediate resistance at 1.2470 followed by 1.2500. Immediate support can be found at 1.2410 and 1.2370. Expect more choppy moves in the Pound with a likely range today of 1.2350-1.2480. Just trade the range shag on this one.

- AUD/USD – The Australian Dollar resumed its climb on the improved risk sentiment due to improved chances of a partial trade deal between the US and China. AUD/USD closed at 0.6762 after trading to 0.67744 overnight high. Immediate resistance lies at 0.6780 followed by 0.6810. Immediate support can be found at 0.6735 and 0.6710. The reason the Aussie Battler is not higher is that Australian 10-year bond yields, up one basis point to 0.89% did not match those of the US and other rivals. Market positioning saw speculative Aussie short bets increase to -AUD 53,302 contracts from -AUD 47,155 the previous week. Today’s Australian Business Insider carried a report that new ABS (Australian Bureau of Statistics) data saw Home Lending data return to its 2017 highs, buoyed by the RBA rate cuts. AUD/USD should trade a likely range today of 0.6750-0.6800. The Battler remains a buy on dips against the Greenback.

Happy Friday and trading all.