Summary: The Yen and Swiss Franc outperformed in the currency markets as trade concerns, weak global economic data, renewed calls by President Trump for a weaker Dollar boosted the two safe havens. In Britain, the Pound plummeted to 1.20239, lows not seen since January 2017 as the UK economy shrank for the first time since 2012. The US Dollar dropped to 105.267 against the surging haven Yen before settling to close at 105.65, down 0.3%. In Europe, political uncertainty in Italy had little effect on the Euro, which managed a 0.2% climb against the Dollar to 1.1202 (1.1182). The Dollar Index, a popular measure of the Greenback against 6 major currencies, dropped to 97.03 from 97.65 Friday. US President Trump repeated his call for a weaker currency to help American manufacturers. The USD/CNH rallied to 7.0970 from 7.0785 despite a lower Dollar PBOC Fix on Friday. The Australian Dollar dipped, falling back 0.45% to 0.6785 (0.6805) after RBA Governor Philip Lowe told Parliament on Friday the bank might be willing to do “unconventional things” like drop the cash rate to zero if the global economy doesn’t smooth out soon. Deteriorating US-China trade relations, North Korean missile tests and escalating protests in Hongkong weigh on risk appetite and the Aussie.

Wall Street stocks slipped while Treasury yields climbed. The US 10-year rate settled 2 basis points higher at 1.74%. The DOW slipped 0.4% to 26,277 at the NY close on Friday.

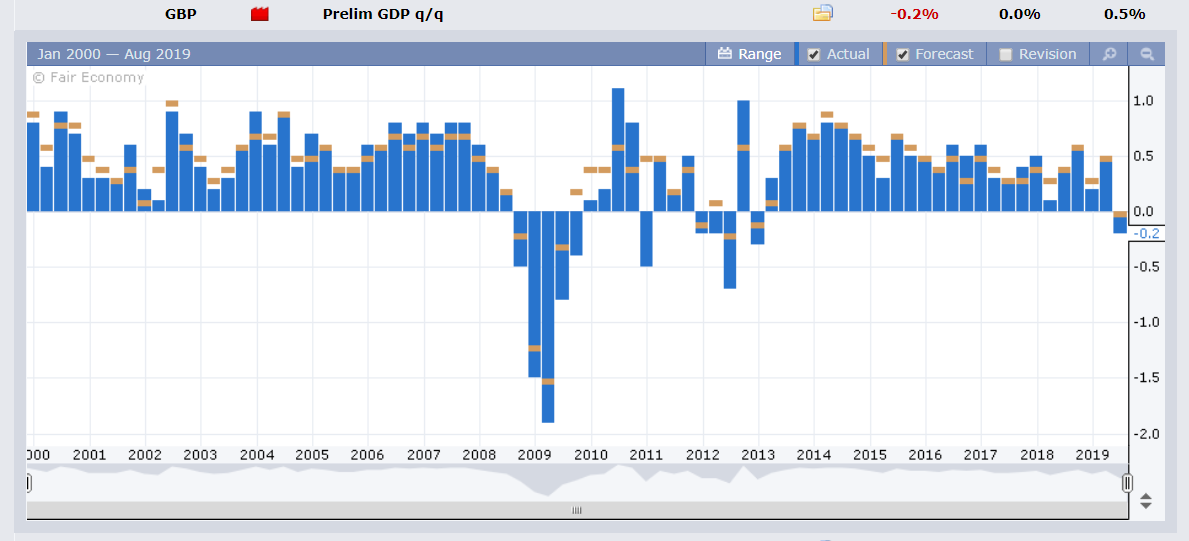

Japan’s Preliminary Q2 GDP beat estimates, up 0.4% from 0.1%. China’s PPI slipped to -0.3% in July from 0.0% June. The UK economy shrank to -0.2% in Q2 2019 below forecasts and the first contraction since 2012.

- GBP/USD – Sterling was pounded by traders to 1.2023, its weakest since January 2017 after the unexpected contraction of the UK economy in Q2 2019. The Pound has already fallen 3.7% against the US Dollar after no-Brexiter Boris Johnson took over the Prime Minister’s role. GBP/USD opens at 1.2030 in early Sydney.

- USD/JPY – The Dollar saw another fall against the haven sought Yen to 105.267, fresh 7-month lows before settling at 105.65. Japan’s Ministry of Finance has stepped up it’s verbal intervention as the Dollar approaches the psychological 105.00 level

- AUD/USD – After rallying on Friday to 0.6822 the Aussie fell back to finish at 0.6785 after RBA Governor Graeme Lowe’s suggestion of zero interest rates. This has emboldened the Aussie Dollar bears, already predicting a slide to 10-year lows at 0.65 cents.

On the Lookout: Markets will continue to monitor China-US tensions which has been the dominant driver of risk assets and currencies. President Trump has repeatedly tweeted accusations of China’s manipulation of the Yuan. Traders will keep their eyes on the PBOC Daily Fix today and moves in the USD/CNH rate.

There are no major economic data releases or events scheduled for today. But the week ahead is loaded. And will likely impact the FX markets.

Japanese banks will be closed in observance of its Mountain Day holiday. But that doesn’t mean the Japanese authorities will not be monitoring the Yen, given the proximity of USD/JPY to the psychological 105 level.

The week ahead sees further British data the UK Employment report on Tuesday. Germany releases its CPI report as well tomorrow. Tomorrow also sees the US Headline and Core CPI report which is the highlight.

Wednesday sees Australian Wage data and China’s trifecta reports of Industrial Production, Retail Sales and Fixed Asset Investment. Euro-area sees Germany’s Q2 GDP. UK CPI and PPI reports for July are also due for release on Wednesday. The EU reports its Q2 GDP which is the highlight. On Thursday, Australia releases its Employment report which will determine what the RBA does next with interest rates. US July Retail Sales are also released.

Trading Perspective: Every currency has a story to tell with the China-US trade rhetoric and the PBOC’s Daily Fix today shaping those stories. The risk aversion them will continue to underpin the Yen and Swiss Franc. However, with USD/JPY close to the psychological 105 level, Japan’s Ministry of Finance will be closely monitoring the market, despite today’s Japanese holiday.

The Dollar Index, where the Euro, JPY, Swiss Franc carry 74.8% of the weight fell to 97.034, which is no wonder. The Dollar’s relatively strong performance despite the China-US trade war is starting to cause economic harm and worry analysts of a possible recession.

- USD/JPY – The Dollar Yen had a decent bounce off its fresh 2017 lows at 105.267 following President Trump’s ratcheting of tariffs against China have seen demand for haven Yen grow. The Dollar has dropped from 107.40 at the start of this month to Friday’s low. USD/JPY bounced back to 105.65 as US bond yields climbed. The US 10-year rate was up 2 basis points to 1.74% while Japan’s 10-year JGB yield fell 3 basis points to -0.23%. Expect Japanese corporate USD buying orders (which are placed with Japanese banks overseas given today’s Tokyo bank holiday) to support the Greenback at 105.20-30. Immediate resistance can be found at 105.80 and 106.20. Prefer to buy dips with a likely range of 105.25-105.85.

- AUD/USD – The Aussie drifted lower after the RBA’s meeting minute release and Governor Graeme Lowe’s testimony to Parliament on Friday. AUD/USD traded to an overnight low at 0.6778 before settling at 0.6785 at the close. AUD/USD has immediate support at 0.6770 and 0.6750. Immediate resistance can be found at 0.6800 and 0.6830. When the Aussie press starts to get bearish on the currency near its short-term lows, it may be time to buy. Likely range today 0.6770-0.6820.

- EUR/USD – The Euro grinded higher despite the political uncertainty in Italy. The Single currency slipped to 1.11782 before rallying to close at 1.1202. In early Asia, the Euro continued its drift higher to 1.1208. Immediate resistance can be found at 1.1230 (overnight high traded was 1.1223). The next line of resistance is found at 1.1280. Immediate support can be found at 1.1185 followed by 1.1155. Look to buy dips with a likely range today of 1.1190-1.1240.

- USD/DXY – The Dollar Index closed just above its immediate support at 97.00 (97.034). USD/DXY has its next support at 96.70. Immediate resistance lies at 97.30 followed by 97.60. The higher US bond yields should provide some support in the short term. However, the deteriorating US economic data and escalating trade war with China will continue to weigh on the Greenback. Look to sell rallies with a likely rang today of 96.80-97.30. ‘

Happy trading all.