Summary: Brexit continued to take centre-stage in FX. Sterling soared anew, hitting 1.2898 after reports that the UK and EU agreed a tentative Brexit deal. The Pound gained and The Euro rallied to 1.1140, near 2-month highs, easing to settle at 1.1125 at the New York close. Though the deal still needs to be ratified by British lawmakers, both currencies kept their gains. Weaker US data continued to erode support for the Dollar, which saw broad-based weakness against its Rivals. The Dollar Index (USD/DXY) a popular gauge of the Greenback’s value against a basket of 6 foreign currencies, fell 0.4% to 97.60 from 98.00 yesterday. The Australian Dollar soared 1% to 0.6825 (0.6762) lifted by a fall in the Jobless rate to 5.2% from 5.3%. The Aussie also got support from comments by RBA Governor Philip Lowe, speaking at the IMF Conference in Washington DC. Lowe said that negative rates are extraordinarily unlikely in Australia. The Dollar was marginally lower against the Yen at 108.64 from 108.75. Emerging and Asian Currencies all recorded gains versus the struggle US Dollar. Wall Street stocks extended gains to finish within record highs amid a cluster of mostly positive earnings reports. The Dow closed at 27,035. while the S&P 500 rallied 0.18% to 2,999.

US bond yields were up a touch with the 10-year yield closing one basis point higher at 1.75%.

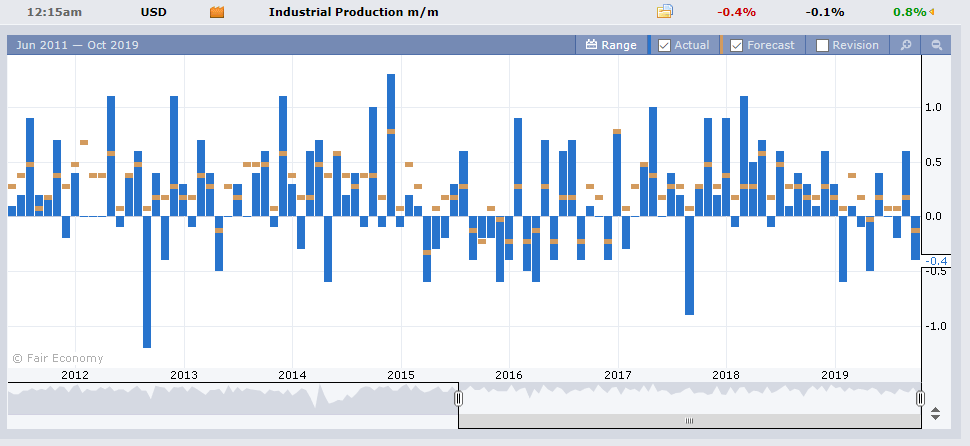

The string of weak US data continued with misses in US Industrial Production, down 0.4% in September, after an upwardly revised 0.8% rise in August, the largest monthly fall since April. US Capacity Utilisation underwhelmed with a 77.5% print versus expectations of 77.7%. Philly Fed Manufacturing Index fell to 5.6 (versus forecast of 7.3), and the lowest since February.

Australia’s economy created 14,700 jobs in September while August’s employment gain was revised up to 37,900 from 34,700. The Unemployment Rate dipped to 5.2% from 5.3%.

- EUR/USD – The Euro rallied to near two-month highs at 1.11398 before easing to close in New York at 1.1125. The shared currency continued to benefit from positive Brexit news and the broad-based US Dollar weakness.

- GBP/USD – The Pound kept its gains, finishing at 1.2890 (1.2825 yesterday) in volatile trade. Sterling slumped to 1.2855 after a leader from Ireland’s Democratic Union Party said they would vote against the UK/EU Brexit agreement. British PM Boris Johnson still needs to get the deal approved by British lawmakers who meet on the issue Saturday.

- AUD/USD – The Aussie came back in true Battler form, jumping to 0.68330 before settling at 0.6825, (0.6762 yesterday) for a 1% gain. A fall in Australia’s Jobless rate and comments from RBA Governor Lowe supported the currency. The Kiwi, antipodean cousin to the Aussie, rose against the Greenback to 0.6350 (0.62900), a gain of 0.9%.

On the Lookout: The string of weaker US economic reports continued with Industrial Production and Capacity Utilisation following Wednesday’s poor retail sales.

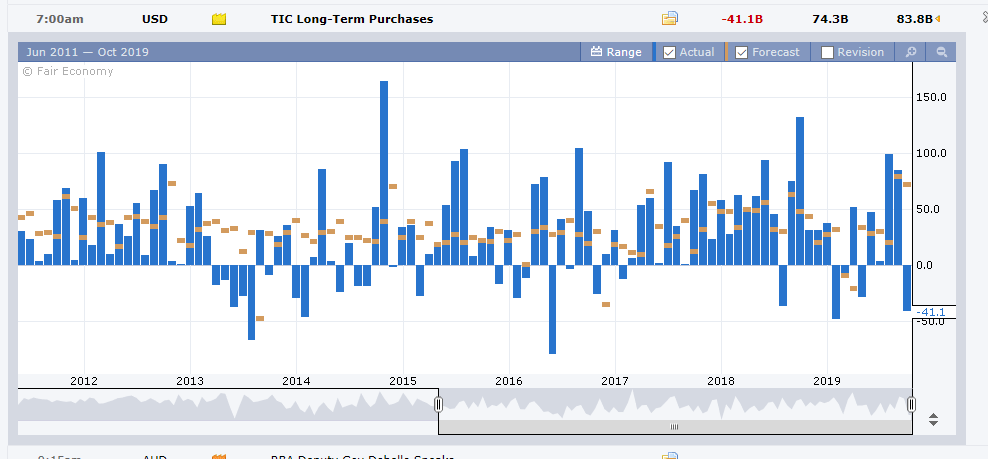

We noticed that US TIC Long Term Purchases (which is the difference in values between domestic and foreign purchases of US Securities) fell to US$41.1 billion from the previous months rise of $83.8 billion. It is the first fall since June and the biggest since February. FX traders are starting to notice the weak US reports. In contrast, those of rival nations are stabilising. FX will focus on today’s Chinese data dump.

Today sees China’s trifecta of GDP, Industrial Production and Retail Sales. China also releases its Unemployment rate.

Asia’s other data release is Japan’s National Core CPI. Europe sees the Eurozone Current Account. Finally, the US releases its Conference Board’s Composite Leading Index.

The IMF Conference in Washington DC continues with Bank of England Governor Mark Carney due to speak.

Trading Perspective: The technical break in the Dollar Index (USD/DXY) below 98.00 to its close at 97.60, was the result of more than just Sterling and Euro strength. The Dollar’s fall overnight was broad-based. The string of weaker US economic reports is eroding support for the Greenback which is on the way to a deeper downside correction. Market positioning has been long of US Dollar bets which will keep the Greenback pressurised.

- USD/DXY – The Dollar Index broke though immediate support at 97.80 after hovering around the 98.00 level yesterday. Overnight low traded was 97.50 which is today’s immediate support. The next support level lies at 97.20. Immediate resistance can now be found at 97.80 and 98.00. The Dollar Index broke through September lows and now appears headed to 97.38. Look for consolidation today with a likely trading range of 97.40-97.90. Prefer to sell rallies.

- EUR/USD – The Euro extended its advance breaking through the 1.1110 level to top out at 1.11398, near two months highs. The shared currency closed at 1.1125. Positive Brexit news will continue to support the Euro. Further signs of a slowing US economy ahead will also buoy the Euro. Immediate support lies at 1.1100 followed by 1.1070. Look for some consolidation today with a likely range of 1.1085-1.1145. Just trade the range for today but the Euro remains a buy on dips in the medium term.

- AUD/USD – The Battler extended its gains squeezing out the shorts following the fall in Australia’s Unemployment rate and comments from RBA Governor Lowe. We highlighted a few reports ago that the Australian Dollar TWI (Trade Weighted Index) was at near decade lows. The RBA will keep itself from easing while this is the case. The Aussie has more topside to it with immediate resistance today at 0.6840 followed by 0.6880. Immediate support can be found at 0.6800 followed by 0.6770. Look to buy dips with a likely range today of 0.6790-0.6840.

Happy Friday, top weekend and trading all.

Am off overseas for a break, back in mid-November. Stay nimble, keep your views firm.