Asian Indices ended mixed today as doubts emerged about the US and China’s partial trade deal. China wants to proceed with further discussions before signing the phase one trade deal.

Last week, Fed Chair Jerome Powell signalled further interest rate cuts and the resumption of bond purchases. Traders increased their bets that the Fed will slash interest rates at its next meeting in October to protect the economy from slowing growth and the effects of the trade tensions. The Hang Seng index is trading 0.11% lower at 26,507. The Shanghai Composite is 0.52% lower at 2,992 while in Singapore, the FTSE Straits Times is 0.08% lower at 3,121. The ASX 200 in Australia trades 0.054% higher at 6,642.

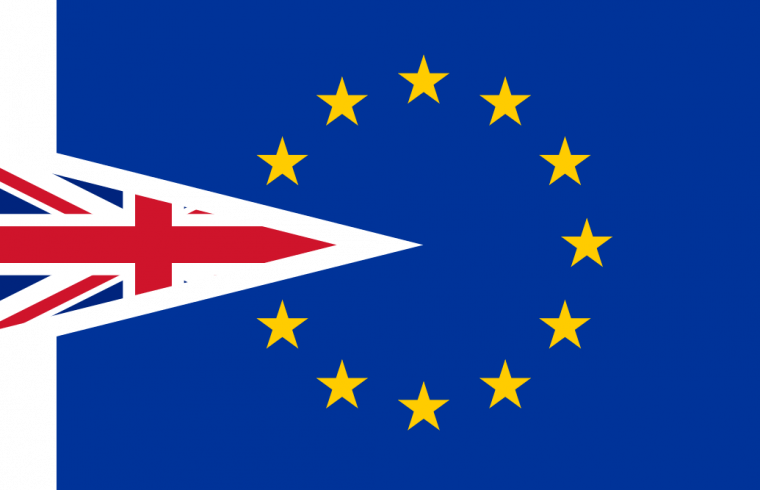

European indices started the day higher. DAX trading 0.36 higher at 12,531, CAC40 is 0.47 per cent higher at 5,672, while the FTSE MIB in Milan is 0.46 per cent higher at 22,199. In London, FTSE 100 is trading 0.06% higher at 7,217. The UK is scheduled to leave the EU on October 31.

In commodities markets, crude oil trades 0.73 per cent lower at $53.20 as global growth worries weigh on crude. Brent oil is trading 0.79% lower at $58,88 per barrel as oil world supply will be affected by the global slowdown. Gold trades lower at 1,493, as the momentum turns bearish after the price trades below the 50-day moving average. On the upside, strong resistance will be met at 1,555.13 recent high while support is at 1,458 the recent low.

In cryptocurrencies, Bitcoin (BTCUSD) momentum is neutral now as BTC trades flat at 8,333, hitting the daily low at 8,233 and the daily high at 8,411. Bitcoin short term momentum is neutral now as it trades above the 200-day moving average. Immediate support for BTC stands now at $7,686 recent low, while the next support stands at 7,406 the low from June 2nd. On the upside, strong resistance now stands at 8,801 recent high and then at 9,000 round figure. Ethereum (ETHUSD) trades higher at 183,61 with capitalisation now to 20.10 billion, and on the upside, the immediate resistance stands at 317 high while the support stands at 136 the low from May 6th. Litecoin (LTCUSD) trades higher at 56.02. The crypto market cap capitalization now stands above $226.85 billion.

On the Lookout: Japan Industrial Production (YoY) came in at -4.7% in line with forecasts for August. The Australian weekly consumer confidence came in at 110.9 previous reading was at 112.3.

The central bank of China set the Yuan rate (USDCNY) at 7.0708 versus yesterday’s settlement at 7.0725.

Trading Perspective: In forex markets, USD index trades 0.03 per cent lower at 98.41, the Aussie dollar trades 0.05 per cent lower at 0.6772, while NZDUSD trades 0.03% lower at 0.6297.

GBPUSD trades 0.22% higher on Brexit deal optimism at 1.2631 as we are getting closer to the Brexit deadline. Major support now stands at 1.2078 recent low which if broken, might accelerate the slide further towards 1.20. On the upside, immediate resistance now stands at 1.2636 recent high, while more offers will emerge at 1.2711 the 200-day moving average.

In Pound futures markets open interest decreased by 1,600 contracts, volume decreased by around 140.500 futures contracts.

EURUSD trades 0.05% higher at 1.1030, as the pair trades for the fourth day out of the descending channel. Immediate resistance for the pair stands at 1.1040 the 50-day moving average and then at 1.1138 the 100-day moving average. On the downside, immediate support stands at 1.1003 yesterday’s low and then at 1.0835, the low from 2017.

In euro futures markets open interest decreased by 4.200 contracts, the volume also decreased by around 128.300 futures contracts.

USDJPY is trading 0.07% lower at 108.31, having hit the daily low at 108.27 and the daily high at 108.44. USDJPY pair will find support at 104.44 the low from August 23rd. On the upside, immediate resistance for the pair now stands at 108.51 the high from yesterday, and then at 109.0, the 200-day moving average.

In Yen futures markets, open interest decreased by 2.300 contracts, and volume decreased by around 91,800 futures contracts.

USDCAD is trading 0.04% lower at 1.3229. The pair will find immediate support at 1.3017 the YTD low while extra support stands at 1.30 round figure. On the upside, immediate resistance now stands at the 1.3356 high from September 3rd before an attempt to 1.3450 high from 31st May.