Summary: Ahead of a big week for FX, Oil prices steadied, maintaining a firm tone as uncertainty on global energy supplies extended. President Donald Trump authorised the use of the country’s emergency crude stockpile (US Strategic Petroleum Reserve) if needed to offset a surge in prices. Still the prospect of another attack kept risk edgy. The Yen (USD/JPY 108.20 from 108.00) and Swiss Franc (USD/CHF 0.9928 from 0.9905) gave up their gains versus the Greenback while the Canadian Dollar stayed bid (USD/CAD 1.3245 from 1.3285). The Euro fell to 1.1004 from 1.1075 against an overall stronger US Dollar. The Dollar Index (USD/DXY) climbed to 98.652 from 97.858 yesterday. Traders widely expect the Fed to cut rates by 0.25% at this week’s upcoming 2-day policy meeting.

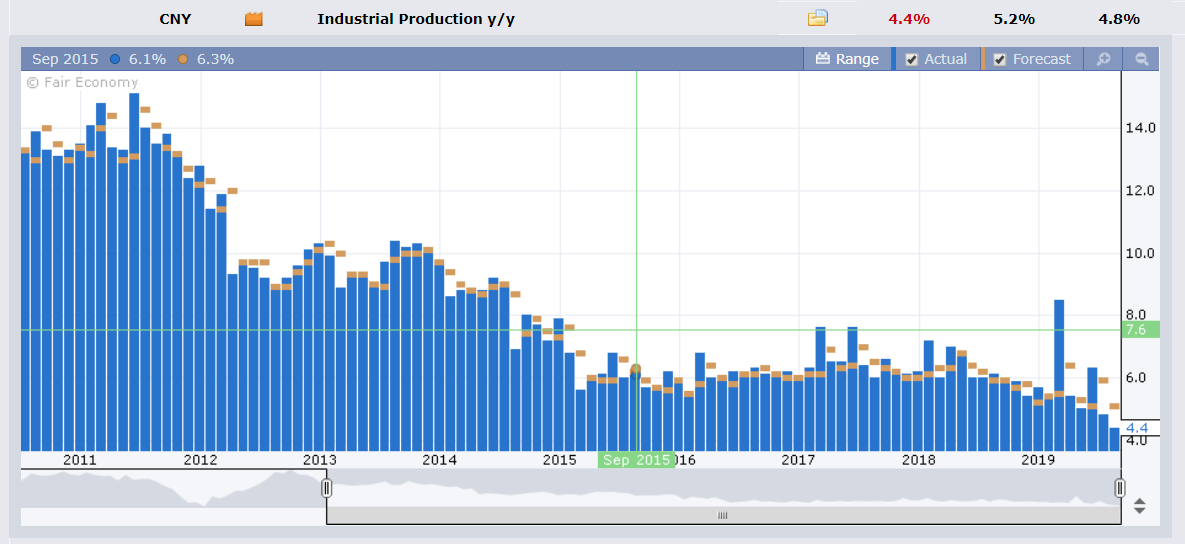

Sterling slipped back to 1.2425 (1.2505) after last week’s short-covering surge on growing confidence that a no-deal Brexit is off. The Australian Dollar slipped back to 0.6865 from 0.6885. Chinese data released yesterday underwhelmed, the trifecta of Fixed Asset Investment, Retail Sales and Industrial Production all missed forecasts.

Brent Crude Oil prices settled at US$67.00 from yesterday’s highs at US$68.75. Wall Street stocks were mostly flat. The US S&P 500 finished at 3,002 from 3,005 yesterday. Global bond yields eased. The US 10-year bond yield finished at 1.85%, down 5 basis points. Germany’s 10-Year bund slipped to -0.48% from -0.45%.

US Empire State Manufacturing Index dipped to 2.0 against median forecasts of 4.1 in August.

- EUR/USD – The Euro reversed its gains after touching a high at 1.1110 on Friday post-ECB rate cut. EUR/USD closed at 1.1005 from 1.1075 yesterday, holding just above the 1.10 support and pivot level. The ECB’s latest stimulus moves, considered the last for now, saw the shared currency gradually lose ground against the Greenback.

- GBP/USD – Sterling gave back its impressive gains after investors grew confident that a no-deal Brexit can be averted. Short covering boosted the British currency to a high of 1.25059 on Friday. Yesterday’s broad-based US Dollar rally saw the Pound gradually lose ground to close at 1.2425, down 0.51%.

- USD/JPY – The Dollar edged back against the Yen as the market’s risk-off stance eased on the US oil stockpile support news. While US 10-year bond yields eased, the widened gap against Japan’s 10-year JGB yield (unchanged at -0.17%) kept the Greenback supported. USD/JPY closed at 108.15 from 108.08 yesterday. The Bank of Japan meets on Thursday on interest rates.

On the Lookout: The uncertainty over the impact on global energy supplies of the Saudi attacks will keep oil prices firm with geopolitical tensions high. Markets will watch for the impact of the move by the US administration to tap its energy reserves if necessary. On the trade front, the US and China appear headed towards a temporary deal. This also remains to be seen. I like the term that Greg Mckenna, my former colleague at NAB who was an excellent head of Currency Strategy then, used in his weekly newsletter to investors. Mckenna who writes a daily commentary for macro markets used the term “enduring positivity” on chances of a trade breakthrough.

Today’s data releases will be monitored ahead of the Fed’s 2-day meeting and rate announcement (Thursday morning, Sydney).

The RBA starts off today with its latest meeting minutes release. (11.30 am Sydney). Australian House Price Index follows. Germany’s ZEW Economic Sentiment Index kicks of Euro area reports. This is followed by the Eurozone ZEW Economic Sentiment Index. Canadian Manufacturing Sales starts off North American data which is followed by the US Industrial Production and Capacity Utilisation reports.

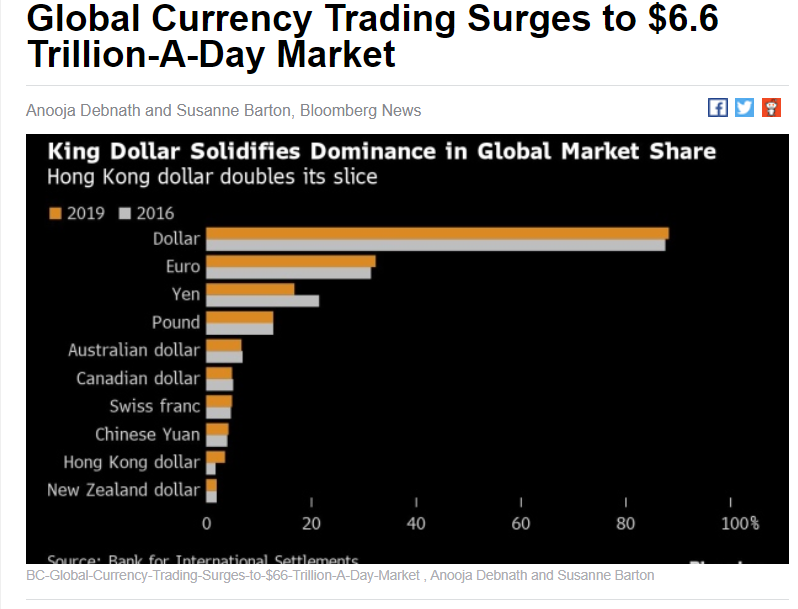

Trading Perspective: The Dollar’s rebound was broad-based, rallying against almost all of it’s Rivals apart from the “oil” currencies, Loonie, Russian Rouble, Norwegian Kroner. A Fed rate cut of 0.25% is widely anticipated. While there is little risk that the Fed may not cut rates, it is a possibility. This is a big week ahead and we also have the Bank of England and Bank of Japan interest rate policy meetings. A report released by BNB Bloomberg on the BIS’s triennial survey on FX said daily market turnover has grown to US$6.6 trillion per day, the highest ever level. The average daily turnover in April was up 29% from the same month in 2016. The 3 years since then, the US Dollar experienced a slide followed by a strong recovery. The US Dollar remains the world’s pre-eminent currency, retaining its dominant status, being on one-side of 88% of all trades.

When uncertainty rules the markets, the Greenback stays bid. Unless we see a big surprise from the Fed, this may just be the case.

- EUR/USD – fell to 1.1005, just above the support and pivot 1.1000 level. EUR/USD traded to an overnight low at 1.09933 overnight. The immediate support at 1.0980 remains strong. The next support level is 1.0950. The latest COT/CFTC report saw a mild increase in short Euro speculative bets. This will continue to support the downside. Immediate resistance can be found at 1.1030 followed by 1.1060 and 1.1080. Ahead of the Fed meeting outcome, the overall range of 1.0980-1.1080 is not likely to break. Look to trade a likely range today of 1.0990-1.1060. Prefer to buy dips at current levels.

- USD/JPY – held its ground, rallying to finish at 108.15 from 108.05 yesterday. The overnight low traded was 107.459. USD/JPY has immediate resistance at 108.20 followed by 108.50. Immediate support can be found at 107.70 followed by 107.40. The US 10-year yield dipped back to 1.85% from 1.90%. This should keep the topside of USD/JPY limited. The latest COT/CFTC report saw a modest increase of speculative long JPY bets. President Donald Trump tweeted earlier this morning that the US had reached an initial trade agreement with Japan regarding tariff barriers. Look to trade a likely range today of 107.50-108.20.

- AUD/USD – The Aussie rallied to a high at 0.6884 overnight, closing at 0.6865. On Friday the Australian Dollar hit a high of 0.68905, mainly on US Dollar weakness. The RBA releases its last meeting’s minutes today. The Australian central bank is not likely to reveal any hints of future policy given the current geopolitical and trade tensions. Policymakers will likely repeat their “ease monetary policy further if needed” phrase. The latest COT/CFTC report saw a trim in speculative AUD short bets. AUD/USD has immediate support at 0.6850 (overnight low 0.68539) and 0.6820. Immediate resistance can be found at 0.6885 and 0.6905. Look to trade a likely range of 0.6855-0.6905. Prefer to buy dips, the market is still short.

Happy trading all.