Summary: Risk assets and currencies continued their march higher boosted by ongoing hopes for a swift economic recovery. The Australian Dollar extended its 8-day rally to finish at 0.7020 from 0.6967. The Kiwi (NZD/USD) jumped 0.85% to 0.6560 (0.6505) after New Zealand’s Prime Minister Jacinda Ardern declared a “win” against Covid-19. New Zealand will ease out of complete lockdown measures imposed a month ago to stem the spread of Covid-19. The Euro finished little-changed at 1.1292 (1.1288 yesterday) despite larger than expected falls in German Industrial Production and Eurozone Sentix Investor Confidence data in May. Against the Japanese Yen, the Dollar plunged 0.94% to 108.40 (109.60) on a delayed reaction to broad-based Greenback selling that started this month. Sterling rebounded to 1.2725 from 1.2670 as the US Dollar extended losses. The USD/CNH pair (US Dollar against Offshore Chinese Yuan) slumped to 7.0570 from 7.0730 following Sunday’s release of a better than expected Chinese trade surplus to USD 62.9 billion. The surplus was a result of a fall in exports and imports in Dollar terms, not an improvement in economic activity.

Wall Street stocks lifted. The DOW finished at 27,545 (27,095) while the S&P 500 added 1.25% to close at 3,228 (3,190). US bond yields eased. The key 10-year US treasury rate finished at 0.88% (0.90%). The US 2-year note yield was higher at 0.23% from 0.21% yesterday.

Japan’s Final Q1 GDP slipped to -0.6% missing forecasts at -0.5%. Japan’s Economic Watchers Sentiment improved to 15.5 from 7.9, beating expectations at 12.6. Germany’s May Factory Orders slumped to -17.9% against the previous month’s upwardly revised -8.9% (-9.2%), missing forecasts at -16.0%. The Eurozone Sentix Investor Confidence Index dropped to -24.8 against forecasts of -22.0.

Canada’s Housing Starts rose to 193,000 units, beating expectations of 160,000.

On the Lookout: Today’s economic and events calendar are light as markets prepare for the US Federal Reserve’s two-day meeting which kicks off today. After Friday’s surprisingly good US Jobs report, and rise in US bond yields, policymakers will have to take these into consideration in any decision and the signals they will send to the markets. The appetite for risk has grown increasing bloated and officials are increasing aware of this.

Today’s data begins with New Zealand’s ANZ Business Confidence Index followed by Australia’s NAB Business Confidence Index and ANZ Job Ads for May. The UK’s BRC Retail Sales starts off Euro area data. Switzerland reports its Unemployment rate followed by Germany’s Trade Balance, Eurozone Final Employment Change and Revised Q1 GDP. The US reports on its JOLTS Job Advertisements, NFIB Small Business Index, and Final Wholesale Sales Inventories.

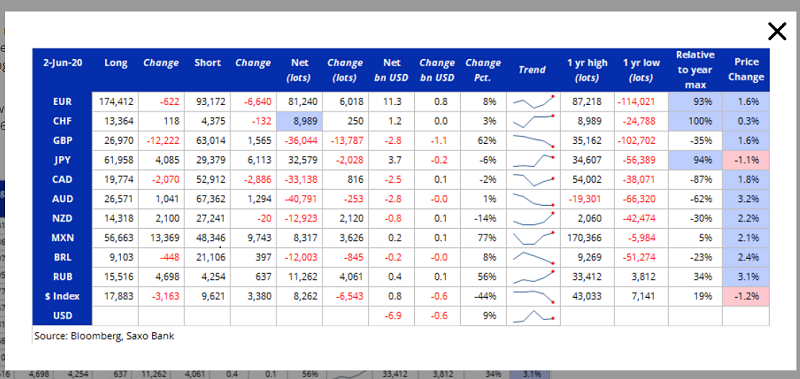

Trading Perspective: The latest Commitment of Traders/CFTC report (week ended 2 June) saw speculators continue to sell US Dollars across the board, either extending short bets or trimming long bets against various currencies. According to Saxo Bank, who thankfully take pains to get the data and provide a short report/commentary, there was “continuous Dollar selling which was moderate but broad-based.” Total net short USD bets increased by 9% to total USD 6.9 billion, a 5-week high. This was mainly due to rising Euro long bets and short covering in the Kiwi and Canadian Loonie. The Dollar has slipped further in the past week which suggests that short USD market positioning will consolidate from here on in.

EUR/USD – Grinds Up, Spec Long Bets Build, Dire German Data to Cap at 1.1350

The Euro grinded higher on broad-based US Dollar selling, enabling the shared currency to climb to 1.13198 overnight highs before easing to settle at 1.123 in later New York trade. Early Sydney saw the Euro up at 1.1303. As equities continued to drive higher with Wall Street stocks climbing to near all-time highs, heightened risk appetite weighed further on the Greenback. The Euro’s gains from this point are the result of USD weakness.

The larger than expected fall in Germany’s Industrial Production to -17.9 % against expectations of -16.0 % followed Friday’s slump in German Factory Orders to -25.8% (against forecasts of -20.0%). This set of data was ignored by FX. Eurozone Sentix Investor Confidence Index also missed forecasts with a fall to -24.8 from -22.0. These fundamentals will soon weigh on the shared currency as the market’s increasingly bloated appetite for risk is due for a reversal and a US Dollar rally.

The latest COT/CFTC report saw net speculative Euro long bets increase to +EUR 81,240 in the week ended 2 June from the previous week’s +EUR 75,222. Which is a large build in Euro longs of +EUR 6.018 contracts. Net total speculative long Euro bets have hit 93% of the annual highs in long Euro positions. A turnaround lower is not far away.

EUR/USD has immediate resistance at 1.1325 followed by 1.1350 and 1.1380. Immediate support can be found at 1.1280 followed by 1.1250. Look to sell rallies in a likely 1.1240-1.1340 range today.

AUD/USD – Extends Gains on Weak USD, Battler to Consolidate, 0.7050 Caps

The Australian Dollar reversed its move lower, rallying to 0.7020 as risk assets continued to climb with hopes building on a quick economic recovery. Broad-based US Dollar selling also lifted the Battler which rose further to an early Sydney high at 0.70428 this morning. The Australian Dollar has risen a total of 27% since its March 19 lows and a deeper pullback is needed for a healthy uptrend to develop. The increase in risk appetite has seen the Aussie, Kiwi and Loonie outperform. General US Dollar weakness in this past week has added to the Battler’s gains.

Australia and New Zealand efforts to contain the Covid-19 outbreak are considered among the best in the world which has added lustre to the currencies.

Today sees second-tier Australian data with NAB’s Business Confidence and ANZ Job Advertisement reports. There are no major Australian economic reports due this week. Any catalyst will come from US data and the Fed’s policy meeting this week. Markets have all but ignored both Australia’s and the US’s trade tensions with China.

The Commitment of Traders/CFTC report for the week ended 2 June saw net speculative Aussie short bets little changed at -AUD 40,791 from -AUD 40,538. AUD/USD has immediate resistance at 0.7040/50 followed by 0.7080. Immediate support can be found at 0.6990 and 0.6960. As we mentioned in our commentary, given the fundamentals, the Aussie above 0.70 cents for now is on thin air. Look to sell rallies in a likely 0.6950-0.7050 range.