Asian indices finished mixed at the start of the week ahead of Wednesday’s FOMC policy meeting and as trade worries resurface and the attack in two oil tankers in Gulf of Oman weighing on traders sentiment.

The Nikkei225 finished 0.03 percent higher to 21,124 the Hang Seng benchmark in Hong Kong, finished 0.41 percent higher at 27,233. The Shanghai Composite finished 0.20 percent higher to 2,887, while in Singapore the FTSE Straits Times index finished 0.38 percent lower to 3,210. Australian equities finished a lackluster session weaker, held back by a heavy 2.3% loss in the Telco sector. The ASX200 finished the session down 23 points or 0.4% to 6,530.

European session started higher today in a quiet session amid renewed worries about trade relations between the US and China and a rise in geopolitical tensions. DAX30 is adding 0.03 percent to 12,099 CAC40 is 0.19 percent higher at 5,377 while the FTSE MIB in Milan is trading 0.45 percent lower at 20,704. The London Stock Exchange is 0,20 percent higher to 7,360 as the Brexit uncertainty continues.

In commodities markets, crude oil trades slightly higher at 52.20 after a previous turbulence week. Oil is down almost 18% from the high in late April, wiping out about half of its rally earlier this year, due to increased global trade worries. Brent oil also trades lower to $61,57 per barrel as major oil producers have yet to agree on adjustments on output.

Gold gives up 6 dollars to 1,347 as traders are taking some gains off the table. The precious metal broke today below the 50-hour moving average and found support at the 100-hour moving average at 1,346. If Gold breaches that level next stop is at 1333 the 200-hour moving average. Immediate resistance for gold stands at 1,342 50 hour moving average and then at 1,357 the yearly high.

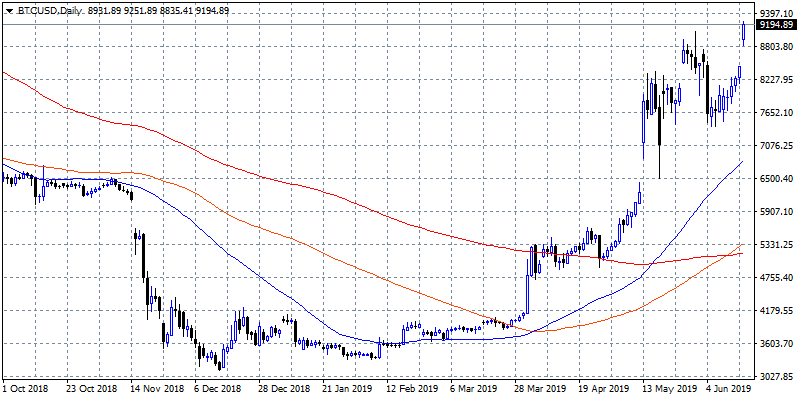

In cryptocurrencies market, bitcoin (BTCUSD) had an excellent weekend and continues its trip north above the 9,000 mark, the daily low for BTC was at 8,835 and the daily high at 9,251. Immediate support for BTC stands now at $9,000 round figure while next support stands at 8,500 the previous week high.

On the upside, strong resistance now stands at 9,251 the high from Asian session while I expect extra pressure from sellers at 9,500 and then at 10,000. Ethereum (ETHUSD) adding over 12 dollars to 268, with capitalization now to 28.7 billion. On the upside, the immediate resistance stands at 287 the recent high while the support stands at 250 round figure, Litecoin (LTCUSD) also trades higher at 134. The crypto market cap now stands above $284.0B.

On the Lookout: Investors focus will be this week on the FOMC meeting Wednesday. The US central bank is expected to keep rates unchanged at 2.5% this week. The week also sees the Bank of Japan and Bank of England policy meetings.

Later today we await from North America the NY Empire State manufacturing index and NAHB housing market index.

Trading Perspective: In forex markets, USD trades higher at 97.56 ahead of the Fed policy meeting, while the Aussie dollar started flat at 0.6871 while Kiwi trades higher at 0.6508 level after downbeat manufacturing PMI figure flagged further RBNZ rate cuts.

GBPUSD started the week flat trading in a narrow trading range as the bearish momentum for Cable is still intact amid growing concerns over Brexit. The pair hit the daily low at 1.2570 and the daily high at 1.2597. Major support now stands at 1.2550 recent low.

On the upside immediate resistance now stands at 1.26 while more offers will emerge at 1.2641 the 50-hour moving average. Pound shows persistent weakness amid UK political uncertainty and also on the back of global risk aversion, so any uptick can match excess offers.

In Sterling futures markets the open interest increased by 6.9K contracts on Friday, volume, shrunk sharply by around 129.4K contracts.

EURUSD started the day on positive foot trading at 1.1218. The pair trades above and below the 50-day moving average ahead of the FOMC meeting later this week. On the upside, the immediate resistance stands at 1.1251 the 50-hour moving, while more offers will emerge at 1.1267 the 100-day moving average. Support stands at 1.12 round, while more bids will emerge at 1.1150 two week lows.

In euro futures markets, the open interest increased by around 7.5K contracts, volume dropped by nearly 86.7K contracts, reaching the second consecutive drop.

USDJPY trades 0.04 percent higher to 108,59, on improved short term sentiment. The pair hit the low at 108.45 and the high at 108.70. The pair will find support at 108.45, the 100-hour moving average. On the upside, immediate resistance for the pair now stands at 109 round figure. The USD price dynamics will continue to drive the pair’s momentum as traders focus shifts to FED next move on Wednesday.

USDCAD started in quite a mood the week and trading as of writing at 1.3412 as the retreat in crude oil prices, Canada’s main export item seems to have added further weakness in the Canadian Dollar (CAD). The pair will find immediate support at the 200-day moving average around 1.3250 while extra support stands at 1.3200 round figure.

On the upside immediate resistance now stands at the 1.35 zone before an attempt to 1.3560 recent high from 31st May.