Major markets saw corrective price action on profit booking post yesterday’s price rally inspired by Sino-U.S. trade optimism and investors now await Powell’s speech for short term directional cues while awaiting headlines on UK parliament session tomorrow.

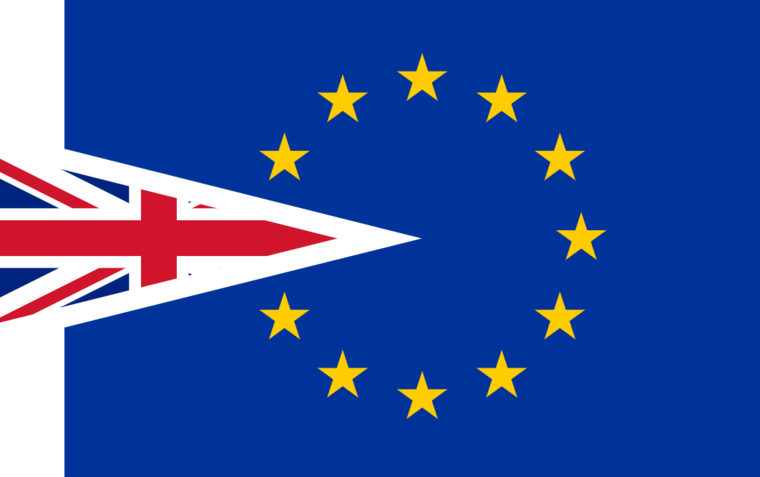

Summary: Following yesterday’s positive price rally inspired by Sino-U.S. Trade optimism, profit booking activities and caution ahead of major political events led to corrective price rally today. All major Asian indices and equities saw a downside move, and this was also mirrored in forex markets which saw range-bound price action. However, price activity was mixed in European markets despite indices hinting at a high level of bearish price action as optimism surrounding Brexit ahead of tomorrow’s UK parliament session underpinned bulls to some extent. Headlines hint that Europe is ready to extend the deadline till 2021 for Brexit while UK parliament is likely to push for a second Brexit referendum or make a solid move to avoid no-deal Brexit scenario. As headlines hint at positive progress in both Brexit and Sino-U.S. trade talk fronts risk appetite remains high in broad market keeping price action in equity and forex markets above critical price levels despite today’s corrective price rally.

Summary: Following yesterday’s positive price rally inspired by Sino-U.S. Trade optimism, profit booking activities and caution ahead of major political events led to corrective price rally today. All major Asian indices and equities saw a downside move, and this was also mirrored in forex markets which saw range-bound price action. However, price activity was mixed in European markets despite indices hinting at a high level of bearish price action as optimism surrounding Brexit ahead of tomorrow’s UK parliament session underpinned bulls to some extent. Headlines hint that Europe is ready to extend the deadline till 2021 for Brexit while UK parliament is likely to push for a second Brexit referendum or make a solid move to avoid no-deal Brexit scenario. As headlines hint at positive progress in both Brexit and Sino-U.S. trade talk fronts risk appetite remains high in broad market keeping price action in equity and forex markets above critical price levels despite today’s corrective price rally.

Precious Metals: Increased risk appetite and profit booking continue to slowly erode price action in the precious metals market. However, weak USD in the broad market and investors caution as deadlines for key events are yet to be officially changed despite headlines hinting at same has kept the precious metal market well funded and above critical support price levels.

USDJPY: The greenback came under downside pressure today on renewed risk appetite, and investors caution ahead of Powell’s speech later in the day forced the pair to recede from recent yearly peaks beyond 111.00 the figure. The pair is likely to resume positive price action later in the day as risk appetite remains high in market weighing down Japanese Yen which is a safe-haven currency.

AUDUSD: The Australian Dollar declined on dovish influence from Chinese markets and corrective price rally which dampened risk appetite. But weak USD in the broad market and optimism surrounding Sino-U.S. trade talks continue to underpin AUD bulls in the broad market. This has resulted in the pair seeing consolidative price action during Asian market hours.

On The Lookout: Following risk-averse trading session early in the day, American market hours is going to see highly volatile price action as all major macro data updates and speech by key central bank members scheduled for the day will be over by early American market hours allowing investors to place bets owing to directional cues expected from Fed Chair Powell’s speech. Further, optimism surrounding Sino-U.S. trade talk is also expected to influence positive price action. The main focus moving forward is the outcome of UK parliament meeting scheduled to occur tomorrow which will give an idea on short term direction of Brexit related events. On the release front, US economic calendar is expected to see the release of Building permits, housing starts, and CB consumer confidence data.

Trading Perspective: Following a corrective rally early in the day and key events scheduled in early US market hours, forex and equity markets are expected to resume its volatile price action with positive bias supported by healthy risk appetite in the market.

U.S. Indices : Following yesterday’s neutral closing, prevalent risk appetite in the broad market is expected to influence positive price action, but gains are likely to be limited as official announcement on postponing China-U.S. trade deal deadline is yet to be made, and details of recent trade talks are yet to hit market which is expected to keep gains limited as evident from slight decline of US index futures trading in international market ahead of Wall Street opening.

EURUSD: Weaker Greenback in the global market ahead of Fed Chair Powell’s speech combined with Sino-U.S. trade optimism and positive Brexit hopes helped EURO stay positive and trade near three-week highs during European market hours. If Powell’s comments to Senate Banking Panel show dovish hints, USD may weaken further helping EURO move back above 1.14 handle.

EURUSD: Weaker Greenback in the global market ahead of Fed Chair Powell’s speech combined with Sino-U.S. trade optimism and positive Brexit hopes helped EURO stay positive and trade near three-week highs during European market hours. If Powell’s comments to Senate Banking Panel show dovish hints, USD may weaken further helping EURO move back above 1.14 handle.

USD/CAD: Despite trading weak in the broad market, the US dollar managed to establish a positive price rally in USDCAD pair and breached 1.32 handle earlier in the day. However, the positive price action of crude oil in the broad market helped limit USD’s gains position which the pair saw some downside move ahead of Powell’s speech. The pair is now likely to move above 1.32 handle as USD is like to regain strength during American market hours.