Summary: In light, pre-holiday trade, the Kiwi took flight, leading FX higher against the beleaguered US Dollar. New Zealand’s Kiwi, fondly referred to as “the Bird,” soared 0.70% to 0.6735 (0.6685), finishing as best performing Major. Against the Japanese Yen, the Dollar accelerated it’s drop to 108.85 (109.47), the lowest close in over two weeks. The Euro rose 0.3% to finish at 1.1200 (1.1177), while Sterling advanced to 1.3125 (1.3085) for a gain of 0.45%. The Australian Dollar briefly traded above 0.70 cents to 0.70043, fresh 5-month highs, before easing to settle at 0.6996. The Dollar fell out of favour against the Emerging Market currencies with USD/THB breaking below 30.00 for the first time since 2013, finishing in New York at 29.97 (30.15 yesterday). Equities fell back from record highs on light-profit taking. The DOW finished 0.55% lower to 28,453. (28,623). The S&P was down 0.43% at 3,222 (3,235). Bond yields were mostly higher with global inflation seen to have bottomed. The US 10-year note yield was up one basis point to 1.89%. Germany’s 10-year Bund yielded 0.19% from -026% yesterday. Japanese 10-year JGB yields were unchanged at -0.03%.

The US yield curve widened with the US 2-year treasury dipping to 1.57% from 1.63%. According to Market Watch’s Bond expert Sunny Oh, the 2-year/10-year Bond yield curve hit its steepest since October 2018. According to Oh, “a steeper curve can indicate brewing expectations for a bump in economic growth and inflationary pressures.”

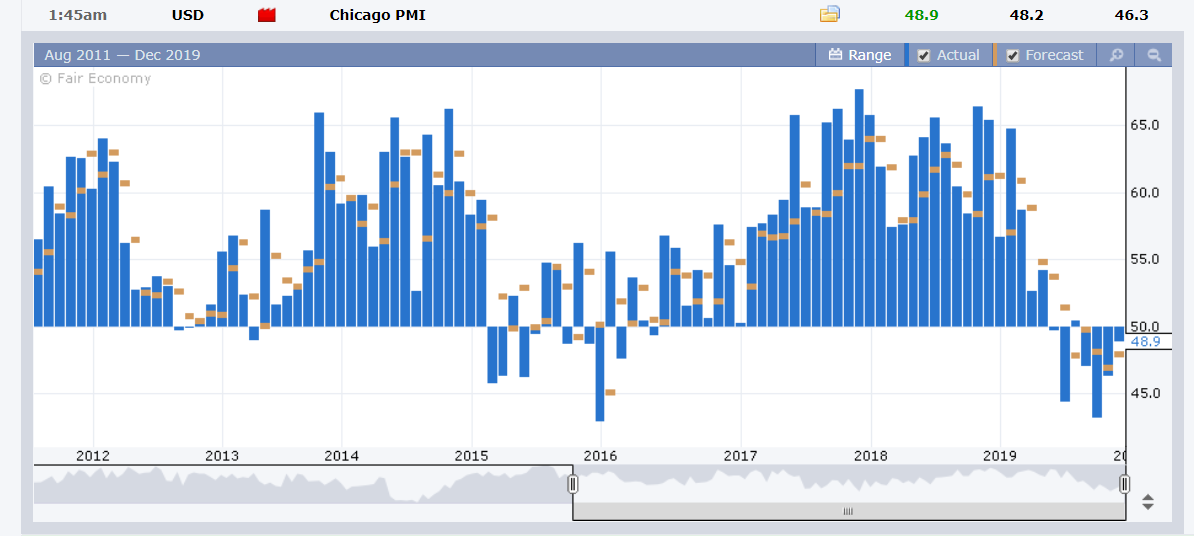

Limited data releases saw Spain’s Flash CPI dip to 0.8% (median f/c 0.7%), UK High Street Lending rose o 43.7K from 41.2K. The US Trade Deficit fell to -USD 63.2 billion, besting forecasts of -USD 69.2 billion, and a previous -USD 66.8 billion. US Chicago PMI improved to 48.9 in December from 46.3, beating forecasts at 48.2.

- EUR/USD – The Euro extended its climb for the 6th day running, trading to a high at 1.12208 before easing to settle at 1.1200 in New York. Speculative shorts continued to cover their positions in light, low volume trade.

- USD/JPY – the Dollar accelerated its fall against the Japanese currency, breaking lower through the 109.00 level to close at 108.85, a loss of 0.51%. An improved set of better Japanese economic data yesterday saw demand for the Yen pick up.

- NZD/USD – The Kiwi, which has been on an upward trajectory against the US Dollar most of December, finished 0.7% higher overnight to 0.6735. Improved economic data saw the Kiwi scale 5-month highs to 0.67363 before easing to settle at 0.6728 currently.

- USD/THB – The Thai Baht led Emerging Market currencies higher against the defensive Greenback. USD/THB broke the key psychological level at 30.00, slipping to 29.86, climbing at the close to settle at 29.97, down 0.56%.

On the Lookout: FX trading will remain thin and light on the last day of 2019, and of this decade. There are some economic reports that could stir markets today. China reports it’s official Manufacturing and Non-Manufacturing PMI for December (12 noon Sydney). European markets will finish early with Germany on holiday today. The US releases its December House Price Index, S&P Case Shiller Composite-20-year House Price Index, and Conference Board Consumer Confidence reports. Last night saw improved US economic performances in the Chicago PMI, and Trade Balance. The US 2-year/10-year yield curve steepened. This should be supportive of the Greenback today.

Trading Perspective: The Dollar’s soggy performance against its Rival in thin volume trade was mainly the result of speculative shorts in the currencies covering against the Greenback. Against that backdrop, US economic data bettered expectations while the US 2-year/10-year yield curve widened, indicative of building economic growth and inflation expectations.

FX will focus on the Chinese and US data releases today. We take a look at the Commitment of Traders/CFTC report on Thursday, Jan 2 to get an idea of market positioning. This writer’s expectation is that total net speculative US Dollar longs have been trimmed.

- EUR/USD – The shared currency traded to an overnight and 4-month high at 1.12208 before settling to straddle 1.1200. There was no European economic data released yesterday apart from Spain’s Final CPI which missed expectations. The Euro’s up move has been driven by speculative short covering in light and thin markets. German 10-year Bund yields are lower than they were two weeks ago. Expect the EUR/USD topside to be limited to today’s immediate resistance at 1.1220. The next resistance level lies at 1.1250. Immediate support can be found at 1.1170 followed by 1.1140. Look to trade a likely 1.1175-1.1215 range today.

- USD/JPY – slip-sliding away, the Dollar played catch-up with its slump against the other majors, to 108.766 overnight and December 12 lows. The Dollar settled at 108.87 in late New York. Speculative JPY shorts will continue to look for levels to cover their positions. This will keep the USD/JPY topside limited. Immediate resistance can be found at 109.15, followed by 109.35. Immediate support lies at 108.75 (108.766 overnight low). Look for the Dollar to consolidate at these lower levels in quiet trade with a likely range today of 108.75-109.25. Prefer to sell USD rallies.

- AUD/USD – The Aussie climbed above the 0.70 cent level to trade to 0.7004 overnight and 5-month high. Australia’s Battler has been steadily moving higher for four weeks now. Today sees the release of Chinese Manufacturing and Non-Manufacturing PMI reports. The rally in Emerging Market and Asian currencies has also buoyed the Aussie. For today, expect the immediate resistance at 0.7005 to hold with 0.7025 the next resistance. Immediate support can be found at 0.6970 (overnight low 0.69779). Look for a likely range today of 0.6970-0.7010. Prefer to sell rallies.

- USD/THB – The Dollar has gradually lost ground against Asia’s strongest currency, the Thai Baht. Thailand’s currency reached a new 6-year high, its strongest level against the US Dollar since May 2013. The Bank of Thailand has been finding it tough to halt the appreciation of the Baht. The Baht has gained 8% against the US Dollar in 2019. Thailand’s huge current account surplus (valued around US$ 26.5 billion) makes the country stand out as a safe- haven for investor capital. While the Baht is expected to remain strong for the next few years, the BOT (Bank of Thailand) will find it hard not to intervene (quietly) to keep the USD/THB from falling too far too fast. Look to buy USD dips with a likely 29.85-30.15 range today.

Wishing all our readers a Happy, Prosperous and Fruitful 2020.

Happy trading all.