Summary: The US Federal Reserve cut rates for the second time this year, as expected, but stopped short of ensuring any future easing. The Fed trimmed the benchmark Funds rate by 0.25% to 2.0%. Three out of 10 policymakers dissented. Noted hawks, Esther George (Kansas City) and Eric Rosengren (Boston) voted against a cut, while Bullard (St. Louis) wanted a 0.5% cut. The Dollar soared to a 7-week high against the Yen (108.478) ahead of today’s Bank of Japan policy meeting and rate decision. The Euro retreated 0.32% to 1.1028 (1.1072) while Sterling dipped to 1.2470 from 1.2500. The Australian Dollar fell back to 0.6830 from 0.6868 ahead of this morning’s Australian Employment report. New Zealand’s Kiwi jumped to 0.6830 from its NY close of 0.6815 after Q2 GDP, just released, beat forecasts at 0.5% against forecasts of 0.4%.

US Bond yields stayed firm with the benchmark 10-year rate unchanged at 1.80%. Two-year US yields rose to 1.76% from 1.72% yesterday. Wall Street stocks ended with modest gains.

Data released yesterday saw UK Headline CPI dip to 1.7% against a forecast 1.8% and previous 2.1%.

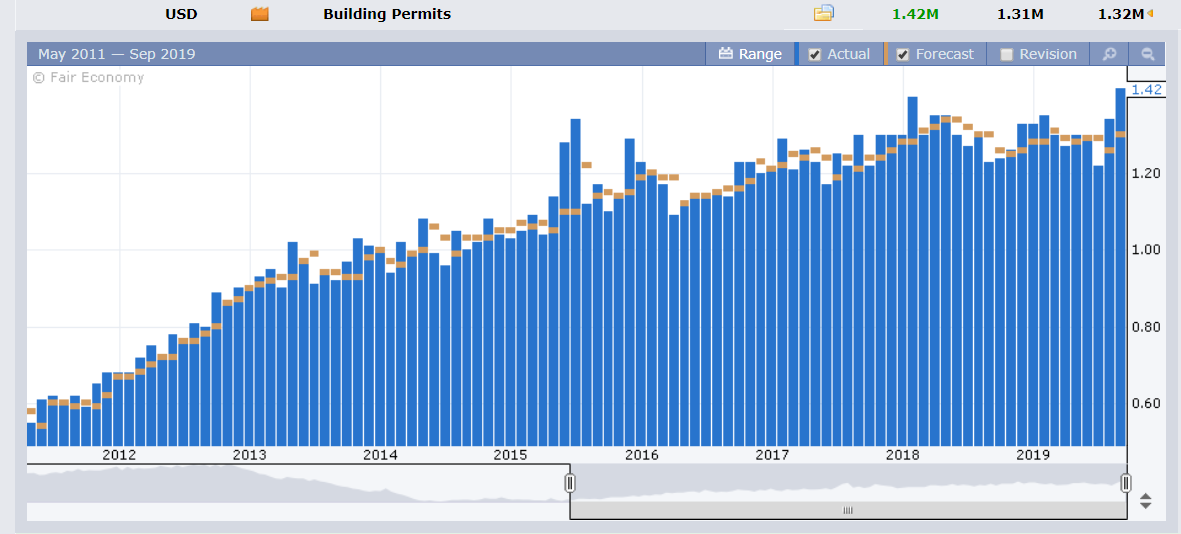

US August Building Permits climbed 7.7% to 1.42 million from 1.32 million, its highest level since May 2007. Housing Starts rose 12.3% to 1.36 million units from 1.19 million as lower US mortgage rates provided a boost to the struggling housing market.

- USD/JPY – The Dollar soared to an overnight and fresh 7-week high at 108.476 from 108.15 yesterday, before settling at 108.45 at the NY close. The BOJ is expected to maintain status quo at the conclusion of its interest rate policy meeting today (1.00 pm Sydney).

- EUR/USD – The Euro retreated to 1.1030 from 1.1072 yesterday following the hawkish Fed rate cut. Overnight low traded was 1.10137. There are no major Euro area data reports for this week. The focus is the US Dollar and upcoming data.

- AUD/USD – The Australian Dollar dipped to 0.6830 from 0.6865 yesterday on broad-based USD strength. Australia’s Employment report is out this morning (11.30 am Sydney). Median expectations are for a modest gain in both full-time and part-time jobs.

- GBP/USD – Sterling eased to 1.2470 from 1.2500 against the overall stronger Greenback. The Bank of England holds its policy meeting today (9 pm Sydney). The BOE is widely expected to keep its policy unchanged with the Official Bank rate at -0.75%.

On the Lookout: Central banks remain the focus today with the Bank of Japan, Swiss National Bank and Bank of England all expected to maintain status quo and keep policy unchanged. Barring any surprises, they will have limited impact on FX.

It boils down to upcoming US data after Fed Chair Jerome Powell stressed an uncertain outlook on future easing. Bond yields responded by staying firm.

Today sees Australia’s August Employment report with Full and Part time Jobs expected to show modest gains. The Participation and Jobless rate are forecast unchanged. Japan reports its All Industry Activity following the BOJ rate decision. The lone Euro area report today is the Eurozone Current Account for August. The UK releases its Retail Sales report just ahead of the Bank of England policy rate decision. The US reports its Current Account (August), Weekly Unemployment Claims and Philadelphia Fed Manufacturing data.

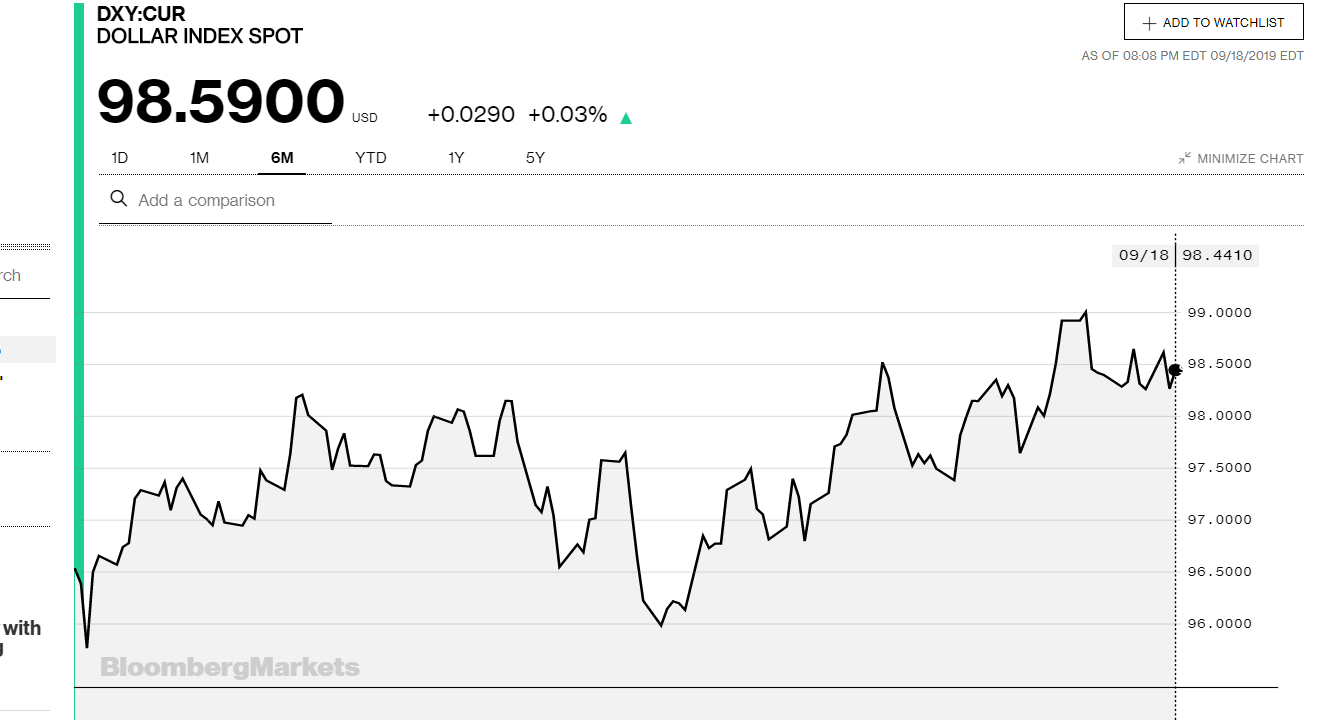

Trading Perspective: The firm US bond yields after the hawkish Fed rate cut will keep a bid on the Dollar. The Dollar Index (USD/DXY) has held the 97.80/98.00 technical support since late August. USD/DXY finished 0.35% up at 98.593 (98.231).

According to Joe Manimbo, senior market analyst at Western Union Business Solutions, “The tone of the Fed’s new forecasts remained largely sanguine despite the global risks. Consequently, the Dollar isn’t likely to stray far from recent highs.” Manimbo was quoted in a CNBC report. He has a valid point. If global economic conditions deteriorate, this would impact the US and Fed will have to trim rates again.

- USD/DXY – Expect the Dollar Index to remain within a wider 97.80-99.20 range which we have seen since the start of this month. The Dollar Index has immediate resistance at 98.70 followed by 99.00. The next resistance level is at 99.20. On the downside, expect support to emerge at 98.20/30, the next support coming in at 98.00. Look to trade a likely range of 98.30-98.80 range today. Look to trade this range for now.

- USD/JPY – The Dollar stayed firm against the Yen given the firm close in US bond yields, closing at 108.45, near overnight and 7-week highs at 108.478. Immediate resistance lies at 108.50 and 108.70. Immediate support can be found at 108.30 followed by 108.00. The BOJ could follow the path of the Fed and deepen its negative rates. Traders will focus on BOJ Governor Haruhiko Kuroda’s press conference following the rate decision. Look to trade a likely range of 108.20-108.90 today. Prefer to buy dips toward 108.00 as the market is positioned long JPY.

- EUR/USD – the Euro eased to 1.1030 after trading to an overnight low at 1.10137. EUR/USD traded to 1.10756 overnight highs which is now strong resistance. Immediate resistance for today can be found at 1.1050 and 1.1080. The downside of the Euro will be supported by speculative shorts. Immediate support can be found at 1.1010 followed by 1.0980. Look for a likely trading range of 1.1010-1.1060. Prefer to buy dips toward 1.1000 today.

- AUD/USD – The Australian Dollar retreated to 0.6830 after hitting an overnight low at 0.68123. Immediate support for the Aussie Battler lies at 0.6810. The next support level can be found at 0.6790. Australian Employment released today should set the short-term direction for the Battler. Median forecasts are for an Employment gain of 15,200 jobs in August following July’s +41,100. Anything less than 10,000 jobs could see the Aussie test back to 0.6780 first up. A gain of over 20,000 jobs would most likely test the immediate resistance at 0.6860. We highlighted yesterday that there was a modest trim of speculative Aussie shorts. This should support AUD/USD on dips with a likely range today of 0.6810-0.6870. Prefer to buy dips.

Happy trading all.