Asian stocks finished in a mixed fashion, as investors digest updates from both the European and US central banks. US President Donald Trump also threatened to impose tariffs on $11 billion of European Union (EU) imports as retaliation on what he claims to be unfair subsidies to Airbus. In Japan, the Nikkei225 main index added 0,69 percent to 21,861, the Hang Seng benchmark in Hong Kong finished 0.30 percent lower at 29,747. The Shanghai Composite underperformed, finished 0.43 percent lower at 3,176 and in Singapore the FTSE Straits Times index finished 0.25 percent lower at 3,322. Australian equities have rebounded from yesterday’s losses and finished the week higher. The ASX 200 finished Friday firmly in positive territory, climbing 52 points or 0.8% to 6251. The index was also higher for the week by 1.13%, its second consecutive weekly gain.

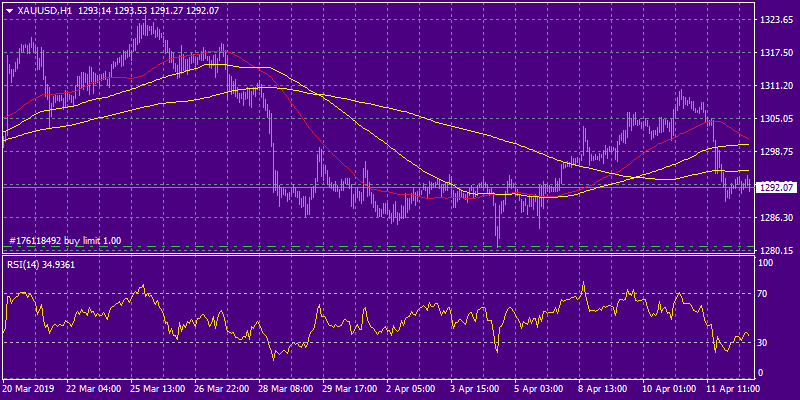

In commodities markets Crude oil retreats from a five-month high, giving up a buck at 63,80 amid OPEC’s ongoing supply cuts, geopolitical uncertainty and the US additional sanctions on Iran. The near-term upside target is the 65.00 figure, but I expect some profit taking to prevail as the black gold has reached overbought levels, the RSI trading above 70. Brent oil started the week with a gap up and trades today at $71.00/barrel also near recent highs. Gold got a hit on the chin yesterday losing 20 dollars from two weeks high at 1307 down to $1287 just to rebound in late Asian session at $1292. XAUUSD‘s technical picture has turned negative, and now immediate support stands at the 100-day moving average at $1285, which if broken can accelerate the downward move to 1260 and the 200-day moving average. Strong resistance now stands at the $1300 round figure and then at the 50-day moving average around $1307.

European session started green as the Brexit deadline extended for one more time, DAX30 is 0.25 percent higher to 11,935, CAC40 is 0.66 percent higher at 5,485 while FTSE100 in London is 0.03 percent lower at 7,417 and the FTSE MIB in Milan is trading 0.06 percent higher at 21,684.

In cryptocurrencies, Bitcoin (BTCUSD) ran out of steam and trades at the 5,030 mark, losing the key 200-day moving average resistance at $5,225 and making the daily low at 4,889. Bitcoin will find support at the 50-hour moving average at 4,514. Ethereum (ETHUSD) also retreats today, trading 10 dollars lower today at 163 while Litecoin (LTCUSD) is also down 10 dollars to 73.75.

On the Lookout: IMF Director Christine Lagarde said on Thursday that the six-month delay of Britain’s exit from the European Union avoids the “terrible outcome” of a “no-deal” Brexit, but does nothing to lift uncertainty over the final outcome. RBA in its semi-annual check on Australia’s financial system said that overall household financial stress remains low, the health of the job market is key. It warned if unemployment were to rise there is a greater risk for mortgage defaults. US initial jobless claims declined by 8,000 from the previous week’s revised level to 196,000, beating expectations for an increase to 211,000 and marking the lowest level since 4 October 1969.

In Brexit front, the EU struck a final accord and offered a flexible Brexit deadline extension until Oct 31st to the UK, leaving doors open for an early exit if the PM May manages to clinch a Brexit deal.

Investor’s attention set to be on today’s Q1 numbers from US banks JP Morgan and Wells Fargo.

Trading Perspective: In Forex markets, most majors are sticking to tight trading ranges for one more day as ECB and FED failed to impress investors. AUDUSD is trading in a narrow trading range, 0.14 percent higher at 0.7132 below the two-week high, after the cautious tone of the Reserve Bank of Australia during its bi-annual financial stability review. The central-bank downgraded growth forecasts and cited risks to trading partners and the global financial system. Kiwi is trading 15 pips lower at 0.6733 while the US dollar index adds 10 cents to 96.63.

GBPUSD consolidates between the 50 and 200-day moving average for one more day. Today the pair is trading slightly higher at 1.3065 (low at 1.3049, high at 1.30850) as Brexit deadline extension is likely good news for Cable. On the downside, major support will be found at 1.2977 at the 200-day moving average while solid protection can be found at the 100-day moving average around 1.2929. On the flipside, immediate resistance stands at 1.3195 the high from previous week session, and from there major resistance can be found at 1.3232 while 1.3382 the yearly high will be met with strong supply.

In GBP futures markets, open interest rose by around 2.7K contracts on Thursday. The volume increased by almost 5.5K contracts, extending the choppy activity for the time being.

EURUSD made an impressive jump during the Asian session at 1.1285 without any news supporting the move. The pair made the daily high at 1.1294. Euro needs to break above 1.13 to give bulls a breath and then approach the 50-day moving average at 1.1329 to establish short term bullish momentum. Immediate support can be found at the 100-hour moving average around 1.1215.

EURO remains in negative mood following recent poor figures in Eurozone. In fact, recent disappointing readings in the region somehow confirm that the slowdown in the bloc and the ‘patient-for-longer’ stance from the ECB could be among us for longer than expected.

On the Euro political front, headwinds are expected to emerge in light of the upcoming EU parliamentary elections, where the focus of attention will be on the potential increase of the populist and right-wing option among voters.

In Euro futures markets, traders scaled back their open interest positions by just 472 contracts on Thursday from Wednesday’s final 494,556 contracts. In the same direction, volume shrunk significantly by nearly 65K contracts, reversing the previous build.

USDJPY: The pair is trading higher today at 111,78 having hit the low at 111.58 and the high at 111.82. Major support for the pair stands at the 111 round figure, if the pair manages to break below the 100-day simple moving average at 111.10. Immediate resistance for the pair stands at 112.06, the March 2019 high.

Open interest in JPY futures markets rose by almost 10K contracts on Thursday from the previous day, while volume also went up by around 11.6K contracts, offsetting the prior drop.

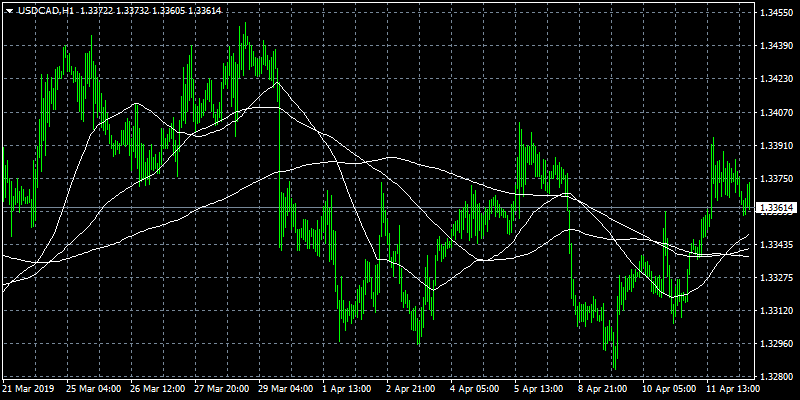

USDCAD retreats from recent high to 1.3371 as oil prices hold the recent highs. The pair will find immediate support at the 100-day moving average around 1.3322 while extra support stands at 1.3285 and the 50-day moving average which if breached will drive prices down to 200-day moving average key support. On the upside, immediate resistance stands at 1.34, a break of which can escalate recent rebound towards 1.3430.