Fresh Chinese worse-than-expected industrial production data which was the lowest output growth in 17 years weighed on Asian equities. In Japan, the Nikkei225 main index lost 0.02 percent to 21,287, and the Hang Seng benchmark in Hong Kong finished flat at 28,834. The Shanghai Composite shed 1.20 percent at 2,990, while stocks in Australia which had been under pressure for most of the afternoon, however, managed to claw back gains in the final hour of trade as the Financial sector improved. The ASX 200 closed up 18 points or 0.3% to 6,179.

In commodities markets, Oil rose above yesterday’s high to a fresh peak since March 1. The high on the first day of the month was $57.88. Crude oil today rallies further beyond $58.50 level, at a 4-month high. Brent oil is also trading higher at $67.95/barrel. Gold is under pressure today trading around $1302 after reaching above the $1312 resistance zone yesterday. XAU may find support at $1297 where the 50-day moving average crosses, ahead of testing 100-day simple moving average down to $1293.

Mixed start for equities in early European trading as investors watch the votes and developments surrounding the Brexit front that can offer the intermediate direction to markets. DAX30 is giving up 0.07 percent to 11,563, CAC40 is 0.32 percent higher at 5,323 while FTSE100 in London is 0.15 lower at 7,149.

On the Lookout: The Swiss State Secretariat for Economic Affairs (SECO) slashed 2019 GDP growth forecast to 1.1% from 1.5% while 2020 GDP growth maintained at 1.7%. In the UK, MPs face another Brexit vote this evening to extend Article 50 to 30 June (or beyond), after ruling out leaving without a deal last night.

In the US economic calendar, the main event will be the US weekly jobless claims, import prices, and the Canadian new housing price index which are due at 12:30GMT. At 14:00 GMT, the US new home sales data will be eyed for fresh USD positions. The UK parliamentary vote on Article 50 extension is scheduled at 19:00GMT, while New Zealand’s business PMI and visitors arrivals data will be published at 21:30GMT and 21:45GMT respectively.

Trading Perspective: The Aussie dollar is trading almost unchanged the last hours at the 0.7065 zone against the worst than expected Chinese macro data. The Kiwi is flat to daily lows at 0.6832. The US dollar index got many offers during US session and broke below the critical 96 level, just to make a small rebound today reaching 96.02.

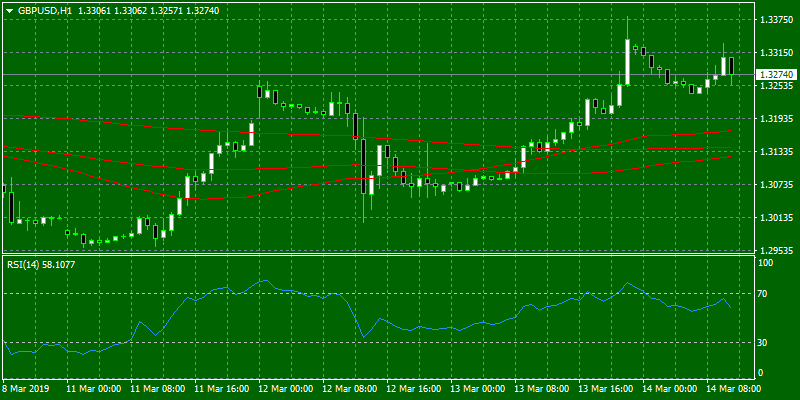

GBPUSD: Volatility is still the name of the game for the pair this week as good and bad news crossing the wires. Traders are closely watching the developments around Brexit votes and rumors, and we can see huge moves in the pair.

We have a busy Brexit Calendar, here are the main upcoming events:

- 14th March – Parliamentary vote on extending negotiations/Article 50

- 21st – 22nd March – EU Leaders’ Summit

- 29th March – Article 50 end date

- 9th May – European Council (heads of state) meeting

- 18th – 23rd May – EU Parliamentary elections

- 20th – 21st June EU Leaders’ Summit

The technical picture is bullish for GBPUSD, and yesterday the pair reached 1.3382 before falling down to 1.3265. Traders today started with bids regaining the 1.33 area. On the downside, major support will be found at 1.2990 where the 50 and 200-day moving averages are crossing. On the flip side, major resistance can be found at 1.3382 the high from yesterday.

In Pound futures markets, traders added nearly 6.3K contracts on Wednesday from Tuesday’s final 191,938 contracts. Volume, instead, dropped after four consecutive builds by more than 99.2K contracts.

EURUSD keeps the bullish tone that started this week in an attempt to regain some of the previous week losses. The pair is trading above 1.13 for the second day and is looking to break above 1.1342 yesterday’s high in order to establish a new bullish trend targeting 1.14. The low from yesterday session at 1.1277 provides immediate support, while the key support for the pair stands at yearly lows at 1.1175.

In Euro fundamental news, the Italian figures still disappoint with Italy Q4 unemployment rate at 10.6% vs. 10.5% expected by analysts. The unemployment rate ticks higher towards the end of last year as there was a drop of 36K in those employed. The big fallout comes from the industrial and agricultural sector.

On the EU political front, headwinds are expected to emerge in light of the upcoming EU parliamentary elections, where the focus of attention will be on the potential increase of the populist and right-wing option among voters.

In Euro future markets, open interest reverted the previous daily drop and increased by around 1.7K contracts on Wednesday vs. Tuesday’s final 536,724 contracts. The volume rose by the third session in a row, this time by around 55.2K contracts.

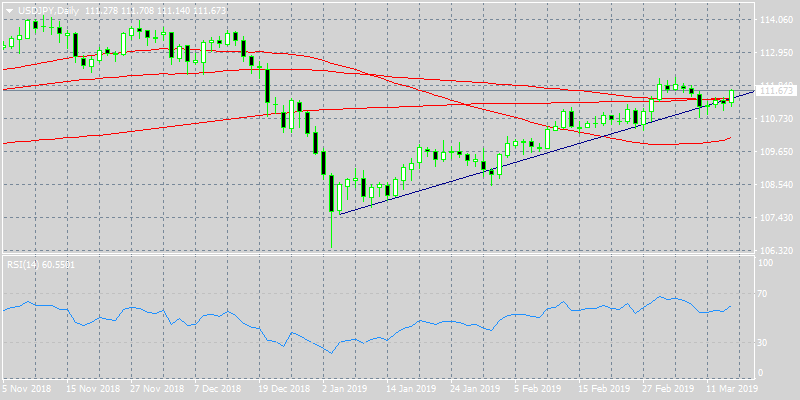

USDJPY shows strength in early European session climbing to fresh daily and weekly high, now at 111.67 for an attempt to 112 round figure resistance. Support can be found at the low from yesterday at 111.27.

In Yen futures markets, traders added around 10.7K contracts to their open interest positions on Wednesday, while volume also increased by nearly 44.9K contracts, recording the second consecutive build.