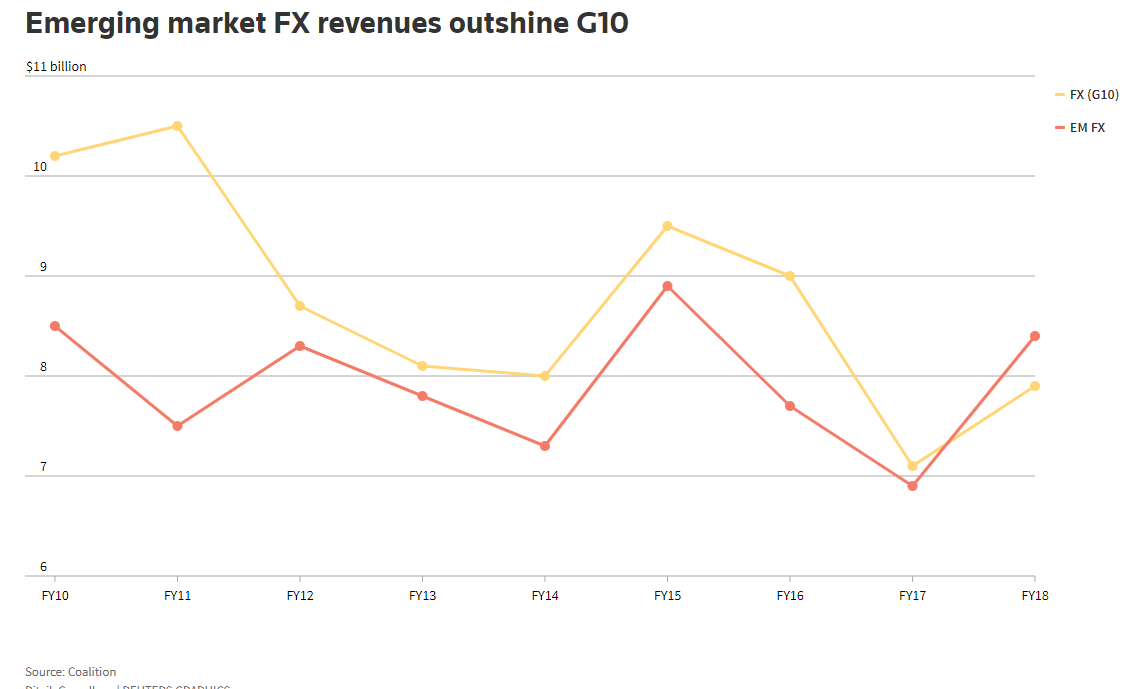

Summary: The Dollar Index (USD/DXY) closed little-changed (97.011) for the 3rd day running. G10 FX volatility stayed depressed, at 5-year lows. China’s economy grew at 6.4% in Q1, slightly higher than analyst’s forecast of 6.3%. Chinese Industrial production and Retail Sales also beat expectations, but markets were cautious after recent slowdowns in import growth and automobile sales. The Australian Dollar jumped to a two-month high at 0.7206 before easing to close flat at 0.7173. Even the British Pound failed to excite following a softer inflation report. Sterling traded in a relatively tight 1.3029-1.3067 range, closing at 1.3040 (1.3047 yesterday). The Euro was modestly higher at 1.1290 from 1.1283 while USD/JPY settled at 112.05 (112.02). USD/CHF was the exception, extending gains to 1.0106 (1.0080), up 0.25%. Emerging Market currencies which have earned Investment banks more trading revenue than the G10 markets last year, extended gains versus the Greenback. USD/TRY (Dollar- Turkish Lira) fell 1.19% to 5.7250 (5.7650). The Offshore USD/CNH was changing hands at 6.6750 from 6.7135 yesterday.

The slowdown in volatility in the major G10 markets were highlighted by an exclusive Reuters report. It showed that the 12 biggest investment banks made more trading revenue from Emerging Market currencies than the G10 counterparts last year.

Stocks eased and bond yields were steady. The US 10-year yield was unchanged at 2.59%.

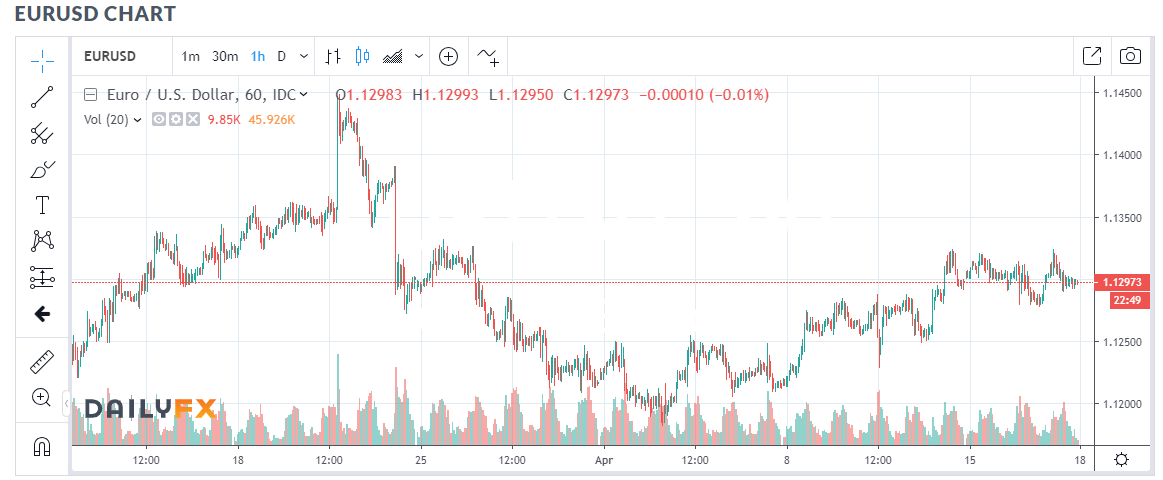

- EUR/USD – The Euro rallied to 1.13236 following the upbeat Chinese reports. The Single Currency then spent the rest of the trading session drifting lower after failing to break higher. EUR/USD closed at 1.1295.

- AUD/USD – The Australian Dollar managed to have a little more life in it’s trading session yesterday. Upbeat Chinese data saw the Battler break above 0.72 cents hitting fresh two-month highs at 0.72058. AUD/USD then drifted lower to finish little-changed at 0.7173. Australia’s Employment data is released today.

- USD/CHF – The Dollar continued to make headway against the Swiss Franc trading to a one-month high at 1.0110. Swiss Franc interest rates are currently the lowest among the Majors. Swiss 10-year bond yields closed at -0.29%.

On the Lookout: The low FX volatility will not linger for too much longer. Traders should be prepared (and hopeful) for a breakout attempt in the current Easter markets. With a lot of data out, we may be in for a change. Happy days ….

Today sees another data dump with Japanese Flash Manufacturing PMI’s to start off. Australia’s March Employment Change and Unemployment rate follow. National Australia Bank’s Quarterly Business Confidence Index is also released. Australia is expected to have added 15,200 Jobs from the previous 4,600. The Jobless Rate is expected to increase to 5.0% from 4.9%. Apart from AUD traders, the RBA will closely monitor this report.

Europe sees Swiss Trade Balance and German PPI data. Euro area and Eurozone Services and Manufacturing PMI’s follow. Production data in the Euro area is expected to have stabilised after a period of weakness in Q1. The UK, Canada and the US release their Headline and Core Retail Sales reports for March. US Flash Manufacturing and Services PMIs, Weekly Jobless Claims and Philly Fed Manufacturing reports round off the day’s data releases.

Trading Perspective: While the G10 FX volatility remained close to 5-year lows, traders should be prepared for a breakout. In a separate study, BNN Bloomberg noted that over the last 25 years, periods of low volatility have preceded a big move for the Dollar. Which is great for any currency trader, whether you are a Greenback bull or a bear. As an experienced former bank FX trader, this observation is accurate. A return to more volatile markets is not far away.

- EUR/USD – The Euro has been holding on to the 1.1300 level for this week. Euro area PMIs will be closely watched by the markets today. Most of the reports are expected to beat forecasts. They will have to after the disappointment seen in Q1. The big levels EUR/USD remain 1.1250 and 1.1350. With market positioning still short Euro bets are multi-year highs, the risk is for a topside attempt. Immediate resistance can be found at 1.1330 followed by 1.1350. Immediate support lies at 1.1280 and 1.1250. Likely trading range today 1.1280-1.1330. Prefer to buy dips.

- USD/JPY – This currency pair has grinded higher to the 112.00 level where is has settled in the past three trading days. Overnight high traded last night was 112.165, near 6-week highs. The climb in the US 10-year bond yield to its current 2.59% and a risk-on market profile has supported USD/JPY. However, it is struggling to make much headway from here.

Market positioning saw an increase in JPY short bets to -JPY 71,500 contracts from -JPY 62,700. The next likely move for USD/JPY is south. Immediate support lies at 111.80 followed by 111.50. Immediate resistance can be found at 112. 20 and 112.50. Likely range today 111.70-112.10. Look to sell rallies. - AUD/USD – the Australian Dollar came to life this week, falling to 0.7140 following the RBA minutes which was initially interpreted as dovish. The market changed its mind quickly and AUD/USD climbed to 0.7175. Upbeat Chinese data boosted the Battler to fresh 2-month highs at 0.72058 before drifting lower to close at 0.7175 for the 2nd day running. Today’s Australian Jobs report will be closely watched by both traders and the RBA. Speculative market positioning in the Aussie remains short. Immediate support lies at 0.7140 and 0.7110. Immediate resistance can be found at 0.7210 and 0.7240. Keep an eye out on the EM currencies as well. If they stay elevated against the US Dollar, this will be Aussie supportive. Look to buy dips in a likely range of 0.7160-0.7210 today.

Wishing you the best for the Easter break. Happy trading all.