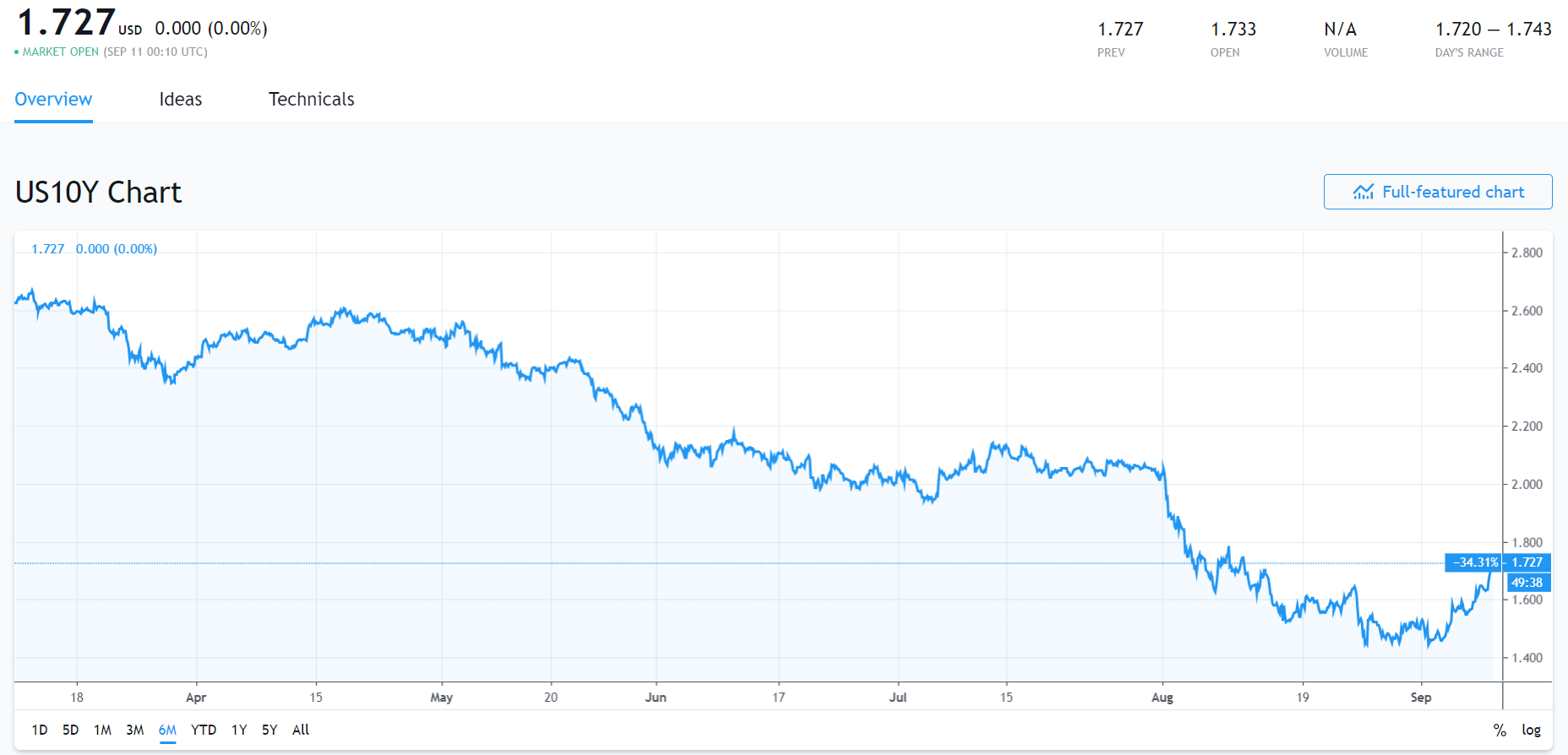

Summary: FX paused for the second day running with little fresh news or data to break it out of recent tight ranges. Markets maintained a wait-and-see attitude ahead of tomorrow’s ECB meeting, the week’s big event. The Euro eased modestly against the Greenback to 1.1042 (1.1047), sticking within its 4-day range (1.1015-1.1085). The ECB is widely expected to introduce further monetary stimulus although traders doubt whether this is enough to address the economic weakness in the Eurozone. Sterling closed steady at 1.2355 from 1.2348 on further upbeat UK employment data, forcing weak shorts to cover. Speculative Pound shorts remain near two-year highs. Against the Yen, the Dollar rose to August 2 highs at 107.582, settling at 107.55 on higher US bond yields. The Dollar Index (USD/DXY) rose 0.10% to 98.377 (98.334). US Treasuries dipped anew on a further corrective move to their August rally, lifting yields. The benchmark US 10-Year rate rose 9 basis points to 1.73%, the highest since August 12.

Risk sentiment was mixed with stocks edging up at the close after selling off earlier in the day. The DOW finished up 0.2% to 26,894. (26,849) while the S&P 500 was flat at 2,978.

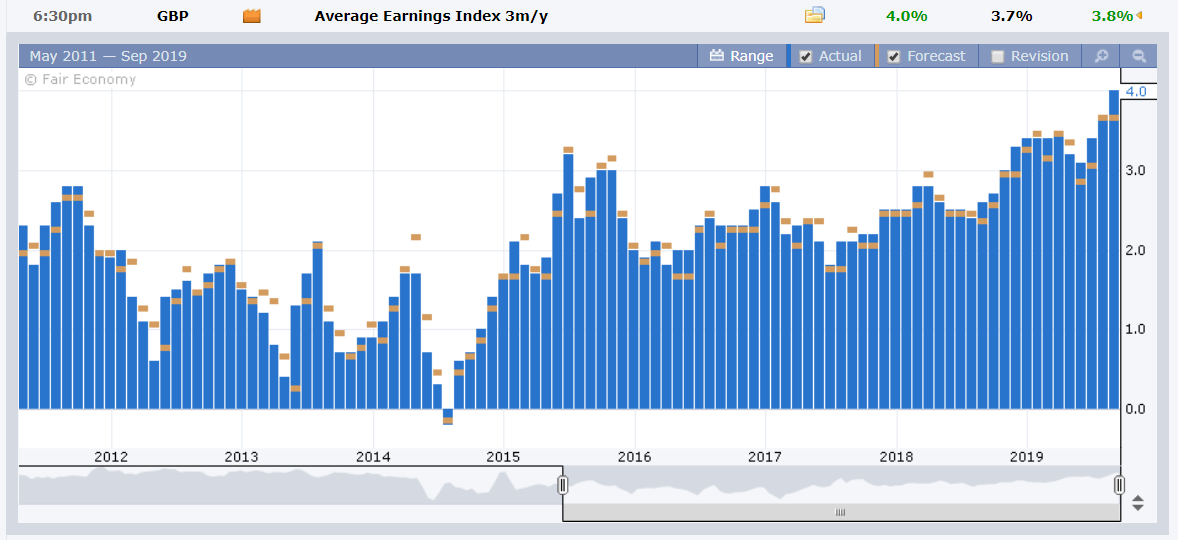

UK Average Earnings (Wages) in August rose to 4%, beating forecasts of 3.7%. Britain’s Unemployment rate improved to 3.8% from 3.9% in July. US JOLTS Job Openings fell to 7.22 million in August from a revised downward 7.25 million in July.

- EUR/USD – The Euro retreated to 1.1042 from 1.1047 after reaching 1.1060 in overnight trading. The shared currency stuck to a narrow 30-point range (1.1030-1.1060) into tomorrow’s ECB meeting.

- USD/JPY – The Dollar climbed against the Japanese Yen to 107.582, its highest since August 2, settling at 107.55. USD/JPY was boosted by higher US 10-year bond yields, up 8 basis points to 1.73%. By contrast, Japanese 10-year JGB rates rose 2 basis points to -0.24%.

- GBP/USD – Sterling was stable after another set of better-than-expected UK data, this time on the employment front. GBP/USD finished at 1.2355 (1.2348 yesterday). The probability of a no-deal Brexit remained on PM Boris Johnson’s stance that he will take the country out of the EU on the Oct 31 deadline. The British currency’s recent slide to low critical levels has been an opportunity for the weak speculative shorts to cover.

On the Lookout: The rise in US bond yields saw global rates of its peers generally higher, although to a lesser degree. This widens out the differentials in favour of the US which is Dollar supportive.

Data releases today are few with US Headline and Core PPI the highlights. Ahead of that are Australia’s Westpac Consumer Sentiment, Japanese BSI Manufacturing Index, and Canada’s Capacity Utilisation Rate (August).

Tomorrow sees a data dump ahead of the ECB’s policy meeting and US CPI report.

Trading Perspective: The narrow ranges should extend into Asia with slightly better support for the US Dollar. With yield differentials favouring the Greenback, its hard to see any extended sell-off. There is much expected from the ECB at the outcome of its meeting tomorrow. ECB policymakers are expected to deliver further stimulus which includes a rate cut and a possible restart of asset purchases. The Euro has rallied on the back of broad-based US Dollar weakness brought about by last week’s weak US Payrolls. Which forced bullish US Dollar bets against the Euro, Sterling and Aussie to cover.

- EUR/USD – The overnight high traded for the shared currency was 1.10595, lower than the previous night’s high at 1.1068. Overnight low was 1.10307, with the close at 1.1042. The range narrowed to a tight 30 points without much fresh catalysts for a break-out. Immediate support lies at 1.1030 and 1.1000 today. Immediate resistance can be found at 1.1060 followed by 1.1080. Germany’s 10-year Bund yield was 4 basis points higher at -0.55%, half of the climb of its US counterpart. Look for a likely range today of 1.1010-1.1060. Just trade the range shag on this one.

- USD/JPY – The combination of higher US 10-year yields and a short USD/JPY speculative market positioning lifted this currency pair to 107.582, finishing not far off at 107.55. Immediate resistance can be found at 107.80 followed by 108.00 and then 108.30. The resistance at 107.80-108.00 level is strong and we would need to see higher US bond yields for this to happen. The latest COT/CFTC report saw speculative JPY long bets pared to +JPY 27,700 contracts from +JPY 33,600. We would need a particularly strong US Retail Sales report (Friday) to see a break-up through 108.00. For today look for a likely 107.30-107.80 range.

- AUD/USD – The Aussie Battler finished flat around 0.6862 (0.6865 yesterday) after trading to an overnight high at 0.68700. AUD/USD has immediate resistance at 0.6880 followed by 0.6900. Overnight low for the Australian Dollar was 0.68373. With the lows coming higher, chances for another test at 0.6880 are possible if the US Dollar turns lower. Immediate support lies at 0.6835 and 0.6800. Look to trade a likely range of 0.6830-0.6880 today. Prefer to sell rallies.

- GBP/USD – Sterling continues to grind higher mainly on short-covering. Two sets of upbeat UK economic data supported the British currency which rallied off multi-year lows. Politics still outweighs economics for Sterling. PM Boris Johnson insisted he won’t ask for another Brexit delay. GBP/USD closed at 1.2355 (1.2348 yesterday). Overnight high traded was 1.23795. Immediate resistance lies at 1.2380 and 1.2410. Immediate support can be found at 1.2330 and 1.2300. Look to trade a likely range today of 1.2330-1.2380. Prefer to sell rallies.

Happy trading all.