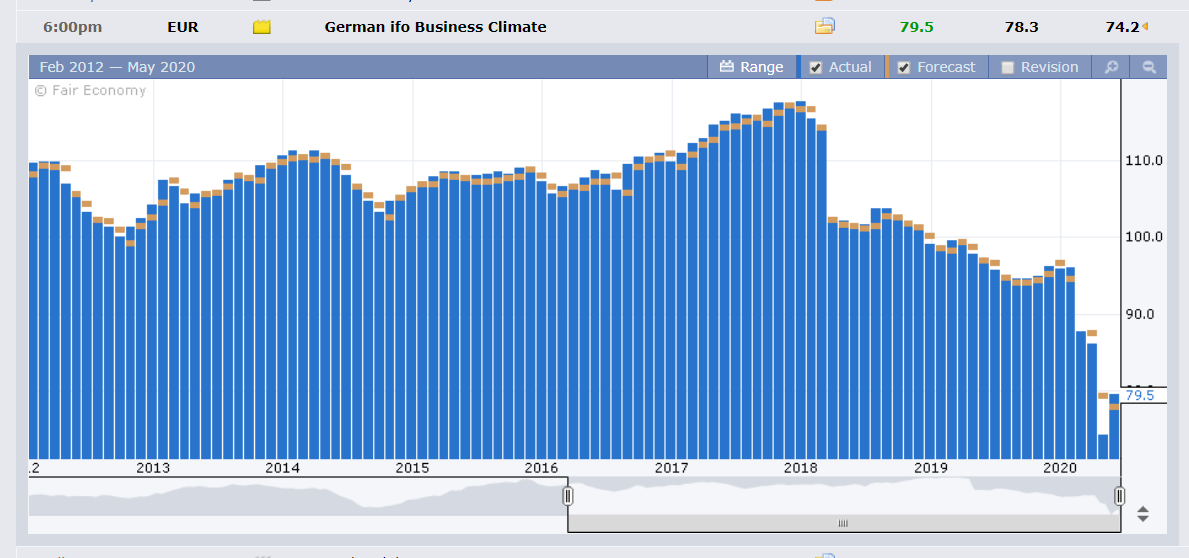

Summary: FX was featureless in thin trade despite many potential catalysts across the globe, due to twin holidays in the UK and US, where the largest global trading centres reside. The Dollar Index (USD/DXY), a favoured gauge of the US currency’s value against a basket of six foreign rivals, was little changed at 99.80 (99.90). Upbeat German Business Climate from its IFO Survey in April to 79.5 from 74.3 in March, bettering forecasts at 78.3, steadied the Euro to 1.0897 from 1.0902 yesterday. Sterling rallied to 1.2188 from 1.2166 after Prime Minister Boris Johnson said yesterday that Britain will reopen thousands of high street shops, department stores and shopping centres next month. Elsewhere, Chinese intentions to get Hong Kong to adopt new national security laws saw protests in the territory turn ugly. Tear gas and water cannons were used and close to 200 protestors were arrested. The US named 33 Chinese companies that could be restricted from listing on the American exchanges or raising money from US investors. Against the Offshore Chinese Yuan, the Dollar (USD/CNH) ended flat at 7.1470. The Australian Dollar was little changed at 0.6547 from 0.6537 yesterday. USD/JPY was modestly higher at 107.72 (107.67) with risk appetite much in check in the thin markets. Wall Street stocks climbed with the DOW up 1.17% to 24,768 (24,520). The S&P 500 rose 1.2% to 2,995 from 2,965 yesterday.

Yesterday’s economic calendar was light. Apart from Germany’s IFO Business Sentiment Climate, Germany’s Final Q1 GDP matched forecasts at -2.2%.

On the Lookout: We can expect more consolidation today with traders monitoring developments in Hong Kong, and the ongoing US-China tussle. President Trump was notably silent on Hong Kong following yesterday’s protests. Hopes of a global economic restart buoyed risk sentiment.

Today’s economic data calendar picks up. New Zealand kicks off with its Trade Balance which is expected to show an improvement in the Surplus. Japan follows with its All Industries Activities, Services Producer Price Index (SPPI, a leading indicator of consumer inflation), and the Bank of Japan’s Core CPI report. Euro area data start with Switzerland’s Trade Balance followed by Germany’s GFK Consumer Climate read, and the UK’s CBI (Confederation of British Industry) Realised Sales report. The ECB releases its Financial Stability Review. US data follow with US House Price Index, S&P/Case Shiller Composite 20-Year House Price Index, Conference Board Consumer Confidence, and New Home Sales. FOMC member and Minneapolis Fed President Neil Kashkari speaks in a panel discussion on the Covid-19 pandemic. Outgoing Bank of Canada Governor Stephen Poloz speaks together with his Senior Deputy Carolyn Wilkins before the Senate Committee on National Finance (tomorrow morning Sydney time 7 am).

Trading Perspective: The Dollar’s fate lies in the balance with risk appetite still the main influence for FX. The month of May has seen the currencies consolidate within ranges. While breakouts were attempted, the overall ranges stuck. The Euro, for example traded between 1.0770 and 1.1020. Its difficult to see a breakout of either extreme, for now.

The US-China tussle remains in the forefront of markets. The relative silence of President Trump and other nations following China/Hongkong saw risk steady and US stocks rally. With economies reopening, traders will focus on the upcoming data releases.

We look at the latest market positioning in the various currencies tomorrow. Meantime the currency reports today see further consolidation.

AUD/USD – Balanced Around 0.6550, Awaiting the Next Catalyst

The Australian Dollar kept its head above 0.65 cents, trading in a slow, relatively tight 30 pip range between 0.6520 and 0.6550 basically. Prime Minister Scott Morrison unveils his plan to combat China’s recent slapping of tariffs on Australia’s exports. Details are scant which should keep the Battler in a relatively tight trading range.

AUD/USD has immediate resistance at 0.6560 followed by 0.6600, which remains strong. Immediate support can be found at 0.6520 and 0.6480. Look to trade within a 0.6510-0.6560 range today. The risk is lower first, but with the market positioning short, there should be good buying support between 0.6480-0.6500. The resistance at 0.6600 will be tested if we manage to hold above 0.6500 cents by mid-week.

EUR/USD – Steadies Near 1.09 on Upbeat Business Survey, Risk Remains Lower

The Euro found support from an upbeat German IFO Business Survey report which bettered forecasts and its previous read. EUR/USD closed just under the 1.0900 level at 1.0896. Overnight, the shared currency traded to a low of 1.08705 before steadying. The euphoria surrounding the Franco-German EUR 500 billion grant facility faded after the proposal was immediately opposed. Over the weekend, Austria, Denmark, Holland, and Sweden offered an alternative proposal but with conditions. The European Commission is expected to make its own proposal soon and will set the stage for negotiations between the heads of state.

EUR/USD has immediate resistance at 1.0915 (overnight high 1.09144) followed by 10950. The big resistance still lies at 1.1000 and that needs to break to see a fresh upside move. Immediate support can be found at 1.0870 followed by 1.0830. The risk is still lower with the market’s positioning long of Euros. Until that is corrected, the Euro is still a sell on rallies. We look at the latest market positioning on the shared currency tomorrow.

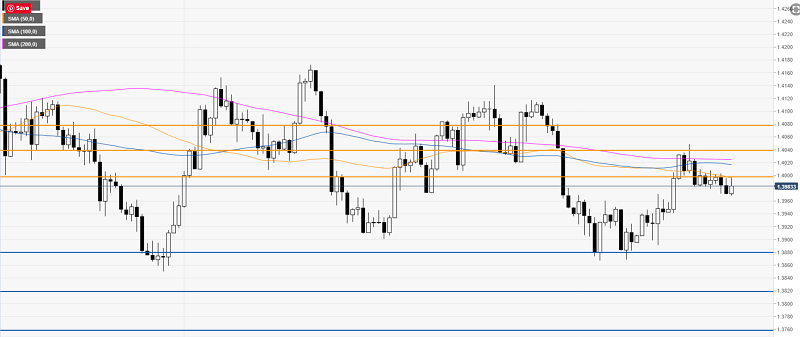

USD/CAD – Hovers Under 1.40, the Catalyst is Still Risk Sentiment

The Dollar traded in a relatively tight range against the Canadian Loonie in thin, holiday-affected trade. The overall range for the USD/CAD pair was 1.2164-1.40075. Relatively stable Oil prices have supported the Canadian Dollar. After some extreme volatility in April, the USD/CAD has consolidated in a relatively stable 1.3870-1.4120 range.

Outgoing Bank of Canada Governor Stephen Poloz is speaking tonight (7 am Sydney time, 27 May) together with Deputy Governor Carolyn Wilkins before the Senate Committee on National Finance.

US data releases today will also impact the Loonie.

USD/CAD has immediate support at 1.3965 (overnight low 1.39687) followed by 1.3920. Immediate resistance can be found at 1.4010 (overnight high 1.40075) followed by 1.4050. Look for a likely trading range today of 1.3965-1.4015. Prefer to buy USD/CAD dips.