Asian indices finished higher today after better data from China; the Caixin Services PMI rose from previous 51.6 to 52.1 in August. The Hang Seng ended 3.55 percent higher at 26,423 registering the largest daily gain in more than 8 years. Nikkei 225 in Japan ended 0.12% higher at 20,649. The Shanghai Composite trading 0.86 percent higher to 2,955, while in Singapore the FTSE Straits Times index finished 1,44 percent higher at 3,134. The ASX 200 in Australia trading 0.87% lower to 6,516.

European equities started higher today, DAX30 is 0.89 percent higher to 12,019, CAC40 is 0.99 percent higher at 5,520 while the FTSE MIB in Milan is 1.55 percent higher at 21,730. In London FTSE 100 is trading 0.29% higher at 7,289.

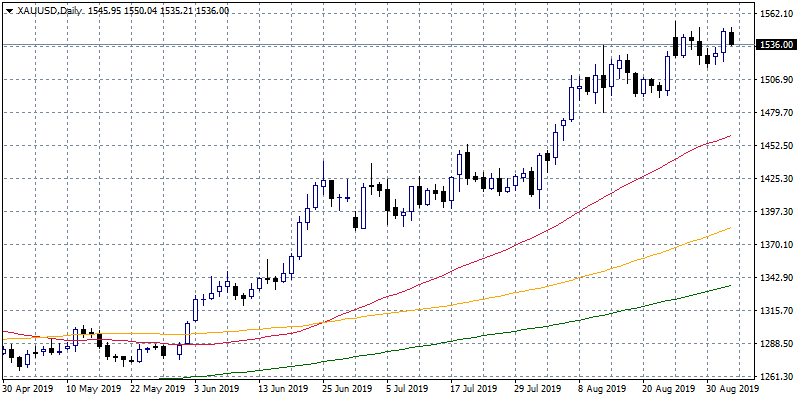

In commodities markets, crude oil trades 1.08 percent higher at $54.52 as traders turn cautious on recent trade war escalation and global growth concerns. Brent oil is trading 0.74% higher at $58,69 per barrel despite the fact that major oil producers have agreed to cut output. Gold trades lower at 1,534 keeping the bullish momentum as the price holds above all the major daily moving averages. On the upside, strong resistance will be met at 1,555.13 recent high.

In cryptocurrencies, Bitcoin (BTCUSD) trading higher at 10,563, hitting the daily low at 10,425 and the daily high at 10,714. Bitcoin short term momentum is bullish now as it trades above the 100-day moving average. Immediate support for BTC stands now at $9,258 recent low, while next support stands at 9,000. On the upside, strong resistance now stands at 13,138 recent high and then at 13,500 round figure. Ethereum (ETHUSD) continues the rebound from 4-month lows at 177,92 with capitalization now to 19.4 billion, on the upside the immediate resistance stands at 317 high while the support stands at 136 the low from May 6th, Litecoin (LTCUSD) also trades higher at 67.51. The crypto market cap now stands above $268.8 billion.

On the Lookout: The central bank of China set the Yuan rate (USDCNY) at 7.0878 at the lowest level in 11 years, versus yesterday fix at 7.084.

China Caixin Services PMI rose from previous 51.6 to 52.1 in August

Australia Gross Domestic Product (year over year) came in at 1.4% in line with forecasts for 2Q; the quarterly reading also matched forecasts. Australia Commonwealth Bank Services PMI came in at 49.1 (August) versus previous reading of 49.2, the AiG Performance of Services Index rose from previous 43.9 to 51.4 in August

New Zealand ANZ Commodity Price rose from previous -1.4% to 0.3% in August.

Trading Perspective: In forex markets, USD index trades 0.29 percent higher at 98.61, the Aussie dollar trades 0.42 percent higher at 0.6787, while Kiwi trades 0.26% higher at 0.6352.

GBPUSD trades 0.97% higher at 1.2198. Major support now stands at 1.2078 daily low which if broken might accelerate the slide further towards 1.20. On the upside, immediate resistance now stands at 1.2312 the 50-day moving average while more offers will emerge at 1.2558 the 100-day moving average.

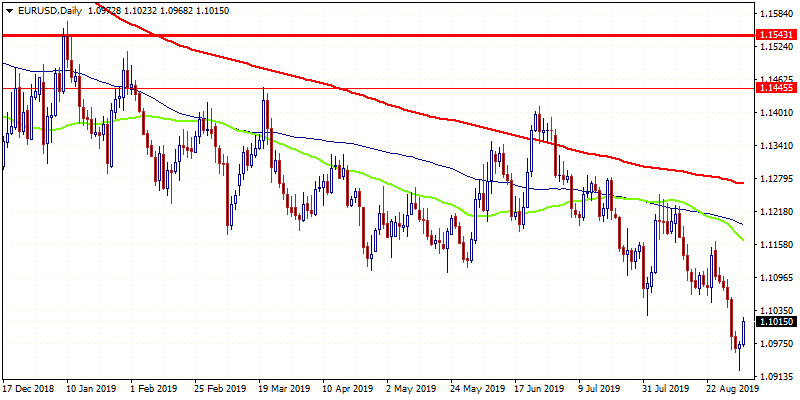

EURUSD trades 0.41% higher and breaks above 1.1017, after mixed signals from the US-China trade war developments. Immediate resistance for the pair stands at 1.1164 the 50-day moving average and then at 1.1271 the 200-day moving average. On the downside, immediate support stands at 1.0968 today’s low and then at 1.0925 YTD low.

USDJPY is trading 0.30% higher at 106.24 having hit the daily low at 105.82 and the daily high at 106.29. USDJPY pair will find support at 104.44 the low from August 23rd. On the upside, immediate resistance for the pair now stands at 107.20 the 50-day moving average and then at 108.52 the 100-day moving average.

USDCAD is trading 0.12 lower at 1.3320, the pair will find immediate support at 1.3017 the YTD low while extra support stands at 1.30 round figure. On the upside, immediate resistance now stands at the 1.3356 high from September 3rd before an attempt to 1.3450 high from 31st May.