Summary: December FOMC Meeting minutes revealed dissension amongst members on the rate hike and reinforced the Fed’s cautious approach to further tightening. Trade optimism remained as China and the US extended talks for the third day in Beijing. The end-result was broad-based Dollar weakness. The Dollar Index (USD/DXY) slid to October lows, closing at 95.15 (95.914 yesterday). EUR/USD climbed 0.8% to 1.1550, the Kiwi was up 0.8% to 0.6798. The Dollar slipped against the Yen to 108.02 (108.67 yesterday). Germany’s trade surplus beat forecasts offsetting yesterday’s weak factory output. The Bank of Canada kept policy unchanged, leaving its overnight rate at 1.75%.

The US government shutdown entered Day 19 without resolution, further weighing on the Greenback as Sydney markets opened.

Wall Street stocks pared gains made earlier on the day, weighed by the partial government shutdown. The S&P 500 was up 0.6% at 2585 (2570).

Brent Crude Oil prices soared 4.5% boosted by OPEC cuts and optimistic trade talks.

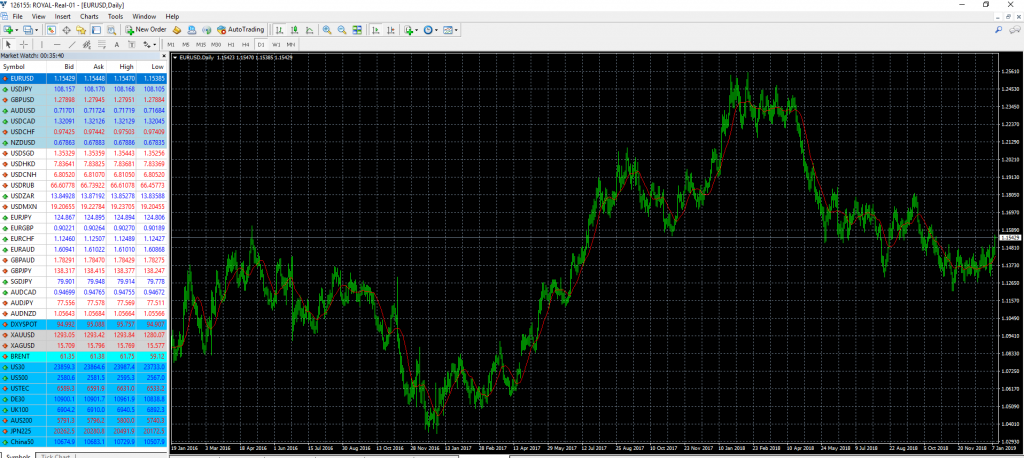

- EUR/USD – The Euro broke above 1.1500 on the dovish Fed meeting minutes and upbeat German trade data. EUR/USD climbed to 1.1557, hitting its strongest level since mid-October. The Single currency pared gains to close at 1.1551.

- USD/JPY – slip-sliding away, this currency pair fell to 107.97 overnight lows, and closing at 108.02, down 0.7%. Japanese economic data releases come through today and tomorrow together with more Fedspeak.

- AUD/USD – rallied to just under 72 cents on broad-based US Dollar weakness. The Aussie finished at 0.7177, up 0.2%. The Battler’s gains were limited by downbeat Australian Building Approvals which fell well below forecasts.

On the Lookout: The FOMC meeting minutes reiterated the Fed’s “patience” about further rate increases. While most members voted to raise interest rates in December there were a few dissensions. Fedspeak mostly echoed lowered expectations of rate increases in 2019.

Several more Federal Reserve officials speak later today. FOMC members James Bullard and Charles Evans speak at different events. The highlight will be Fed Chair Jerome Powell who addresses the Economic Club of Washington DC where audience questions are expected. Upbeat Sino-US trade talks in Beijing are expected to end today with a statement expected. Data releases today begin with China’s annual PPI and CPI for December, followed by Japanese Leading Economic Indicators and 30-Year JGB Bond Auction for Asia. Europe sees ECB Monetary Policy Meeting accounts followed by the US Fed speakers.

Trading Perspective: While the Dollar is clearly on the back-foot, the events and data releases could make for a rebound. Fed Chair Powell’s speech will be closely followed. While trade talks between China and the US remain optimistic, any disappointment will give the Greenback support, while weigh on stocks. Tomorrow sees the release of US Headline and Core CPI which will be crucial. Fed officials said that they could afford to be more “patient” about tightening rates due to “muted inflation pressures”.

US bond yields steadied further with the 10-year finishing 2 basis points higher at 2.74%. Germany’s 10-year Bond yield settled at 0.27% from 0.22%.

- EUR/USD – The Single Currency hit a high of 1.1557 not seen since October 17 last year. The Euro backed off those highs and settles currently at 1.1543, suggesting that the immediate resistance at 1.1555/60 should hold. The ECB has it’s turn tonight when it releases its monetary policy meeting accounts. A bit of caution on the topside before getting too carried away. We see a likely trading range of 1.1485-1.1555 today.

- USD/JPY – The Dollar slid to 107.97 earlier this morning before settling at 108.15 currently, suggesting immediate support just under 108.00. If we look back to May 2018, USD/JPY has been in a wider 108-113 range. And unless we see a lower US 10-year bond yield, its difficult to see that break. That said, the USD/JPY always tends to overshoot (as it did during the recent flash-crash). Japanese data releases today and tomorrow and further Fedspeak will determine the next big move for this currency pair. Immediate support lies at 107.90 and then 107.60. Immediate resistance can be found at 108.35. For today we see a likely range of 107.95-108.55.

- AUD/USD – The Aussie traded to 0.71939, short of the immediate resistance at 0.72 cents. The Aussie lagged its Rivals against the generally weaker US Dollar. Base metal prices stabilised after their strong rally earlier this week. Trade talks between China and the US remain the big factor for the Battler. Chinese CPI and PPI data releases today will also impact the currency. The resistance on the AUD/USD pair lies between 0.7200/20 and that should cap any rallies for today with a likely range of 0.7150-0.7200.

- S&P 500 – This Wall Street financial stock index rallied to a high of 2595 before paring gains to close with modest gains at 2589. Immediate resistance can be found at 2600 followed by 2630. Immediate support lies at 2560 and then 2520. The ongoing government shutdown will limit any further gains. The risk is down should optimism on trade fail to sustain.

Happy trading all.