Summary: The Dollar rebounded after Federal Reserve Chair Jerome Powell shrugged off negative rates when questioned during an event where he spoke at. “The committee’s view on negative rates really has not changed. This is something we are not looking at,” said Powell. On the economy, the Fed Chair said the US could face an “extended period” of weak growth. USD/DXY, the US Dollar Index, a favoured gauge of the Greenback’s strength against 6 major currencies, rebounded 0.29% to 100.223 (100.04 yesterday). Prior to Powell’s speech the Dollar was under pressure against most of its rivals. Earlier in the day, the RBNZ left its OCR (Overnight Cash Rate) unchanged at 0.25% but surprised traders by doubling its intended QE purchase amounts. The New Zealand central bank said that they are prepared to ease interest rates further if needed. The Kiwi tumbled to 0.6005 from 0.6065 immediately, dipping further to 0.5980 overnight before settling to close at 0.5995 in New York. The Australian Dollar also traded lower to 0.6438 from 0.6470 yesterday, trading to 0.6455 in late New York. Australia’s Employment report is due today (11.30 am Sydney time) and a bad number could see further losses for the Battler. The British Pound fared better against the US Dollar, dipping 0.14% to 1.2235 (1.2255) after UK Q1 GDP and other UK data were better than forecast. The Euro retreated 0.25% to 1.0817 from 1.0847. Against the safe-haven Yen, the Dollar was moderately lower to 107.05 from 107.15. Wall Street stocks slipped on Powell’s remarks on the economy. The DOW was 1.08% lower to 23,305 (23,595). The S&P 500 was at 2,825 from 2,847, down 0.74%. Global bond yields were a touch lower, the key US 10-year rate closing at 0.65% (0.67%). Germany’s 10-year Bund yield ended at -0.54% from -0.51% yesterday.

Japanese Economic Watchers Sentiment Index dipped to 7.9 from 14.2, missing forecasts at 10.1.

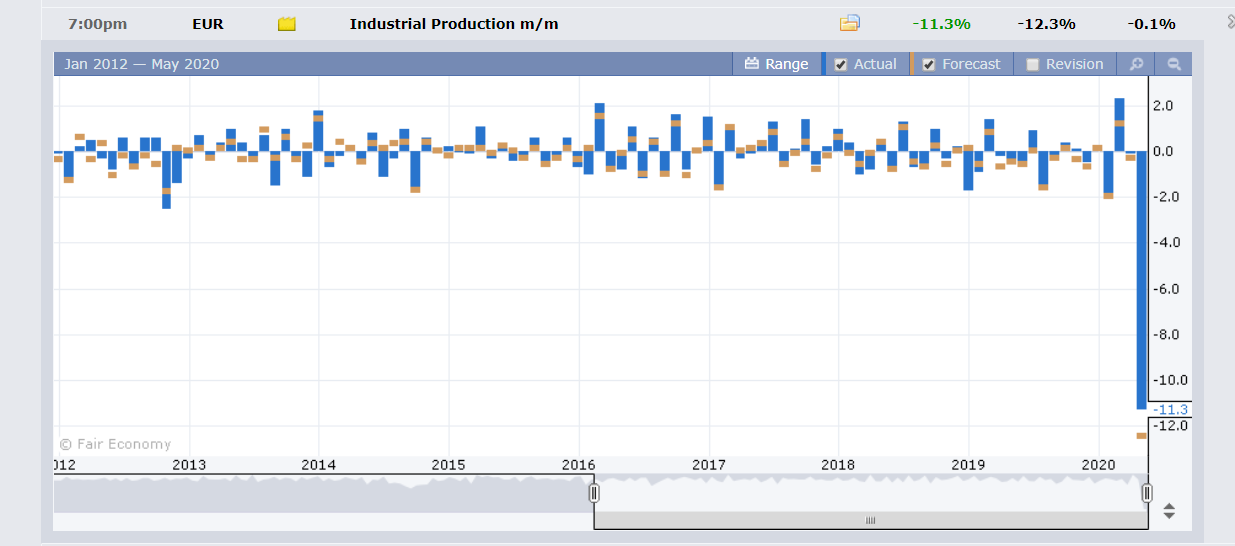

The UK Q1 GDP was at -2.0% from 0.0% in Q3, beating forecasts of -2.5%. UK Manufacturing Production also beat expectations with a -4.6% print against -6.0%. UK April (monthly) GDP also beat forecasts at -5.8% against -7.9%. Eurozone Industrial Production fell to -11.3% from -0.1% (March) beating forecasts at -12.3%. US Headline PPI fell to -1.3% (forecast -0.5%) while Core Producer Prices were at -0.3% against median expectations of -0.1%.

On the Lookout: Data releases today will continue to paint a bleak global economic picture. New Zealand kicks off with its Monthly Visitor Arrivals report. New Zealand will also release its Annual Budget report later in the day. Australia releases its April Employment report, expected to see a loss 575,000 jobs while the Unemployment rate is forecast to spike to 8.3% from March’s 5.2%. China releases its Foreign Direct Investment report. Japanese Preliminary Tools Orders follow.

Euro area reports start off with Germany’s Final CPI and WPI (Wholesale Price Index). Swiss PPI follows. Bank of England Governor Andrew Bailey is due to speak at a financial webinar. Canada reports its Manufacturing Sales for April while the Bank of Canada releases its Financial System Review followed by a speech from BOC Governor Stephen Poloz. The US releases this week’s latest Unemployment Claims report.

Trading Perspective: While the US Dollar has gained the upper hand, its performance is still inconclusive. The Dollar Index (USD/DXY) is still a long way from its March highs at 103.00. The Greenback has been trading in a relatively tight range between 98 and 101.

The US currency faces another test today with the release of the latest weekly US Unemployment Claims report. Jobless Claims in the US are forecast to ease to 2.5 million from the previous week’s 3.169 million. The number is still huge, but it is still better than the previous number.

Australia’s Employment report will also have the potential to move the Aussie which has been stuck between 0.64 and 0.66 cents. We look at the individual currencies.

EUR/USD – Quietly Steady, However, a Downside Break Remains Real

The Euro had another subdued trading session where the shared currency held steady despite broad-based US Dollar strength. EUR/USD traded to an overnight high at 1.08964 before slipping to a New York close at 1.0818, down 0.25% from yesterday’s 1.0848. Euro area data saw Eurozone Industrial Production fall to -11.3% in April from March’s -0.1%. While production fell, it was slightly better than expectations of a -12.3% fall. The drop is still huge. There has been an absence of Euro area reports this week, but Friday sees Germany’s Q1 GDP report which could be huge for the Euro.

We reported the net speculative long Euro bets were trimmed to +EUR 76,299 contracts in the week ended 5 May from the previous -EUR 79,681. That is still a huge number of Euro long bets. Market positioning could eventually break the back and a downside break is in the making.

EUR/USD has immediate support at 1.0810 followed by 1.0770 and 1.0720. Immediate resistance can be found at 1.0850 and 1.0900. The next resistance level lies at 1.0950. Look for a likely range today of 1.0785-1.0885. Prefer to sell rallies .

NZD/USD – RBNZ and FED Divergence Weigh, Can the Bird Sprout Wings?

The New Zealand Dollar tumbled under the double whammy of a dovish RBNZ and less dovish Federal Reserve. NZD/USD closed in New York just under the 0.60 cent support level at 0.5995. The Kiwi had been trading at 0.6065 ahead of the RBNZ meeting outcome and statement. Overnight NZD/USD tumbled to 0.5980 before settling at 0.5995. The Kiwi also slumped against the Aussie and other currencies.

Today New Zealand releases its Annual Budget which will reveal the government’s outlook. While the economic future is not going to look pretty let us not forget that New Zealand is one of the more successful countries in battling the coronavirus outbreak. Jacinda Ardern’s government began to ease lockdown restrictions this week and opened some businesses. While a second wave of infections is expected, the Kiwis are well placed to keep the spread under control. This will allow the economy to recover relatively faster than the rest of the world.

We reported that speculative NZD short bets increased to -NZD 14,953 from -NZD 13,799. This is a supportive factor for the Bird. It may have to weather some heavy selling should the USD stay bid but the Bird can still sprout wings. NZD/USD has immediate support at 0.5980 followed by 0.5930 and 0.5880. Strong support can be found between 0.5580 and 0.5920. Immediate resistance lies at 0.6040 and 0.6100. Strong resistance lies at 0.6200. Look for a likely trade between 0.5970-0.6070 first up. Trade the range shag on this puppy too but a base may be forming.

AUD/USD – Depressed by Strong USD, Up Next – Aussie Jobs Report

The Australian Dollar traded in a relatively tight range between 0.65240 (overnight high) and 0.64384 (low) before settling to close at 0.6455 in New York. The Aussie Battler was depressed by the overall stronger Greenback and the weak performance by its smaller cousin, the Kiwi. The AUD/NZD cross was up 1.17% to 1.0772 (1.0648) following the RBNZ’s dovish bent in contrast to the RBA’s more neutral stance.

Today’s April Employment report could be key for the Australian Dollar. Expectations are for a median fall of -575,000 Employment Change from March’s gain of +5,900. There could be more focus on the Unemployment rate which is forecast to climb to 8.3% from 5.2%. A fall of more than -575,000, around -600,000 or more will see the Aussie sold off. An Unemployment rate of 8.5% or larger will also see the Aussie slump. On the topside a report of less than -500,000 jobs lost could see higher levels tested.

AUD/USD has immediate resistance at 0.6480 followed by 0.6530 and 0.6560. The 0.66 cent strong resistance level should hold. Immediate support can be found at 0.6430 followed by 0.6400 and 0.6370. We reported that speculative Aussie shorts were trimmed to -AUD 33,455 from -AUD 37,741. The short Aussie bets should be a support around the 0.6350 level. Look for some fireworks in the Aussie Battler today, with a likely range of 0.6380-0.6540. Trade the range shag on this one.