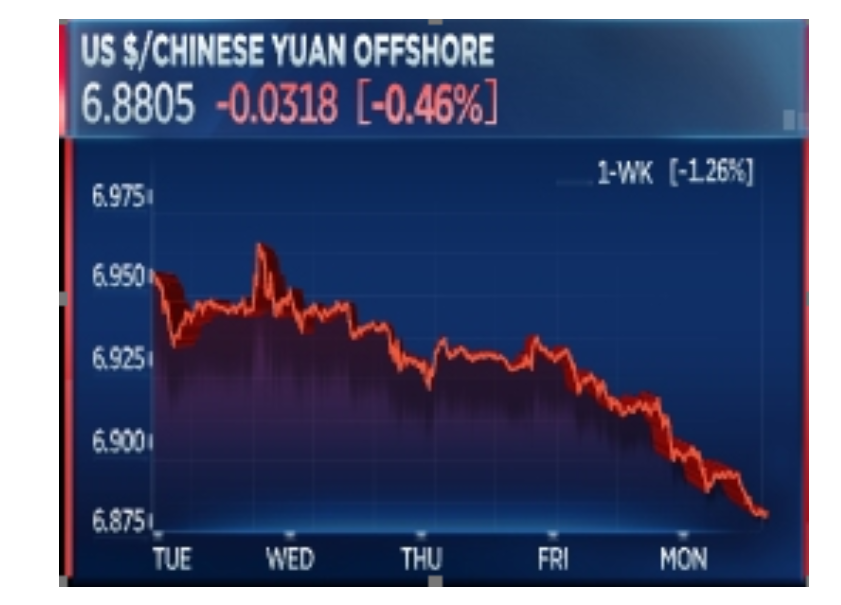

Summary: Risk appetite rose on optimism about a planned signing this week of the China-US trade deal. Equity markets rallied while FX saw a mixed US Dollar. The Australian Dollar extended gains to 0.6910, the highest close in a week. Against the safe haven Yen, the Dollar soared to fresh 8-month highs at 109.92 (109.52). Sterling dipped to 1.3000 (1.3065) after soft domestic data affirmed dovish comments from the Bank of England’s Vleighe. The Euro rallied 0.23% to 1.1139 in limited trade. The Greenback was lower against China’s Offshore Yuan (USD/CNH) at 6.8810 from 6.9150 after the US said it would lift its designation of China as a currency manipulator. The first Commitment of Traders report for 2020 saw long Dollar bets reduced to an 18-month low.

Wall Street stocks were higher. The Dow finished at 28,877. (28,815), up 0.28% while the S&P 500 rallied 0.6% to 3,285 from 3,265. US bond yields rose. The 10-year note yielded 1.84% (1.82%).

UK GDP in December underwhelmed to -0.3% against expectations of 0.0%. Manufacturing Production in Britain dropped 1.7%, widely missing forecasts of a 0.3% fall. UK Construction Output rose 1.9%, beating forecasts of 0.6%. The US Government posted a USD 13.3 billion budget deficit in December, missing forecasts of a surplus of USD 5 billion but improving from November’s USD 208.8 billion.

- EUR/USD – The Euro rose in limited trade to a 1.1140 from 1.1122 after hitting a high at 1.1147. Euro area data yesterday was little and second tier.

- USD/JPY – The Greenback extended its gains against the safe haven Yen finishing at 109.92, an 8-month high. US 10-year bond yields were up 2 basis points to 1.84% while Japanese JGB rates were unchanged at -0.01%.

- GBP/USD – Sterling was pounded further towards 1.30 after mostly soft domestic data (GDP and Manufacturing Production) gave credence to a dovish leaning Bank of England. UK 10-year bond yields were down 2 basis points to 0.75%.

- AUD/USD – The Aussie Battler continued to grind its way higher in the current environment, up 0.2% to 0.6910. AUD/USD traded to a high at 0.69198 before settling.

On the Lookout: The China-US trade deal is looking more and more like a done deal. The Trump administration said it would lift its designation of China as a currency manipulator. Everything is looking rosy for the future of the relationship between the world’s two largest economies. This should see the risk on environment extend to Asian markets. This writer is wary of complacency setting in with any disturbance like to cause a stir.

Economic data and earnings will have more impact from here on in. Once all these expectations are met, the proof will come through the data.

Earlier today New Zealand’s Business Confidence Index climbed to -21 in December from -40 the previous month. Japanese Bank Lending, Current Account and Economic Watchers Sentiment follow. China is scheduled to release its December Trade Balance (in CNY and USD).

There are no Euro area reports scheduled for release today. The US releases its NFIB Small Business Index survey followed by Headline and Core CPI data (December).

Trading Perspective: The risk on environment has seen a mixed Dollar overall with haven currencies weaker and growth currencies stronger. This pattern should continue in Asia, although the risks are there for complacency.

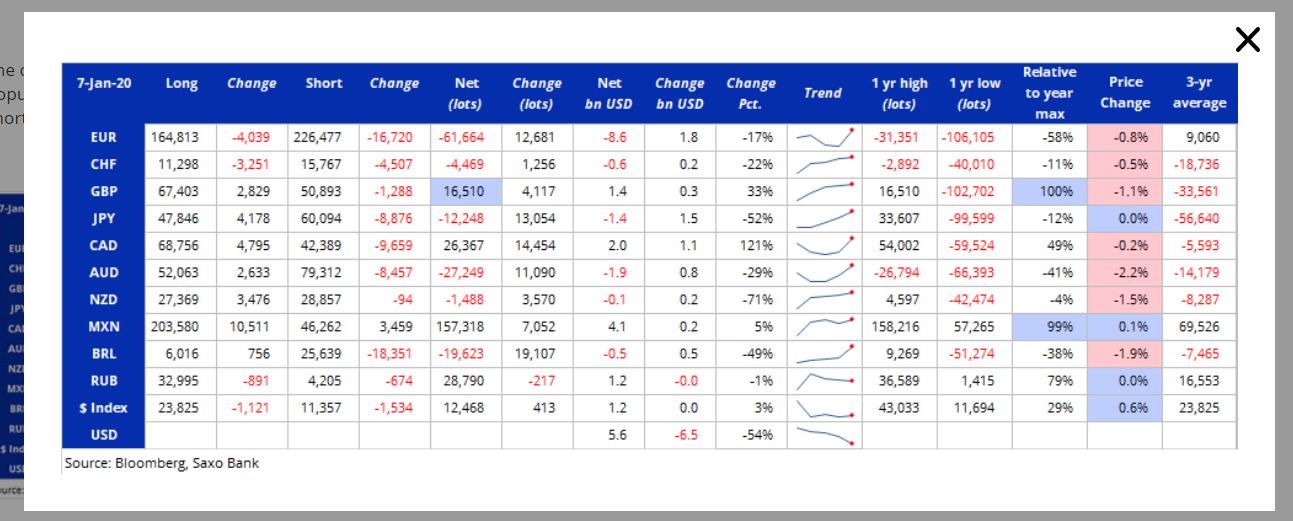

We look at the market’s positioning at the start of 2020. The latest Commitment of Traders report saw total net long US Dollar bets further cut to an 18-month low. For the week ended 7 January 2020, the Dollar was sold against all the majors. Net total Dollar longs fell to USD 5.6 billion from $12.3 billion in the previous week. We look at the breakdown of the currencies.

- EUR/USD – The Euro was 0.23% higher to 1.1140 at the New York close. EUR/USD traded to a high at 1.11469. Immediate resistance lies at 1.1150 followed by 1.1180. Immediate support can be found at 1.1115 (overnight low 1.11124) followed by 1.1085. The latest COT report was net Euro shorts cut by a massive EUR 12,681 to a total -EUR 61,664 contracts. While that is a big trim, the net result is still a short Euro position for the speculators. Look for a likely range today of 1.1110-50. Look to trade this range today.

- USD/JPY – The Dollar continued to grind its way higher against the Yen to 109.92, eight-month highs fuelled by the rise in risk appetite, higher stocks and US 10-year yields. USD/JPY has immediate resistance at 110.00 and 110.30. Immediate support can be found at 109.50 followed by 109.20. The latest COT report was net speculative short JPY bets slump to -JPY 12,248 in the week ended 7 January from -JPY 25,302 the previous week. Look for a likely range today of 109.55-109.95. Prefer to sell rallies.

- GBP/USD – Sterling slumped to 1.3000 from 1.3065 on the soft UK domestic data and dovish sentiment from the Bank of England. As this is written, the Pound has slipped further to 1.2990. The latest COT report saw net speculative GBP longs increase to +GBP 16,510 (week ended 7 Jan) from +GBP 12,393 the previous week. The Pound looks soft and with the speculative market long of Sterling, the pressure is for lower. GBP/USD has immediate support at 1.2960 followed by 1.2930. Immediate resistance can be found at 1.3030 followed by 1.3060. Look to trade a likely range of 1.2970-1.3020. Prefer to sell rallies.

AUD/USD – the Aussie continued to grind higher boosted by the market’s healthy risk appetite. AUD/USD traded to a high at 0.69198, which is where immediate resistance lies. The next resistance level can be found at 0.6950. Immediate support is found at 0.6890 followed by 0.6860. The latest COT report saw net speculative AUD shorts cut to -AUD 27,249 from -AUD 38,339, which is large. Look to trade a likely range today of 0.6890-0.6920. Just trade the range shag on this one.