Summary: The Dollar finished little changed in limited trade due to a US holiday (Martin Luther King Day). Major FX was confined to narrow intraday ranges with the Euro settling just under 1.1100, at 1.1093. Further Brexit uncertainty saw Sterling pounded to a low at 1.29621 before rebounding to settle at 1.3005. UK Wages and employment data are due today. Against the Japanese Yen, the US Dollar maintained its strength, at 110.17, up 0.08%. The Australian Dollar closed at 0.6874 from 0.6868, up 0.1%. The Dollar Index (USD/DXY), a popular gauge of the Greenback’s strength against a basket of 5 major currencies was flat, closing at 97.621. Asian Emerging Market currencies extended gains against the US Dollar and EU FX, led by the Indonesian Rupiah and Chinese Yuan.

The Dollar plunged to 13,625 Indonesian Rupiah, near 2-year lows ((13,650 yesterday). Against the Offshore Dollar/Chinese Yuan (USD/CNH), the Greenback slumped to 6.8453, near 7-month lows, climbing back to end at 6.8670. Global stocks were firm, finishing just under record levels. Dow futures were at 29,335, while S&P 500 futures settled at 9,165.00. Risk appetite stayed healthy on reports that French President Macron and US President Trump agreed a truce on tariffs until the after the US elections, end-2020. There was limited data released yesterday. UK Rightmove House Price Index rose 2.3% from 0.9%. Japanese Industrial Production in December dropped 1.0%, against an expected fall of 0.9%. Germany’s Producer Price Index rose 0.1% beating forecasts of flat.

- EUR/USD – The Euro settled at 1.1095 after trading to an overnight high at 1.11023. The overnight low was limited to 1.10767. The ECB has shown little appetite to ease monetary policy, the preference seems to be fiscal policy. The ECB meets on rates this week.

- USD/JPY – Against the Japanese Yen, the Dollar maintained its strength closing at 110.17, not far off from overnight highs at 110.217. Trading was limited to a narrow 110.080-110.217 range. The BOJ meets today, expecting to keep policy unchanged and maintain a dovish bias.

- GBP/USD – Sterling slumped to an overnight low at 1.29621 before bouncing to 1.3005, where it closed. UK Prime Minister Boris Johnson has set his sights on a speedy resolution of trade disputes with the US and EU according to an article in the Financial Times. Markets are less convinced.

- AUD/USD – The Aussie Dollar was little changed at 0.6872 after limited trade overnight between 0.68553 and 0.68885. The firmer Asian EM currencies buoyed the Aussie.

On the Lookout: Little is expected from the Bank of Japan today at their policy rates meeting, today’s main event. Weaker-than-expected Japanese Industrial Production kept the USD/JPY on a firm note. FX has little fanfare for the BOJ meeting, expecting no change in policy with a dovish bias. Markets will look to the meeting for future direction.

UK Employment data kick off Europe today with Average Weekly Earnings (Wages are released monthly, 45 days after the month ends), Claimant Count Change (Change in claims for Unemployment benefits) and the Unemployment rate. Germany and the Eurozone report on their ZEW Economic Sentiment Indexes. Finally, Canada wraps up the day’s reports with its December Manufacturing Sales.

Trading Perspective: Southeast Asian Emerging Market currencies outperformed both the US Dollar and Europeans in the FX space today. The Indonesian Rupiah has outperformed hitting fresh 23-month highs against the Greenback. Earlier this month, the Bank of Indonesia said that it would allows the Rupiah to strengthen. Indonesia’s cash rate is close to 5%, higher than any of the developed nations.

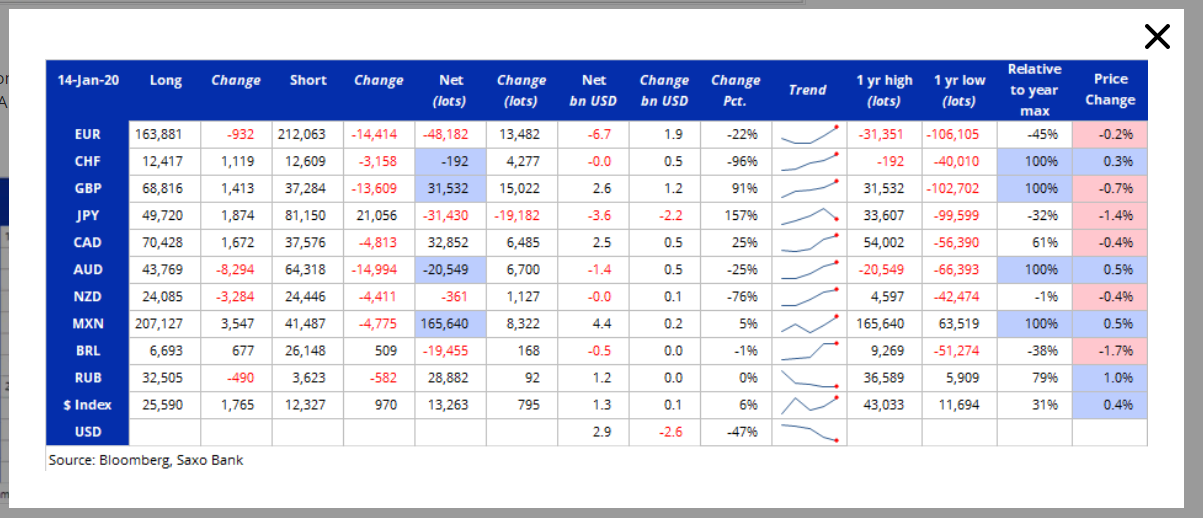

The latest Commitment of Traders Report (week ended 14 January 2020) saw further speculative US Dollar selling against ten IMM currencies. Total net Dollar long bets have been cut to 18-month lows to just $2.9 billion according to Saxo Bank. Only aggressive JPY selling, which reached a new low, prevented the Dollar from entering neutral territory. Euro and Aussie shorts were trimmed further. The British Pound, Canadian Dollar and Mexican Peso saw extended buying, with the MXN hitting the largest long position on record. The Swiss Franc and Kiwi were close to flat.

Strong Emerging Market currencies will eventually lead to a lower US Dollar overall. US interest rates are expected to remain low. The US holiday should see further limited trade with intraday ranges pretty much intact.

- EUR/USD – The Euro continues to grind higher against the US Dollar, although it’s stayed under 1.1100 yesterday (1.1093). Much of the Euro’s climb has been the result of short covering as European data continues to improve. The ECB is also seen less inclined to cut interest rates, with the preference seen to be on fiscal policy. This should keep the Euro on stable ground in the short term. EUR/USD has immediate resistance at 1.1105 followed 1.1125. Immediate support can be found at 1.1080 followed by 1.1050. Look for a likely trading range today of 1.1090-1.1120. Prefer to buy dips.

- GBP/USD – Sterling had a good bounce off it’s lows at 1.2962 to just above 1.3000 (1.3003) after the UK Financial Times reported that Boris Johnson intends to hold bilateral trade deals with the US and the EU at the same time in order to get something done by the end of 2020. Meantime, the COT report revealed that Sterling long bets increased to +GBP 31,532 from +GBP 16,510. Which is a whopping build of +GBP 15,022 contracts. Net total longs are at their biggest since May 2018, which spells danger on the downside. GBP/USD has immediate resistance at 1.3010 (overnight high 1.30089) followed by 1.3040. Immediate support lies at 1.2990 and 1.2960. Prefer to sell rallies with a likely range today of 1.2960-1.3010.

- USD/JPY – Dollar Yen kept its overall bid tone trading a limited range of 110.08-110.22 overnight. The COT report saw further aggressive JPY selling (USD buying), which was the only major IMM currency where the net change was an increase in currency shorts (USD longs). Net total JPY short bets increased to -JPY 31,430 from -JPY 12,248. The BOJ is not expected to alter its policy or its bias later today at the conclusion of its meeting. The risk is for a lower USD/JPY should there be a surprise from the BOJ on the fiscal side. Easy monetary policy has not seen an improvement in the Japanese economy. USD/JPY has immediate resistance at 110.20 followed by 110.50. Immediate support can be found at 110.05 and 109.85. Look to trade a likely range today of 109.80-110.20. Prefer to sell rallies.

Have a good week ahead all, happy trading.