Summary: The Dollar eased against most major currencies bar the Yen after Fed Chair Jerome Powell sounded less upbeat in a speech to US lawmakers. Powell said that more state aid was needed, or the economic recovery would be hampered. Risk sentiment deteriorated after an American health-oriented news website, STAT News questioned the validity of Moderna’s Covid-19 vaccine tests results. The USD/JPY pair traded to an overnight and 1-month high at 108.09 after the Bank of Japan called for a monetary policy meeting this Friday (22 May) which was unscheduled. On Monday, Japan’s economy officially fell into a recession after Q1 GDP data released saw a contraction of -3.4% following Q4’s -7.3%. USD/JPY eased at the NY close to 107.72 as Wall Street stocks slipped. The Euro finished with modest gains at 1.0925 (1.0915 yesterday) after trading to 1.0976, near 3-week highs. The shared currency rallied yesterday above 1.0900 after a Franco-German proposal for a EUR 500 billion recovery fund was announced. German and Eurozone ZEW investor confidence readings improved in the month of May. The Australian Dollar extended gains, up a modest 0.2% to 0.6535 (0.6525) despite Chinese tariffs on barley and beef products in retaliation for support to the WTO challenge. New Zealand’s Kiwi outperformed, climbing 0.58% to a 0.6075 NY close (0.6040 yesterday). Sterling rallied to 1.2235 (1.2195) after UK Employment data was mostly better than expectations. Wall Street stocks slipped, reversing earlier gains. The DOW finished 1.32% lower to 24,205 (24,565) while the S&P 500 lost 0.91% to 2,922 (2,952 yesterday).

Bond yields eased. The key US 10-year Treasury rate fell 4 basis points to 0.69%. Germany’s 10-year Bund yield was unchanged at -0.47%.

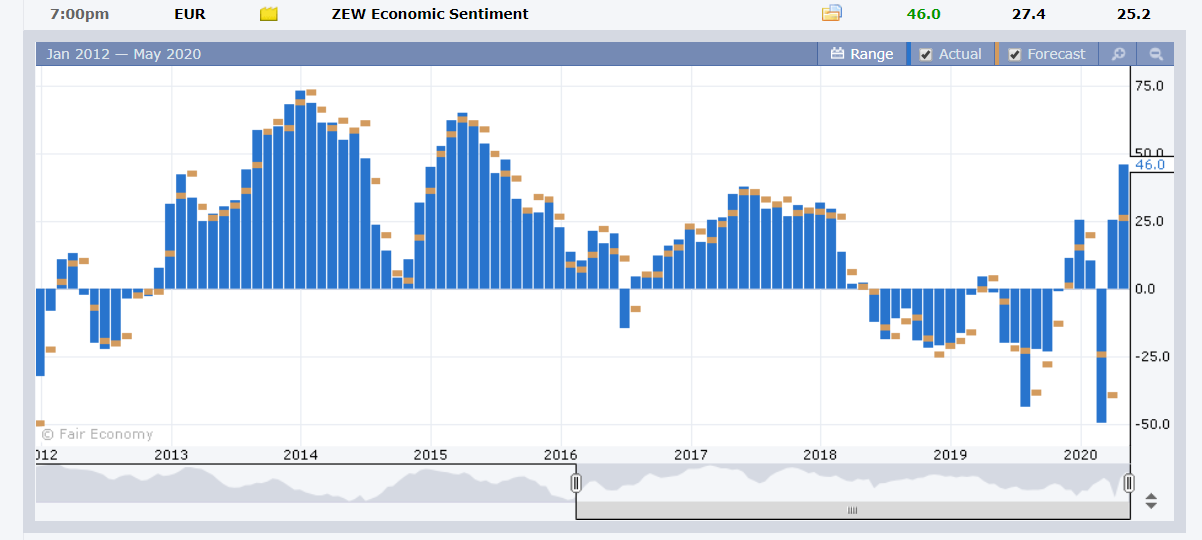

Data released yesterday saw New Zealand’s Q1 PPI Input slip to -0.3% from an upwardly revised +0.3% in Q4. PPI Output was up 0.1%. The UK’s Claimant Count Change (number of people claiming unemployment related benefits) rose to 856.5K against a forecast rise of 675K. Britain’s Unemployment rate though improved to 3.9% from 4.0% and forecasts of 4.4%. The Eurozone ZEW Economic Sentiment Index rose to 46.0 from 25.2, bettering forecasts at 27.4. US April Housing Starts fell to 0.89 million units, missing forecasts at 0.95 million and an upwardly revised 1.28 million units the previous month.

On the Lookout: Risk remains in the balance and sentiment remains mixed. Markets will continue to monitor trade and virus updates. The US-China trade spat is intensifying. Australia has its own trade “beef” with China. Healthcare is what markets are concerned about and this roller coaster ride of vaccine tests and the success of their results will continue. Meantime economic data reports for today kick off with Japan’s Core Machinery Orders and Australia’s M1 Leading Indicators. UK Inflation numbers are out with its Annual CPI, Core CPI, Monthly PPI Input, PPI Output, Retail Price Index and House Price Index (y/y). Canada’s monthly CPI and Core CPI follow. Canadian Annual Trimmed CPI and monthly Wholesale Sales reports follow. Eurozone Consumer Confidence data rounds up the day’s calendar. Finally, the Fed FOMC Meeting Minutes are released (4 am, 21 May, Sydney).

Trading Perspective: While the US Dollar eased against most major currencies, it may be too early to call a turn in the tide for the Greenback. The Euro’s recovery and the rallies in the commodity cousins, the Aussie and Kiwi could be the clues. Whether they can break new ground or not.

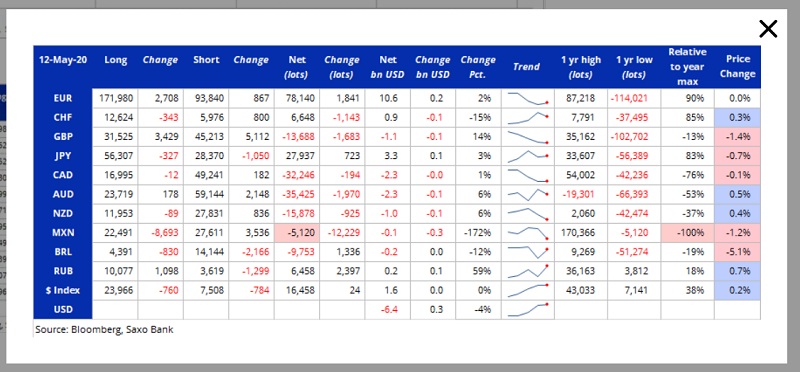

Meantime the latest Commitment of Traders/CFTC report for the week ended 12 May saw small changes according to Saxo Bank. Total net speculative US Dollar shorts against the 10 IMM currency futures were reduced by 4% to the lowest total (USD 6.4 billion) since March. Most of the US buying came against the Mexican Peso. The majors saw little change although net speculative Euro long bets saw a mild increase. We look at the respective currencies in the reports that follow.

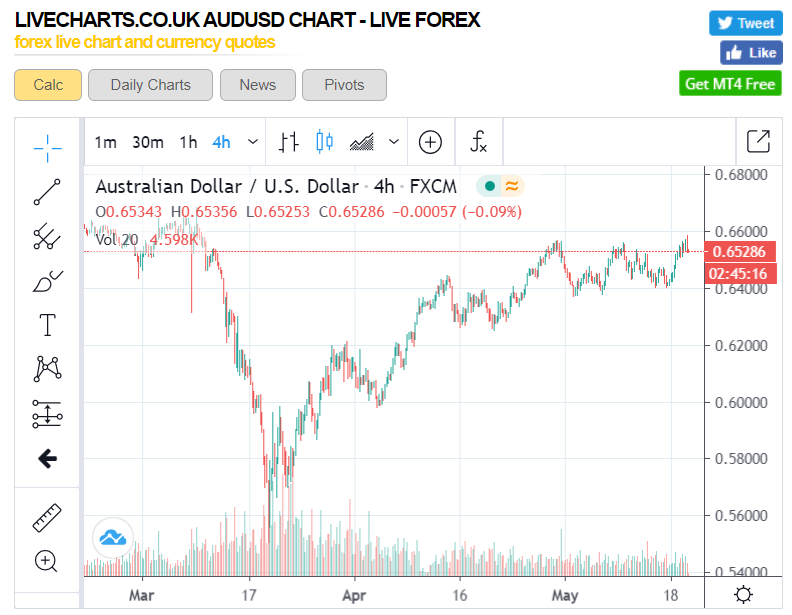

AUD/USD – Keeps Bid but Momentum is Waning, 0.6600 Caps

The Australian Dollar extended its rally, consolidating above the 0.6500 level after trading to 0.65849, overnight and 10-week highs. Broad-based US Dollar weakness supported the Battler while the ongoing Australia-China trade dispute prevented any meaningful gains. AUD/USD finished the New York session at 0.6535, up 0.2% from 0.6525 yesterday. China instituted an 80% tariff on Australian barley yesterday in retaliation for Australia’s call for an international investigation into the coronavirus spread. Traders will continue to monitor developments on this front.

The latest Commitment of Traders/CFTC report saw net speculative Aussie short bets increase slightly to -AUD 35,425 contracts (week ended May 12) from the previous week’s -AUD 33,455. The net short positions are 53% of the year’s high. There was little change in the market positioning.

The next significant event in the domestic Australian scene to have a possible impact comes tomorrow with RBA Governor Philip Lowe speaking in Sydney.

AUD/USD has immediate resistance today at 0.6600 which is formidable. The next resistance level can be found at 0.6630. Immediate support can be found at 0.6510 (overnight low 0.65094) which is followed by 0.6470. The Aussie’s upward momentum is slowing, and we see a likely range today of 0.6470-0.6570. Look to sell rallies.

EUR/USD – Holds Gains, Long Specs Prevent a Significant Turn; 1.10 Caps

The Euro held on to its gains above 1.0900, closing a modest 0.08% higher to 1.0925 from 1.0915 yesterday. EUR/USD traded to 1.0976, 24 pips shy of the 1.10 resistance level. Yesterday’s report of an agreement in principle of a Euro 500 billion recovery fund for EU nations by French President Emmanuel Macron and German Chancellor Angela Merkel boosted the shared currency above 1.09. The Euro had been in consolidation mode basically between 1.0770 and 1.0900 for almost 3 weeks now. The break above 1.0900 has some excited that a turn in the tide may be in the making.

While that is possible, our view is that it is unlikely for the following reasons. The first is the market positioning. The latest Commitment of Trader report (week ended May 12) saw speculative long Euro bets increase modestly to +EUR 78,140 from +EUR 76,299. The total amount represents 90% for the year’s biggest total. The Franco German recovery fund agreement still needs to be agreed by all member nations. French Finance Minister Bruno Le Maire said that the EU recovery fund probably will not be available until 2021.

EUR/USD has immediate resistance at 1.0975 followed by 1.1005. Immediate support can be found at 1.0900 followed by 1.0870. Prefer to sell rallies in a likely range today of 1.0870-1.0970.