Summary: The Dollar retreated against its Rivals ahead of what is expected to be the worst US Payrolls report ever. Economists expect a record number of 21.5 million Americans lost their jobs in April which will push the Unemployment rate sharply higher to 16.0% from March’s 4.4%. US Treasury yields slipped with the benchmark 10-year rate trading at 0.64% in late New York. The two-year US bond yield plunged to a record low at 0.14% (0.178% yesterday). Yesterday, the weekly total number of Americans filing for Unemployment Claims was at 3.169 million, and while it was better than the previous week’s 3.839 million, it was worse than forecasts at 3.0 million. The Euro rallied off its overnight and near two-week low at 1.07666, to close at 1.0832, up 0.3% against overall weaker US Dollar. German and French Industrial Production were both worse than forecast. Sterling ended with moderate gains at 1.2365 (1.2343) after the Bank of England left its interest rate and bond purchase program unchanged. However, two members voted in favour of an increase in bond purchases while BOE Governor Andrew Bailey said they could do more QE in June. The Australian Dollar outperformed, jumping 1.6% to 0.6495 (0.6402) following upbeat Australian and Chinese trade data. Australia’s Trade Surplus soared to +AUD 10.60 billion in March, (forecast +AUD 6.5 billion) on a 15% rise in exports. The Service sector though contracted further. China’s Trade Surplus was boosted by a surprise 8.2% increase in exports. Against the Canadian Loonie, the US Dollar dropped to 1.3980 from 1.4145, despite a plunge in Canada’s IVEY PMI to 22.8 (26.0), a record low. The Greenback was lower against the EM and Asian currencies. Wall Street stocks rallied on news that US and Chinese trade negotiators will speak soon. The DOW gained 1% to 23,985 (23,670). The S&P 500 added 1.65% to 2,892 (2,845).

Data released yesterday saw China’s Trade Surplus in April climb to +CNY 318.13 billion, beating forecasts at +CNY 125.82 billion, from +CNY 139.42 billion in March. An 8.2% jump in exports boosted the trade surplus. German Industrial Production fell to -9.2%, missing forecasts at -7.3%. France’s Industrial Production slumped to -16.2% from 0.9% in March, underwhelming expectations of -12.7%.

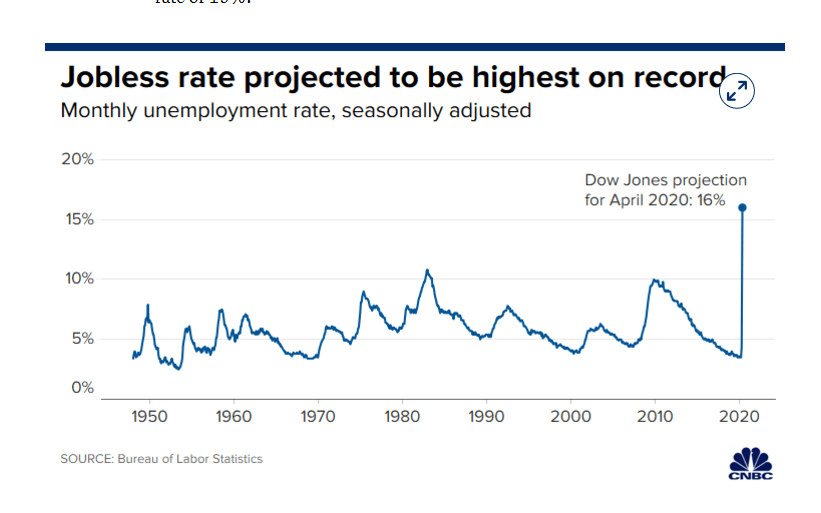

On the Lookout: Welcome to Payrolls Friday and markets are expecting the horrific report. US Job losses are expected to climb to a record 21.5 million Jobs last month which would push the Unemployment Rate to 16% from last month’s 4.4%. Average Weekly Earnings are expected to dip to 0.3% from the previous 0.4%.

Canada’s Employment report will also be released with Job losses expected to climb to 4.125 million in April from 1,010 million last month. The Unemployment rate is forecast to rise to 20% from 7.8% in March. Expect some fireworks from those numbers.

Earlier in the day, the RBA releases its latest Monetary Policy Statement and Quarterly Economic Projections. This could be a market mover for the Aussie in Asia.

Other data releases scheduled for release today include Japan’s Average Cash Earnings and Household Spending. European reports follow with Germany’s Trade Balance, and UK GFK Consumer Confidence. Canada also reports on its April Building Permits.

Trading Perspective: With FX prepared for the worst US Payrolls report ever, where does the risk lie? The Dollar eased into today’s numbers while risk assets rallied, the correlation remaining consistent. Bond yields, however slumped although they rallied off 3-day lows in the end, still finishing lower. The Payrolls number is forecast to be between -21.5 million to -24.0 million (Goldman Sachs). The Unemployment Rate is forecast between 14% to 16%.

If the Payrolls number comes out near 20 million or less, expect the Dollar to reverse rally with the USD/DXY soaring above 100.20. A Jobless figure of 24 million or higher will push the Dollar lower.

Watch the Jobless rate and Wages too. It is between the real numbers against the expectations.

Market positioning will also have a bearing, as well as other data, Canadian Employment for one.

AUD/USD – Risk-On, Upbeat Trade Boost Battler, RBA Report Next

The Australian Dollar rebounded strongly to trade above 0.65 cents, its highest in over a week boosted by upbeat domestic and Chinese trade data and a risk-on stance in US trading. Reports that US and Chinese trade negotiators plan to talk as early next week lifted risk sentiment and pushed equities higher in late New York trade. Broad-based US Dollar weakness also contributed to the Aussie’s strength.

The RBA releases its latest monetary policy statement and economic projections which are forward looking. This has the potential to move the markets more than the recent RBA policy meeting which was earlier this week. US Non-Farms Payrolls report will also impact the Aussie, which has shown remarkable strength against the US Dollar and other currencies. Speculative market positioning is also short AUD bets, which is a positive.

Where does the risk lie? A disappointment from today’s RBA report, and a reverse USD rally after tonight’s Payrolls report could see Aussie bulls disappointed. AUD/USD has immediate resistance at .6510 and 0.56550. The big resistance level is at 0.6600 cents. Immediate support can be found at 0.6460 followed by 0.6410. Look for an initial trading range between 0.6430-0.6530. Prefer to sell rallies.

USD/CAD – Upbeat Mood Lifts Loonie, Canada Payrolls Up Next, Expect Fireworks

The Canadian Loonie lifted together with its Commodity counterparts, the Aussie and Kiwi on the upbeat mood which saw risk assets rise. USD/CAD slumped to 1.39532 overnight low before climbing to settle at 1.3982 at the New York close (1.4145 yesterday). Despite a dip in crude oil prices, WTI down 2.13% to US$24.50 (US$25.10) and a dire Canadian IVEY PMI report to the biggest total fall on record, USD/CAD fell on broad-based Dollar selling.

Canada’s Employment report which is also scheduled for release at the same time as that of its US counterpart is forecast to see a horrendous Jobs loss of 4.125 million in April from March’s -1.010 million. The Jobless rate is expected to climb to 20% from 7.8%. That is huge in the context of the size of the Canadian economy compared to the US. That said, with both numbers expected to be horrible, the focus will fall on the bigger US Payrolls. Still any rise much worse than the numbers forecast, given the unprecedented fall in Canada’s Ivey PMI’s, the Loonie could suffer.

USD/CAD has immediate support at 1.3950 followed by 1.3910. Immediate resistance can be found at 1.4010, 1.4060, and 1.4100. Expect a trading range between 1.3950 and 1.4150 ahead of the numbers. After that, we could see a wild roller coaster ride where the 1.3900-1.4200 six-week range could be hit on both sides. Let’s get ready to rumble!