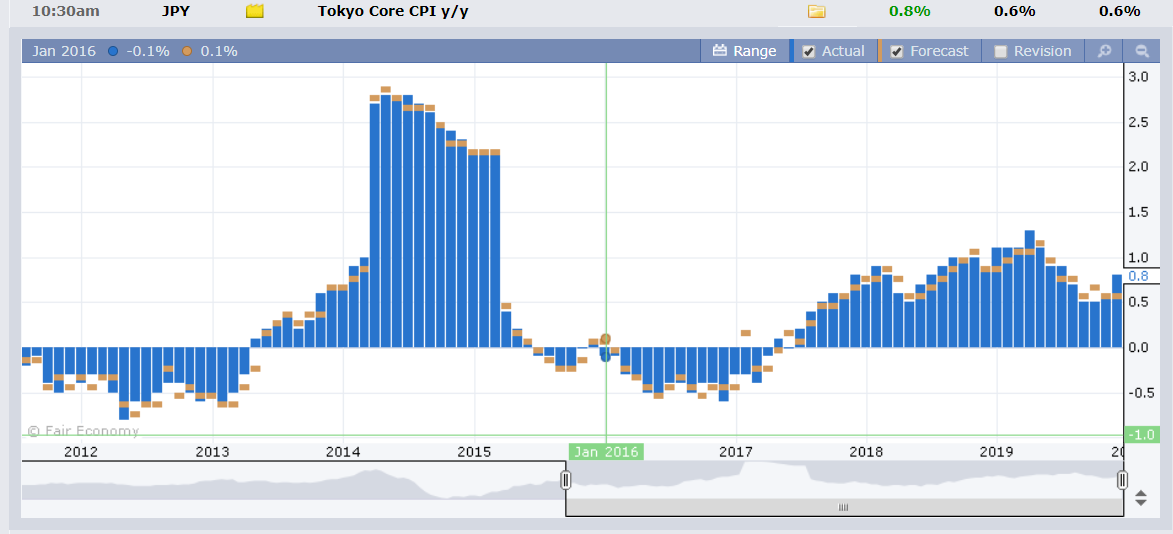

Summary: The US Dollar retreated across the board as speculative long bets headed for the exit in thin volume trading. Sterling extended its climb, gaining 0.50% to close at 1.3085 after briefly climbing above 1.3100. The Euro outperformed the majors, advancing 0.61% to 1.1177 (1.1107), a 10-day high. The Dollar Index (USD/DXY), a popular gauge of the Greenback’s strength against a basket of 5 major currencies, weakened 0.53% to 97.014 (97.523 Friday). The Australian Dollar, often referred to by traders as the Battler, advanced 0.3% to 0.6985 (0.6945), nearing the psychological 0.70 cent level. A surprise rise in Tokyo’s Annual Core CPI to 0.8%, against a median forecast of 0.6% saw the Japanese Yen climb 0.15% against the Dollar to 109.46 (109.66). Japan’s 10-Year JGB yield climbed 2 basis points to -0.02%. In contrast, US 10-year treasury yields dipped 2 basis points to 1.88% (1.90%). An improvement in Swiss Economic Expectations saw USD/CHF plunge 0.82% to 0.9745 (0.9807). The Dollar’s fall was broad-based, lifting Emerging Market and Asian currencies higher. USD/ZAR (Dollar/South African Rand) lost 1% to 14.0304 (14.1340 Friday).

Wall Street stocks set all-time highs before easing to settle with modest gains at the close. The DOW was last at 28,612 while the S&P 500 closed at 3,235 (3,232).

Optimism on the trade front extended with China and the US reportedly preparing for a signing ceremony for phase one deal.

Other data released Friday saw Japan’s Unemployment Rate fall to 2.2%, beating forecasts at 2.4% while Preliminary Industrial Production bettered forecasts of -1.1%, to -0.9%. Japanese Annual Retail Sales fell 2.1% from a previous fall of 7%, and an expected fall of 1.7%. Switzerland’s Credit Suisse Economic Expectations Barometer rose 12.5%, bettering the previous month’s fall of -3.9%.

- AUD/USD – The Australian Battler advanced for the 4th straight week, grinding higher towards 0.70 cents in true Aussie fashion. AUD/USD traded to a high at 0.69872, a 5-month high before settling at 0.6885. Like the Euro, the Aussie’s rally has been fuelled by speculative short covering.

- USD/DXY – slip-sliding away, the Dollar Index slumped to 97.014, for a 0.53% loss. USD/DXY had steadied to 97.57 on Friday despite disappointing US economic data. Reality set in and the speculative long US Dollar bets bailed in thin trading.

- EUR/USD – The shared currency advanced toward 1.1200, reaching an overnight high at 1.11883 before easing to settle at 1.1177. The Euro’s rally was fuelled by broad-based US Dollar weakness which saw speculative Euro short bets run for cover. The Euro rallied from Friday’s opening at 1.1107.

GBP/USD – The British Pound extended its advance, closing at 1.3085 after hitting a low last week at 1.2904 (December 24). The British currency had traded to just above 1.3500 before plunging 6 cents, finding a base near 1.2900. It was a classic buy the rumour, sell the fact scenario as Boris Johnson was elected to lead the country. Johnson’s hard Brexit stance has weighed on the Pound which found buying interest near 1.2900. Sterling traded to an overnight high at 1.3117.

On the Lookout:

While most markets are open today, thin trading conditions will remain until next week. The New Year (2020) occurs mid-week and most trading rooms will be sparse. Economic reports released today are few although the US has the bulk of them.

The day starts off Germany’s Retail Sales (November), Spain’s Q3 GDP and Flash CPI. Switzerland’s KOF Economic Barometer follows. The UK releases its High Street Lending report. Finally, the US reports on its Goods Trade Balance, Preliminary Wholesale Inventories, Pending Home Sales and Chicago PMI.

Trading Perspective:

The Dollar is struggling as we enter the last two trading days of the year. Speculative long US Dollar positioning in thin conditions has weighed on the Greenback for this month. US economic data has been mostly weaker after the improvements seen between July and October. The Dollar Index (USD/DXY) tested the 97.00 level after holding below 97.80 last week.

Expect the Greenback to remain weak in the current environment but respect the ranges.

- EUR/USD – The Euro climbed 0.61% to a 1.1177 finish after trading to 1.11883 overnight and 2-week high. The shared currency will struggle to break above 1.1200 immediate and key resistance for today. Immediate support lies at 1.1165 followed by 1.1145. Germany’s November Retail Sales are due out today where expectations are for an improvement to + a gain of 1.0% from a previous fall of 1.9%. That’s huge so keep an eye out on this number. Meantime look to trade a likely range of 1.1145-1.1195.

- AUD/USD – The Aussie Battler extended its advance to 0.6985 from 0.6945 Friday for a 0.3% gain. It was the 4th straight week that the Aussie rallied against its US counterpart. The start of December saw extreme bearish sentiment weigh on the Battler which began trading around 0.6750. Economists were calling for rate cuts from the RBA in early 2020. Australia’s economic reports gradually improved as the month went by. The speculative shorts started to get squeezed higher. Initially we traded between 0.68 and 0.69 cents before a clean break began last week. Overnight, AUD/USD traded to 0.69872 high before settling at 0.6985 at the close. The Aussie is nearing the 0.7000 psychological level which is immediate and key resistance. AUD/USD has immediate support at 0.6945 (overnight low 0.69411) followed by 0.6915. Look to trade a likely range of 0.6940-90. Prefer to sell rallies up here, we may need to consolidate lower first.

- USD/DXY – The Dollar Index dipped to an overnight low at 96.915 before a modest rally to 97.014 at the New York close. Immediate support lies at the 96.90 level followed by 96.50 and 96.00. Immediate resistance can be found at 97.30 and 97.60 (overnight high 97.552). Today sees US Chicago PMI report where expectations are for an improvement in December. Look for a likely trading range today of 96.85-97.25. Just trade the range shag on this one.

- USD/JPY – The Dollar declined a modest 0.15% to 109.47 from 109.65 on Friday on overall Greenback weakness. The Dollar’s fall against the Yen has been mild so far. A further fall in the US Dollar and yields could see this currency pair accelerate to the downside. Japan’s 10-year JGB yields rose 2 basis points to -0.02%. This was in direct contrast to the fall in the US 10-year note yield to 1.88% from 1.90%. Which will keep a lid to USD/JPY. Immediate resistance lies at 109.60 (overnight high 109.589) followed by 109.80. Immediate support can be found at 109.35 (overnight low 109.390). The next support level can be found at 109.10. Look to trade a likely range of 109.15-109.55. Prefer to sell rallies

Have a good week ahead, happy trading all.